Coin Metrics' State of the Network: Issue 142

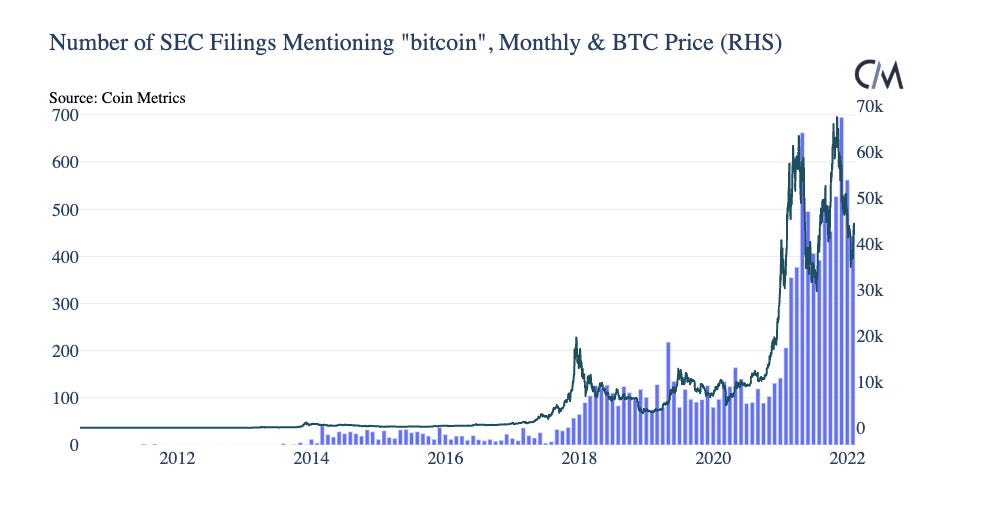

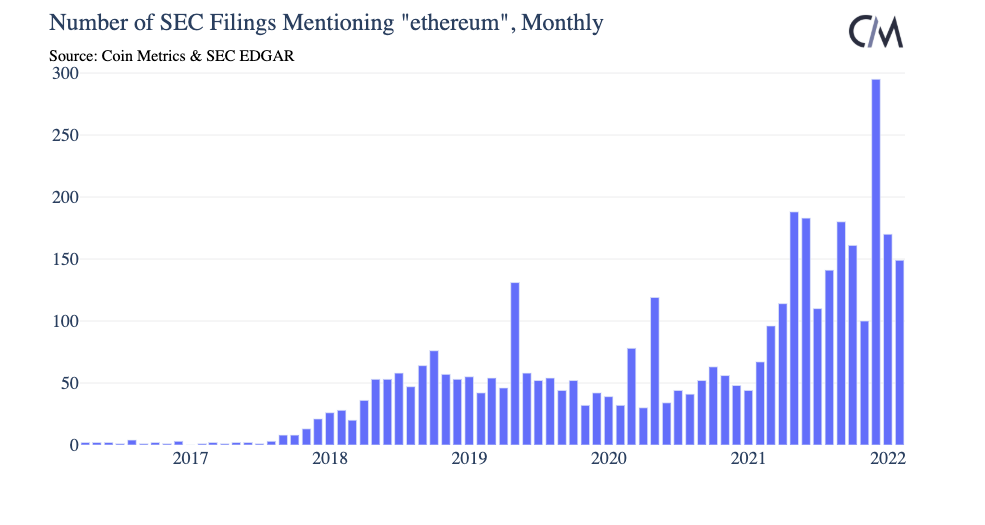

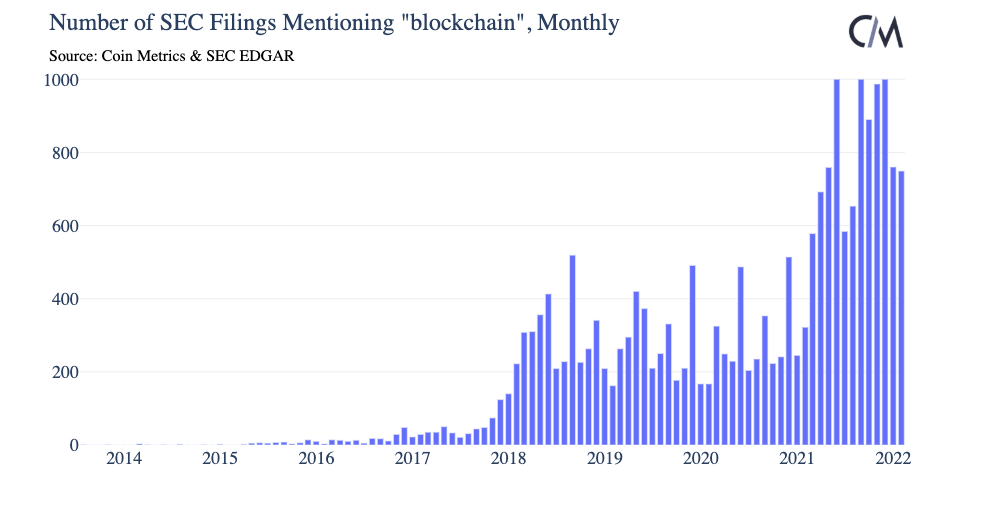

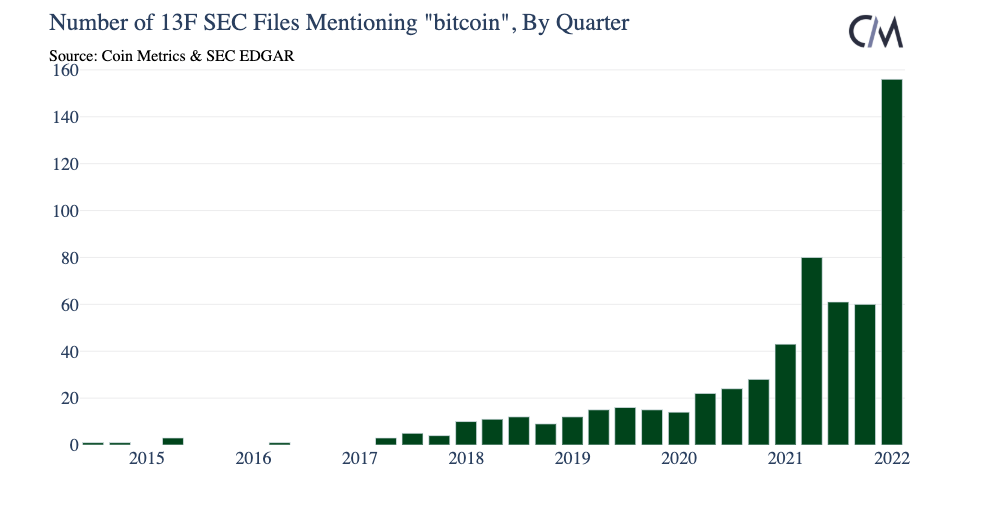

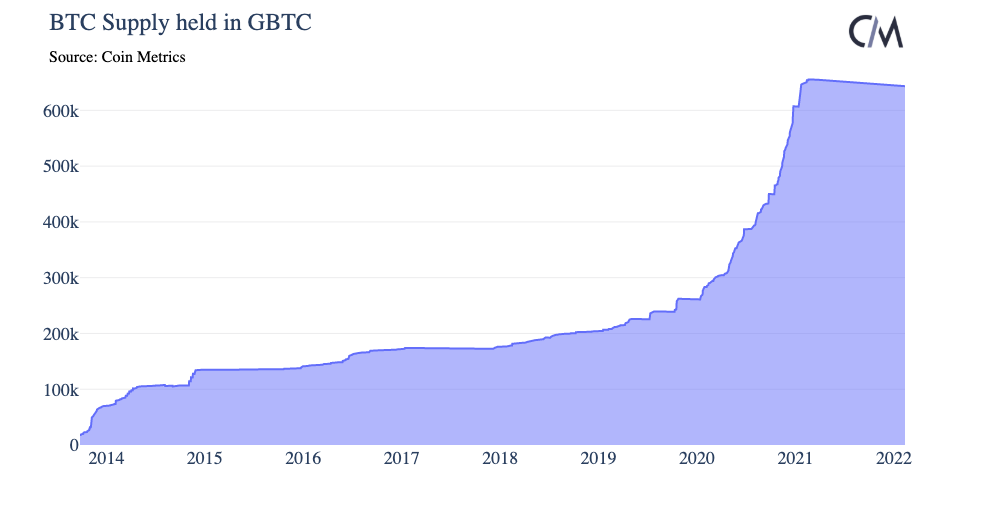

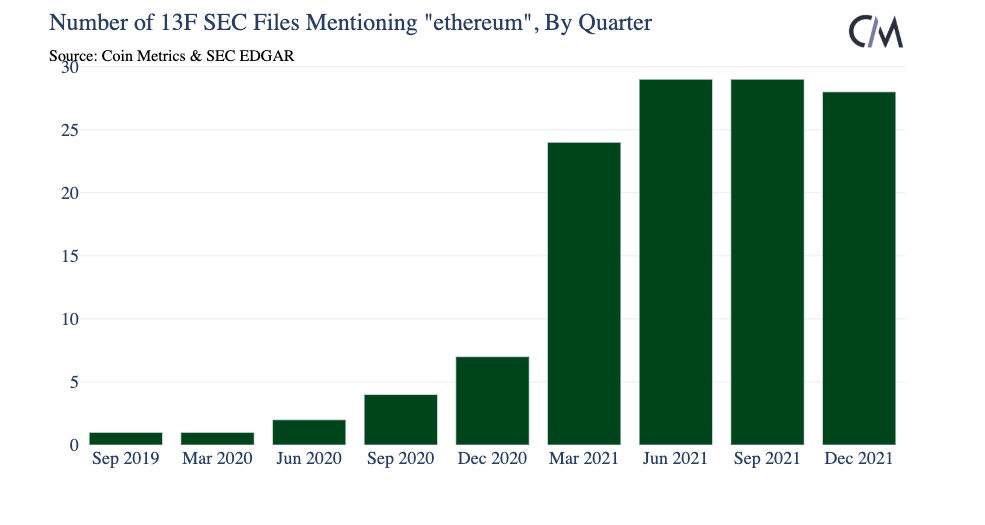

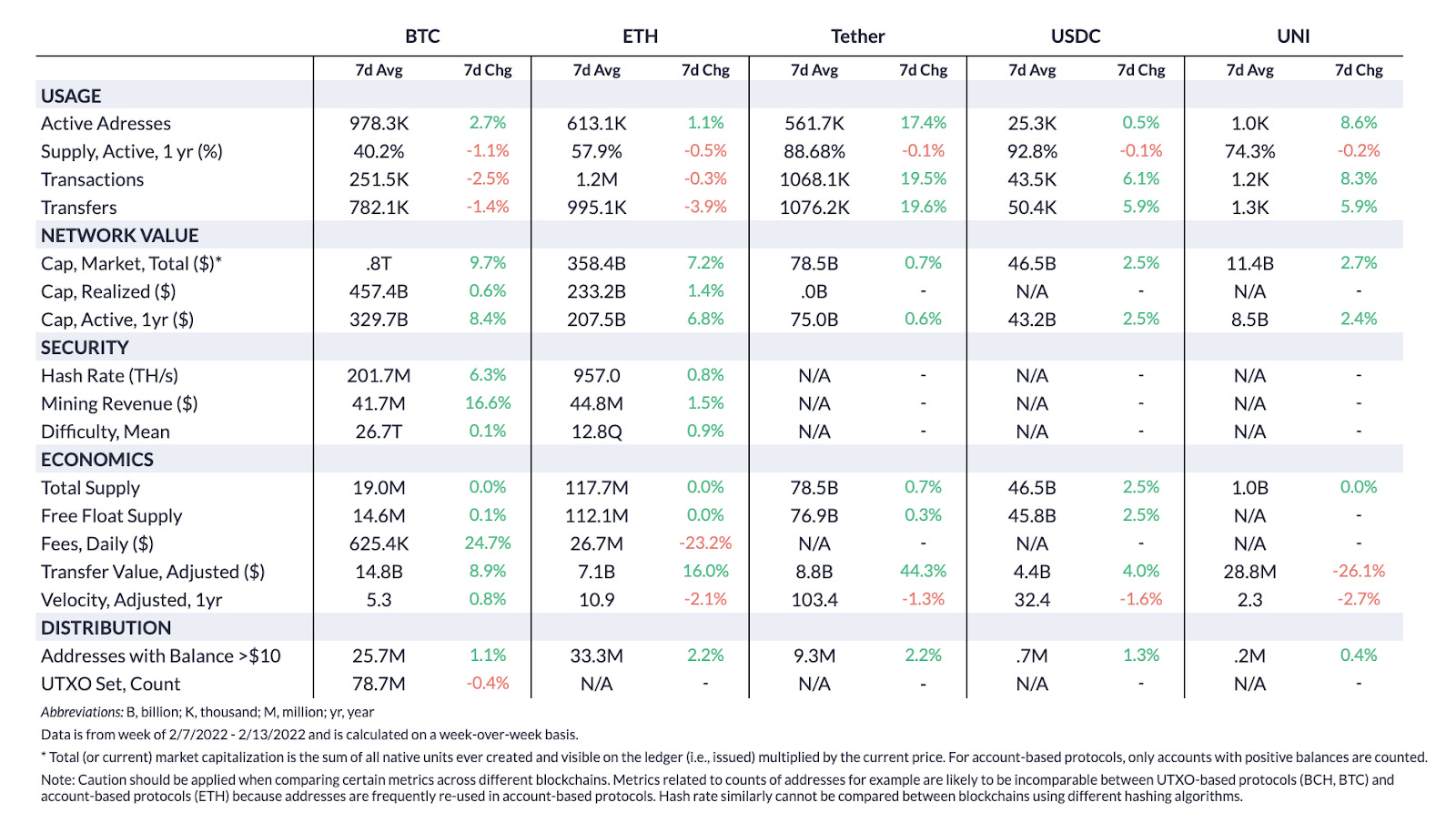

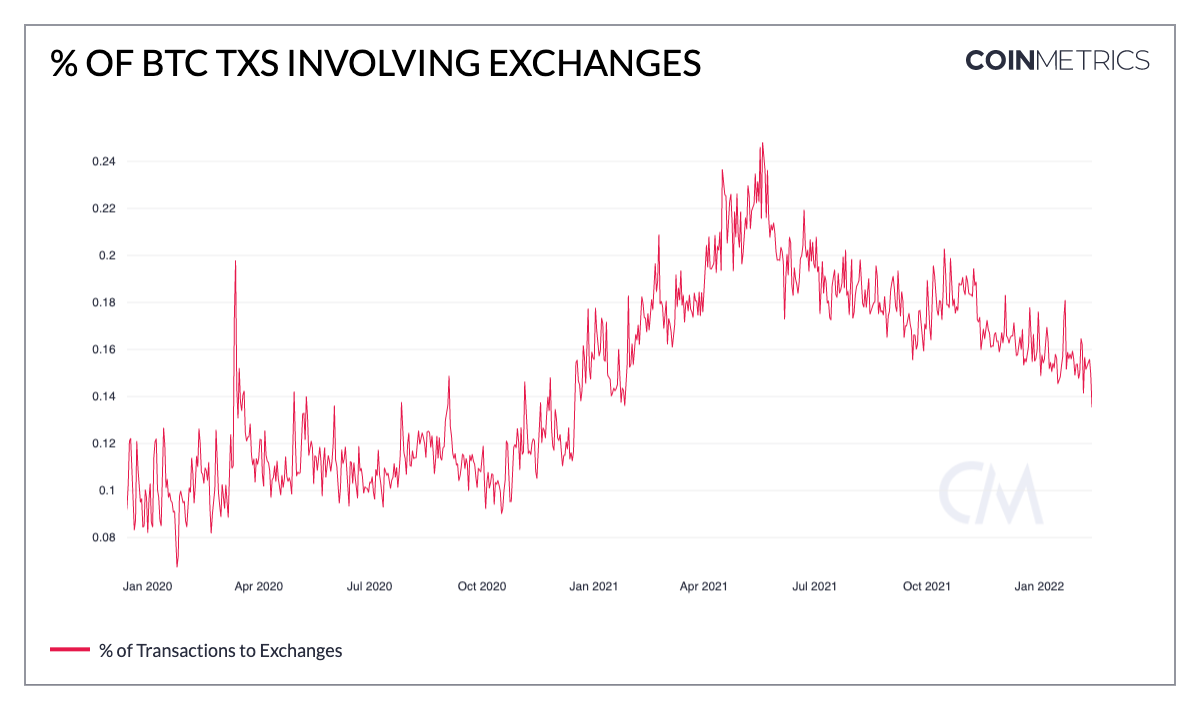

Get the best data-driven crypto insights and analysis every week: Searching Millions of SEC Filings for Crypto-Related TermsBy Kyle Waters and Nate Maddrey The first ever mention of Bitcoin in a document filed with the U.S. Securities and Exchange Commission (SEC) was appropriately entrepreneurial: “STARTING A BITCOIN VENTURE.” Found in a supplementary list of loan requests submitted by a peer-to-peer lending company Prosper Marketplace in June 2011, the filing details a California-based computer programmer’s plans to use a $7K loan to invest in bitcoin (BTC), build computers to mine bitcoin, and rent an office to establish a brick & mortar BTC/USD exchange. Since then, Bitcoin has been mentioned in 11,510 SEC filings by 2,169 unique filing entities. Publicly-traded companies in the US and other institutions like investment funds have long been reporting financial results (e.g. quarterly and yearly updates in 10-Q and 10-K filings) and communicating guidance on future plans and other economic information via documents submitted to the SEC. These filings are numbered in the millions and hold a wealth of data for researchers, economists, investors, and others. Just like the first ever filing to mention Bitcoin shows, SEC filings can be useful alternative data to analyze trends in investment interest and adoption of crypto assets. As more institutions and crypto companies from exchanges to Bitcoin miners receive debt and equity funding from public markets, the amount of filings mentioning crypto are increasing. In this week’s SOTN, we mined filings in the SEC’s EDGAR database for crypto-related terms, searching for signs of institutional interest and more. Initial Data AnalysisThe SEC provides a “full-text search” tool that allows users to discover filings in EDGAR containing case-insensitive strings of text like “B(b)itcoin” during specific time ranges, for example, all filings mentioning “Bitcoin” in the last 30 days. This covers all file types from prospectuses to earnings announcements and company presentations, for example. The chart below shows the number of filings by month mentioning Bitcoin plotted against BTC’s price. The number of mentions closely tracks historical price cycles, and has risen during bull runs. Mentions of Bitcoin were fairly rare until 2017 when they accelerated during that year’s price rise. They were again pretty flat until BTC’s price started rising during 2020/21 when mentions increased dramatically. A similar trend is noticeable for other crypto-related terms. Below are the number of filings mentioning “ethereum” and “blockchain” by month, which increased significantly in 2018 and going into 2021. Entity-Level DataThe number of filings is a useful starting point, but is a fairly rough proxy. Once a company starts mentioning Bitcoin (such as a Bitcoin miner) they will likely continue mentioning it or mention it everywhere in each filing (e.g. in disclaimers, business description). Another way to slice the data is by looking at the number of unique entities that are mentioning crypto-related terms. Entities include companies such as the Bitcoin mining company Riot Blockchain (RIOT) to asset-management companies such as Grayscale to companies with operations not primarily focused on crypto such as Tesla (TSLA) or Microstrategy (MSTR) that hold BTC on their balance sheets. The number of unique entities mentioning crypto terms has increased since 2020, which reflects a broader trend of crypto’s growing institutionalization. Bitcoin miners have also accounted for much of the increase. There are now over 40 publicly-traded Bitcoin mining companies on US and Canadian exchanges. Gauging Institutional Interest in 13F FilingsDeciphering institutional from retail interest is a particularly challenging problem in crypto research. One rough proxy is looking on-chain at the number of addresses holding relatively large amounts of native assets. Going into 2021, the number of addresses holding high balances of BTC and ETH rose, aligning with anecdotal evidence that institutional interest was picking up then. However, the trend seemingly broke during the second half of 2021 by this measure. Source: Coin Metrics’ Formula Builder Certain types of SEC filings can also be useful to measure institutional interest in crypto assets. Most investment funds that operate and conduct business in the US with at least $100M of assets under management (AUM) have to report a 13F filing that discloses each fund’s holdings to the public on a quarterly basis. Only a subset of a fund’s investments need to be reported however, and any positions in spot BTC do not need to be reported along with other spot commodities and currencies not treated as 13(f) securities. However, crypto-related investment vehicles such as trusts are often reported. The chart below shows the number of 13F filings mentioning Bitcoin which increased going into the beginning of 2021 but dipped somewhat in Q2 and Q3 last year, aligning with the on-chain data. To date, a popular way institutions have gained exposure to BTC has been through trusts, such as Grayscale’s Bitcoin Trust (GBTC), the largest by net asset value (NAV) that currently holds around 643K BTC valued at ~$27B. GBTC’s BTC holdings increased steadily along with the number of investment funds mentioning BTC in their 13F filings during 2020-2021. While GBTC holdings have flatlined since early 2021, 13F filings mentioning Bitcoin accelerated at the end of 2021. This reflects the introduction of the first (futures based) exchange-traded BTC products in the US in October 2021 which included the launch of ProShares’ Bitcoin Strategy ETF (BITO) and Valkyrie’s Bitcoin Strategy ETF (BTF) that hold BTC futures contracts traded on the CME. These funds are now being reported on 13F filings, accounting partially for the increase in unique entities. A similar trend from 2020 to 2021 is noticeable for Ethereum, reflecting its growing interest with institutions. However, there has yet to be any Ethereum ETF approved in the US, leaving trusts as the primary investment vehicle. ConclusionLooking at public SEC filings can be a helpful way to measure crypto’s growing presence in the US economy. Regular reporting is often viewed as an important component of the financial markets to assess performance and to analyze other disclosures. While it will be useful to keep watching for new information in future filings, it’s worth noting that public blockchains can enable far more granular updates. Crypto data is ushering in a new era of effectively real-time economic insights powered by on-chain data, a topic we have discussed before, and aim to expand on again in the future. Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Pro Activity on-chain on Bitcoin and Ethereum was mostly flat week-over-week with active addresses only rising about 3% on Bitcoin and 1% on Ethereum. In a potential sign of how much activity on Ethereum is currently US-focused, on-chain activity slowed on Superbowl Sunday with ETH fees averaging under $15 per transaction in a day for the first time since September 25, 2021. Network HighlightsThe percentage of BTC transactions involving exchanges has fallen to about 14% of daily transactions – about the same level as December 2020 – after peaking in the last year in May 2021 at around a quarter of all daily BTC transactions. Source: Coin Metrics’ Formula Builder Looking at all of the exchanges Coin Metrics tracks, Huobi now holds the smallest amount of BTC at 21K, after holding the most as recently as October 2020 when it held 300K BTC. This is further evidence of an ongoing global shift in crypto activity as Huobi has adjusted to new restrictions from the Chinese government. Source: Coin Metrics’ Network Data Charts Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. Check out the Coin Metrics Blog for more in depth research and analysis. © 2022 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. If you liked this post from Coin Metrics' State of the Network, why not share it? |

Older messages

Coin Metrics' State of the Network: Issue 141

Tuesday, February 8, 2022

Tuesday, February 8th, 2022

Coin Metrics' State of the Network: Issue 140

Tuesday, February 1, 2022

Tuesday, February 1st, 2022

Coin Metrics' State of the Network: Issue 139

Tuesday, January 25, 2022

Tuesday, January 25th, 2022

Coin Metrics' State of the Network: Issue 138

Wednesday, January 19, 2022

Wednesday, January 19th, 2022

Coin Metrics' State of the Network: Issue 137

Tuesday, January 11, 2022

Tuesday, January 11th, 2022

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏