Accelerated - 🚀 Should the SEC regulate crypto?

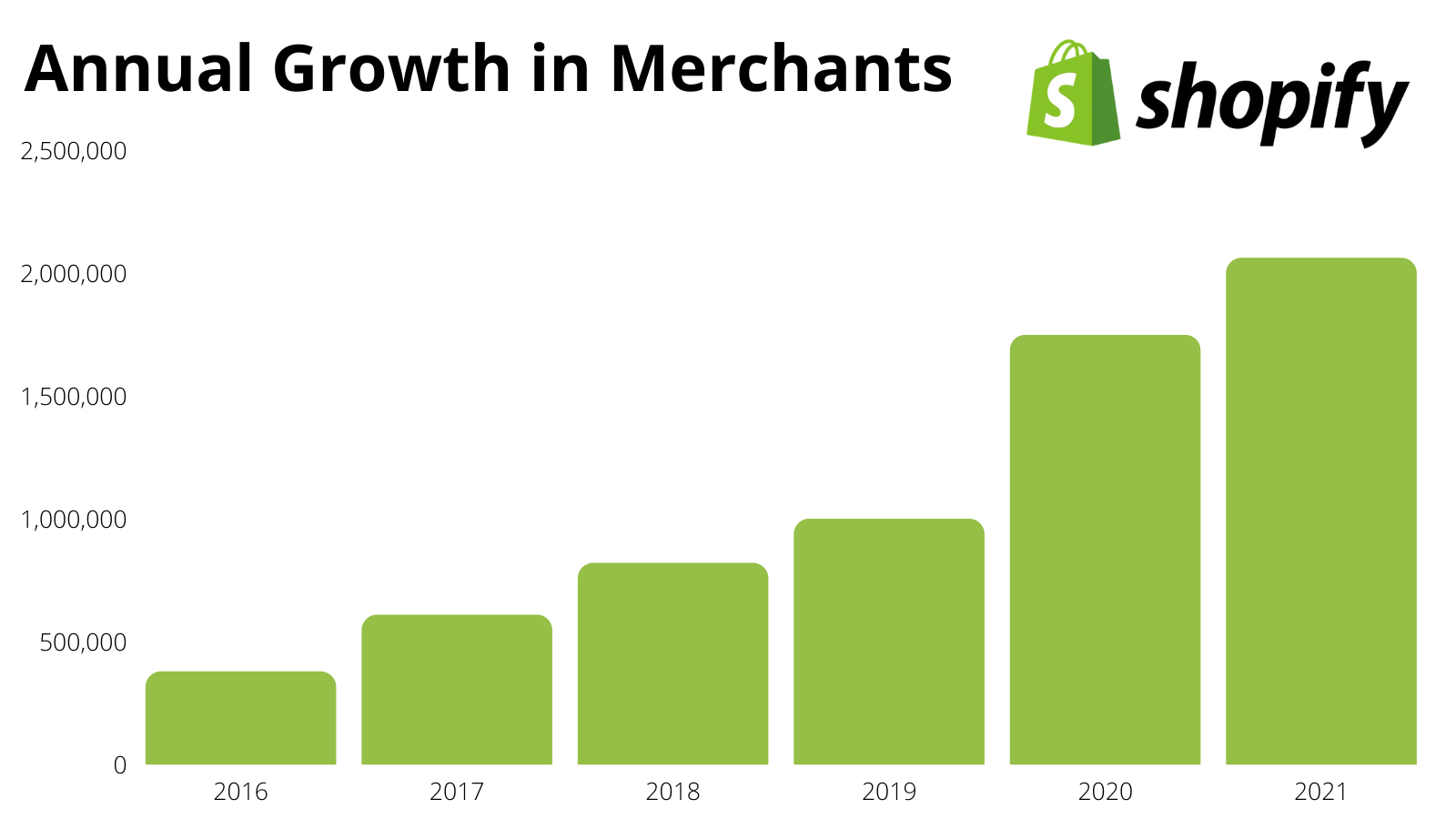

Shopify reported earnings this week (more below) - and the platform officially crossed 2M merchants! As you can see from the graph above, COVID was a massive accelerant for Shopify, which saw a 75% jump in merchants in 2020. This growth has fueled another category of companies: e-commerce enablement tools. These companies sell software that helps merchants run their online stores, tackling everything from SMS marketing to package tracking and customer support. If you’re interested in this space, Alloy Automation has a great overview of the e-commerce “stack.” It includes companies you might know - like Zendesk, Happy Returns, and Affirm - as well as newer entrants like Skio, Okendo, and Canal. I’m doing an independent study this quarter with GSB classmates about e-comm enablement tools, with a focus on how they sell into brands. We’re gathering data from people who work at these companies - I’d really appreciate if you could send this quick survey to anyone you know who works in this space! news 📣🎙️ Spotify buys more podcast startups. Despite the Joe Rogan controversy, Spotify isn’t giving up on its podcasting ambitions. This week, Spotify announced acquisitions of Podsights and Chartable (terms weren’t disclosed). These companies match advertisers with podcasts and enable both sides to measure the results of their campaigns. Over the past two years, Spotify has been making a hard push to better monetize podcasts, as revenue per user meaningfully trails other media. 💊 D2C healthcare updates. It’s been a while since we discussed D2C telemedicine companies! To recap: we saw a wave of these businesses launch in the late 2010s, centered around increasing access to care by making it easier to get medication online. Many raised lots of VC $ and quickly scaled nationwide, sparking questions about regulation and competitive moats. It’s been fascinating to watch these businesses mature - a few updates from the past two weeks:

📊 Earnings continue. It was yet another busy week for tech earnings:

It feels like all of these earnings updates are better suited to a “grandkid roundup” (Encanto reference) - I’m honestly considering it for next time… If you somehow weren’t watching the Olympic ice dance last weekend, you may have been tuning in to another sporting event: the Super Bowl. And you likely saw the Coinbase ad, which featured a bouncing QR code reminiscent of the DVD logo. If you scanned the code, you were directed to a website offering $15 in free BTC if you created a Coinbase account (and entry to a $3M sweepstakes). The ad was so popular that it drove an immediate 309% increase in app downloads - an influx of users that temporarily crashed the app. what i’m following 👀How TikTok is on the front lines of the Russia / Ukraine conflict. A look at the rise of the “me, an empath” meme. It’s already been a huge year for firms raising $1B+ funds. The SEC is considering new regulations that would require some private startups and VC firms to publicly disclose performance metrics. It’s been an eventful week in the SEC’s ongoing battle to regulate crypto. The biggest news was BlockFi settling a case with the SEC and paying $100M in penalties. The company’s high-yield interest accounts, which allowed users to lend out crypto (and earn up to 9.5% interest), was charged with violating securities laws. The SEC alleges that this product met the legal definition of a security, and therefore should have gone through the agency’s registration process. In addition to paying the penalties, BlockFi has also agreed to stop onboarding new customers to its high yield accounts - though it plans to create a new product that is SEC compliant. As the headlines above (all from this week!) illustrate, the BlockFi case is not the SEC’s only move into regulating crypto. SEC Chair Gary Gensler, who took office in April 2021, has serious concerns with crypto as an asset class - he believes it is “rife with fraud, scams, and abuse” and has even compared it to subprime mortgages before the 2008 financial crisis. It’s impossible to deny that there have been high profile scams in crypto, and that asset prices can swing wildly. However, crypto advocates have questioned whether it’s inherently more dangerous than other assets that the SEC does regulate - even “normal” stocks now see immense volatility that doesn’t appear to be driven by underlying fundamentals (and meme stocks are an extreme example). I would argue that SPACs are the most egregious case. I spend an embarrassing amount of time perusing the SEC’s EDGAR database, and I’ve seen some truly insane SPAC filings. I’m not referring to the Chamath-backed SPACs, which have largely performed poorly but have real traction. I’m talking about companies that have little to no revenue and questionable business models. A few examples:

I think these SPACs illustrate an important point: registering an asset with the SEC doesn’t guarantee that it’s “safe” for retail investors. Crypto is probably too much of a “Wild West” today - but I’m not yet convinced that putting every crypto product under the purview of the SEC will stop the scams. And I worry that forcing early stage projects to comply with heavy regulation may slow the pace of innovation we’re seeing in this space (by making it too time intensive / costly). I’m admittedly new to this space, so if you’ve spent time thinking about crypto regulation and have an opinion on how it should (or shouldn’t) happen, I’d love to hear from you! Feel free to comment below or find me on Twitter @venturetwins. jobs 🎓SVB Capital - Senior Associate* (Palo Alto) DCVC - Associate (Palo Alto) Deserve - Associate Product Manager (Palo Alto) Scopely - Associate Product Manager (LA) Mosaic - Biz Ops & Strategy Associate (San Diego, Remote) Bullish - Analyst (NYC) Rally - Chief of Staff (NYC) Commonfund Capital - VC Analyst (NYC) Redesign Health - Portfolio Ops Associate (NYC, Remote) Ramp - Business Operations* (NYC, Remote) Argyle - Growth Product Manager (Remote) *Requires 3+ years of experience. internships 📝thredUP - MBA Biz Ops & Strategy Intern (Remote, Oakland) Carbon Health - PM Intern (Remote) BBG Ventures - MBA Summer & Fall Intern (Remote, NYC) Clearcover - Growth Ops Intern (Remote) M1 - Customer Growth Spend Intern (Remote) Robinhood - Consumer & Product Comms Intern (Remote) B Capital Group - MBA Summer Associate Intern (SF) JUMP Investors - VC Intern (Santa Monica) Techstars - Founder Intern (Baltimore) The Engine - Summer Associate (Cambridge, MA) Live Nation - Summer Ventures Analyst (NYC) Spotify - Innovation & Market Intelligence Intern (NYC) puppy of the week 🐶Meet Ryley, a 27-month-old golden retriever from Syracuse, NY. She enjoys annoying her dad by napping on prohibited furniture, hiking, chewing balls, and finding sunlight to nap under. She's also an avid reader of Accelerated! Hi! 👋 I’m Justine Moore, an early stage consumer & SMB investor. I’m currently Head of GTM at Canal. Thanks for reading Accelerated. I’d love your feedback - feel free to tweet me @venturetwins. If you liked this post from Accelerated, why not share it? |

Older messages

🚀 Has Facebook saturated the world?

Sunday, February 6, 2022

Plus, some thoughts on Joe Rogan and "deplatforming."

🚀 Are you Super Pumped?

Sunday, January 30, 2022

Plus, a new podcast recaps the week's Twitter drama 👀

🚀 The Great Convergence: why is every social app starting to look the same?

Sunday, January 23, 2022

Plus, it's officially market correction season!

🚀 Is YC squeezing out seed funds?

Sunday, January 16, 2022

Plus, the TV show that scouted Gen Z's biggest stars!

🚀 Announcing Accelerated's VC recruiting guide!

Sunday, January 9, 2022

Plus, a look at Twitter's newest feature 👀

You Might Also Like

AI Assistants Will Be Great (Especially for the Biggest Companies)

Friday, February 14, 2025

Plus! Short Selling; Crypto Treasury Gresham's Law; The Joy of Higher Rates; Labor Substitution; Pricing Black Swans AI Assistants Will Be Great (Especially for the Biggest Companies) By Byrne

🏈 The Super Bowl flight that upped tariffs

Friday, February 14, 2025

The US stamped 25% tariffs on key metal imports, France is coming for America's AI reputation, and chocolate tinned fish | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Why Economists Got Free Trade With China So Wrong

Friday, February 14, 2025

“The China Shock” gets revisited View this email online Planet Money “The China Shock” Revisited by Greg Rosalsky By now, many economists are hoarse screaming that higher tariffs and a trade war will

FinTech is People - Issue #508

Friday, February 14, 2025

FTW Opinions: When fintech principles shape government finance, the stakes go beyond efficiency—trust, security, and oversight are on the line ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Special Announcement From Harry Dent

Friday, February 14, 2025

Harry Dent February 11, 2025 Many of you have heard me talk about John Del Vecchio, one of our trusted partners at HS Dent. He runs two highly successful programs, Microcap Millions and FAST Profits,

Using AI as a Retirement Vision Board

Friday, February 14, 2025

This tool paints a picture of your financial future ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Get a life insurance quote in seconds

Friday, February 14, 2025

And get approved just as fast ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

❌ Altman dissed Musk's OpenAI bid

Friday, February 14, 2025

Musk bid nearly $100 billion for OpenAI, Europe prepared its own diss for the US, and the egg undercurrent | Finimize TOGETHER WITH Hi Reader, here's what you need to know for February 12th in 3:04

Fossicking in the dark or twenty-twenty foresight?

Friday, February 14, 2025

Rishi Khiroya and Lydia Henning If you asked people what skill they would most love to have, you might receive answers like 'to fly', 'to be invisible' or even 'predicting the

I love you(r high credit score)

Friday, February 14, 2025

plus Benson Boone + pizza perfume ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏