Earnings+More - Feb 24: Bally waits to make its play

Feb 24: Bally waits to make its playBally Corporation Q4, Better Collective Q4, Churchill Downs Q4, earnings in brief +MoreGood afternoon. In another busy day, the agenda is as follows:

BREAKING: Churchill Downs has announced on its Q421 earnings call that it is exiting the “online wagering” business. CEO Bill Carstanjen said: “This isn't the result we wanted, but it is the prudent next step. We remain excited about Twin Spires horse racing.” More reaction to the earnings call and Churchill Downs’ results in tomorrow’s Weekend Edition. Bally Corporation Q4

Special committee: Having formed an independent board committee to consider the bid from major shareholder Standard General, chairman Soo Kim said nothing further on the call. Better get it right: With the Bally Bet 2.0 sportsbook set to launch (and debut in New York) in H1, the group said it was not worried about going live later than its main rivals. Earlier in the week, Bally chairman Soo Kim told PoliticsNY that the group’s focus was always on getting the product right.

No splash: The group won’t be making a big marketing or advertising splash. Having forecast ~$125m in revenues and ~60m EBITDA loss (vs. -$80m initially) from its North America interactive activities for 2022, CEO Lee Fenton said the $20m improvement was partly due to the timing of the launch and the group staying cautious “on build-out”.

DB checks: Despite not having physical properties in New York, Fenton pointed out that Bally’s Atlantic City casino database had as many New York addresses as New Jersey ones, with the same trend applied to its Pennsylvania resort.

Different kind of chip: Asked how Bally’s would “chip away” at the market shares of its main competitors, Fenton mentioned the group’s partnership with Sinclair Broadcasting, “significant capacity” to recruit players through its free-to-play games. “But I’m not sure if I like the expression to “chip away”, “gain significantly” over time is how I would describe it.” Analyst quick takes Jefferies said there was “so much to unpack” and the quarter reflected “limited near term visibility into the business, based on the lower than expected results and guidance”. However, factors such as Soo Kim’s ~$2bn bid for the group and the company's share buyback scheme also played a part. Wells Fargo said “revenues were 7% below our $586m and 6% below consensus' $586m. International interactive EBITDA was $70m vs. our $79m (margins 27.8% in line with our 28%), while North America interactive EBITDA was -$9m vs. our -$8m.” **Sponsor's message: Spotlight Sports Group, a world-leading technology, content and media company has announced a significant new partnership with U.S. media giant Advance Local. The agreement sees Spotlight Sports Group deliver customised integrated affiliation tools, free-to-play games and national and localised sports betting content for a select number of Advance Local’s network of digital media and websites. Read more on the story here. To find out more on how Spotlight Sports Group can fully managed, modular solutions for global media at spotlightsportsgroup.com. Better Collective Q4

Supercalifragilistic: There can be no doubting the transformation being wrought by the sports-betting boom in the US which, Better Collective said today, is now its single biggest market. In Q4, the US contributed €20m of revenue or ~38% of the total. For the full year 2022 the company expects the US to be worth $100m.

Share crop: Søgaard suggested the company was seeing the first signs of a shift in the US from CPAs to revenue shares.

Lost in translation: Still, the “quantum leaps” that CEO Jesper Søgaard said the business was making came with some downsides. Despite the large rise in NDCs, the proportion of those coming through on revenue share - while boosting long-term revenues - also had a short-term impending effect on revenues and EBITDA. Combined with a low sports-betting margin for the period, the company estimated a ~€6m effect on earnings. Paid in full: There were specific issues around paid media where margins fell to 5% from 13% in the prior-year period, comparing poorly with the 40% margins in the publishing segment. Paid revenues were flat.

What Søgaard said On future US M&A: “We are very comfortable with the position we have in the US brands. We believe we can build from that position. We have no need to buy but there could be opportunities that would be a nice supplement to our business there. But it's more nice to have than must-have.” On Better Collective being an attractive acquirer: “I think BC has a very strong name in terms of being a potential buyer when a seller considers selling the business.” Churchill Downs Q4

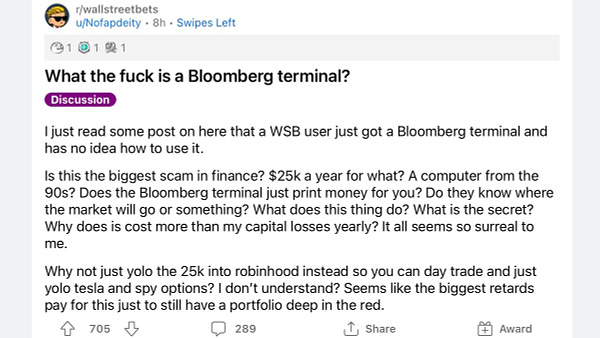

Historic quarter: The record results for 2021 were driven by the gaming segment which delivered the majority of adj. EBITDA at $411.9m. The Twin Spires horse-racing segment saw adj. EBITDA fell 6% YoY to $119m. The company announced the expansion of its gaming segment (particularly the historical racing machines segment) with the acquisition of the Peninsula Pacific Entertainment business earlier this week. Churchill Downs will conduct an earnings call on Friday, Feb25. Earnings in briefSuper Group: Pre-announcing its FY21 results, the operator behind the Betway and Spin brands said net revenue would be up ~36% to $1.52bn while estimated full-year 2021 EBITDA will be in the region of $350m. Super Group’s full results will be published in the first half of April. Galaxy Entertainment: The Macau operators said revenues were up 53% to HK$19.7bn but that adj. EBITDA recorded a loss of HK$1bn. Chairman Liu Che Woo said he remained confident in the future of Macau and said trading through the Chinese New Year had been encouraging. FuboTV: Q122 revenues will reach $232-$237m and FY22 revenue will hit between $1.08-$1.09bn. The company didn’t update on its sports-betting numbers other than to say its “expansion into real-money wagering is underway” in two states (Arizona and Iowa), “with additional states expected to follow this year”. Ainsworth: The Australian-listed gaming machine provider saw revenue rise 39.7% for H1 to A$100.7m with the company once again reporting an EBITDA profit of A$24.6m, from a loss in the prior year period of A$36.8m. In part, the results were driven by an increase in the revenue derived from historical racing machines. Cirsa: The slots hall operator saw revenue rise 79% to €378.4m while adj. EBITDA was up 137% to €121.2m. The company is on track to return to pre-Covid elevsl with the hours of operation in Q4 at 95% across its European and LatAm operations, up 6pp on Q3. Everymatrix: Revenue rose 33% to €23.9m in Q4 and was up 23% in 2021 as a whole at €86.7m. Q4 EBITDA rose 23% to €4.4m and 65% to €19.7m for the year. The increases came despite the “challenges” in Germany. Everymatrix has applied for licenses in New Jersey, West Virginia and Michigan and is in the process of applying in more states. Startup newslineAccess: Previous Startup Focus company Sporttrade has gained market access to two more states, Indiana and Louisiana, via market access agreements with Penn National and Caesars Entertainment respectively. It hopes to go live in each state in 2023. Jefferies Macau updateMacau’s daily revenue for the week ending Feb20 dropped to MOP185m/day from the Chinese New Year highs MOP333m/day and MOP429m/day in the first two weeks of February due to the “traditional post-holiday visitation slowdown and weaker travel sentiment after recent Zhuhai Covid cases”, the team at Jefferies said. The VIP win-rate was slightly below the 2.7% average and that also contributed to lower GGR. Brazil regulatory updateBrazil has legalized online and land-based casino gambling. The vote by the country’s Chamber of Deputies will allow integrated resorts to be established across Brazil’s 26 states. The bill will be voted on today (Feb24) in the Senate and is expected to pass. The licensing fees for offline and online casinos have been set BRL$600K/$120K per establishment and domain name. Sports betting is being regulated separately, licenses will be granted at both federal and state government levels. Taxes on winnings are set at 15%. NewslinesTriple deal + Lone Star option: Rush Street Interactive has secured market access in Ohio, Maryland and Missouri by signing a 20-year strategic partnership with Penn National Gaming. The agreement will enable RSI to operate its BetRivers brand in those jurisdictions once OSB and gaming regulations have passed. RSI has also been granted first refusal rights over a potential skin agreement with Penn National in Texas should the state pass OSB or icasino legislation. California dreaming: A UC Berkeley Institute of Governmental Studies survey released Wednesday and co-sponsored by the Los Angeles Times reports that 45% of California voters are in favor of legalizing sports betting in the state. One-third of voters opposed the idea and 22% of respondents were undecided. Three ballot measures proposing different business models are set to appear on the midterm ballot in November, voters were not asked which model they would prefer. Done deal: Las Vegas Sands has completed the $6.25bn sale of the Venetian to Apollo Global and VICI Properties. In a statement, LVS said its strong balance sheet and operational focus on Macau and Singapore meant it was Poised for a new era of growth,”, according to CEO Rob Goldstein. LVS will maintain its corporate headquarters in Las Vegas. Nugget deal: Century Casinos said it is acquiring the Nugget Casino in Sparks, Nevada, from Marnell Gaming for $195m including the sale of 50% of the real estate for $95m with a five-year option to buy the rest for $105m. The $100m value of the operational business is priced at 5.6 times 2021 EBITDA. Keno down under: Lottoland and Tabcorp shared the spoils of Australia's first multi-channel Keno licenses in the state of Victoria. The 20-year licenses allow the companies to provide online and retail Keno, replacing the current 10-year retail-only license held by Tabcorp since 2012. See you in court: Gaming machine-to-fintech provider Everi has filed a legal action challenging the validity of a patent owned by cashless payment provider Sightline Payments. Sightline has previously sued Everi for patent infringement. Everi believes the Sightline suit is without merit. What we’re readingDating disaster: Were the dinosaurs wiped out on a beautiful spring day? California love: The LA Times breaks down the sports betting survey findings from the UC Berkeley Institute of Governmental Studies. On socialIt’s terminal…

Calendar

Contact us

If you liked this post from Wagers.com Earnings+More, why not share it? |

Older messages

Feb 23: Caesars: Digital Q1 ‘will be ugly’

Wednesday, February 23, 2022

Caesars Entertainment Q4, Catena Media Q4, Churchill Downs P2E acquisition, DraftKings analyst downgrade, earnings in brief, Playtech takeover news +More

Feb 17: New Jersey defies the odds

Thursday, February 17, 2022

New Jersey, Michigan Jan22, Tabcorp H1, Aspire G4, Wynn analyst update, Sportico fan engagement seminar, earnings in brief +More

Feb 16: Wynn’s 'absolute stunner'

Wednesday, February 16, 2022

Wynn Resorts Q4, Super Bowl betting, New York wk.5, AGA State of the Industry, GiG, earnings in brief +More

Feb 14: The billion-dollar ball game

Monday, February 14, 2022

Super Bowl betting, Gambling.com analyst update, 2021 OSB market shares, Startup focus - DoTrust, the shares week +More

Feb 11: Weekend Edition no.33

Friday, February 11, 2022

Kambi Q4, LeoVegas Q4, MGM analyst update, earnings in brief, sector watch - affiliates +More

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these