Earnings+More - Feb 17: New Jersey defies the odds

Feb 17: New Jersey defies the oddsNew Jersey, Michigan Jan22, Tabcorp H1, Aspire G4, Wynn analyst update, Sportico fan engagement seminar, earnings in brief +MoreGood morning. A packed global agenda today.

Across the great divide. Click here: New Jersey Jan22

Smash and grab: One of the shibboleths of the short history of online sports-betting in the U.S. appeared to be smashed yesterday when New Jersey broke a new record for handle despite New York having opened up to mobile betting during the month. And yet: Deutsche Bank noted that New York had opened after the majority of the College Bowl season and that NJ was likely helped by the tsunami of promos across the Hudson with border-crossing customers using NJ apps to hedge NY-sourced promo wagers.

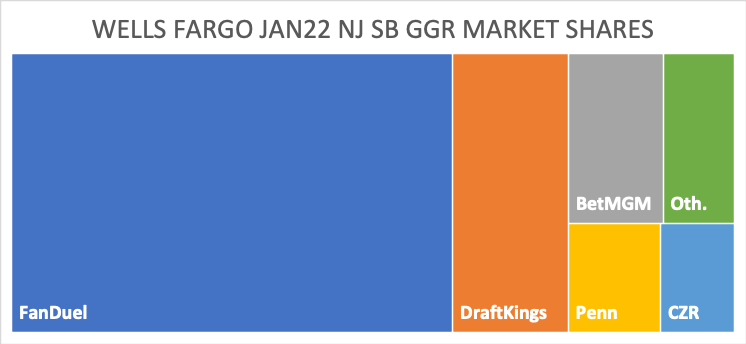

Market shares: Wells Fargo estimated the markets shares in sports-betting with FanDuel ahead on 61% followed by DraftKings (16%), BetMGM (8%), Penn (5%) and Caesars (4%). **Sponsor's message: Spotlight Sports Group (owned by Exponent Private Equity) is a leading technology, content and media business specialising in sports betting. Working with the largest media companies in the world, including AS.com, Spotlight Sports Group offers fully managed solutions that allow publishers to maximise revenue across their highly valuable sports betting audiences. For more information visit: spotlightsportsgroup.com Michigan Jan22

Promo slo-mo: January promotional spend dipped significantly, down by 35% from December’s total or representing 45% of total OSB GGR vs. 68% in Dec21. However, as Wells Fargo analysts pointed out, hold at 8% was high in Jan22 vs. a lower hold in Dec21. But the lower promos will likely rebound with the Super Bowl in Feb, say EKG.

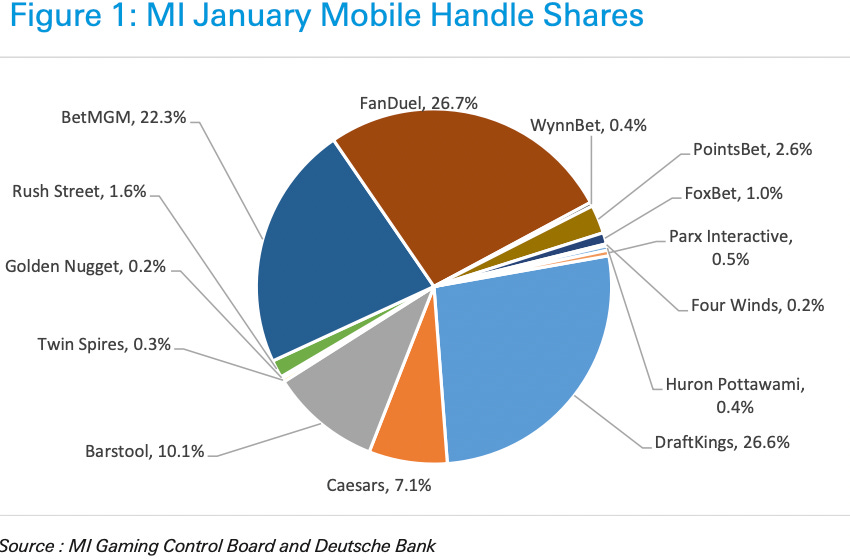

Toploader: By market share, FanDuel, DraftKings and BetMGM controlled ~84% of GGR. (Handle share was c75% - see DB chart below). EKG pointed out that the super-aggressive Caesars (at 3.3% GGR) hasn’t made as much of an impression in MI as elsewhere. Maturing: For iGaming, EKG pointed out that another near-record month - helped by cold weather and a busy sports calendar for sports-led brands - means that monthly online per adult GGR is now trending ahead of Pennsylvania and closing in on the more mature - and wealthier - NJ.

Aspire Global Q4

Live M&A: CEO Taschi Maimon said the group had excelled at executing its strategy of controlling as much of the value chain by focusing on the key B2B segments: online sports betting, casino, bingo and, he added:

US visa: The upcoming NeoGames acquisition will enable Aspire to accelerate the pace of U.S. deals it can sign with lottery operators, Maimon said. Note: Aspire’s PariPlay has been active in the U.S for the past two years and Maimon said BtoBet had “big plans” there as well. Say it loud, say it proud: Maimon was keen to stress Aspire would not be distracted by the “easy money” to be made in unregulated territories.

Tabcorp H1

Oz Lottery: The demerger of the lottery and keno business remains on track, said CEO David Attenborough, and will complete in June. The business enjoyed a record first half with adj. EBITDA up 15.1% to A$358m. Tie me kangaroo down: Wagering and media bore the brunt of the impact of Australia's covid containment measures with lockdowns meaning there were 45% fewer venue trading days vs. the prior year. Wagering and media adj. EBITDA fell 34.8% to $148m. Margins were reduced due to higher advertising costs while shops were shuttered. Gaming services static at A$21m. Raketech Q4 earnings callSolid air: Much of the Q&A focused on North America and Raketech CEO Oskar Mühlbach the focus was on securing “a solid footprint” in the U.S. and has established a U.S. division with former GAN exec Danielle Parsons to head it up.

Sub Club: U.S. revenues grew 149.5% to €2.6m thanks to the ATS buyout, but while New York “has a positive effect” it wasn’t as pronounced as other affiliates due to ATS’ current subscription model. Wynn analyst snap

Sportico fan engagement seminarOh Superman: Talking on a Sportico seminar panel held yesterday afternoon, Karol Corcoran, the general manager for online sportsbook at FanDuel suggested a difference in the U.S. betting experience versus Europe was the degree of interest in the performance of individual players.

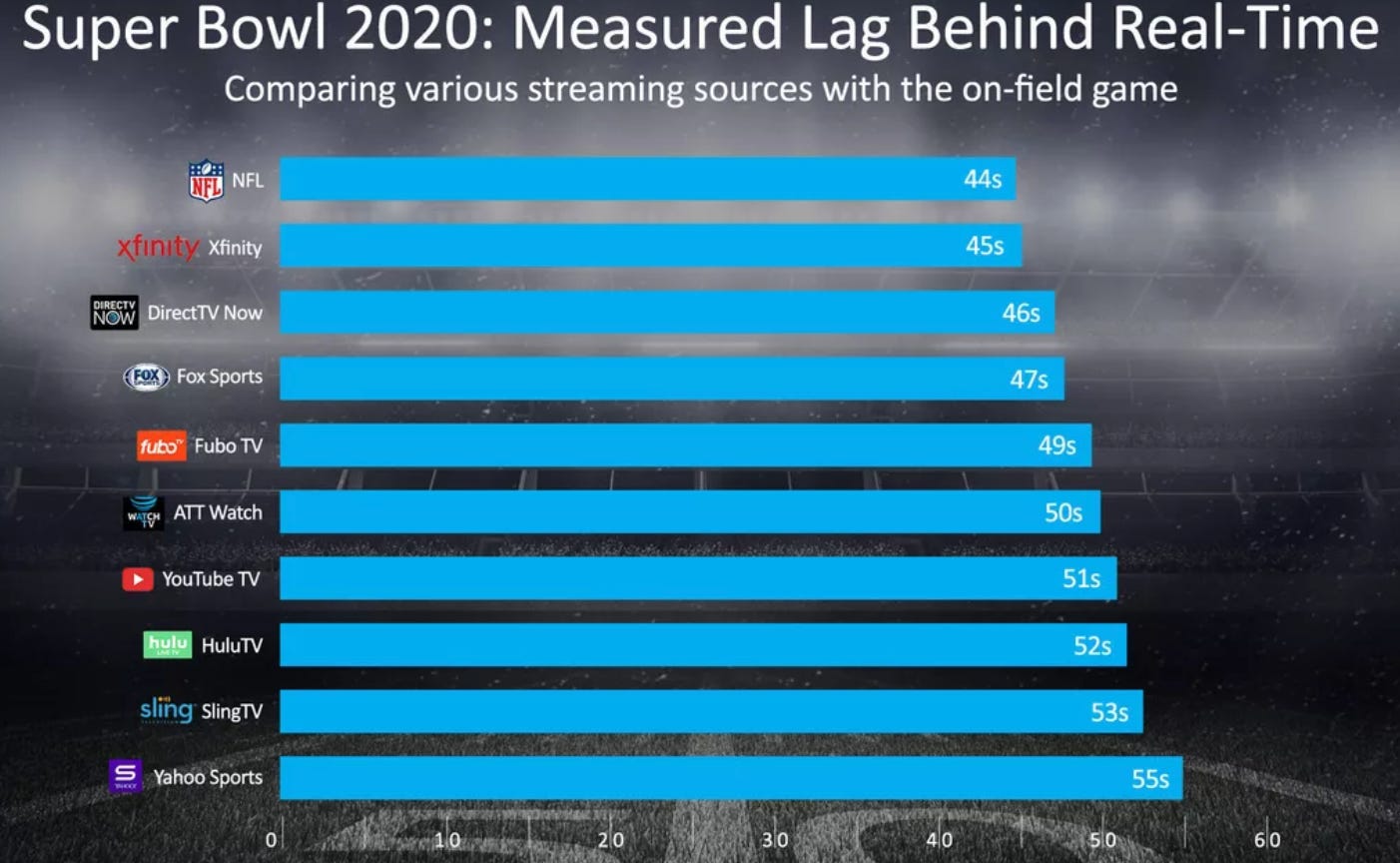

In-play catch-up: Carsten Coerl, CEO at Sportradar, suggested that the current inversion of the European model - with more pre-match than in-play in the U.S., wouldn’t be long-lasting. “It’s just catching-up,” he added. “It’s just a question of how fast.” Can the delay: Corcoran noted, however, that latency problems, notably with TV viewers that have gone digital, were a practical issue. “How the customer consumes the sport and gets the latest betting info is not necessarily at the same speed,” he added. Hi-frequency: Coerl said the task was to “get the same latency as the financial markets”. “But the technology is there,” he added. “Cloud computing can do this with zero latency.” Scott Kaufman-Ross, senior VP and head of gaming and new business ventures, NBA, agreed that ‘the technology is there” to enable the shift from linear to digital.

Further reading: The Super Bowl streaming delays measured. NewslinesNew games: Evolution will provide Sisal with a selection of online slots games from group companies netEnt and Red Tiger, extending the existing live casino partnership. Ontario opposition: The Mohawk Council of Kahnawà:ke and the Six Nations of the Grand River have signed a Mutual Cooperation Agreement on Gaming to protect their rights to provide gaming in Canada. They will oppose the forthcoming regulation of online sports betting and gaming in Ontario in April and across the country more generally. Boardroom level: FanDuel and Boardroom, the sports business site set up by Kevin Durant and Rich Kleiman, have signed a multi-year exclusive content-focused partnership spanning web, editorial, video, audio and social media. Local hero: Spotlight Sports has announced a new sports betting content partnership with U.S. media group Advance Local. The partnership will be live across Advances’s 12 media websites in states such as New York, Michigan or Oregon. What we’re listening toTrust us: The Gambling Files speaks to Charles Cohen, CEO at recent WE+M Startup Focus company DoTrust. On social Kindred Group @KindredGroup "Ensuring compliance with national and international laws contributes to a sustainable society." Rolf Sims, Kindred’s Public Affairs Manager Norway explains the regulatory turbulence in Norway: https://t.co/Vh4KJMbiWvCalendar

Contact us

If you liked this post from Wagers.com Earnings+More, why not share it? |

Older messages

Feb 16: Wynn’s 'absolute stunner'

Wednesday, February 16, 2022

Wynn Resorts Q4, Super Bowl betting, New York wk.5, AGA State of the Industry, GiG, earnings in brief +More

Feb 14: The billion-dollar ball game

Monday, February 14, 2022

Super Bowl betting, Gambling.com analyst update, 2021 OSB market shares, Startup focus - DoTrust, the shares week +More

Feb 11: Weekend Edition no.33

Friday, February 11, 2022

Kambi Q4, LeoVegas Q4, MGM analyst update, earnings in brief, sector watch - affiliates +More

MGM: ‘We're just getting rolling’

Thursday, February 10, 2022

MGM Resorts International Q4, Betsson Q4, bet-at-home 2022 forecast, earnings in brief, Jefferies' sports-betting customer survey +More

Feb 9: Kindred loosens ties with Kambi

Wednesday, February 9, 2022

Kindred, Evolution Q4, Gambling.com trading update, Super Bowl betting forecasts, Wells Fargo sector update +More

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these