DeFi Rate - This Week in DeFi - February 25

This Week in DeFi - February 25This week, Starkware beta and Opera browser integration, Yearn comes to Arbitrum, Zebec raises $15m for USDC payroll, and Celsius funds Maple

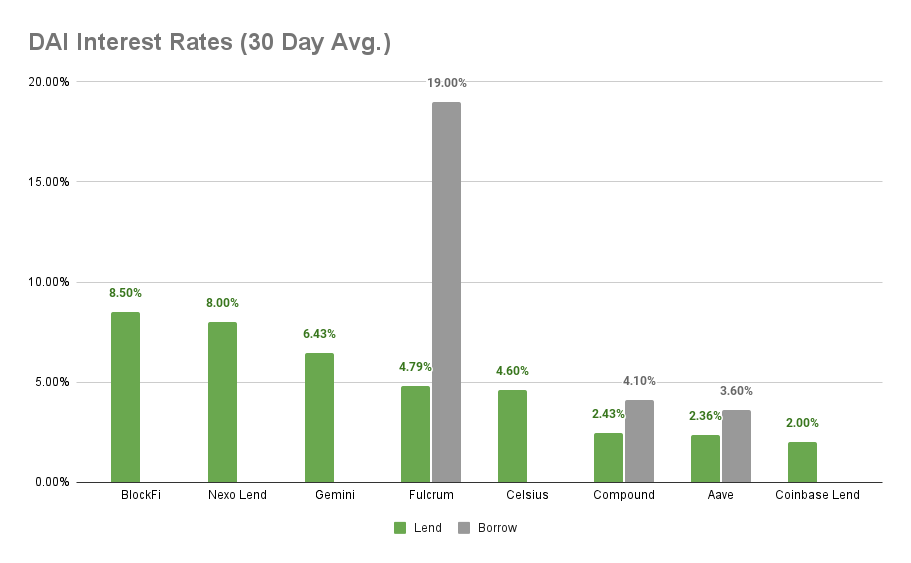

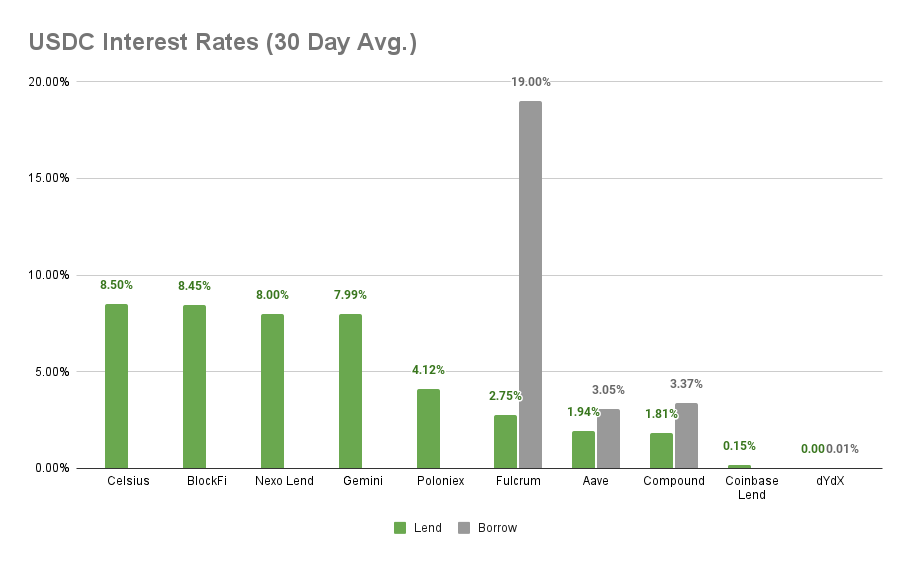

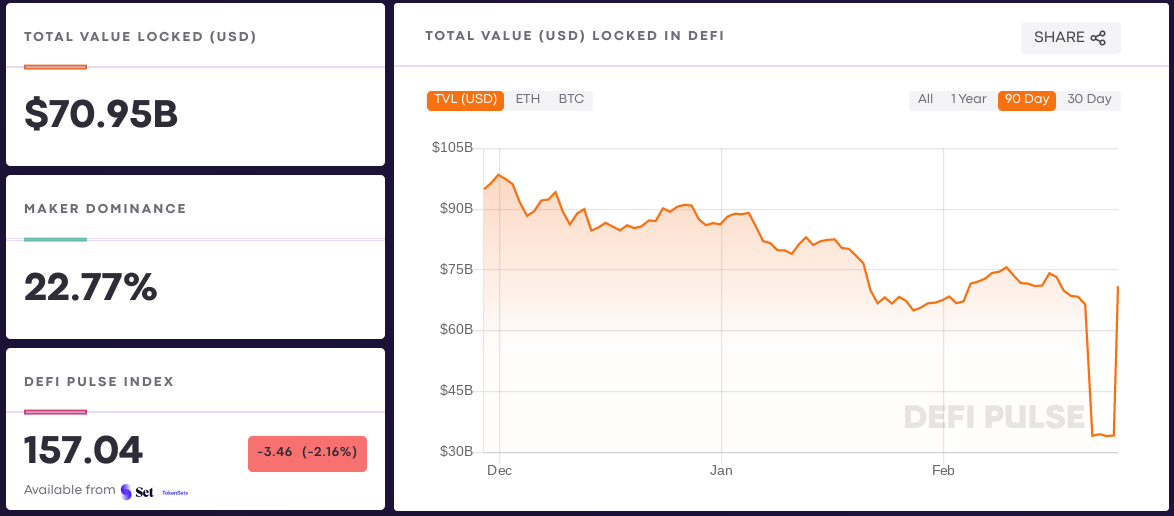

To the DeFi community, This week, Eth L2 Starknet launched its public beta and announced an integration with the Opera web browser and DiversiFi, allowing users to trade digital assets on L2 directly from their browser. In addition to the substantial savings on gas costs, the partnership will seek to bring additional DeFi functionality to the user-friendly DeFi access point, including support for providing liquidity and earning yield on assets.  DeversiFi 🥷 @deversifi We have teamed up with @opera and @StarkWareLtd to power the first mobile browser wallet on #Ethereum #Layer2 🚀 Transact instantly and gas-free with #L2 directly from the #Opera browser 🙌 Find out more here👇 https://t.co/qX4EJmaUFt https://t.co/8happjhtefYearn Finance added support for the Arbitrum L2, bringing gas savings and improved transaction throughput, while also allowing users to withdraw from Arbitrum using Binance or FTX.   Solana-based Zebec Pay raised $15 million from a group of investors including Alameda Research, Coinbase, and Circle. The platform enables real-time settlement for payroll and other payments use cases using USDC and other stablecoins, providing documentation and support to make such on-chain operations easier for businesses to account for in their existing frameworks and for tax and compliance purposes. Funds will go towards additional partnerships with crypto projects and additional value-added services for business customers.  Sam Thapaliya @sam_thapaliya 🚨 Fundraising announcement 🚨 We are excited to announce that Zebec has raised a $15 million private round from some of the best investors in tech and crypto to scale our product to support rapidly increasing crypto adoption. https://t.co/2TANdbsUA1 https://t.co/Jos8aXo9kNAnd CeFi lending platform Celsius is getting in on the DeFi action with a $30 million allocation into Maple Finance. Maple uses a hybrid model where users can contribute to pools of capital designated for particular types of investments, while delegated analysts assess risk and help direct undercollateralized loans to promising projects.   Maple and Celsius teaming up is one of a handful of early examples of the crossover between centralized and decentralized finance, offering an early glimpse of what the evolution of finance based on blockchain infrastructure could look like. Centralized lending services are always looking for the best possible source of yield for their customers, and Maple has developed a unique system of managing lending risk that, in theory, will beat returns from overcollateralized lending platforms while reducing the overhead for making and maintaining such loans and unlocking new ways of attracting and rewarding delegates who assess risk. We can envision this framework playing out on a much larger scale as an analogy for widespread DeFi adoption - one basket of protocols or services focused on providing a simple, easy-to-use user experience, managing the particulars of KYC and compliance reporting, and serving as a primary sales funnel to a mostly DeFi back end, with a second based focused on technical execution and managing risk in an effective but low-cost way. Instead of relying on a handful of banks at massive scale to subsume all of these roles, seek rent, and limit their focus to only the most profitable or palatable opportunities, DeFi offers the opportunity to break these essential financial functions into constituent parts that can focus on a far wider set of priorities. Ultimately, such a system could allow humanity to work to address inequality, climate change, and a host of other pressing issues more quickly and directly, and without funneling the profits from doing so to a handful of executives or shareholders. There will be many roadblocks and challenges along the way, but the opportunity to use our financial infrastructure to lift up communities and solve big problems the world over is too good to pass up. Keep your eyes on the prize! Thanks to our partner: Nexo – Unlock the power of your crypto with up to 17% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: BlockFi at 8.50% APY, Nexo Lend at 8.00% APY Cheapest Loans: Aave at 3.60% APY, Compound at 4.10% APY MakerDAO Updates DAI Savings Rate: 0.00% Base Fee: 0.00% ETH Stability Fee: 2.00% USDC Stability Fee: 0.00% WBTC Stability Fee: 2.00% USDCHighest Yields: Celsius at 8.5% APY, Nexo Lend at 8.00% APY Cheapest Loans: dYdX at 0.01% APY, Aave at 3.19% APY Top StoriesPolygon Rewards $75k To a White-Hat HackerCosmos Builder Tendermint Rebrands to ‘Ignite’ as Team Shifts FocusTerra Raises $1 Billion for an Emergency Bitcoin ReserveCosmos Ecosystem Quietly Surges to $17B in TVLStat BoxTotal Value Locked: $70.95B (down -18.78% since last week) DeFi Market Cap: $106.49B (down -3.4%) DEX Weekly Volume: $19.07B (up 18.67%) DAI Supply: 9.22B (down -5.73%) Total DeFi Users: 4,425,760 (up 0.69%) Bonus Reads[Timothy Craig – Crypto Briefing] – Ukraine Bitcoin Donations Top $4M as Russia Conflict Intensifies [Ben Giove – Bankless] – Guide to Sustainable Yield Farming [Jacob Oliver – Crypto Briefing] – Where the Bufficorns Roam: ETHDenver Reviewed [Denis – Dose of DeFi] – EVM compatibility and the future of blockchains If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week in DeFi - February 18

Friday, February 18, 2022

This week, new Castle Island $250m fund, Curve on Moonbeam, Ref Finance raises $4.8m, and Gnosis Safe spins out into SafeDAO

This Week in DeFi - February 11

Friday, February 11, 2022

This week, Optimism pays $2m bug bounty, Polygon raises $450m in private sale, ssv.network raises $10 million, and new MakerDAO bug bounties

This Week in DeFi - February 4

Friday, February 4, 2022

This week, Kuiper offers DeFi native indexes, Aave executes cross-chain governance, 1inch adds new stablecoin pools, and Dune raises $69m

This Week in DeFi - January 28

Friday, January 28, 2022

This week, SuperDAO raises $10.5m seed funds, BitDAO funds zkDAO with $200m, HAL raises $3m and Aave integration, and new Syndicate DAO tools

This Week in DeFi - January 21

Friday, January 21, 2022

This week, 1inch comes to Avalance and Gnosis Chain, Aave Arc headed to L2, Stader Labs raises $12.5m for staking, and EIP-1559 for Polygon

You Might Also Like

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏