DeFi Rate - This Week in DeFi - March 4

This Week in DeFi - March 4This week, Electric Capital raises $1b for Web3, 1inch intros P2P swaps, Nested raises $7.5m, and VALR gets $50m for crypto in Africa

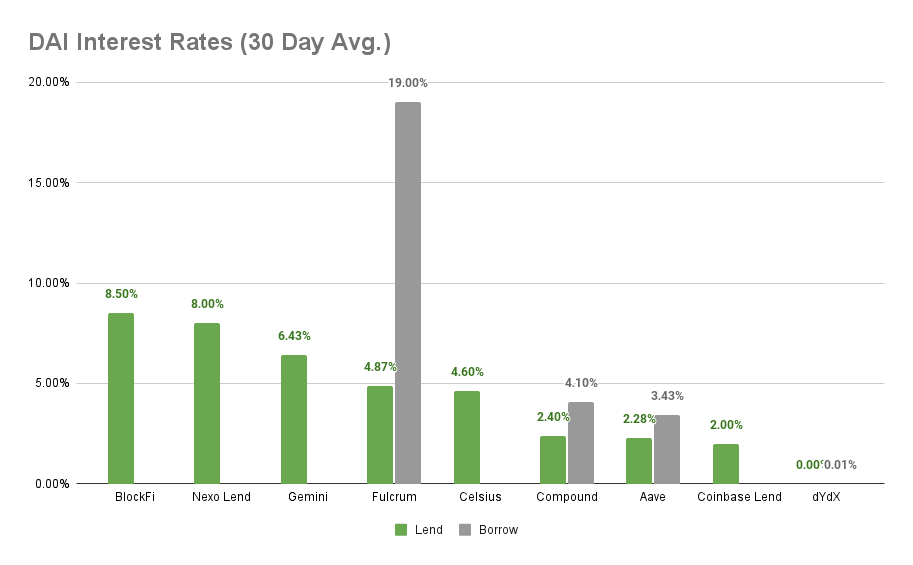

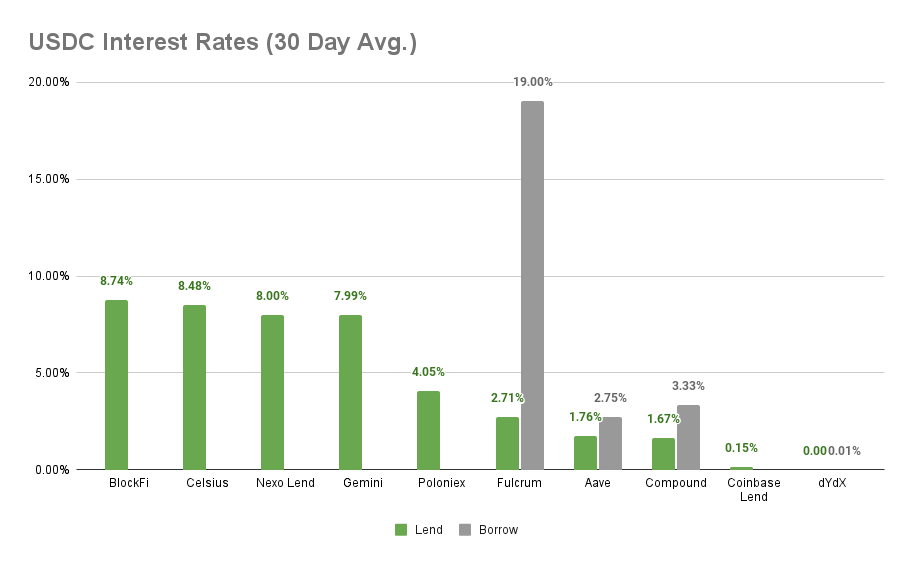

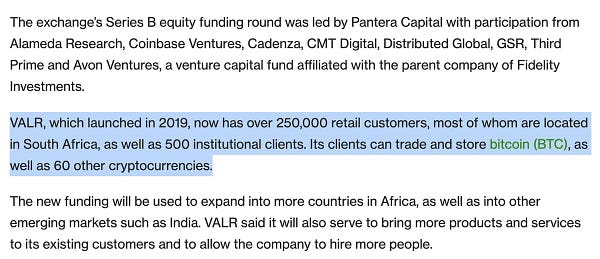

To the DeFi community, This week, Electric Capital announced $1 billion in capital split between two funds, $400 million for VC investments and $600 million for investing in crypto tokens. The crypto-centric funding will be used to bolster projects in DeFi, decentralized infrastructure, and the NFT space, while also supporting participation in DAOs and helping grow Web3 participation.   1inch added support for P2P swaps on all supported chains, creating a potential new option to compete with OTC desks or other trades that can’t support large trades without significant slippage. Sharing addresses is also done via URLs instead of 1inch backend infrastructure, ensuring the tool remains permissionless and censorship resistant.   Nested Finance raised $7.5 million in a preliminary funding round including famous British investor Alan Howard. Nested also released details on its upcoming Nested Portfolio, an NFT serving as a unique identifier for customizable baskets of DeFi, CeFi, and NFT positions as well as copy trading and social sharing capabilities.  The Block @TheBlock__ Alan Howard leads $7.5 million raise into DeFi trading platform Nested https://t.co/2pqnq7r8LKAnd South African crypto exchange VALR raised $50 million in a Series B round that they claim as the largest ever for an African crypto company. Funds will go towards expanding VALR to additional countries in Africa and beyond, hiring additional developer and administrative support, and building additional exchange products and features.   Financial inclusion is a key component of the overall value proposition of cryptocurrencies and the Web3 ecosystem, even if other aspects often grab the headlines. Providing crypto services to parts of the world that have been largely left out of the traditional financial system presents unique challenges and opportunities, but presents probably the strongest option for making a positive impact on the greatest number of people, allowing them to live a more stable and comfortable life, without giving up culture that makes them unique or requiring relocation to a more advanced urban setting. With new sanctions emerging and governments taking crypto questions more seriously than ever, the temptation remains to try to fit the digital asset industry into boxes created for legacy finance. But to do so would be to artificially constrict an orders-of-magnitude jump in the efficiency of moving value around the world, potentially locking out those that have been physically distant from centers of capital for another generation, at least. Freedom and stability are fragile, and too often taken for granted in western economies, where access to financial tools is reasonably robust and capital seems abundant. But humanity has a duty to extend those assets beyond our borders, for the sake of empathy and because it will make the world a more vibrant, accessible, happy place to live. Crypto can’t solve everything, but its potential is limited more today by our imaginations than by the capabilities we now possess. Let’s make the most of them. Thanks to our partner: Nexo – Unlock the power of your crypto with up to 17% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: BlockFi at 8.50% APY, Nexo Lend at 8.00% APY Cheapest Loans: Aave at 3.43% APY, Compound at 4.10% APY MakerDAO Updates DAI Savings Rate: 0.00% Base Fee: 0.00% ETH Stability Fee: 2.00% USDC Stability Fee: 0.00% WBTC Stability Fee: 2.00% USDCHighest Yields: BlockFi at 8.74% APY, Celsius at 8.48% APY Cheapest Loans: dYdX at 0.01% APY, Aave at 2.75% APY Top StoriesOsmosis Lets Liquidity Providers Earn Dual Incomes from Staking and LP RewardsAlameda research performs a significant percentage of its trades on DeFi platformsFriesDAO raises $5.4 million with plan to buy fast food restaurantsSchwab files with SEC to create 'Crypto Economy ETF'Stat BoxTotal Value Locked: $77.96B (up 9.88% since last week) DeFi Market Cap: $118.48B (up 11.25%) DEX Weekly Volume: $19.07B (down -4.35%) Total DeFi Users: 4,452,100 (up 0.6%) Bonus Reads[Chris Williams – Crypto Briefing] – Ukraine Cancels Airdrop for Crypto Donors [William M. Peaster – Bankless] – 5 ways to earn fixed-rate yields on DeFi [Brady Dale – The Defiant] – Anchor’s TVL Surges to All Time High of $11.7B After Luna Foundation Refills Reserves [Vaish Puri – The TIE] – Solving the Blockchain Trilemma: On Scaling Challenges and their Solutions If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week in DeFi - February 25

Friday, February 25, 2022

This week, Starkware beta and Opera browser integration, Yearn comes to Arbitrum, Zebec raises $15m for USDC payroll, and Celsius funds Maple

This Week in DeFi - February 18

Friday, February 18, 2022

This week, new Castle Island $250m fund, Curve on Moonbeam, Ref Finance raises $4.8m, and Gnosis Safe spins out into SafeDAO

This Week in DeFi - February 11

Friday, February 11, 2022

This week, Optimism pays $2m bug bounty, Polygon raises $450m in private sale, ssv.network raises $10 million, and new MakerDAO bug bounties

This Week in DeFi - February 4

Friday, February 4, 2022

This week, Kuiper offers DeFi native indexes, Aave executes cross-chain governance, 1inch adds new stablecoin pools, and Dune raises $69m

This Week in DeFi - January 28

Friday, January 28, 2022

This week, SuperDAO raises $10.5m seed funds, BitDAO funds zkDAO with $200m, HAL raises $3m and Aave integration, and new Syndicate DAO tools

You Might Also Like

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏