Mar 1: Flutter in choppy international waters

Mar 1: Flutter in choppy international watersFlutter FY, January 22 US OSB estimate, Esports Entertainment Q4, IGT payments unit sale, Rush Street Interactive analyst update, New York analyst update +MoreGood morning. On today’s agenda:

Flutter full year

Ukraine crisis: Flutter noted that “since completing” the merger with The Stars Group it had “materially reduced” its Russian exposure and said the market was worth $41m in contribution in 2021. In comparison, Ukraine was worth £19m.

Challenger: Despite owning the leading US sports-betting brand, Jackson said the company was “leaning in '' to the market despite the competitive pressures.

What they said:

Challenging: The international segment is beset by troubles, with tough comparables (on poker in particular) and the disruption caused by regulatory change in the Netherlands and Germany. Excluding all the bad stuff, revenues would have increased 14%. Analysts at Regulus suggest a revival here would depend on the extent to which poker can be revitalized and new markets can be added. UKI OK: The UK and Ireland segment was hampered in the earlier part of 2021 in particular by continued Covid restrictions on retail trading. Total revenues of £2.06bn were up 2% with sports-betting flat at £1.28bn and gaming revenues of £781m up 5%. UKI online rose 3% to £1.89bn while retail was down 13% to £174m. Online sports-betting was helped by a 25% rise in stakes.

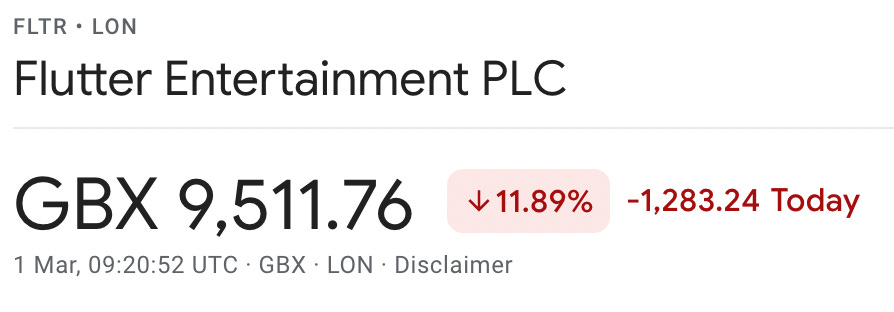

Further reading: Flutter ties bonuses to responsible gambling metrics. Market reaction: The share price suffered a near 12% fall in early trading on fears over the international business. ** Sponsor’s message: Venture capital firm Yolo Investments is home to €350m of equity in more than 50 of the most exciting companies across fintech, gaming and blockchain. It continues to build one of gaming’s most dynamic portfolios as it eyes up seed and A-stage opportunities across the sector. Its dedicated 28-company, €135m AUM gaming fund already houses holdings in fast-growing suppliers and operators, including Kalamba Games, SimWin and ThriveFantasy. Yolo Investments is also on the lookout for LPs as it looks to scale new concepts, including its high-roller live casino brand, Bombay Club. As a proud sponsor of Earnings+More from Wagers.com, Yolo Investments wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat. BREAKING NEWS: 888 has been hit by a £9.4m fine by the UK Gambling Commission for social responsibility and money-laundering failures. This is the second enforcement action within the past five years after the company had to pay a £7.8m penalty package. UKGB CEO Andrew Rhodes warned that if there was a repeat of the failures, then the Commission would have to “seriously consider the suitability of the operator” as a licensee. Jan22 US OSB estimateThe New York effect: With only five states yet to report, Deutsche Bank have estimated sports-betting GGR for January will come in at ~$630m, up ~69% sequentially and the same percentage rise YoY. Both metrics were influenced by the New York opening.

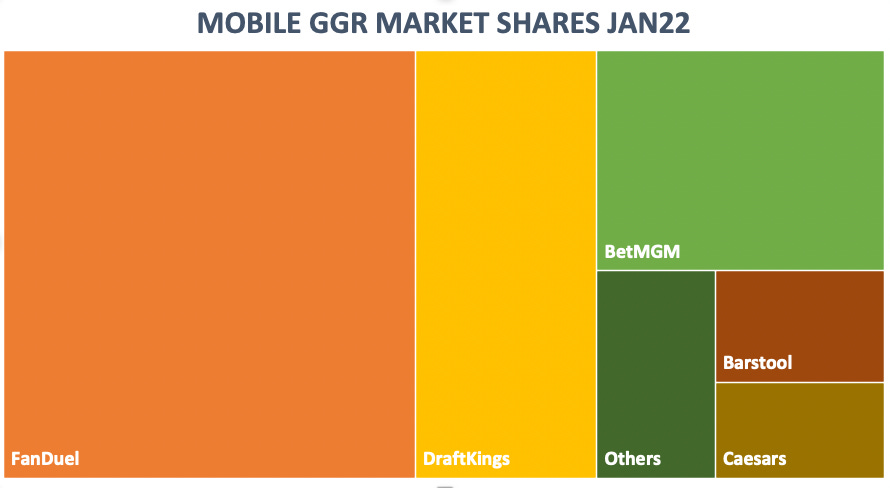

Market shares: Looking at the data from Illinois, Indiana, Iowa, Michigan, New Jersey, Pennsylvania and Tennessee for January, DB estimate that FanDuel led the way with 46.7% followed by DraftKings on 20.6% and BetMGM on 16.8%. Esports Entertainment FYQ2

Out of luck: As with others (Kindred, Betsson et al), Esports Entertainment said the cessation of activities in the Netherlands left a dent in its earnings. Revenue of $14.5m was down 11.4$ sequentially while net losses climbed to $34.5m from a $0.6m loss in FYQ1. The company also slashed its FY22 forecasts to $70m-$75m from $100m previously.

Emergency measures: Analysts at Roth Capital noted with a cash burn of approximately $1.3m a month, the company is resorting to an at-the-money (ATM) program where it can sell shares to raise up to $20m. So far, it has raised over $4m as of mid-Feb. The other looming issue of $35m of convertible notes where the company is currently negotiating “agreeable” terms.

Cash raise latest: On Sunday, the company announced the pricing of $15m worth of stock and warrants. The offering is expected to close on Wednesday, March 2.

IGT payments unit sale

Proximity high: IGT has sold its Italian ‘proximity payment’ business LISPAY, previously part of its lottery unit, to PostePay for ~$780m. New IGT CEO Vince Sadusky (appointed Jan22) said the deal was an opportunity to monetize the payments business and also streamline the company’s product offering. The company will use the proceeds to reduce net debt.

Zeroing in: Macquarie said this was evidence of Sadusky’s goal of deleveraging and said the sale “further focuses the company’s earning stream on lottery” which now comprise ~80% of EBITDA. Earnings call: IGT will report its Q421 earnings today, March 1, with the analyst call at 8am ET. RSI analyst update

Losing altitude: The Roth team noted the share rose as high as $24 in the summer on widespread speculation that RSI might make an attractive target for possible new entrants such as Fanatics or ESPN. But with uncertainty over the future of other second-tier brands (TwinSpires and WynnBet get a mention), it took the wind out of the M&A talk, at least temporarily. i of the beholder: But RSI is more than an OSB play, the team adds. “We believe investors are unfairly discounting RSI's iGaming exposure,” the team suggests. “We also believe RSI's iGaming-first strategy offers higher margins over time, where ROIs on CPAs seem lower for OSB.”

New York analyst updateDown but not out: Looking at last Friday’s data, Morgan Stanley said the expected fall in handle week-on-week (the first full week after the NFL and also the NBA All-Star game mid-season break) still indicated a run-rate of ~$1.3bn in FY22 GGR, which is above the $1bn forecast.

Heavy concentration: Caesars once again saw handle share fall (to 19% from 38% the previous week) with GGR share down at 17% (vs. 48% for Jan) but MS said the latter figure was still ahead of its long-term 10% forecast.

#StandWithUkraineMany organizations and individuals involved in the gaming sector have launched a GoFundMe to hello support efforts in Ukraine. Click here if you wish to donate. See Rasmus Sojmark’s post on LinkedIn for more info on who is supporting the effort. NewslinesDifferent meta: Affiliate marketer Playmaker has announced a strategic partnership with MetaBet, a provider of automated and contextual sports betting products. Ready for the Nether: Aspire Global says it has received regulatory certification for its entire suite of products including sports betting from the Dutch gambling authority. Late last year, Aspire’s PasriPlay division signed a content deal with Holland Casino and in January it signed a deal with Boylesports to supply its yet-to-launch Dutch operation. Buyback better: Better Collective has initiated a share buyback program of up to €5m to cover future payments relating to “completed and potential new acquisitions”. The group said it was actively pursuing M&A targets and was currently involved in a number of active discussions where shares may be part of the considerations. Maple syrup: Maple Leaf Sports & Entertainment has named Amazon Web Services its new cloud provider to help develop fan experiences that span augmented reality, virtual reality and sports-betting. MLSE owns the NHL’s Toronto Maple Leafs, NBA’s Toronto Raptors, MLS club Toronto FC and the CFL’s Argonauts. Calendar

Contact us

If you liked this post from Wagers.com Earnings+More, why not share it? |

Older messages

Feb 25: Weekend Edition no.35

Friday, February 25, 2022

Churchill Downs Q4 call, Bally analyst reaction, PointsBet investor call, REIT Q4 review, Playtike Q4, sector watch - payments +More

Feb 24: Bally waits to make its play

Thursday, February 24, 2022

Bally Corporation Q4, Better Collective Q4, Churchill Downs Q4, earnings in brief +More

Feb 23: Caesars: Digital Q1 ‘will be ugly’

Wednesday, February 23, 2022

Caesars Entertainment Q4, Catena Media Q4, Churchill Downs P2E acquisition, DraftKings analyst downgrade, earnings in brief, Playtech takeover news +More

Feb 17: New Jersey defies the odds

Thursday, February 17, 2022

New Jersey, Michigan Jan22, Tabcorp H1, Aspire G4, Wynn analyst update, Sportico fan engagement seminar, earnings in brief +More

Feb 16: Wynn’s 'absolute stunner'

Wednesday, February 16, 2022

Wynn Resorts Q4, Super Bowl betting, New York wk.5, AGA State of the Industry, GiG, earnings in brief +More

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these