The Daily StockTips Newsletter 03.07.2022

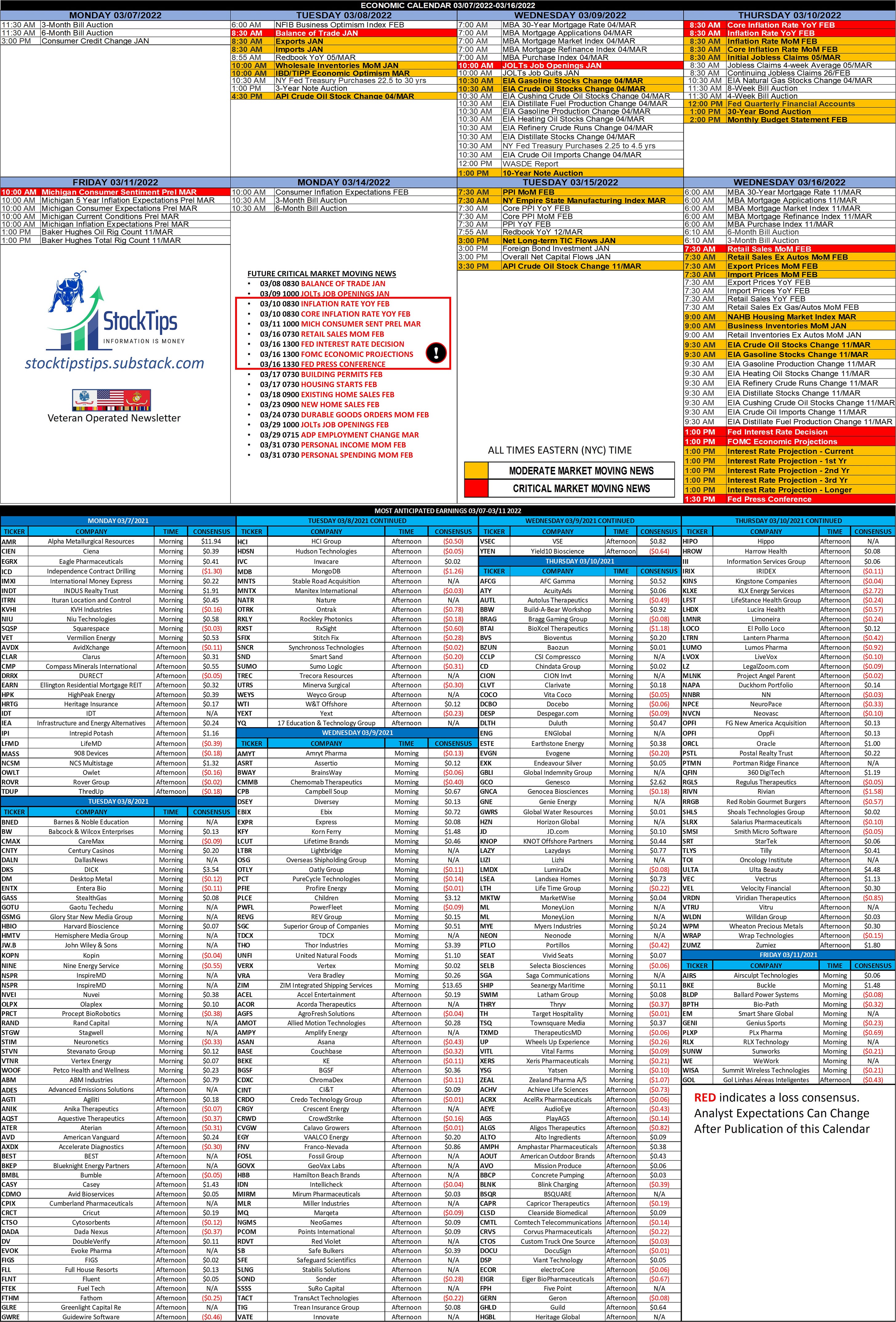

The Daily StockTips Newsletter 03.07.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)CLICK HERE TO SEE THE STOCKTIPS RECORD WE’RE ON YOUTUBE NOW! See HERE, HERE, & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings (Note: Red Indicates an Earnings Loss [Not Miss] Consensus), Yesterdays Insider Buys & Yesterdays Unusual Call Options Volume.Insider Buys: Back by Request TODAYS COMMENTARY Get a Cup of Coffee & Enjoy Catching Up! BUY LIST UPDATE: The BUY LIST is just plain ugly! -11% as she stands right now … & these companies were trading at a value PRIOR to the Russian Invasion of the Ukraine. It is important during times like these to maintain a little discipline … if you are intent on going long. You may do what you like, but I think traders should have a cash position of AT MINIMUM 30%. There’s also nothing wrong for selling calls against the underlying if you are intent on holding. I’s be carful about establishing new positions today. In any case, these “super value” buys, pending a recovery, ought to do well in the long run. MARKET UPDATE: Oil futures are up ….. they’re up BIG! Crude shot up to $130bbl on news that the US & NATO allies are considering a ban on Russian oil, the highest prices since 2008! This, of course, is something I warned about well before I accurately predicted the invasion down to within 24 hours. President Biden is mulling panhandling to Venezuela, a Russian ally, Iran, another Russian ally, & OPEC countries, instead of drilling at home. You may be rolling your eyes at this point, whether it be because you think oil is disproportionately spiking given that Russian oil only makes up 5-10% of the US market, or that I’m criticizing your favored political candidate. To the first, oil is a global market & our ally’s are much more dependent than we are. A NATO ban on Russian oil will not only reduce the supply in the US, it will reduce the supply in Europe as well. So regardless, such a ban has a disproportionate impact than what you would think at face value. To the second observation, President Biden is obviously against drilling in the US. See HERE, HERE, HERE, HERE, & HERE. It is obvious that he would rather finance the Russian invasion, or pay other unsavory characters, than roll back his anti-drilling green agenda. There’s nothing President Biden would love more than to sanction Russian oil & natural gas. But before he does he needs a new source of supply, & as a result of his policies there is no quick solution at home. Nevertheless, there are calls from Congress, (an inevitability), to sanction Russian oil & its only a matter of time before a bill lands on his desk that, for political reasons, HE WILL NOT WANT TO VETO. Democrats could block it, but for political reasons they will not want to be viewed as on the wrong side of this issue. This creates a decision point for President Biden. 1) Wait for the Bill & approve or deny it. 2) Be proactive & ban Russian oil before Congress forces his hand. Either way he will need a new source of supply, & he IS NOT willing to drill at home. It is obvious that he would rather finance the Russian invasion, or pay other unsavory characters, than roll back his anti-drilling green agenda. Many people are going to get hurt in this economy for this lack of energy foresight, & it will be reflected in company earnings ... especially in discretionary markets. On the other side of the economic coin, we still have 7.5% YoY inflation (New numbers come out on the 10th), & it seems as though the FED will implement a 25 basis point hike instead of the much feared 50 (I still think this is a massive mistake). Nevertheless, this is because an increase in the price of oil may have the effect of slowing down inflation as folks will have less money to spend on goods & services. All the same, an increase in the price of energy still increases the cost of EVERYTHING, & this will result in some SERIOUS PAIN for consumers. The consensus February inflation estimate on the 10th is 7.9%. I think it will be much higher than that. Subsequent months to come will likely reveal inflation spiking each month for AT MINUMUM another two to three months even with the Fed rate hikes (assuming no changes). Also keep an eye on food. Prices are astronomical. WEAT is up big over the last two weeks. Hungary has banned the export of wheat, more countries are expected to follow, Russia & the Ukraine are being knocked out of the wheat export equation, & Russia has banned the export of fertilizers. Shits getting real! Moreover 90% of the worlds neon gas was produced in the Ukraine, roughly 5% comes out of Russia, & neon gas is used to produce semiconductors & electronic devices. IMPORTANT: Right now you can bet your ass that big money is hedging, & the market activity reflects as much. They honestly don’t care where the market goes in the short run, & neither should we. They have puts covering their long positions & they’re selling calls against the underlying for some money while they’re waiting for their positions to flip (I have a video on this). In some cases they’re going long & short on the same equity (which retail cannot do), or going long/short on two like companies (which retail can do). The creativity utilized by big money is derived from years of experience, & retail can learn a lot from them. For those of you afraid to go short in a market like this, the feeling is natural. Retail traders hate risking margin calls. However, there are ways you can go short while eliminating the possibility of a margin call … & its quite easy. You go short 100 shares & buy an at the money or slightly above the money call. No matter how high the price goes on your short position, the most you can lose is what you paid for the call (& perhaps a little more on the spread between the strike & current stock value). In many cases this can pay for your call (a free call). Then you can cover your short position prior to either selling or holding the free call. If, however, you have a broker that doesn’t let you short (Like Robinhood), its time to change brokers! HERE is my referral code. Yes, you can transfer current stock positions. But if you cannot short, you don’t have a solid broker! Going short is a CRITICALLY ESSENTIAL TOOL! You want it at your disposure! Moreover there is nothing wrong with buying 100 shares & buying a put in many circumstances … unless you think the stock is going to immediately skyrocket (rarely does this ever happen). Even so, if it goes higher than what you paid for the put, you profit. If it goes down & you still like the stock, you make money on the put which somewhat offsets your losses on the stock. Then you will benefit from the eventual reversal more so than if you just bought & held. There’s a lot more to consider when implementing such strategies above, but I have an intelligent subscribership. Headwinds Ahead: I have a responsibility to warn my subscribers that bullish companies are going to be increasingly hard to find in this environment. I therefore owe it to you to scrutinize my picks more than ever as a result of REAL headwinds. The quick turnarounds we were accustomed to in the past are simply not going to happen in this economy. A swing that may take a month or two last year may take a quarter or two this year. Therefore I think it prudent to buy in slow & only average down when it hurts. Most companies remain profitable, but an adjustment in long term valuations & expectations are necessary. I will trade accordingly. Significant News Heading into 03.04.2022:

AVERAGE STATS ON ALL STOCKS ON THE BUY LIST AS OF MARKET CLOSE 02/18/2022 (FINVIZ & YCHARTS)

PAID CONTENT IN THE PAYWALL BELOW:

👉CLICK HERE TO SEE THE DETAILS OF EVERY STOCK ON THE BUY LIST (AND SEE THE PRICE ASSESSMENT BASED WATCHLIST / THE STOCKS UNDER $20 LIST & THE HIGHLY SPECULATIVE LIST) LOGIN INSTRUCTIONS: You will need to login to see the detailed list. The “email login link” will send the link to login directly to your inbox (Click the link & it will automatically log you in). You can also choose the “login with password” option. You will need to set up a substack password for this option.Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 03.04.2022

Friday, March 4, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 03.03.2022

Thursday, March 3, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 03.01.2022

Tuesday, March 1, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 02.24.2022

Thursday, February 24, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 02.23.2022

Wednesday, February 23, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

👋 Investors ditched the S&P 500

Monday, March 10, 2025

The US president didn't rule out a recession, but TSMC eased some of investors' other worries | Finimize Hi Reader, here's what you need to know for March 11th in 3:07 minutes. TSMC's

💳 Find a new credit card

Monday, March 10, 2025

Let's get those rewards ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Text and Telos

Monday, March 10, 2025

Plus! Diff Jobs; Scaling; Retail Investors; Comparative Advantage; Transaction Costs and Corporate Structure; DeepSeek Governance Text and Telos By Byrne Hobart • 10 Mar 2025 View in browser View in

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏