The Daily StockTips Newsletter 03.01.2022

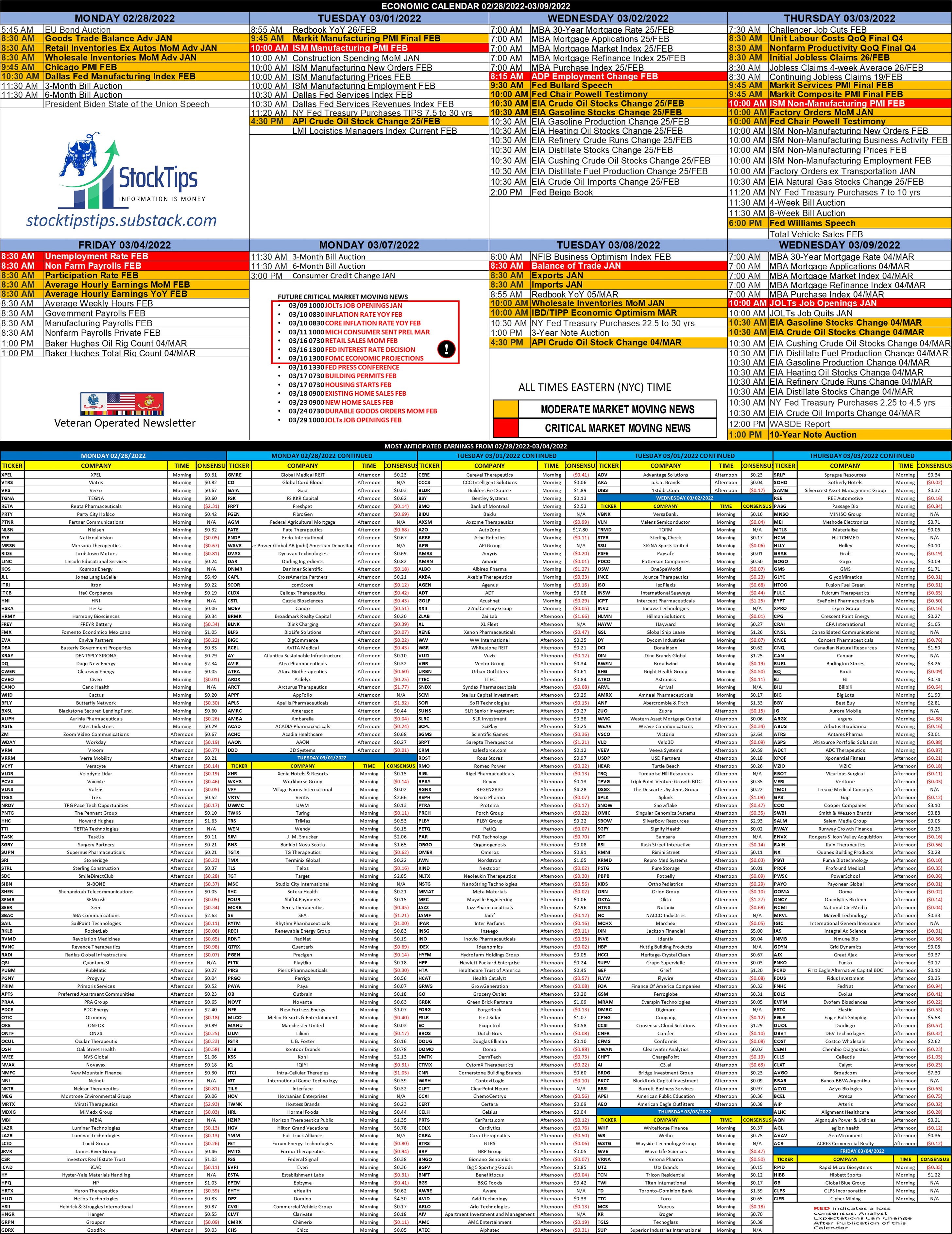

The Daily StockTips Newsletter 03.01.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)CLICK HERE TO SEE THE STOCKTIPS RECORD WE’RE ON YOUTUBE NOW! See HERE, HERE, & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings (Note: Red Indicates an Earnings Loss [Not Miss] Consensus), Yesterdays Insider Buys & Yesterdays Unusual Call Options Volume.TODAYS COMMENTARY Get a Cup of Coffee & Enjoy Catching Up! Manufacturing Price Managers Index to be reported today! (See the economic calendar above) BUY LIST UPDATE: Alright I’m tired of this invasion uncertainty. I’ve got a play added to the BUY LIST today that is trading at a value & will likely find itself advantaged by the war in Ukraine, (& wider implications thereof). The more I research this company the more I like it! It is a volatile penny stock (a stock well below $5.00) so watch how you enter to maximize future profit, but the company is profitable & trading near BV nonetheless. I like the idea of covered calls & cash secured puts on this one as well. RUSSIA UPDATE: Its hard to see if there is anything else that could be done to push the markets lower, but do not discount a war’s ability to surprise! I hate to say it, but there’s plenty value in the market to scoop up as a result of this overreaction, & the war has presented us with increased opportunities. My addition to the BUY LIST today will likely benefit from increased defense spending both at NATO & at home (Few people have heard of this company). What of the massive 40 mile convoy about to steamroll into the Ukraine you ask? We all know what’s that’s about, & what the likely outcome will be. As a veteran of two wars, the idea that both the young Russian boys & the Ukrainian Armed Services will be slaughtering each other in the most ugly form of warfare known to man (conventional), puts an real & undeniable sickness in the pit of my stomach not felt since the last time I was shot at. My heart goes out to them both. What a waste! CHINA: I continue to assess that you will want to keep your eye on China. Over the weekend they announced military exercises in the South China Sea. China has stopped short of overly criticizing & sanctioning Russia. In fact, they’ve committed to buy more Russian oil & eliminate sanctions on Russia wheat & barley. I certainly hope the worlds response on Russia’s invasion is enough to deter the Chinese from making a move on Taiwan, but there’s no guarantee. The Chinese think tank advising Xi seems to think that sanctions will backfire on the West, & for now, China is the likely economic winner amid these sanctions. Headwinds Ahead: I have a responsibility to warn my subscribers that bullish companies are going to be increasingly hard to find in this environment. I therefore owe it to you to scrutinize my picks more than ever as a result of REAL headwinds. The quick turnarounds we were accustomed to in the past are simply not going to happen in this economy. A swing that may take a month or two last year may take a quarter or two this year. Therefore I think it prudent to buy in slow & only average down when it hurts. Most companies remain profitable, but an adjustment in long term valuations & expectations are necessary. I will trade accordingly. Significant News Heading into 03.01.2022:

AVERAGE STATS ON ALL STOCKS ON THE BUY LIST AS OF MARKET CLOSE 02/18/2022 (FINVIZ & YCHARTS)

PAID CONTENT IN THE PAYWALL BELOW:

👉CLICK HERE TO SEE THE DETAILS OF EVERY STOCK ON THE BUY LIST (AND SEE THE PRICE ASSESSMENT BASED WATCHLIST / THE STOCKS UNDER $20 LIST & THE HIGHLY SPECULATIVE LIST) LOGIN INSTRUCTIONS: You will need to login to see the detailed list. The “email login link” will send the link to login directly to your inbox (Click the link & it will automatically log you in). You can also choose the “login with password” option. You will need to set up a substack password for this option.Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 02.24.2022

Thursday, February 24, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 02.23.2022

Wednesday, February 23, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 02.22.2022

Tuesday, February 22, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 02.16.2022

Wednesday, February 16, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 02.14.2022

Monday, February 14, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

👋 Investors ditched the S&P 500

Monday, March 10, 2025

The US president didn't rule out a recession, but TSMC eased some of investors' other worries | Finimize Hi Reader, here's what you need to know for March 11th in 3:07 minutes. TSMC's

💳 Find a new credit card

Monday, March 10, 2025

Let's get those rewards ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Text and Telos

Monday, March 10, 2025

Plus! Diff Jobs; Scaling; Retail Investors; Comparative Advantage; Transaction Costs and Corporate Structure; DeepSeek Governance Text and Telos By Byrne Hobart • 10 Mar 2025 View in browser View in

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏