The Daily StockTips Newsletter 03.08.2022

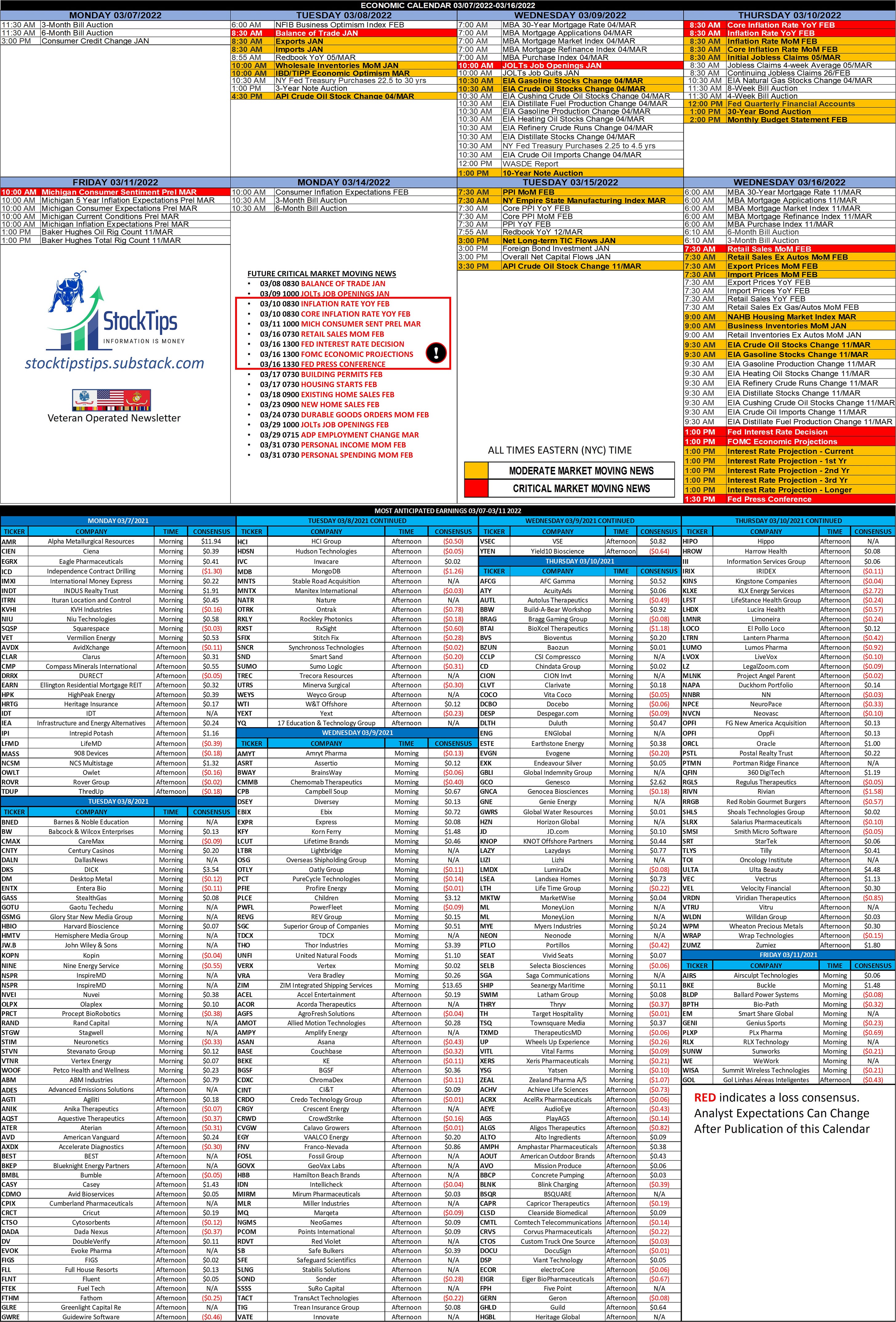

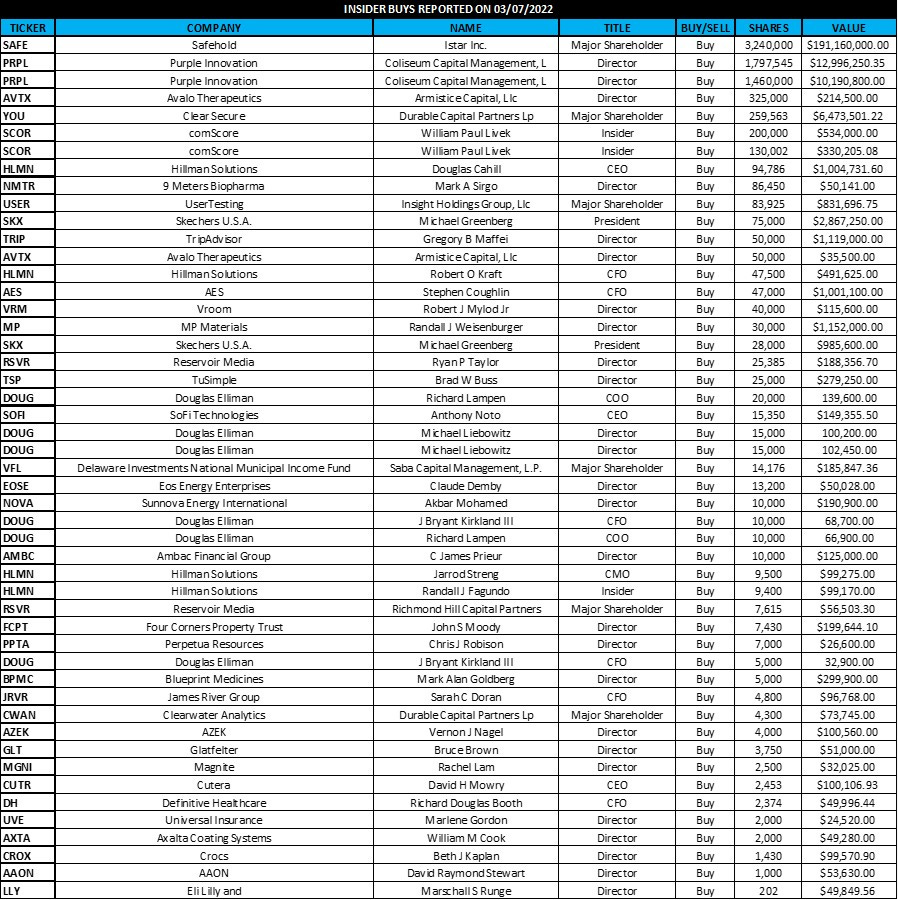

The Daily StockTips Newsletter 03.08.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)CLICK HERE TO SEE THE STOCKTIPS RECORD WE’RE ON YOUTUBE NOW! See HERE, HERE, & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings (Note: Red Indicates an Earnings Loss [Not Miss] Consensus), Yesterdays Insider Buys & Yesterdays Unusual Call Options Volume.Insider Buys: Back by Request TODAYS COMMENTARY Get a Cup of Coffee & Enjoy Catching Up! BUY LIST UPDATE: The BUY LIST is just plain ugly! -15.54% as the market panicked yesterday … & these companies were trading at a value PRIOR to the Russian Invasion of the Ukraine. It is important during times like these to maintain a little discipline … if you are intent on going long. You may do what you like, but I think traders should have a cash position of AT MINIMUM 30%. There’s also nothing wrong for selling calls against the underlying if you are intent on holding. In any case, these “super value” buys, pending a recovery, ought to do well in the long run. Buy in small, average down as necessary, & don’t rush it! MARKET UPDATE: The S&P is in correction territory & the NASDAQ is in bear market territory. Ladies & Gents, this is where we make our money! Time & Discipline are our friends here. There are certainly some highly risky options strategies that we can implement at these levels that may pay off big in the long run … HOWEVER, only God knows that the future will bring. WE ARE ONE GEOPOLITICAL DISASTER AWAY FROM A CERTAIN RECESSION! Watch China! So watch your risk! So why are the markets freaking out? Well we still have supply chain issues, semiconductor shortages, high inflation (7.5% for January), & the Fed is certain to raise interest rates by at minimum 0.25% this month. The Russian invasion of the Ukraine has cut off some of the world supply of steel, food from at least 3 countries, fertilizers from 2 countries, mining from 2 countries, & 92%+ of the worlds neon gas. The elephant in the room is gas prices. Normally the markets rally when gas prices increase due to high demand. However prices aren’t increasing due to high demand. They’re increasing due to short supply. The price for a gallon of gas hit an all time US record high yesterday. And the more people pay for gas, the less money they spend on other items. Also the higher energy costs increase, the more expensive everything becomes. Its a double whammy!! I cannot emphasize enough how devastating these high energy costs are. Even if OPEC were to commit to increase the supply of oil by just a few million barrels per day, it would likely take 6 months to a year before it would come close to that target. The White House continues to be firmly in the anti US energy production camp. In addition to all the restrictions on leasing & drilling, they have yet to hold a summit with oil executives. (Note that they had a very public meeting with automakers & unions when the administration wanted to incentivize electric vehicle production, but nothing thus far with respect to bringing in the oil executives.) Instead, President Biden is opting to meet with the Saudi’s in an attempt to ramp up foreign production (The Saudi’s have a large stash of reserves). Given that the Biden Administration has already run afoul with the Saudis by scrutinizing the war in Yemen & restricting arms sales, such a meeting should be interesting. In the interim the White House isn’t even being close to honest on how how destructive their policies are on oil prices. Other options for the White House include panhandling to Venezuela & Iran. But by begging Venezuela & Iran, they would be sanctioning blood money in order to finance more blood money. In this hyper politically conscious administration, (an observation derived from the fact that they put green energy policies before the American people’s wallets), such a prospect prior to the November elections would be political suicide. Either way I assess that the political pressure to sanction Russian energy is high (For a number of countries), & its only a matter of time before Congress puts a bill on his desk. Therefore the implied task for President Biden is to find a source of supply to supplement the disruption in Russian supply. Oil companies are already breaking ties from Russia anyway. And honestly there is no short term solution to the immediate oil crisis. The lack of foresight & proactive reasoning by the White House on oil has put us in a serious bind here. And regardless of how we approach things for now, there’s just no replacing Russian oil without pain at the pump that will last for well over a year. I assess we WILL have record high oil prices for the foreseeable future. INFLATION WARNING: As one of the most prominent causes of current inflation, if not the most prominent at the moment, high commodity prices (such as oil) WILL LIKELY MAKE INFLATION WORSE THAN ANALYSTS ARE CURRENTLY PRICING IN! At this time consensus inflation numbers for February are 6.4% (Core Inflation), 7.9% (Inflation Rate). I assess that inflation will likely continue to rise in the months to come. The Fed’s interest rate increases will take months to produce any substantive effect. Worse still, these record high gas prices, food prices, & commodity prices as experienced right now, will not be priced into the inflation numbers reported on March 10th, but rather the following month. And if we have yet another geopolitical disaster … whether it comes from China, North Korea, Iran, etc., the inflation thereof will very likely push us well into double digit inflation. The headwinds & risks are significant! Trade accordingly! Significant News Heading into 03.08.2022:

AVERAGE STATS ON ALL STOCKS ON THE BUY LIST AS OF MARKET CLOSE 02/18/2022 (FINVIZ & YCHARTS)

PAID CONTENT IN THE PAYWALL BELOW:

👉CLICK HERE TO SEE THE DETAILS OF EVERY STOCK ON THE BUY LIST (AND SEE THE PRICE ASSESSMENT BASED WATCHLIST / THE STOCKS UNDER $20 LIST & THE HIGHLY SPECULATIVE LIST) LOGIN INSTRUCTIONS: You will need to login to see the detailed list. The “email login link” will send the link to login directly to your inbox (Click the link & it will automatically log you in). You can also choose the “login with password” option. You will need to set up a substack password for this option.Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 03.07.2022

Monday, March 7, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 03.04.2022

Friday, March 4, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 03.03.2022

Thursday, March 3, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 03.01.2022

Tuesday, March 1, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 02.24.2022

Thursday, February 24, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

👋 Investors ditched the S&P 500

Monday, March 10, 2025

The US president didn't rule out a recession, but TSMC eased some of investors' other worries | Finimize Hi Reader, here's what you need to know for March 11th in 3:07 minutes. TSMC's

💳 Find a new credit card

Monday, March 10, 2025

Let's get those rewards ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Text and Telos

Monday, March 10, 2025

Plus! Diff Jobs; Scaling; Retail Investors; Comparative Advantage; Transaction Costs and Corporate Structure; DeepSeek Governance Text and Telos By Byrne Hobart • 10 Mar 2025 View in browser View in

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏