The Pomp Letter - The Insiders Are Yelling Warning Signs

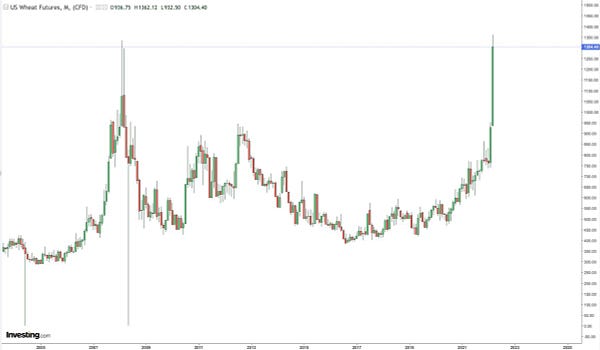

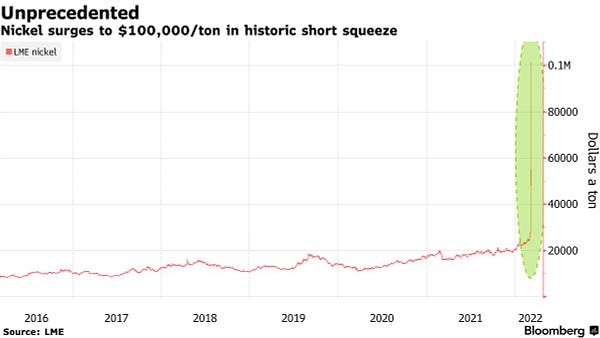

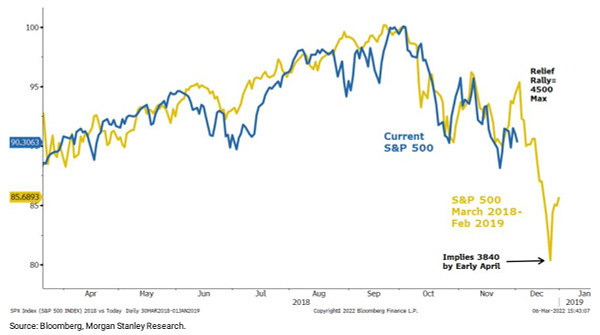

If you are not a subscriber of The Pomp Letter, join 215,000 other investors who read my personal opinion on finance, technology, and bitcoin each morning. To investors, The geopolitical chess game continues to evolve at an incredible rate. Over the last 24 hours, reports are surfacing that the United States is looking to ban imports of Russian oil and various options are being evaluated in an attempt to freeze Russia’s gold reserves. These punishments are being pursued as Russia continues their military offensive in Ukraine. The implications of the current events are unknown, but we are beginning to see commodity prices spike aggressively. First, wheat has hit an all-time high.   Nickel has been increasing by hundreds of percent as well.   And, of course, oil prices are going parabolic. It shouldn’t be shocking that commodities, especially ones where Russia and Ukraine are major producers, are being driven higher during this conflict. The surprising part is how quickly it is happening and how large the moves in price have become. The joke on Twitter is that commodities are trading like shitcoins, which has a hint of truth to it. But while all this is going on, I continue to ask myself what it all means for the future macro economy? No one has a crystal ball but can we use history as a guide? Social Capital’s Chamath Palihapitiya recently explained on the All-In Podcast that every time energy prices have spiked by 50% or more in the last 30-40 years, it was followed by a recession. Sven Henrich highlighted this morning that the last time wheat prices reached these levels, a recession followed. History doesn’t repeat perfectly, but the warning signs of a potential recession are growing louder and louder. Now the biggest curveball in the situation is that the Federal Reserve is still sitting with interest rates at 0%. Given that inflation is likely to come in at 8% or more during the next report, the normal reaction would be for the Fed to raise rates to bring that inflation more in-line with their goals and expectations.   We have now entered into a dicey situation where hiking of interest rates could actually accelerate us into a recession. This means that the Federal Reserve has a nearly impossible job. Allow inflation to continue to ravage the financial well-being of hundreds of millions of people or risk pushing the global financial system into a downward spiral across financial assets. This is a lose-lose scenario with no clear off-ramp. So how does this play out for the United States, our allies, our adversaries, and the various fiat currencies that they control? Zoltan Pozsar of Credit Suisse published a note yesterday that will blow your mind. Before I highlight what he said, it is important to understand who Pozsar:

Essentially, Zoltan Pozsar is the epitome of the insider or establishment, especially when it comes to his views on currencies, financial assets, and markets. In the note, which is titled Bretton Woods III, Pozsar starts off with the following excerpt:

Pozsar then went on to explain why people should be concerned about recent commodity price moves:

Pozsar finished his piece with the following conclusion:

Reading this type of thought process from someone who understands the intricacies of the financial system, while also having a grasp of how policy makers are thinking right now, has to make you start thinking about how much bigger this situation could become. I don’t know how the future plays out, but my guess is that most people will start looking for a safe place to store their wealth, regardless of what happens. Somehow, all roads lead back to bitcoin. Hope you have a great day. Talk to everyone tomorrow. -Pomp If you are not a subscriber of The Pomp Letter, join 215,000 other investors who read my personal opinion on finance, technology, and bitcoin each morning. Do you want a job in the crypto industry?My team and I have been working with the top HR teams in the industry to create a training program that teaches the fundamentals of crypto. We cover everything from how central banks work to bitcoin’s technical architecture to smart contract platforms to niches of the industry, such as NFTs, DAOs, and much more. This 3-week intensive program has 50+ events packed into the most valuable training program in crypto. We helped more than 400 people get hired last year and you can be one of them. Our next cohort starts in March: CLICK HERE TO APPLY. SPONSORED:Western Rise creates performance clothing for travel, work, and play. They use the world's highest performance fabrics to be wearable for any occasion and comfortable in any situation. Western Rise was founded by Will & Kelly Watters in Telluride, Colorado. Instead of chasing fads and trends, they decided to elevate classic staples to be more versatile than ever before. Every design detail and process is considered, removing anything unnecessary for maximum versatility. Every item is backed by a lifetime guarantee with free returns. Get 20% off your first purchase when you use code "BBS" at checkout. Podcast SponsorsThese companies make the podcast possible, so go check them out and thank them for their support!

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re a free subscriber to The Pomp Letter. For the full experience, become a paid subscriber. |

Older messages

We Should Not Normalize Economic War On Innocent Civilians

Tuesday, March 1, 2022

Listen now (6 min) | If you are not a subscriber of The Pomp Letter, join 215000 other investors who read my personal opinion on finance, technology, and bitcoin each morning. To investors,

The US and NATO Mitigate Short-Term Problems At The Expense Of Long-Term Problems

Monday, February 28, 2022

Listen now (8 min) | To investors, The Russia-Ukraine conflict continued to increase in intensity over the weekend. While the violent combat has been playing out on the ground, the United States and

Russia, Ukraine, China, Oil, and Bitcoin

Thursday, February 24, 2022

Listen now (7 min) | If you are not a subscriber of The Pomp Letter, join 215000 other investors who read my personal opinion on finance, technology, and bitcoin each morning. To investors, Russia

Central Bank Digital Currencies Will Be One Of The Greatest Violations Of Human Rights In History

Tuesday, February 22, 2022

Listen now (8 min) | To investors, The invention of blockchain technology solved a decades-long computer science problem and unleashed a monetary revolution in the form of bitcoin. This decentralized,

Bitcoin Is The Freedom Technology The Western World Needs

Monday, February 21, 2022

Listen now (7 min) | To investors, The situation in Canada has received international attention across the internet. People are wondering how a liberal, democratic country could descend into

You Might Also Like

The Keywords No One’s Using—Yet

Monday, March 10, 2025

Most SEOs chase the same keywords. You won't. Get ahead by targeting search terms no one else knows about—yet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Silver Influencer 🩶

Monday, March 10, 2025

Work with Gen X and Boomer influencers.

Elon lost the fight to Open AI

Monday, March 10, 2025

but did he really lose?..... PLUS: Authors sued Meta!

TikTok updates, video editing hacks, avoiding AI hallucinations, and more

Monday, March 10, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... presented by social-media-marketing-world-logo Mondays can feel overwhelming, Reader, but don't worry... we've got your

How Amazon Lures Chinese Factories Away From Temu [Roundup]

Monday, March 10, 2025

Need funding for your Canadian Amazon business? Not sure if you should use a Canadian corporation or US LLC to form your company? We'll cover these questions and more in our Start and Grow Your FBA

Is The Trump Administration Crashing The Market On Purpose?

Monday, March 10, 2025

Listen now (4 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Dry powder piles up for mature funds

Monday, March 10, 2025

Defense tech VC deals balloon; data dive on VC's emerging opportunities; France's positive quarter, but sluggish year Read online | Don't want to receive these emails? Manage your

Digiday wants to hear from you

Monday, March 10, 2025

As a loyal reader, your feedback is vital as we continue to evolve our products and coverage. We're reaching out to see if you'd answer a few questions to help make your experience with Digiday

Advertisers are calling for full URL-level campaign reporting, and DSPs are responding in different ways

Monday, March 10, 2025

The Trade Desk quells talk of full URL-level campaign reporting (similar to Amazon), but there are nuances. March 10, 2025 PRESENTED BY Advertisers are calling for full URL-level campaign reporting,

The 90-10 Rule: Why Great Leaders Don’t Need Universal Approval

Monday, March 10, 2025

Leaders who focus too much on making everyone happy may inadvertently stifle the very innovation and progress that constructive dissatisfaction can inspire.