DeFi Rate - This Week in DeFi - March 18

This Week in DeFi - March 18This week, Optimism raises $150m Series B, Sushiswap launches new AMM aggregator, Aave debuts V3, and Ethereum merges in Kiln

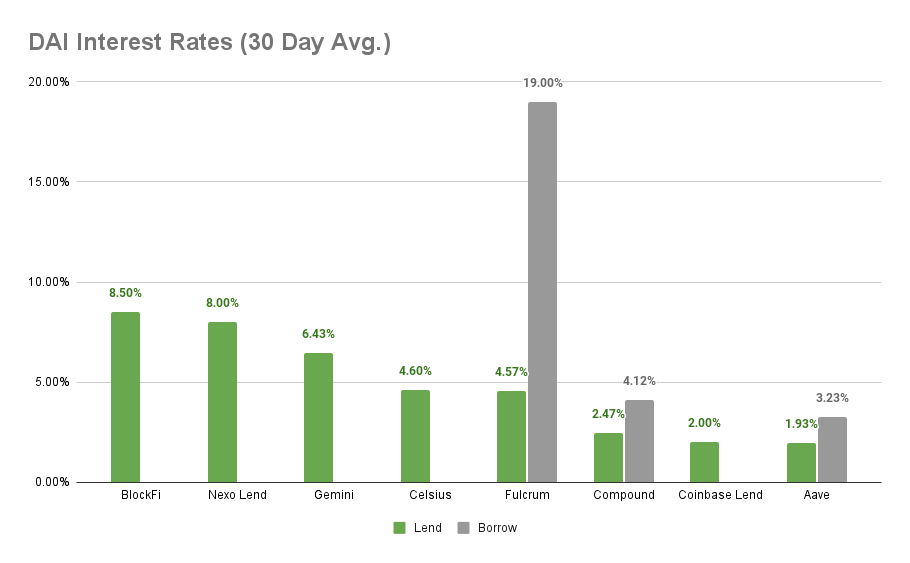

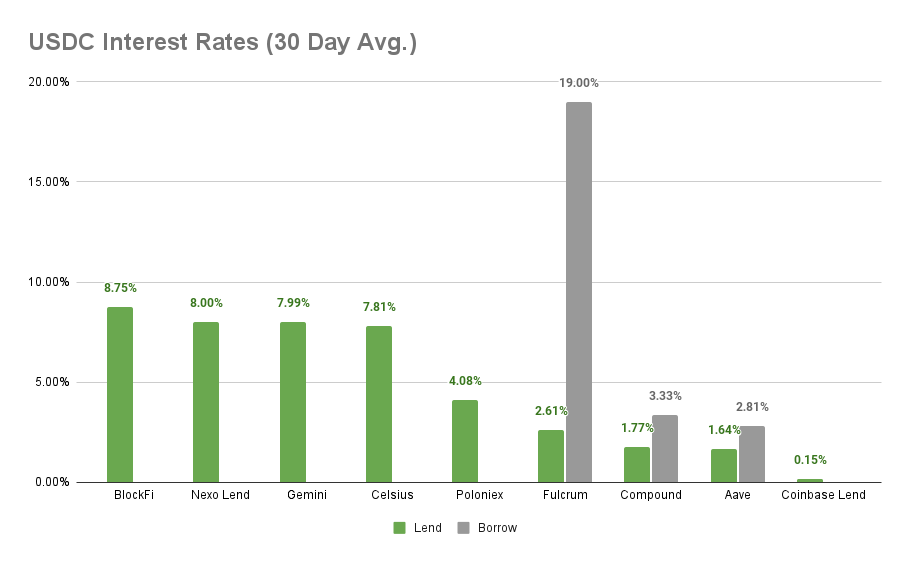

To the DeFi community, This week, Optimism raised $150 million in a Series B round that valued the Ethereum scaling solution at $1.65 billion. Optimism says they’ll continue improving the protocol to reduce transaction fees, including by adding additional developer talent to the team.   Sushiswap launched a new AMM aggregation framework, Trident, on Polygon, aiming to consolidate the functionality of Ethereum-based AMM apps into a more cohesive environment for developers and users. Pools using Trident will be accessible using the IPool interface, and new pools will be required to pass an audit and internal review to be added to the interface.   Aave launched V3 of its DeFi lending protocol across Polygon, Fantom, Avalanche, Arbitrum, Optimism, and Harmony, adding cross-chain ‘portals’ between supported chains, gas optimizations, a redesigned user interface, and other new features.   And the Kiln Ethereum testnet successfully executed the long awaited ‘merge’, combining existing transaction processing with the Beacon chain to power network consensus entirely through Proof of Stake. Kiln is the final merge related testnet created before existing public testnets are upgraded- barring any technical issues, that means Ethereum PoS on mainnet could be just a few months away.   DeFi has come a long way in a very short amount of time. That’s a result of big investments by crypto participants and venture capital alike, but also speaks to some of the key advantages that make decentralized development so powerful in the first place. An emphasis on open-source development means that builders aren’t required to reinvent the wheel, or even the engine to try out a new idea. Deconstructing these components is also a huge opportunity for those learning to build in the crypto industry, and tooling is also rapidly maturing and more widely available every day. It all adds up to an orders of magnitude increase in the pace of development and the potential for revolutionary products to be created, both for a wide audience but also for hundreds or thousands of edge cases around the world. Crypto and DeFi, alongside the open source movement and the revolution of the Internet itself, have massively increased humanity’s capacity to creatively tackle our problems and build a world that is both more expressive and unique while being more inclusive and equitable than ever before. It won’t happen in a day, or even a year- even baseline internet access is still in the process of proliferating, and many aspects are truly generational shifts. But to stick with DeFi will be to have a remarkable front-row seat to one of the most exciting periods of development in human history. Born too late to explore the Earth, born too soon to explore the stars. But born just in time to see humanity break free from centralized, institutional control of economic life and join in revolutionary ways of organizing work, relationships, and play. It’s a good time to be alive. Author’s note: This will be my final edition of This Week in DeFi- a new writer should take over soon. Thanks very much for reading, it’s been great fun and an honor keeping up with the best of DeFi over the weeks. Follow me on Twitter @Watch_Crypto or reach out at alexander.c.behrens@gmail.com if you’d like to get in touch. Cheers! Thanks to our partner: Nexo – Unlock the power of your crypto with up to 17% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: BlockFi at 8.50% APY, Nexo Lend at 8.00% APY Cheapest Loans: Aave at 3.23% APY, Compound at 4.12% APY MakerDAO Updates DAI Savings Rate: 0.00% Base Fee: 0.00% ETH Stability Fee: 2.00% USDC Stability Fee: 0.00% WBTC Stability Fee: 2.00% USDCHighest Yields: BlockFi at 8.75% APY, Nexo Lend at 8.00% APY Cheapest Loans: Aave at 2.81% APY, at Compound at 3.33% APY Top StoriesConsenSys Raises $450M Series D FundingFTX Ventures and 3AC Bet on Mina EcosystemConsenSys’ Lubin Confirms MetaMask Token in the WorksDeFi Analytics Firm Treehouse Raises $18M Seed FundingStat BoxTotal Value Locked: $77.35B (up 3.97% since last week) DeFi Market Cap: $119.75B (up 5.03%) DEX Weekly Volume: $14.03B (up 2.78%) Bonus Reads[Timothy Craig – Crypto Briefing] – Ethereum Gas Fees Are Cheap Again. Why? [Chris Powers – Dose of DeFi] – ApeCoin and the number of bridges in a multichain world [Donovan Choy – Bankless] – Why DAOs are the new firms [Anthony Sassano – The Daily Gwei] – The DeFi Renaissance - The Daily Gwei #459 If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week in DeFi - March 11

Friday, March 11, 2022

This week, Kyberswap on Arbitrum, Avalanche announces $290m in incentives, Cega gets $3.4m for Solana derivatives, and Wirex adds Paraswap

This Week in DeFi - March 4

Friday, March 4, 2022

This week, Electric Capital raises $1b for Web3, 1inch intros P2P swaps, Nested raises $7.5m, and VALR gets $50m for crypto in Africa

This Week in DeFi - February 25

Friday, February 25, 2022

This week, Starkware beta and Opera browser integration, Yearn comes to Arbitrum, Zebec raises $15m for USDC payroll, and Celsius funds Maple

This Week in DeFi - February 18

Friday, February 18, 2022

This week, new Castle Island $250m fund, Curve on Moonbeam, Ref Finance raises $4.8m, and Gnosis Safe spins out into SafeDAO

This Week in DeFi - February 11

Friday, February 11, 2022

This week, Optimism pays $2m bug bounty, Polygon raises $450m in private sale, ssv.network raises $10 million, and new MakerDAO bug bounties

You Might Also Like

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏