Earnings+More - Mar 21: Chanos and Robins renew fight

Mar 21: Chanos and Robins renew fightDraftKings short selling fight, Bally and IGT analysts notes, UK horseracing intervention, startup focus - Tallysight +MoreGood morning. On the agenda today:

Money’s too tight to mention. But this at least remains free: Chanos vs Robins round two: During an appearance on CNBC to talk about his views on Coinbase, famed short-seller Jim Chanos let slip that he had made a mistake with his previous position on DraftKings.

Madcap laughs: Back in December when Chanos, who runs Kynikos Associates, made his original attack, Robins said Chanos’ financial case was “insane”. Robins renewed his own attack in the wake of the latest CNBC appearance:

Eat my shorts: He added that he found it hard “believing this was truly a ‘mistake’”. “He supposedly runs a sophisticated shop, and this was a very simple error that anyone who invests (or shorts) for a living should never have made.”

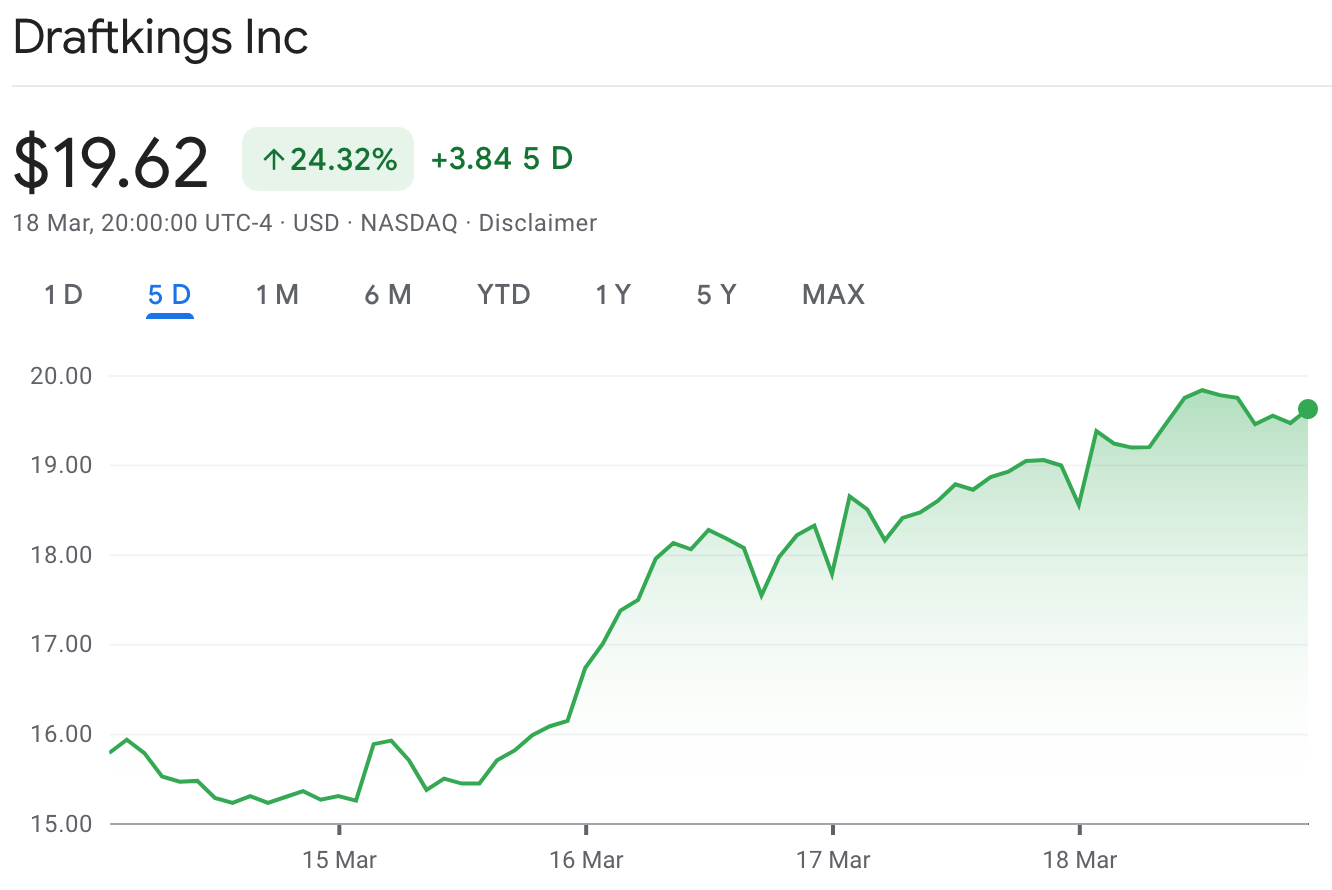

Punchdrunk: In the past week, DraftKings has indeed seen something of a bounce - dead cat or otherwise - up over 24%. Downdraft: More prosaically, according to various reports on Twitter DraftKings mobile site was down over the weekend. Competitors were quick to take advantage:  Darren Rovell @darrenrovell Yes, DraftKings is down again. ** SPONSOR’S MESSAGE: Spotlight Sports Group, a world-leading technology, content and media company has released a new white paper detailing the sports betting opportunity for publishers across North America. The paper investigates the size of the market, the revenue models available and the changing behaviors of sports fans. Outlining the keys to success, the research also discusses Racing Post's successful journey from a traditional digital publisher to super affiliate. Click here to download the full white paper. New York Wk10Manhattan highs: Handle was up 13% WoW to $406m, the first time it has cleared $400m since Super Bowl week. GGR came in at $36.8m, the state’s second-highest total since launch and resulting in $18.8m in taxes. Top spot: FanDuel continues to lead with 42.6% share of handle, with DraftKings second (25.3%), followed by Caesars (16%) and BetMGM (10%). Bally analyst updateMoving parts: The team at Jefferies note that the imponderables are piling up at Bally. Saying the company is in the process of an “evolution”, Jefferies noted the recent appointment of Steve Capp at CFO, the ongoing bid situation from major shareholder Standard General as well as the relaunch of the digital business.

IGT analyst updateChain of fools: After meeting with management last week, Deutsche Bank analysts came away suggesting IGT has “cost levers” it can press should the macroeconomic situation worsen. That said, they added that product sales with gaming remain robust, though supply chain issues will have a “modest impact: on the cadence of 2022 sales. Lottery remains positive regardless.

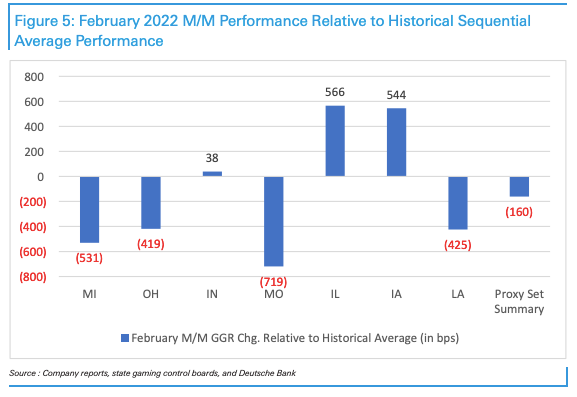

Q1 regional gaming trendsFundamentals watch: The team at Deutsche Bank said the gaming sector’s “fundamental dynamics” need to be kept an eye on because of the potential impact of macroeconomic events on regional gaming consumers. Looking at the latest data and comparing with their Q1 forecasts for the three regional operators they cover, DB said Caesars Entertainment were up $15.2m on their forecasts, while Boyd Gaming and Penn National were down ~$7.3m. UK horseracingCatterick garrison: According to the Sunday Times, UK Chancellor Rishi Sunak has intervened in the ongoing Gambling Act review process by writing to the Department of Culture, Media and Sport. He was reportedly prompted to raise the issue of the impact on horseracing by John Sanderson, managing director of Catterick racecourse which is in Sunak’s constituency. Can’t pay, won’t pay: Sanderson has raised concerns that the rumored proposed affordability checks would see racing lose £60m a year of the money it receives from the bookmakers. He has called on the government to take account of horseracing when it comes to its review conclusions.

At the ready: Meanwhile, Betting and Gaming Council CEO Michael Dugher says the sector is “ready, willing and able” to assist in the Chancellor’s post-Covid economic recovery plan, but warned against the sector’s economic prospects post-review. What we’re sayingWE+M launched its podcast last week.

Startup focus: TallysightWho, what, where and when: Tallysight was founded in San Francisco in 2019 by tech startup co-workers Matt Peterson and Masheed Ahadi. The company is an all-in-one content and monetization toolkit for online sportsbooks and publishers to monetize their audiences. Funding backgrounder: The group recently announced the closing of a strategic financing round, but did not disclose details. It was led by Phoenix Capital Ventures and includes participation from H. Barton Asset Management and Warren Packard, co-founder of fan engagement platform Thuuz Sports, which was acquired by STATS Perform in 2020. It recently kicked off a seed round which it plans to close later this spring. So what's new? Tallysight recently signed Catena Media to add to its network of more than 1,000 publishers and over 3,100 creators, which includes media groups such as Gannett/USA Today and The Dallas Morning News. The longer pitch: “We are dedicated to unlocking the creator economy for sports betting and gaming,” says Matt Peterson, co-founder and CEO of Tallysight, who adds that not all publishers or operators should require teams of designers and engineers to create their content.

The week aheadGAN publishes its Q4s on Tuesday and analysts will be keen to hear about the financial impact of Churchill Downs ending its online sports betting and gaming activities. Gambling.com reports on Thursday, where it will update the markets on the ongoing integrations of Rotowire and Bonusfinder. NewslinesDerby days: Kentucky’s House of Representatives passed an online sports-betting and poker bill at the end of last week on a bipartisan basis. Votes for the bill came in at 58 to 30 against, but many Republicans in the GOP-controlled legislature continue to oppose gambling in all forms. Rocky tax rates: Colorado House Speaker Alec Garnett is looking into legislation to change state laws and allow online sportsbooks to deduct promos from taxable revenue. Garnett said such a change would double the state’s tax take from sports betting. Walk in the Parx: Parx Casino has rebranded its online sportsbook and casino platforms by launching the betPARX app in New Jersey and Pennsylvania. The betPARX app will also launch in Ohio in early 2023 through its partnership with the PGA Tour's Memorial Tournament. What we’re readingGoing around the block: How NFTs interact with gambling compliance, digital assets and securities. Swing hitter: Alun Bowden looks beyond some of the gambling sector’s received wisdom. On socialCalendar

Contact us

If you liked this post from Wagers.com Earnings+More, why not share it? |

Older messages

Mar 18: Weekend Edition no.38

Friday, March 18, 2022

FOX Corp. earnings call, Endeavor earnings call, Allwyn lottery win, New Jersey, Michigan and Pennsylvania Feb22, Sector Watch - Gaming +More

Mar 14: PointsBet predicts more marketing frenzies

Monday, March 14, 2022

SXSW review, New York data, Inspired earnings call, Jefferies brand matrix, Startup Focus - Prophet Exchange +More

Mar11: Weekend Edition no.37

Friday, March 11, 2022

Genius Sports Q4, NeoGames Q4, Accel Q4, DraftKings analyst meeting Full House earnings call +More

Mar 9: 888 sorry and enjoys record FY21

Thursday, March 10, 2022

888 FY, Century Casinos, Full House Resorts Q4, Newlines +More

Mar 7: FanDuel asserts NY dominance

Monday, March 7, 2022

New York, RSI acquires Run It Once Poker, Playtech takeover update, Startup focus - WSC Sports +More

You Might Also Like

Sold over 500,000 of products on Amazon

Friday, January 10, 2025

I love that you're part of my network. Let's make 2025 epic!! I appreciate you :) Today's hack Sold over 500000 of products on Amazon Did you know that more than 70% of sales on Amazon

🔍 How To Build Your Brand’s Social Narrative

Friday, January 10, 2025

January 09, 2025 | Read Online All Case Studies 🔍 Learn About Sponsorships It's been a minute. Things have changed. Our focus changed. We've narrowed the newsletter down. We're more focused

A Community Just for Agency Owners

Friday, January 10, 2025

Hi there , Most business advice online isn't built for agency owners. Running an agency comes with unique challenges. Whether it's pricing projects or managing client expectations, generic

🎙️ New Episode of The Dime She Hits Different: The Story Behind Cake's Explosive Growth ft. Chloe Kaleiokalani

Thursday, January 9, 2025

Listen here 🎙️ She Hits Different: The Story Behind Cake's Explosive Growth ft. Chloe Kaleiokalani Cake is hitting different. A hockey stick chart is every founder's dream—but what looks

😬 Who's Slammed by the Spam Update

Thursday, January 9, 2025

Massive Local SEO Algo UPDATE ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Email trends and predictions, ‘Returnuary’ is here, advice from newsletter veterans, and more

Thursday, January 9, 2025

The latest email resources from the Litmus blog and a few of our favorite things from around the web last week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bounce Rate is Killing Your SEO 💀

Thursday, January 9, 2025

SEO Tip #68

Python Weekly - Issue 682

Thursday, January 9, 2025

January 09, 2025 | Read Online Python Weekly (Issue 682 January 9 2025) Welcome to issue 682 of Python Weekly. Happy New Year! I hope you had a great holiday and took some time off to recharge. Learn

Bubbles, Crashes & Fiscal Dominance - Should You Be Worried?

Thursday, January 9, 2025

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s Better, X or LinkedIn?

Thursday, January 9, 2025

Our Data and Some Learnings To view this email as a web page, click here saastr daily newsletter This edition of the SaaStr Daily is sponsored in part by Stripe What's Better, X/Twitter or LinkedIn