UFI FLEX THO OUT & 50% of TITN REMOVED FROM THE BUY LIST THIS MORNING

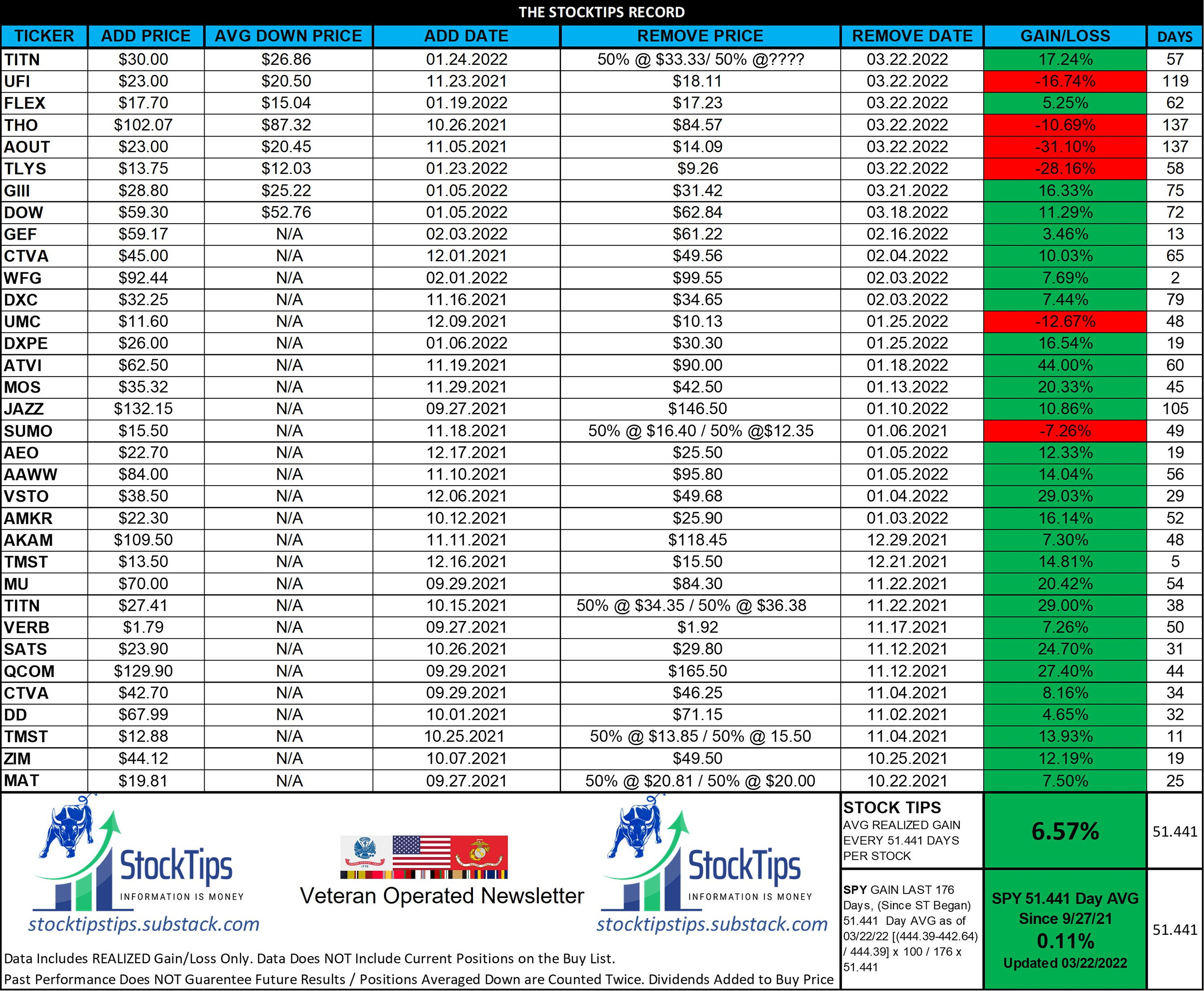

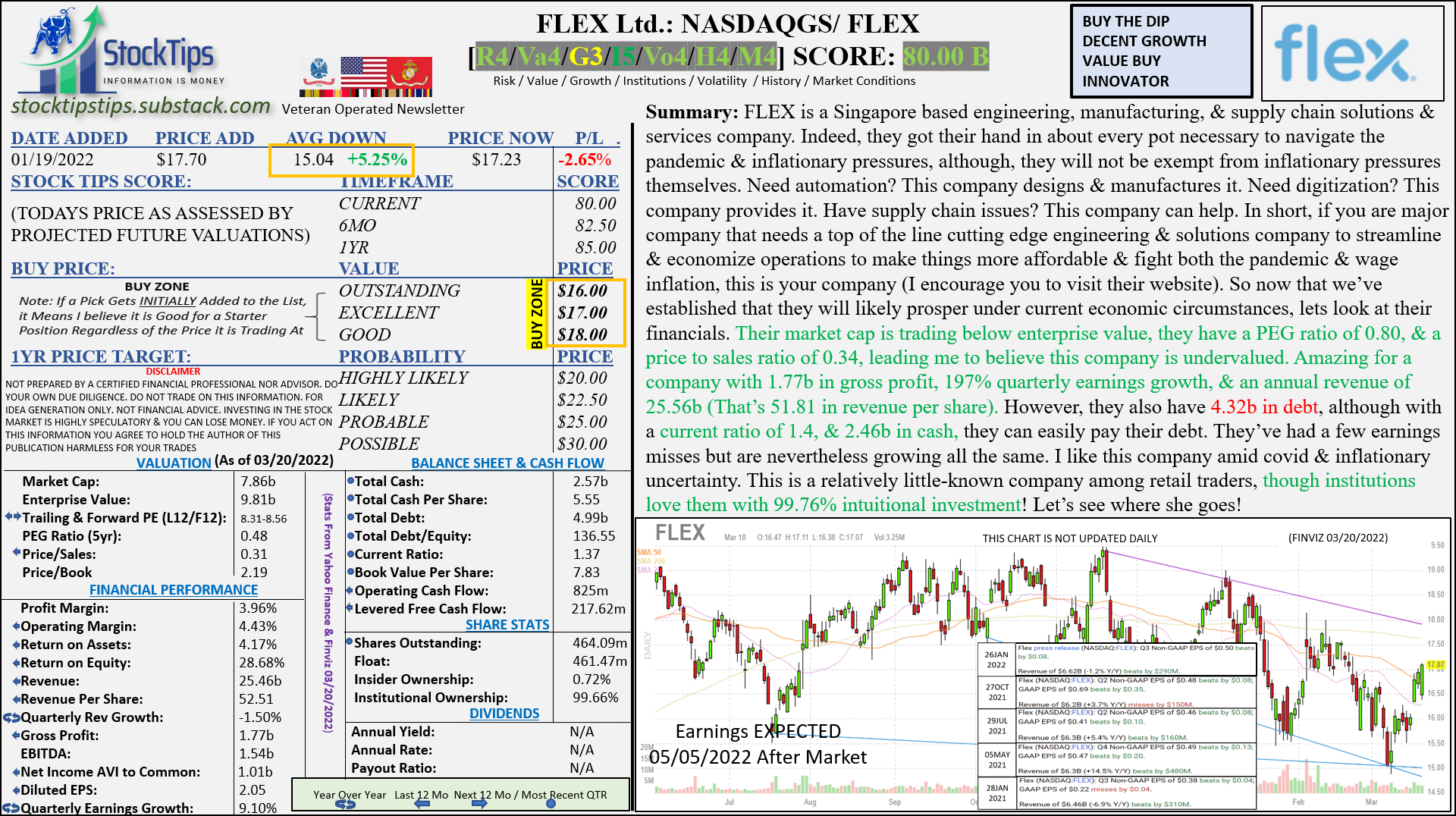

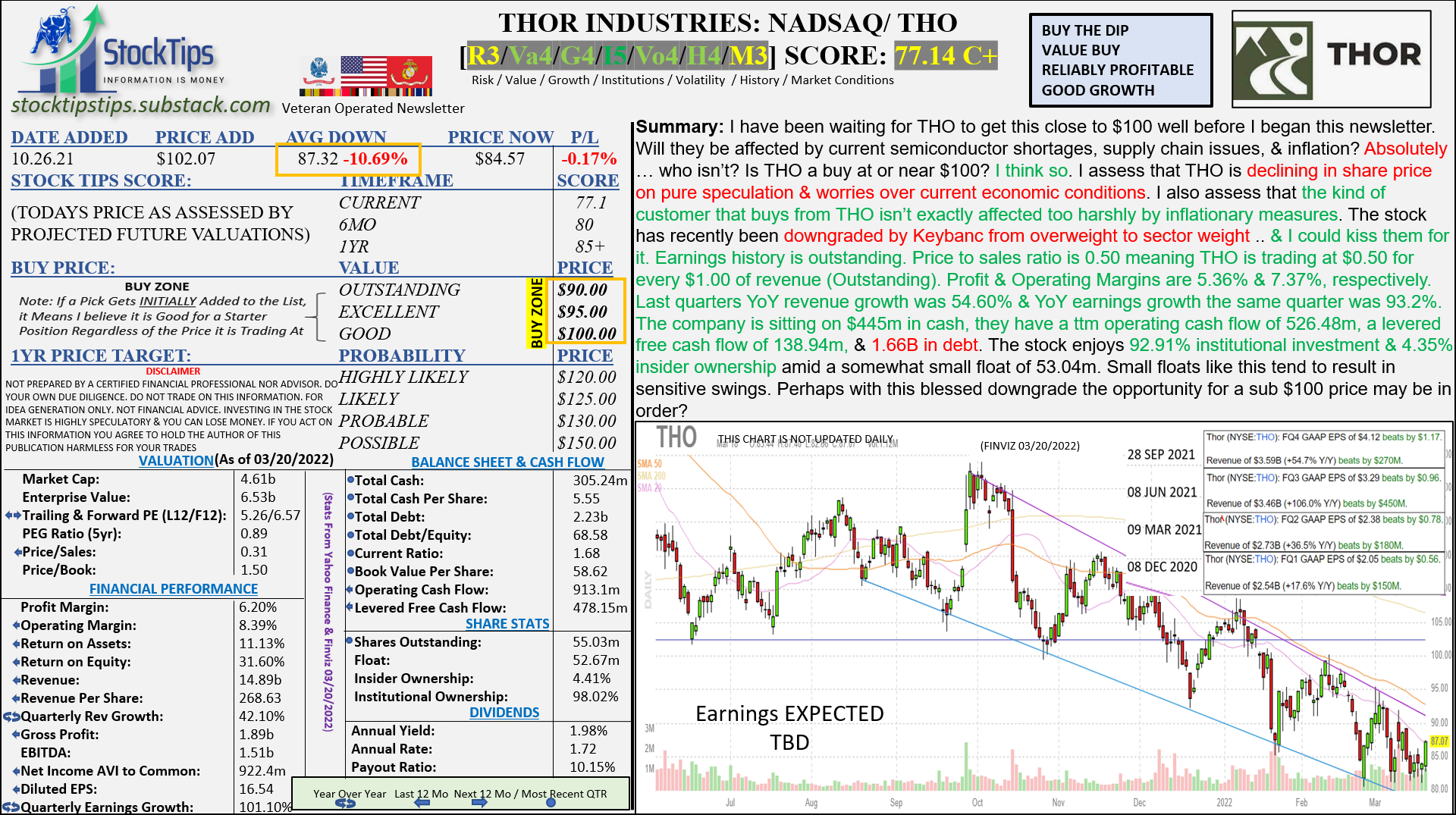

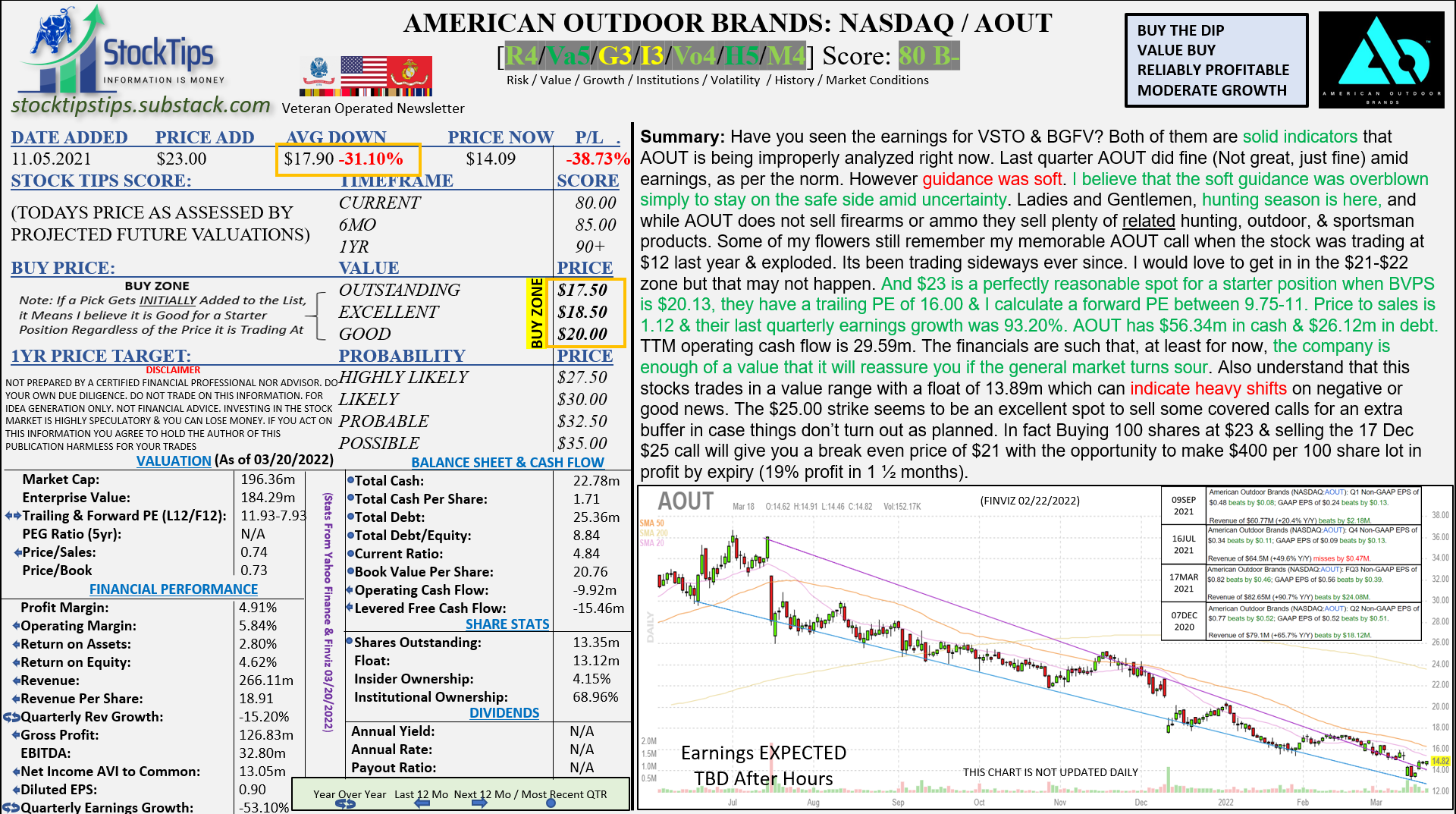

UFI FLEX THO OUT & 50% of TITN REMOVED FROM THE BUY LIST THIS MORNINGTrimming the Fat Amid Uncertain Economic Times (Inflation / War / Supply Chain Bottlenecks / Semiconductor Shortages / Record High Energy Prices)REMOVING WEAKNESS FROM THE BUY LIST: These companies are great companies & will do fine over the long haul. However I am not going to sit on them as they recover over the next year or so. I think my money can be better placed elsewhere. I MUST come to realize that the underlying financial & economic conditions that existed when they were added are NOT in existence today! Examples below. PROBLEMS AHEAD: As indicated before, shit is getting bleak. Inflation is a very very real threat! This war in Ukraine will only worsen inflation in energy, steel, food, etc. Moreover there are still very real backlogs. Energy is becoming a very real problem. PRICING OUT: I cannot know what kind of lives you all live. But for middle class folks, they’re getting priced out of the market … & fast. When people get priced out of the market they economize on their needs & cut back on their wants. This leads to less goods purchased, and therefore, less revenue for retailers. Less revenue for retailers leads to less investment, price cuts to break even, & layoffs. Layoffs lead to less employment, & less spending. It may not go exactly like this but you get the point. EVERY EXTRA DOLLAR shoppers pay for ANYTHING is a dollar that cannot be spent somewhere else. If you have been in the market for more than a decade you know this tune. If you’ve been in since 2019, this is a new phenomena to you (2018 was not a great year). I assure you, its real. FED RATE HIKES: The market is so overheated, inflation is so rampant, & there is so much worldwide uncertainty, that these rate hikes are going to amount to a whole lot of nothing. We will be lucky if inflation isn’t at 10% by July-November (It’s above that already in many aspects of the economy, I’m talking about the CPI). THE FED WILL BE GRADUALLY RAISING RATES RIGHT AT THE MOMENT THAT BUSINESSES WILL NEED CREDIT TO MAKE ENDS MEET AS CONSUMERS ARE GETTING PRICED OUT. WE CAN NO LONGER LOOK TWO EARNINGS OUT: Companies that are meeting analysts expectations or even smashing earnings in many cases are dumping all the same. TLYS & AOUT did fine! THO did outstanding! FLEX did great! However the street isn’t pricing in next earnings … they’re pricing in turmoil. MOVING FORWARD: We are going to have to hedge, we are going to have to go short (There are ways to do this safely & I will teach you soon), I am not through re-arranging the BUY LIST, & long positions will require EXTREME SCRUTINY a patience. CUTTING THE FAT: As a result of headwinds, I have cut the following from the BUY LIST. Please read the summary that was written when they were posted. See where I was right, & see where I was wrong. See my assumptions, & see what actually happened. It’s a great learning exercise. Things are much different than when they were added. IMPORTANT DISCLAIMER: I am NOT a registered investment adviser, broker dealer, or member of any other association for research providers in any jurisdiction whatsoever & I am NOT qualified to give financial advice. Investing/Trading in securities, particularly microcap securities, is highly speculative & carries an extremely high degree of risk. The information, analysis, & opinions listed above are my own & may not properly reflect the underlying conditions of a company or security. You should do your own Due Diligence. Past performance does not guarantee future results. If you trade based on anything I have written YOU ACCEPT FULL RESPONSIBILITY AND LIABILITY for your own trades & actions & hold the author of this publication harmless. If that isn’t clear enough DO NOT TRADE, ACT, OR INVEST, BASED UPON ANYTHING I WRITE OR RECOMMEND. There, we should be solid now.You’re a free subscriber to StockTips Newsletter. For the full experience, become a paid subscriber. |

Older messages

GIII WILL BE REMOVED FROM THE BUY LIST TOMORROW MORNING & ADDED TO THE STOCK TIPS RECORD

Sunday, March 20, 2022

GIII WILL BE REMOVED FROM THE BUY LIST TOMORROW MORNING & ADDED TO THE STOCK TIPS RECORD: What an awesome earnings huh? Well as you will notice in tomorrows newsletter, you will see that I'm

The Daily StockTips Newsletter 03.18.2022

Friday, March 18, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

DOW INCORPORATED REMOVED FROM THE BUY LIST TODAY & ADDED TO THE STOCK TIPS RECORD

Friday, March 18, 2022

DOW INCORPORATED REMOVED FROM THE BUY LIST TODAY & ADDED TO THE STOCK TIPS RECORD: I like DOW for a long hold but I believe it's time. I'm not sure to what extent they are affected by their

The Daily StockTips Newsletter 03.17.2022

Thursday, March 17, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 03.15.2022

Tuesday, March 15, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

Text and Telos

Monday, March 10, 2025

Plus! Diff Jobs; Scaling; Retail Investors; Comparative Advantage; Transaction Costs and Corporate Structure; DeepSeek Governance Text and Telos By Byrne Hobart • 10 Mar 2025 View in browser View in

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March