Earnings+More - Mar 23: GAN waits on fragmentation

Mar 23: GAN waits on fragmentationGAN Q4, Deutsche Bank promo spend note, Playmaker Q4, regulatory roundup +MoreGood morning. On today’s agenda:

Just. Click below: GAN Q4

Hold that thought: The company blamed poor hold in CoolBet’s European business - which fell to 4.6% in Q4 - for the underperformance which CFO Karen Flores said represented a “significant challenge”. B2C revenue was down 9% on Q3 at $19.2m. B2B revenues were static at $11.2m. A win’s a win: Launches in the year ahead include Red Rock Resorts in Nevada and with the Soaring Eagle tribe in Michigan. Smurfit said the Red Rock deal was an opportunity to launch “at considerable scale in Nevada, arguably the most complex regulated market environment in America”. California dreaming: On the market fragmentation, Smurfit said that major native gaming states such as California would present a “major opportunity”. Churchillian: Asked about Churchill Downs' recently announced exit from sports-betting, Smurfit noted the business was only worth a “relatively modest” ~3% of total revenues. He went on to strike a philosophical note.

Hill of beans: Asked about the fragmentation issue, Smurfit said smaller operators could drive profits as with what happened in Europe if the full online opportunity was opened up. “I think really the question (is) about how quickly does iGaming legislation get implemented,” Smufit suggested.

Trolling MGM: According to Bloomberg, the lawsuit mentioned in the results statement is with MGM with GAN accusing the casino giant of patent infringement with regard to the iBridge omnichannel conversion platform. GAN says the infringement relates to the connection between the M Life platform and BetMGM.

After hours: Results came post-close in New York, but in after hours trading GAN’s share price slumped nearly 20%. ** Sponsor’s message: Venture capital firm Yolo Investments is home to €350m of equity in more than 50 of the most exciting companies across fintech, gaming and blockchain. It continues to build one of gaming’s most dynamic portfolios as it eyes up seed and A-stage opportunities across the sector. Its dedicated 28-company, €135m AUM gaming fund already houses holdings in fast-growing suppliers and operators, including Kalamba Games, SimWin and ThriveFantasy. Yolo Investments is also on the lookout for LPs as it looks to scale new concepts, including its high-roller live casino brand, Bombay Club. As a proud sponsor of Earnings+More from Wagers.com, Yolo Investments wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat. Deutsche Bank scratches promo itchPumped up kicks: Looking at the “more evident” link between excessive promo spend and elevated handle growth, the team suggest that “when pulled back, we expect handle and GGR to follow”.

Let me down gently: DB reached the conclusion that the market “as defined by net revenue” is likely to be “considerably smaller than how most people articulate it at present”. Ruffling feathers: The team acknowledged this “can be construed as being somewhat aggressive/judgemental”. They note three main arguments against:

When the levee breaks: In response, though, they point out it is “hard to ignore” the continued rising spend in Pennsylvania - both in absolute terms and as a percentage of handle - which has just completed its third full NFL season.

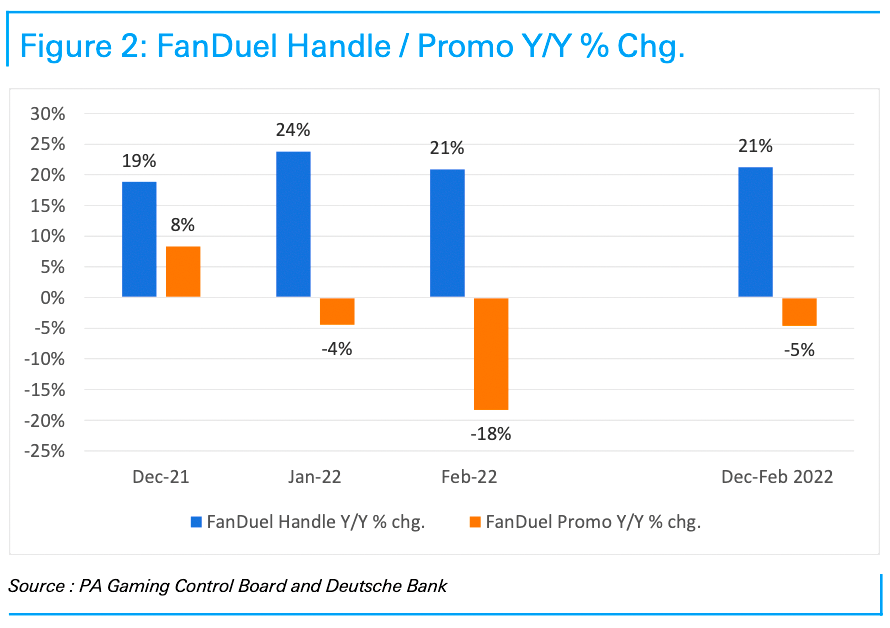

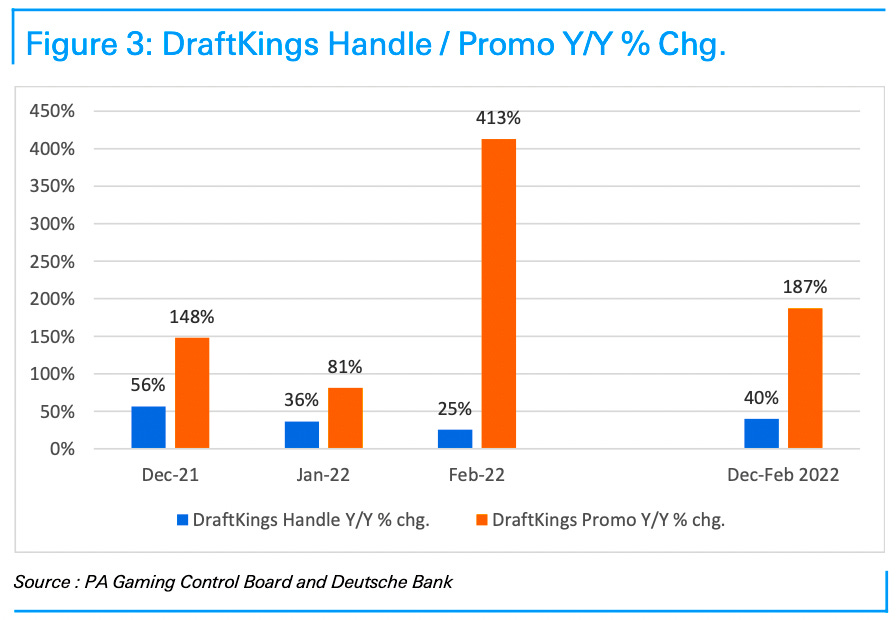

Comparison shopping: The comparisons across operators are revealing. Broadly, while FanDuel and Barstool pulled back their promo spend between Dec21-Feb22 (down 5% and 49% respectively), DraftKings and BetRivers increased their spend levels (up 187% and 45%). Yet, while Barstool suffered an 11% fall in handle, FanDuel’s rose 21%. Meanwhile, DraftKings saw handle rise 40% over the three-month period and BetRivers rose 10%. You do it to yourself, you do And that’s what really hurts Regulatory roundup

Playmaker Q4

The company you keep: “We are in that conversation,” CEO Jordan Gnat said of Playmaker’s status as #6 of Comscore’s sports digital media groups for the Americas among such names as ESPN, CBS and Yahoo Sports. In Latin America the company was #1. We are sailing: Gnat said 2021 was “foundational” for Playmaker after it added four acquisitions in Q4 (including TNN, Super Poker and Cracks) and has completed one more (Futmarketing in Brasil) since January.

Gnat noted that though the company has $7m of cash on the balance sheet, should it seek further sizeable assets then “we need to think about our balance sheet”. That means either debt or equity.

NewslinesElevated view: iGaming Academy and the UNLV’s International Gaming Institute have created a new training program called ElevateRG that will bring IGI’s responsible gaming (RG) training to gaming industry staff and learners across the US and worldwide. Micro-transaction: Bragg Gaming subsidiary Oryx Gaming has signed a content deal with Microgame in Italy for a range of slots. Spam-a-lot: Exiting UK National Lottery operator Camelot has been fined £3.15m for sending marketing messages to app users who had either self-excluded or had been identified as showing signs of gambling harm. Camelot also informed up to 20,000 players that their winning ticket was a non-winner and double-charged 22,210 players who had purchased a single ticket through the app. X marks the spot: Free-to-play gaming services startup Sparket has signed XPoint Tech as its provider of geolocation and fan engagement services. Sparket currently counts US Bookmaking and Cahuilla Casino in California as clients and will be rolling out its free-to-play wagering contest platform Social Betwork in the coming months. Paid in full: Payment services provider Global Payments will supply its sports betting-focused payment products to 888 for the group’s Sports Illustrated-branded sportsbook. What we’re readingCome as you are: The Parleh has an open invitation for Ontario’s launch. What we’re writingOn Wagers.com: Data deals point to NCAA data shift. On socialShaq: It’s all Serbo-Croat to me Collective banner: March Madness for everyone   Calendar

Contact us

If you liked this post from Wagers.com Earnings+More, why not share it? |

Older messages

Mar 21: Chanos and Robins renew fight

Monday, March 21, 2022

DraftKings short selling fight, Bally and IGT analysts notes, UK horseracing intervention, startup focus - Tallysight +More

Mar 18: Weekend Edition no.38

Friday, March 18, 2022

FOX Corp. earnings call, Endeavor earnings call, Allwyn lottery win, New Jersey, Michigan and Pennsylvania Feb22, Sector Watch - Gaming +More

Mar 14: PointsBet predicts more marketing frenzies

Monday, March 14, 2022

SXSW review, New York data, Inspired earnings call, Jefferies brand matrix, Startup Focus - Prophet Exchange +More

Mar11: Weekend Edition no.37

Friday, March 11, 2022

Genius Sports Q4, NeoGames Q4, Accel Q4, DraftKings analyst meeting Full House earnings call +More

Mar 9: 888 sorry and enjoys record FY21

Thursday, March 10, 2022

888 FY, Century Casinos, Full House Resorts Q4, Newlines +More

You Might Also Like

🔍 How To Build Your Brand’s Social Narrative

Friday, January 10, 2025

January 09, 2025 | Read Online All Case Studies 🔍 Learn About Sponsorships It's been a minute. Things have changed. Our focus changed. We've narrowed the newsletter down. We're more focused

A Community Just for Agency Owners

Friday, January 10, 2025

Hi there , Most business advice online isn't built for agency owners. Running an agency comes with unique challenges. Whether it's pricing projects or managing client expectations, generic

🎙️ New Episode of The Dime She Hits Different: The Story Behind Cake's Explosive Growth ft. Chloe Kaleiokalani

Thursday, January 9, 2025

Listen here 🎙️ She Hits Different: The Story Behind Cake's Explosive Growth ft. Chloe Kaleiokalani Cake is hitting different. A hockey stick chart is every founder's dream—but what looks

😬 Who's Slammed by the Spam Update

Thursday, January 9, 2025

Massive Local SEO Algo UPDATE ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Email trends and predictions, ‘Returnuary’ is here, advice from newsletter veterans, and more

Thursday, January 9, 2025

The latest email resources from the Litmus blog and a few of our favorite things from around the web last week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bounce Rate is Killing Your SEO 💀

Thursday, January 9, 2025

SEO Tip #68

Python Weekly - Issue 682

Thursday, January 9, 2025

January 09, 2025 | Read Online Python Weekly (Issue 682 January 9 2025) Welcome to issue 682 of Python Weekly. Happy New Year! I hope you had a great holiday and took some time off to recharge. Learn

Bubbles, Crashes & Fiscal Dominance - Should You Be Worried?

Thursday, January 9, 2025

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s Better, X or LinkedIn?

Thursday, January 9, 2025

Our Data and Some Learnings To view this email as a web page, click here saastr daily newsletter This edition of the SaaStr Daily is sponsored in part by Stripe What's Better, X/Twitter or LinkedIn

These are the 14 ways to instantly build trust with visitors

Thursday, January 9, 2025

Some websites sparkle with evidence and reasons to believe. Other websites are really just piles of unsupported marketing claims. Today, we are sharing a guide for building pages that build trust with