The Daily StockTips Newsletter 03.24.2022

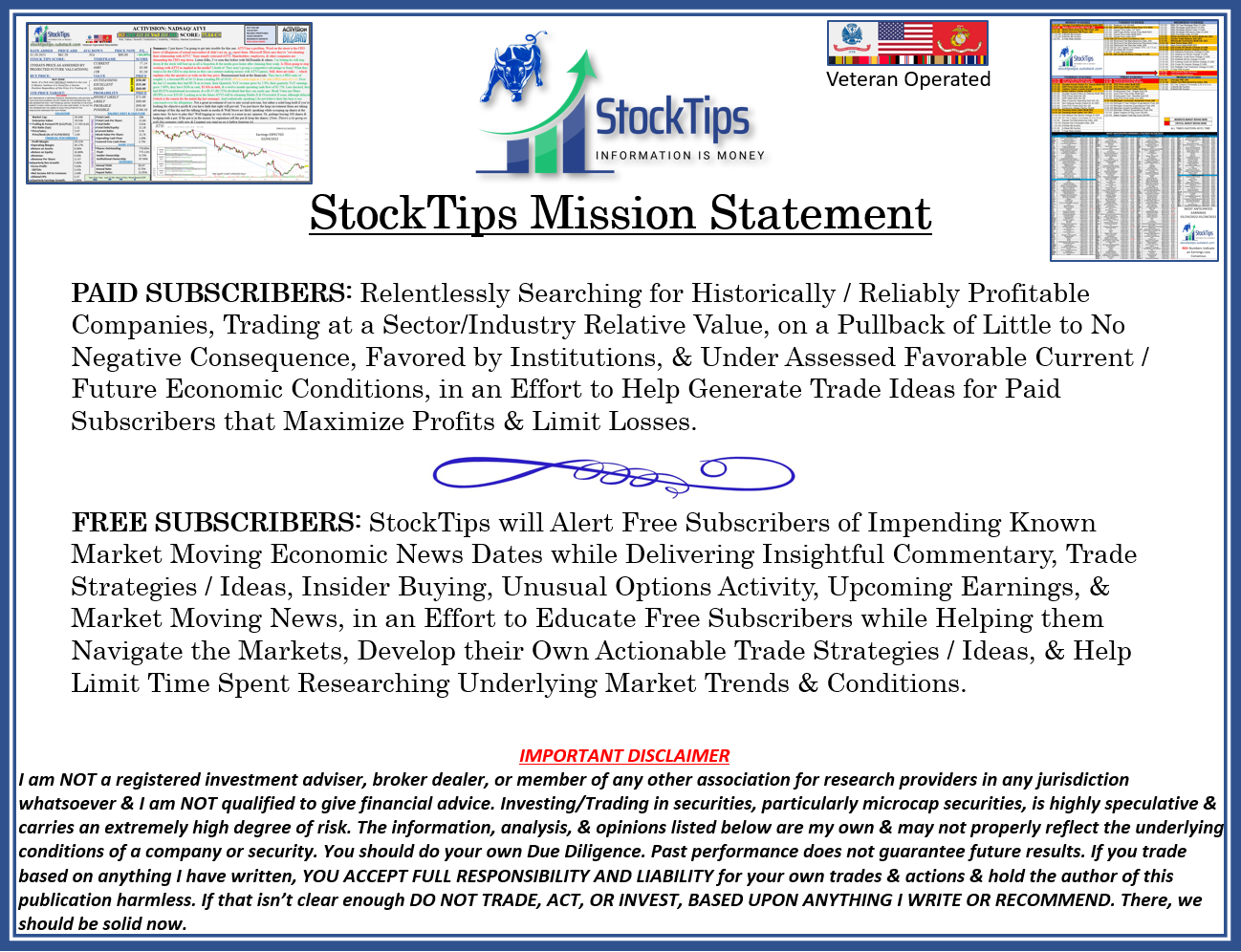

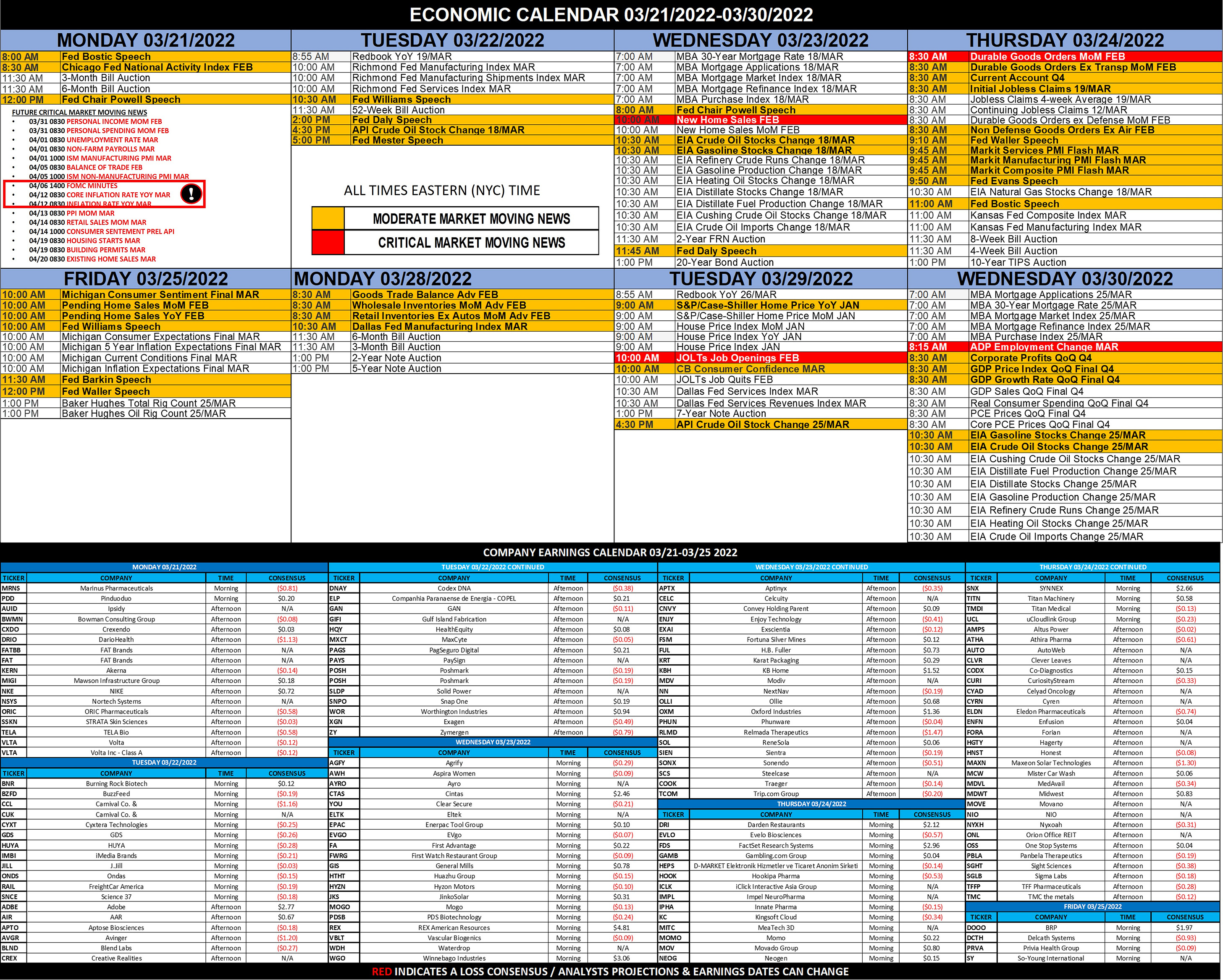

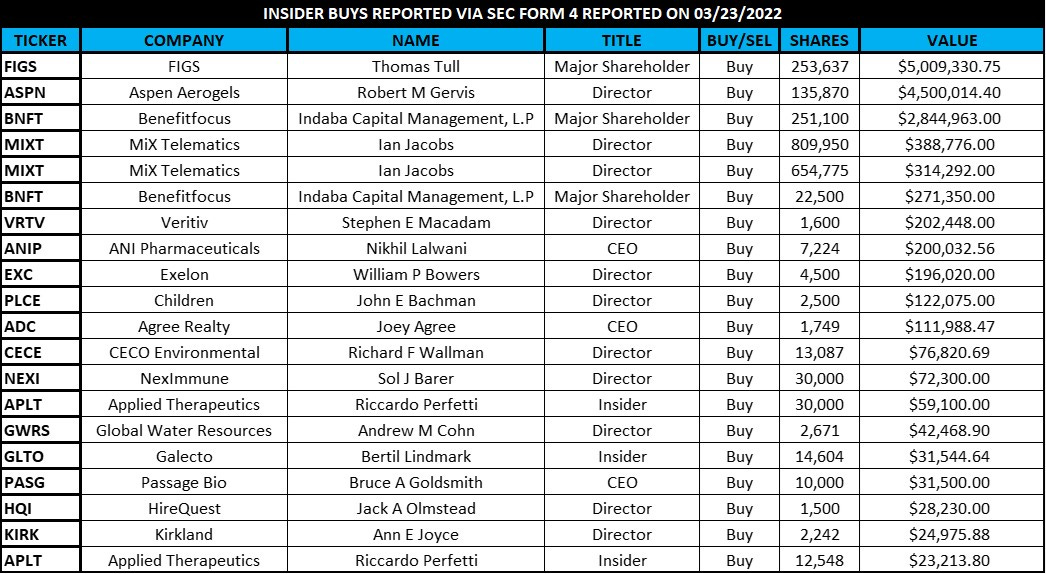

The Daily StockTips Newsletter 03.24.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)CLICK HERE TO SEE THE STOCKTIPS RECORD WE’RE ON YOUTUBE NOW! See HERE, HERE, & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings (Note: Red Indicates an Earnings Loss [Not Miss] Consensus), & Yesterdays Insider Buys.INSIDER BUYS TODAYS COMMENTARY Get a Cup of Coffee & Enjoy Catching Up! If you aren’t reading this daily you are missing out on a wealth of information that could prevent unforced & unnecessary trading errors. Current Economic Conditions: I sent out a number of Tweets on some recent economic numbers & stats. Be Careful How You Invest in this Market!: I’m using this time to unravel some of the BUY LIST. To the extent I will be adding to the Buy List, it will be companies that will tend to prosper under current & assessed future economic conditions. I assess that large institutions are doing the same. It is important that we follow the numbers here. Retail sales look to be topping off, home sales are topping off, inflation is expected to come very close to 9-10% by July/August, fuel prices are skyrocketing (fuel stocks are low), food prices are skyrocketing, electronic prices are skyrocketing, vehicle/vehicle repair prices are skyrocketing, & the geopolitical environment is shaky. There is a large amount of uncertainty surrounding Iran, North Korea is firing off rockets again, we still don’t fully know the fallout of Russia’s invasion of the Ukraine, the cyber threat is elevated (I’d say immanent), & as I have documented since the beginning of this newsletter, China is obviously playing dangerous geopolitical games with the United States. Combined with the Fed inching up interest rates (They should be higher folks) & the Presidents refusal to work with oil companies, I think there is enough here to understand that this Fall will be much different than last Fall. The Fed simply does not want to rip the Band-Aid off. Powell wants to ease his way into things in the hopes that supply chain issues, semiconductor shortages, commodity prices, & geopolitics will subside & bring down prices. Despite the fact that M2 money supply is up by over 1/3rd since the beginning of covid. I think the chances that this will offset current inflationary pressures is low. I’m certainly not alone. So we are caught between a rock & a hard place. Dramatically raising rates will shock the economy. But high inflation is shocking the economy. And raising rates to shock the economy while the economy is being rocked by high inflation is like a double whammy. It’s necessary … but incredibly painful! History is clear on such transitions … it means economic pain! I will trade accordingly. If you’re looking for me to start rapidly adding to the buy list, its just the wrong time. I’m not going to post garbage that I know will not weather the storm in an effort to please folks who won’t be so pleased a few months from now. I must be careful, I must be clever in the way I approach these markets, & I will not sell my credibility by giving you garbage to look at. If it doesn’t make sense, it doesn’t make sense. I need plays that clearly make sense! Significant News Heading into 03.24.2022:

PAID CONTENT IN THE PAYWALL BELOW:

👉CLICK HERE TO SEE THE DETAILS OF EVERY STOCK ON THE BUY LIST (AND SEE THE PRICE ASSESSMENT BASED WATCHLIST / THE STOCKS UNDER $20 LIST & THE HIGHLY SPECULATIVE LIST) LOGIN INSTRUCTIONS: You will need to login to see the detailed list. The “email login link” will send the link to login directly to your inbox (Click the link & it will automatically log you in). You can also choose the “login with password” option. You will need to set up a substack password for this option.Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 03.22.2022

Tuesday, March 22, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

UFI FLEX THO OUT & 50% of TITN REMOVED FROM THE BUY LIST THIS MORNING

Tuesday, March 22, 2022

Trimming the Fat Amid Uncertain Economic Times (Inflation / War / Supply Chain Bottlenecks / Semiconductor Shortages / Record High Energy Prices)

GIII WILL BE REMOVED FROM THE BUY LIST TOMORROW MORNING & ADDED TO THE STOCK TIPS RECORD

Sunday, March 20, 2022

GIII WILL BE REMOVED FROM THE BUY LIST TOMORROW MORNING & ADDED TO THE STOCK TIPS RECORD: What an awesome earnings huh? Well as you will notice in tomorrows newsletter, you will see that I'm

The Daily StockTips Newsletter 03.18.2022

Friday, March 18, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

DOW INCORPORATED REMOVED FROM THE BUY LIST TODAY & ADDED TO THE STOCK TIPS RECORD

Friday, March 18, 2022

DOW INCORPORATED REMOVED FROM THE BUY LIST TODAY & ADDED TO THE STOCK TIPS RECORD: I like DOW for a long hold but I believe it's time. I'm not sure to what extent they are affected by their

You Might Also Like

Text and Telos

Monday, March 10, 2025

Plus! Diff Jobs; Scaling; Retail Investors; Comparative Advantage; Transaction Costs and Corporate Structure; DeepSeek Governance Text and Telos By Byrne Hobart • 10 Mar 2025 View in browser View in

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March