Startup Self-Repricing as a Recruiting Tool

Tomasz TunguzVenture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Startup Self-Repricing as a Recruiting Tool

Could Instacart’s self-repricing become the first of many? It’s quite possible. The company announced it would mark its shares to a market price 40% less the last round. In a fundraising environment awash with capital and term sheets lapping up on the front doors of many startups, why might we see more self-repricings? Talent. Startups appeal to candidates span many dimensions: influence, category creation, smaller teams. But lottery-ticket upside remains one of the most important. Join the right company and it will change your economic life. Today’s talent market may be the most competitive on record. The current herd of unicorns, hundreds in number, sport saddlebags loaded with billions of dollars, each vying for the best staff. Amidst this competitive jostling, equity upside trumps perks. Reducing the strike/grant price of an option or RSU (restricted stock unit) increases the potential upside for future grant recipients - a group comprising both existing employees receiving grants and new hires. In other words, our equity now has more upside - come work here! If more startups do self-reprice, boards and heads of people/HR should ensure hires whose options are now less compelling receive some additional shares to ensure fairness and remain motivated. How broad might startup self-repricing become? It’s hard to say, but the motive force will be competition in the talent market. Startups whose trajectories remain stellar may never consider the idea. The best companies will always find buyers willing to pay top dollar both in the private and the public markets - public market multiples be damned. New rounds may also influence this decision. During diligence, investors forecast the potential return of an investment, basing the ultimate value of a business on other companies, called comparables or comps. If the comps are worth 40% more or 40% less, return scenarios shift meaningfully.

With interest rates continuing to increase by the day, it’s hard to imagine multiples retracing their previous highs. Rather than facing a down-round, companies may pre-emptively reprice. Imagine a startup raises at $5b and then reprices its RSUs to imply a $3b valuation. It could then raise its next round at $4b and consider it an up-round. Benjamin Graham, the father of modern investing, wrote in Security Analysis “In the short-run, the stock market is a voting machine. Yet, in the long-run, it’s a weighing machine.” Valuations of companies may move up and down based on the whims of the market - hot money, interest rates, M&A, IPOs. In the end, great companies will always be valuable, irrespective of the bumps and turbulence along the way. |

Older messages

The Spicy Future for Data

Tuesday, March 22, 2022

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. The Spicy Future for Data What's the price of

The App Store Model Comes to Web3

Monday, March 21, 2022

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. The App Store Model Comes to Web3 Six months ago,

Usage Based Pricing: 3 Questions to Ask Before Leaping

Thursday, March 17, 2022

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Usage Based Pricing: 3 Questions to Ask Before

Guess the Startup Answers

Monday, March 14, 2022

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Guess the Startup Answers Thanks to the many

Guess the Startup

Friday, March 11, 2022

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Guess the Startup I'm going to tell you a bit

You Might Also Like

Yann LeCun joins buzzy AI startup

Thursday, March 6, 2025

+ how to build a board of directors View in browser Powered by ViennaUP by Tom Nugent Good morning there, Some of Europe's buzziest AI startups are in a bind. As Kai Nicol-Schwarz reports today,

[VIDEO] From $4000 to a $14B empire: The Ray Dalio Episode

Wednesday, March 5, 2025

Hard-won lessons on success, decision-making, and overcoming setbacks. design-2-header-newsletter Hi there, We're thrilled to bring you the latest episode of the Foundr Podcast featuring Ray Dalio,

The Major Forces Transforming Commerce

Wednesday, March 5, 2025

The catalysts & shifts catalyzing new opportunities and changes across the ecosystem ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

115 new Shopify apps for you 🌟

Wednesday, March 5, 2025

New Shopify apps hand-picked for you 🙌 Week 9 Feb 24, 2025 - Mar 3, 2025 New Shopify apps hand-picked for you 🙌 What's New at Shopify? 🌱 Shop available in French, German and Spanish New ⸱ Shop ⸱ 3

🗞 What's New: Attacked after disclosing her crypto wealth online

Wednesday, March 5, 2025

Also: US indie hackers escape new red tape ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

PSA: DO NOT DO THIS

Wednesday, March 5, 2025

Read time: 57 sec. I came across a crazy Reddit post the other day. The guy said: “I burned the ships. I left my job… before even getting a client.” 🚨Sound the alarm 🚨 This is officially a public

SketchFlow, Balzac AI, Showcase, GitLoom, Subo, and more

Wednesday, March 5, 2025

Free Temp Email Service BetaList BetaList Weekly Subo Stay on top of your subscriptions and avoid surprise charges. Balzac AI Meet Balzac, your fully autonomous AI SEO Agent RewriteBar Exclusive Perk

How Depict Is Ending Shopify Doomscrolling ☠️🚀

Wednesday, March 5, 2025

Just hunted a new AI tool that turns boring Shopify grids into stunning visual stories—without a single line of code. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

A Founder's Guide: Essential Management Advice for Startups

Wednesday, March 5, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. A Founder's Guide: Essential Management Advice for Startups

Anne-Laure Le Cunff — Tiny Experiments— The Bootstrapped Founder 379

Wednesday, March 5, 2025

We chat about goals, reprogramming your own subconscious, and how learning in public can benefit anyone on any journey. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

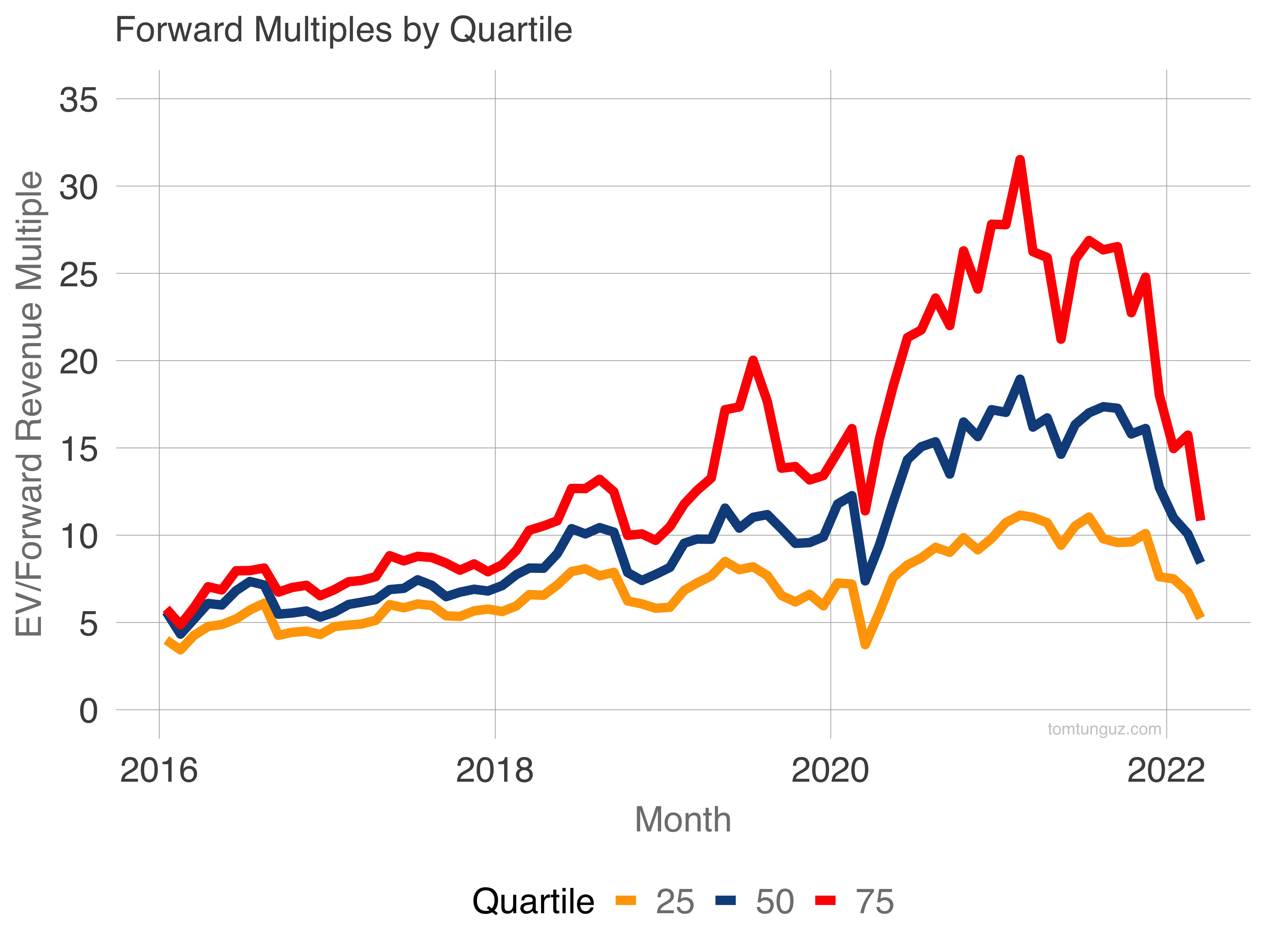

Multiples have compressed by 53% for the 25th percentile public software company and 66% for the 75th percentile (fastest growers). As the public markets have fallen more than 50%, Series C valuations have fallen about 30% year to date.

Multiples have compressed by 53% for the 25th percentile public software company and 66% for the 75th percentile (fastest growers). As the public markets have fallen more than 50%, Series C valuations have fallen about 30% year to date.