CommerceTech - Cazoo - Online Car Retailer

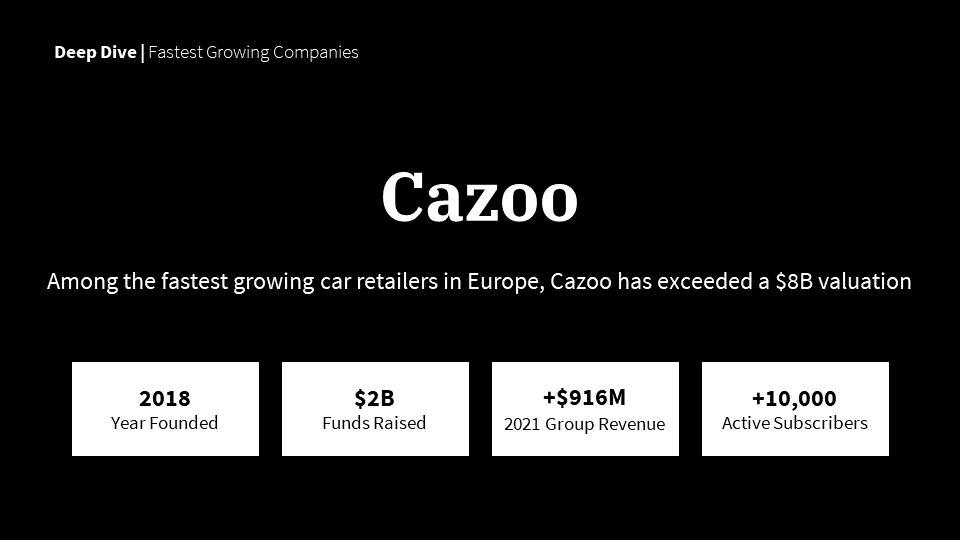

Cazoo - Online Car RetailerIn under 3 years, Cazoo built a leading online car dealership that was valued at over $8 Billion at its peakThese briefs are produced by leveraging publicly available data sources and information. If you notice a mistake or see an area for improvement, please let us know through this typeform. Snapshot

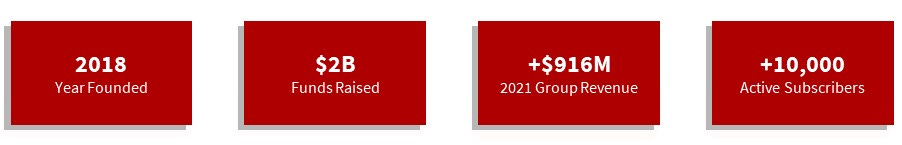

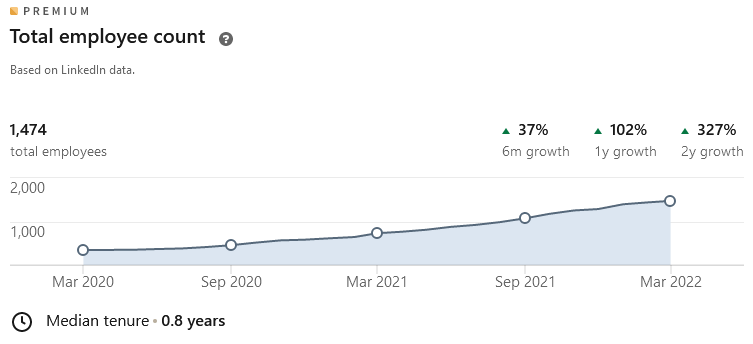

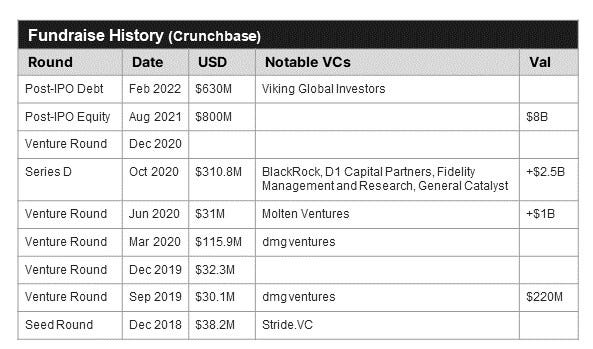

Business Overview and ProductsModeled on the likes of Beepi or Vroom in the US, Cazoo has developed an efficient app-based method to buy used cars online. The online platform allows customers to simply browse and select from their vast catalog of used cars and get access to financing. Cazoo also offers a subscription service that allows consumers to lease cars. Recently it expanded ancillary services via service plans and added the option of buying used cars directly from other consumers. How It WorksOriginally, Cazoo bought and owned every used car that it sold online. These cars are reconditioned and then offered for sale on its online portal. Interested buyers can view 360-degree quality images of the car on its portal and access details of features and history of each vehicle. They may sample the car by using it for up to 7 days and can return it for free in case of dissatisfaction. The company enables customers to have the entire transaction process online, with the option to get instant financing or offers for any part exchange. Once an order is placed, the car is home-delivered to the buyer in a 2-hour delivery slot within a few days. Buyers also get a 90-day warranty and roadside assistance upon making the purchase. In France and Germany, every Cazoo car has a full 7-day money-back guarantee and a 12-month warranty. Business Model and PricingCazoo uses a fully-integrated digital business model. The entire car-buying process is online and prices are fixed, which leaves no room for haggling. Most cars listed on the website are a maximum of 6 years old and prices start from £4,200. Upon selection, the car is delivered without delivery charges within 72 hours. In FY‘21, the company made a Retail Gross Profit per Unit in the UK of £450 ($620), up from £229 ($315) in FY’20. While Cazoo does not charge buyers for any consumer credit services, if the buyer and lender do get into a financing agreement, Cazoo receives a payment or benefit from the lender for facilitating the process. This compensation varies according to the lender and the product type and is based on a fixed fee or percentage of the amount borrowed by the buyer. The compensation does not impact the rates offered to the buyer. TractionIn FY2020, Cazoo earned $221M in revenues while suffering a loss of $135M in the same span. In FY2021, the company sold over 49,500 total cars which was a 230% Y-o-Y growth. Group revenues experienced a 300% Y-o-Y growth, rising to £665M ($916M). Retail Gross Profit per Unit in the UK rose from £229 ($315) to £450 ($620). By the end of 2021, Cazoo had sold 45,000+ cars since its launch in the UK less than 2 years ago, while its team grew to 3,800+ across UK, France, Germany, Spain & Portugal. Throughout 2021, Cazoo has made significant strides in its operations. The company grew its reconditioning capabilities by taking it fully in-house in the UK. In February 2021, it was operating out of just 1 reconditioning site, but during the year Cazoo grew to 11 reconditioning sites with an output capacity of 250,000 units/year. The team at Cazoo grew to 4,000+ employees as well As of February 2022, Cazoo is a leader in consumer car subscriptions in the European market and has around 10,000 active subscribers. It plans on selling over 100,000 retail units in 2022, with a goal to earn up to £2B ($2.7B) in revenues through a Y-o-Y growth of 200%. Founder(s) & TeamAlex Chesterman: Founder and CEO. Prior to Cazoo, he founded numerous internet ventures including Zoopla (which went public and was then acquired for £2.2B). History and EvolutionCazoo was founded in 2018 by serial entrepreneur Alex Chesterman. In the very first 3 months of commercial operations, Cazoo logged £20M ($25.6M) in sales and reached a valuation of about $220M by September 2019. In March 2020, when the first wave of coronavirus was spreading, Cazoo managed to raise $116M in funding which was used to expand its business. At a time when businesses and in-person sales were slowing down, this round signaled investor trust in the business model of Cazoo. In June 2020, Cazoo reached unicorn status with a valuation of over $1B, and became one of the fastest-growing British businesses to enter the unicorn club. Nearly 3 months later, by October 2020, Cazoo doubled its valuation to over $2.5B after an all-equity round. In August 2021, Cazoo completed a reverse merger with a SPAC raising $1B in the process. This brought the company to a valuation of $8B and enabled Cazoo to launch its services in France and Germany as well as expand its car-subscription business. Cazoo kicked 2022 off with the acquisition of Italian brand Brumbrum, a used vehicle marketplace that had raised over $177M. Following this in February, Cazoo raised $630M to support its expansion across the UK and Europe. Combined with the company’s strong liquidity position, this amount will help Cazoo execute its multi-year strategy and expedite its European expansion. Additional Learnings

Market Snapshot

Suggested Next Reads

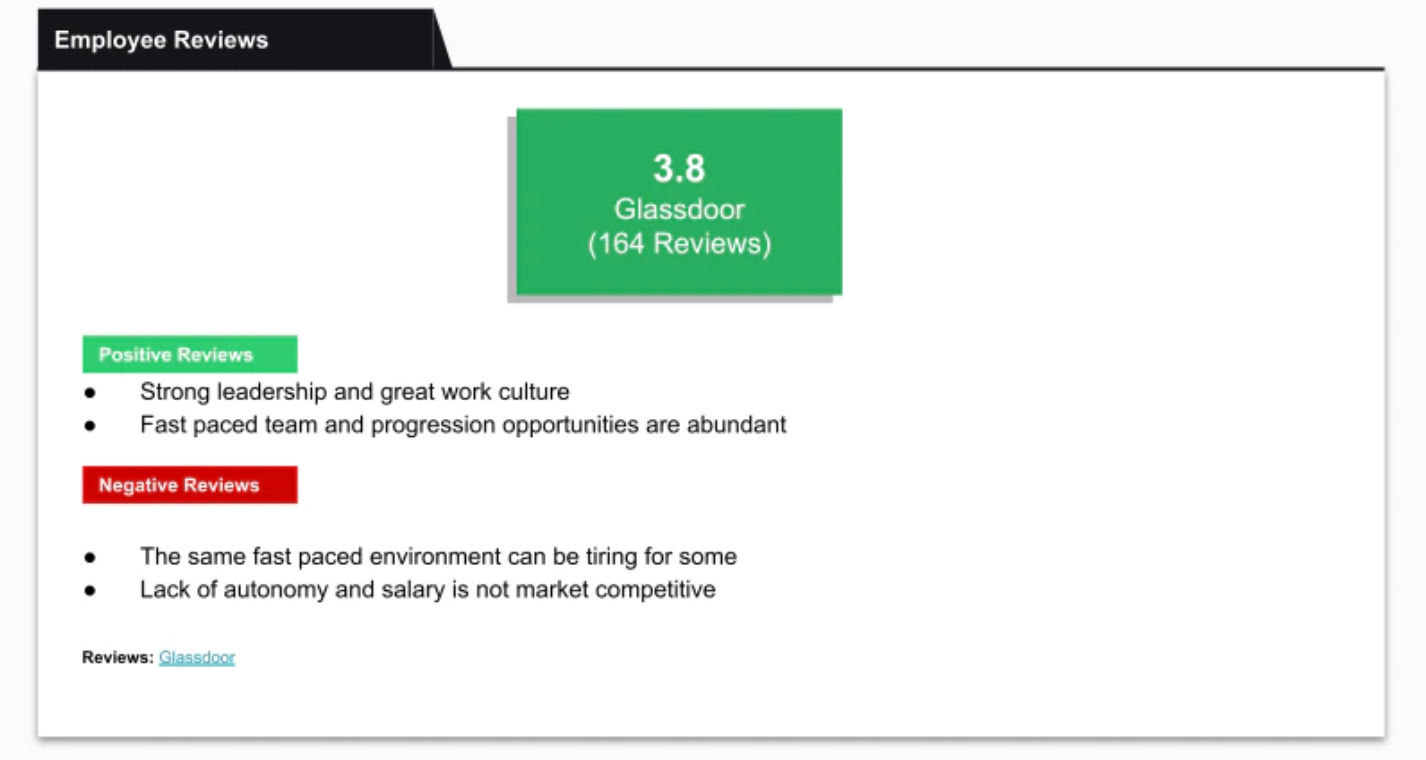

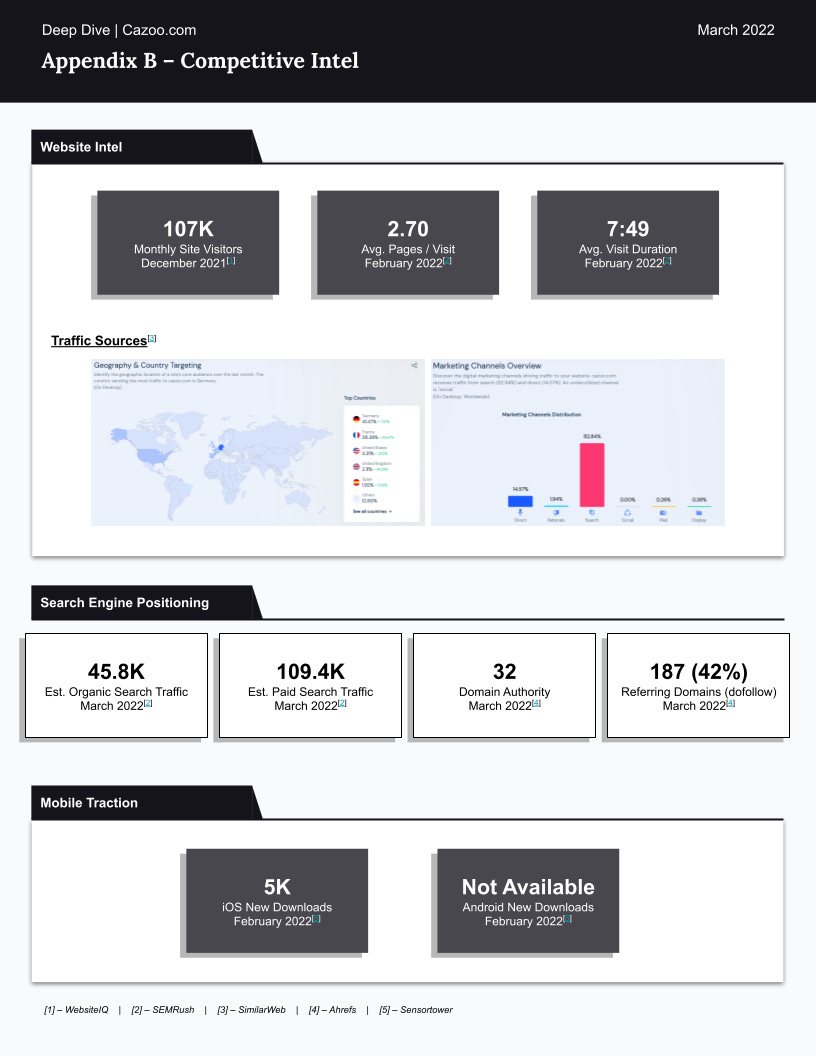

Company Reviews & Competitive IntelIf you liked this post from The Commerce Tech Newsletter, why not share it? |

Older messages

Teardown | Cart.com

Thursday, March 24, 2022

Founded in 2020, Cart.com has raised close to $500M to acquire and develop a suite of eCommerce enablement solutions

Teardown | Zetwerk – B2B marketplace for manufacturing

Tuesday, March 22, 2022

In just 3 years, Zetwerk has scaled its global B2B procurement marketplace to a $2.7B valuation.

GlobalBees – Indian House of Brands

Tuesday, March 22, 2022

The retail company that has scaled to a $1.1B valuation in under a year

You Might Also Like

Building complete rank and rent sites in just minutes

Monday, March 3, 2025

This tool is incredible

🌁#90: Why AI’s Reasoning Tests Keep Failing Us

Monday, March 3, 2025

we discuss benchmark problems, such as benchmark saturation, and explore potential solutions. And as always, we offer a curated list of relevant news and important papers to keep you informed

I interviewed THE largest Amazon Seller [Roundup]

Monday, March 3, 2025

Need funding for your Canadian Amazon business? Not sure if you should use a Canadian corporation or US LLC to form your company? We'll cover these questions and more in our Start and Grow Your FBA

The state of data-driven decision-making for CPG brands

Monday, March 3, 2025

How marketers use purchase insights to maximize campaign performance

Facebook updates, TikTok ROI, Instagram format matches, and more

Monday, March 3, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... presented by social-media-marketing-world-logo New week, fresh insights, Reader! Stay sharp with the latest updates on AI, social

Are you losing revenue to rivals?

Monday, March 3, 2025

This is a challenge that costs businesses millions every year: Their customers are switching to competitors for various reasons... even though most of them could easily be fixed. On Tuesday, March 4,

DeepSeek’s 545% Profit Claim

Monday, March 3, 2025

PLUS: Siri 2027?!

Insurtech VC resets, readies for growth

Monday, March 3, 2025

Europe's share of regional IPOs sinks; the agtech revolution is now; hope flares for natural gas deals Read online | Don't want to receive these emails? Manage your subscription. Log in The

What I Think About The Crypto Strategic Reserve

Monday, March 3, 2025

Listen now (8 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

$92K BTC After Trump’s Crypto Call, MARBLEX Invests $20M—WOOF Ups the Game!

Monday, March 3, 2025

PlayToEarn Newsletter #262 - Your weekly web3 gaming news