The Daily StockTips Newsletter 04.21.2022

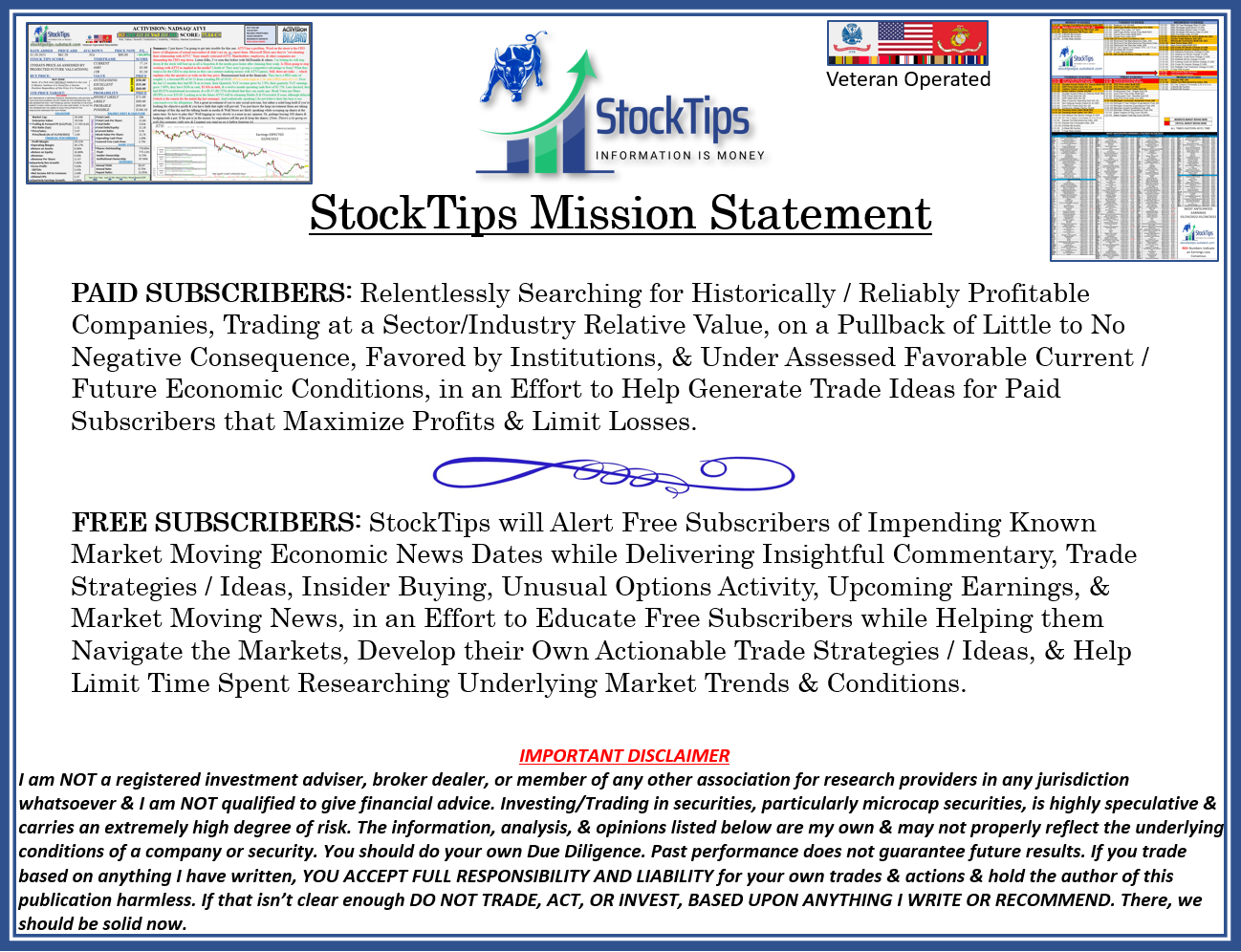

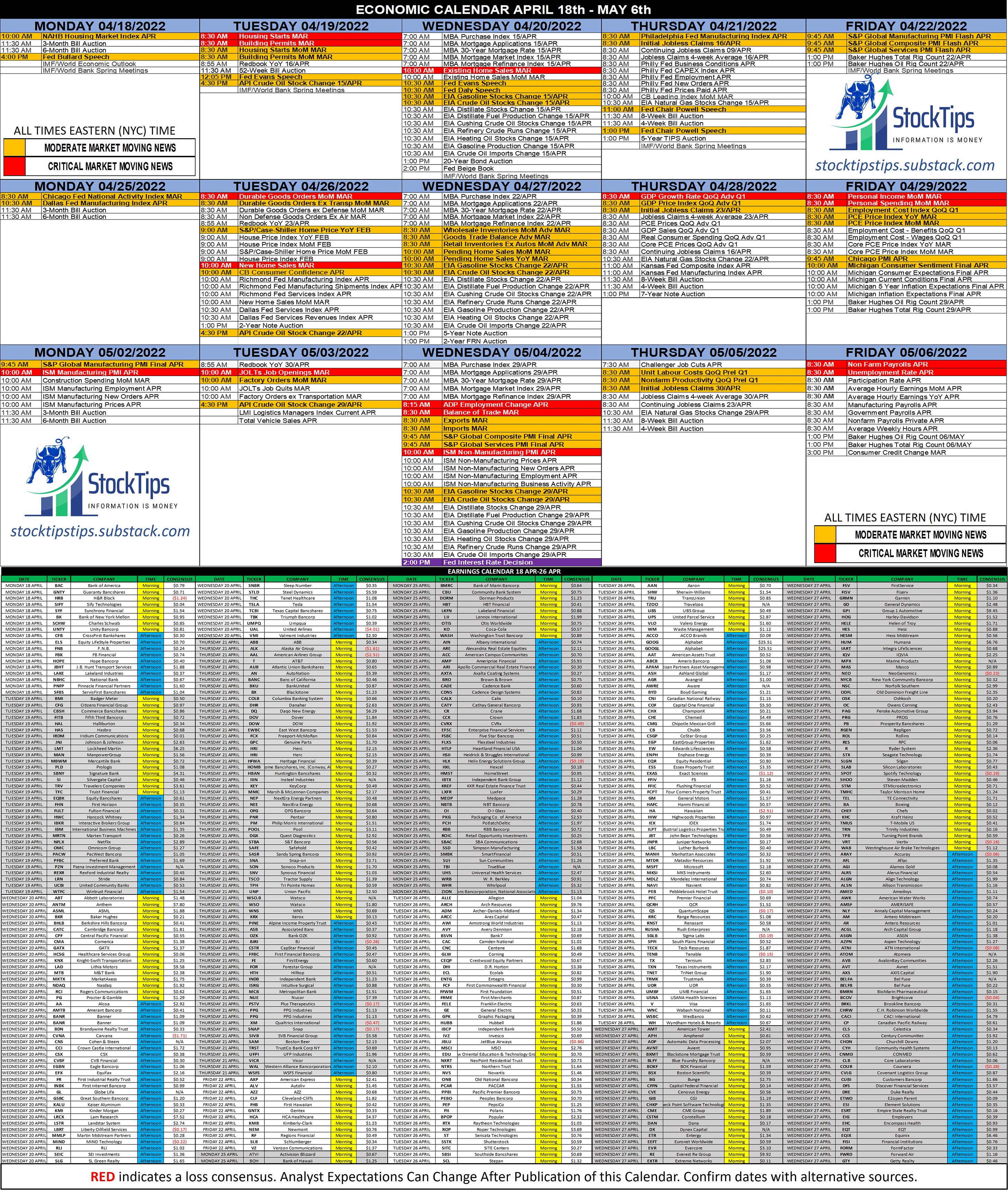

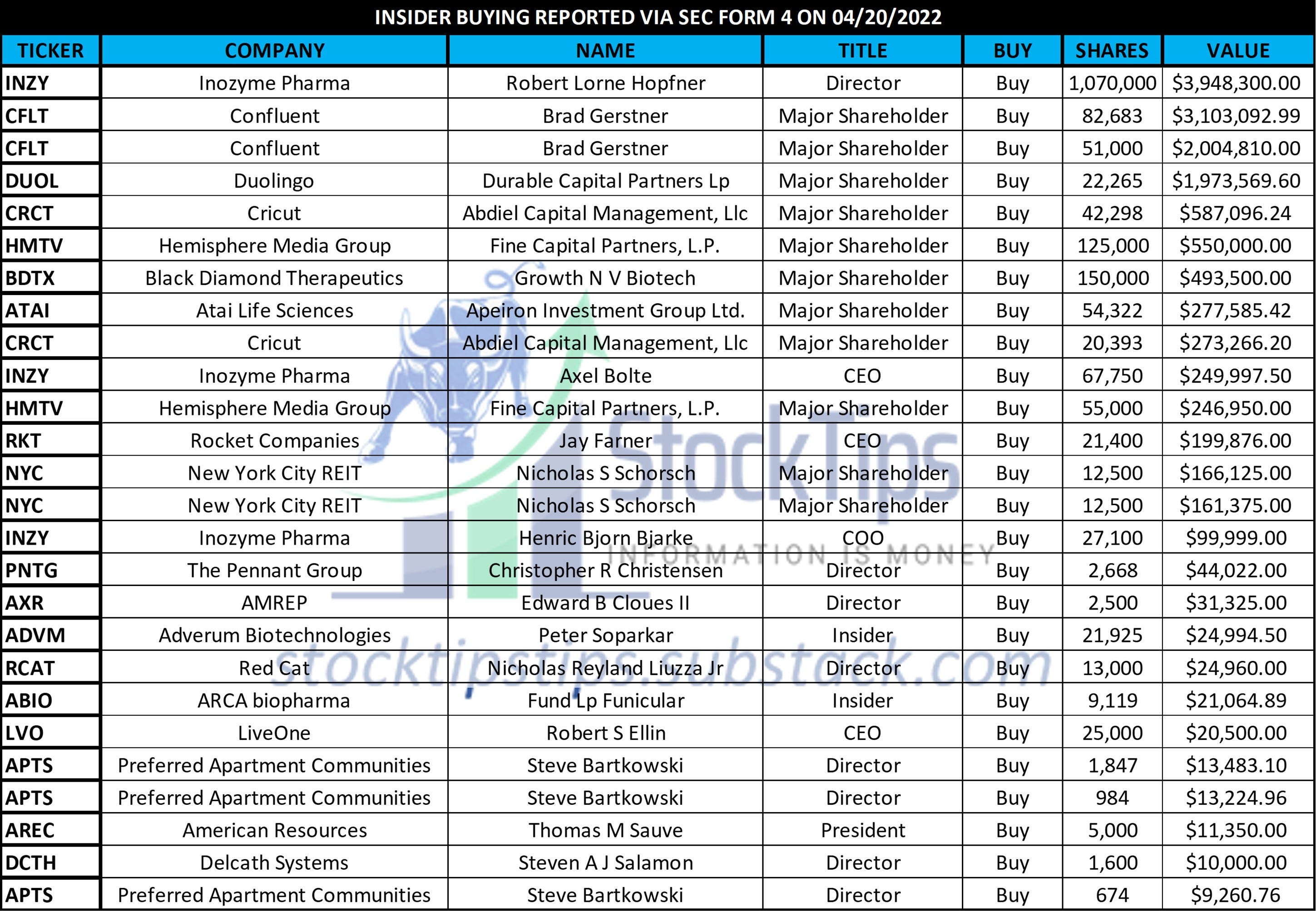

The Daily StockTips Newsletter 04.21.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)CLICK HERE TO SEE THE STOCKTIPS RECORD WE’RE ON YOUTUBE NOW! See HERE, HERE, & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings (Note: Red Indicates an Earnings Loss [Not Miss] Consensus), & Yesterdays Insider Buys.YESTERDAYS INSIDER BUYING TODAYS COMMENTARY Get a Cup of Coffee & Enjoy Catching Up! If you aren’t reading this daily you are missing out on a wealth of information that could prevent unforced & unnecessary trading errors. BUY LIST UPDATE: One Option Strategy Added Today TRADING TODAY: Federal Reserve Chair Jerome Powell will be speaking today (See the Economic Calendar Above). Powell's speech is at 11 a.m. ET & he's already said (in May) that the Fed is ready to raise interest rates by 50 basis points. Powell is also scheduled to speak again at 1 p.m. ET, at the International Monetary Fund alongside European Central Bank President Christine Lagarde. Yes … the markets can & will likely move on what he says. Traders will be looking for statements that imply a more or less aggressive posture on inflation. And trust me, no matter how good he paints a picture, the markets usually gives 10x the credit to the one or two negative observation/s he may have. The next big data release on the economic calendar (above) will be the durable goods orders next Tuesday. This report covers new orders for US manufactured durable goods (That’s goods that are expected to last for 3 years or longer). In short, these are not your one time use goods like food, gas, chemicals, toiletries, etc … but rather furniture, household appliances, machinery, etc. They are generally more expensive than your temporary goods & can often be a “one time,” or “once in a while,” purchase. When inflation bites you can generally see it first in the durable goods market. People tend to forgo large expensive purchases when everyday items increase … effectively depleting their spending power. Last month durable goods came in at -2.2% month over month (MoM). Consensus at the time was -0.5%, a 1.5% spread to the negative below analyst expectations. In the next report analyst expect a 1% increase MoM. A higher or lower than expected swing in new durable goods orders has the tendency to move markets. YESTERDAYS HOUSING DATA: The average price of a single family home increased to over $370,000, housing starts came in at 7.93m (higher than the 7.45m expected), building permits came in at 8.73m (higher than the expected 8.65m), existing home sales plummeted 2.7%, mortgage applications are down the lowest level in over 2 years, Refinancing is down big, & the average 30 year fixed interest rate comes in at over 5%. Big takeaway? We are still in a housing shortage which is why demand remains & housing prices are increasing despite the increase in interest rates. Less people are refinancing as a result of the higher rates & investors are buying homes keeping demand high. Few are selling & many are buying. The implications are many & some were explained in Monday’s Newsletter. YESTERDAYS EARNING RESULTS PG RCI NDAQ MCRI MKTX MTB LAD KNX HCSG GATX FCCO FMAO CTBI CMA CPF CATC BFC BKR ANTM ABT VMI UAL UMPQ TBK TCBI TSLA THC STLD SNBR SLG SEIC RLI MMLP LBRT LSTR LRCX KMI KALU GL FR EFX EGBN CVBF CSX CCI CNS CVNA BDN BANR AA Significant News Heading into 04.21.2022:

PAID CONTENT IN THE PAYWALL BELOW:

👉CLICK HERE TO SEE THE DETAILS OF EVERY STOCK ON THE BUY LIST (AND SEE THE PRICE ASSESSMENT BASED WATCHLIST / THE STOCKS UNDER $20 LIST & THE HIGHLY SPECULATIVE LIST) LOGIN INSTRUCTIONS: You will need to login to see the detailed list. The “email login link” will send the link to login directly to your inbox (Click the link & it will automatically log you in). You can also choose the “login with password” option. You will need to set up a substack password for this option.Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 04.20.2022 5x Stocks Removed From the Buy List Today!

Wednesday, April 20, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

EARNINGS TRACKER Q2 2022

Wednesday, April 20, 2022

TRACKING & AGGRIGATING EARNINGS TO IDENTIFY BULLISH SECTORS & TRENDS

The Daily StockTips Newsletter 04.19.2022

Tuesday, April 19, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 04.18.2022

Monday, April 18, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 04.12.2022

Tuesday, April 12, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏