| Dear friends, In JC’s Newsletter, I share the articles, documentaries, and books that I enjoyed the most in the last week, with some comments on how we relate to them at Alan. I do not endorse all the articles I share, they are up for debate. I’m doing it because a) I love reading, it is the way that I get most of my ideas, b) I’m already sharing those ideas with my team, and c) I would love to get your perspective on those. If you are not subscribed yet, it's right here! If you like it, please share about it on social networks! Share 💡JC's Newsletter

💡Must-read👉 Jonathan Abenaim - Basic-Fit: Increasing Returns to Scale (Join Colossus) Overview:

➡️ Interesting overview of their scale. Their markets are a perfect overlap with ours (except the Netherlands, it will be interesting to understand why). Market:

➡️ So, building services around the gym would be for 10% of our members (maybe slightly more given our populations) with the potential to go to 20% if we become similar to the US. Unit economics: We could walk through the economies of gym openings for Basic-Fit. They're very simple. There's about 1.2 million euros in upfront CapEx, which includes the fitness equip plus any structural building reinforcement, the showers, AC, wiring, Samsung TVs, the clubs then break even at about 1600 members. And that's a level they reach within five months, and then clubs mature at about 3,300 members within 24 months. At which point they will generate 420,000 euros of EBITDA.

➡️ 3.3k members is not that big. ➡️ Very impressive. ➡️ Even 20€ a month is huge compared to our coverage and what people pay for health insurance. Type of members: 20% to 30% of Basic-Fit members are what I call sleepers. They're members that have joined Basic-Fit because just like Netflix, if they're in the mood to watch a movie that is available to them. So about 20% to 30% are members that come once a month, the rest are members that really benefit from having a low cost gym in their town, which is close to their home or close to their office. If you look at Basic-Fit, the average length of stay is 24 months. And for an independence, it's about 12 months.

Density: So if you look at Bordeaux, which is a great example of how powerful the Basic-Fit model is, Basic-Fit has 13 gems. If you look at the average gym, which has 3,300 members, you multiply that by the amount of gyms they have in Bordeaux, that would equal about 43,000 members in the Bordeaux area. There's about 300,000 residents in total and the greater Bordeaux area. So if you pencil out 20% penetration, that would mean that basic has 70% member share.

Content: Basic-Fit also provides access to its mobile app and its vast content library for at home workouts. All their content is catered to the local language and local culture. So in Spain, for example, people are more attracted to the idea of working out in a class environment. So you have more live classes in Spain. There's an important local aspect to low cost fitness.

🏯 Building a company👉 Niantic CEO John Hanke talked to Decoder about, among other things, deciding to shut down its Harry Potter game that it was making with Warner Bros. (The Verge) “You’ve been around the tech industry for a long time, you know that every time two companies are trying to do something in a cooperative way, that process is just harder. I mean, I’m sure you see that even inside your own organization: when trying to make decisions — and when more and more people join the table — it becomes harder and harder to move quickly. We just didn’t think we’re going to be able to get it done.”

➡️ About how hard it is to do a partnership. 👉 Brain Food: Why Expensive is Cheap, Setbacks, and Influence (Newsletterest) "Steam, electricity, aviation, the automobile, the telephone, the computer, the microchip, the Internet, and many more in the future. These innovations tend to follow patterns, have similar growth rates, similar obstacles to growth, and so on. Cars at first had no highways and gas stations, the Internet had no broadband, telegraphs had no poles and wires.

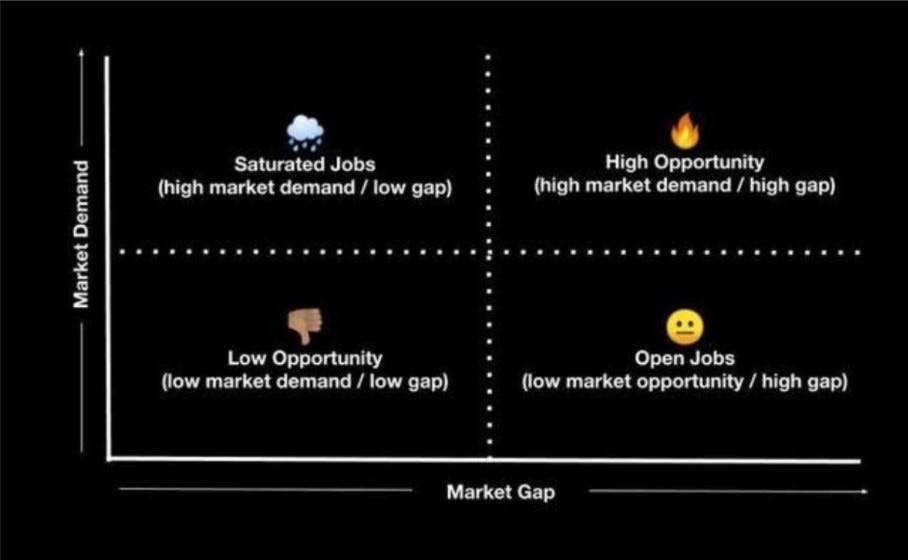

➡️ Every new innovation/invention starts ugly. 👉 Build Products That Solve Real Problems With This Lightweight JTBD Framework (Review FirstRound) Just because something is proven to be healthy or lead to good outcomes doesn’t ensure people will be motivated to try it out. The idea is that innovators win by resolving a consumer’s struggle and satisfying their unmet aspiration. "People don't simply buy products or services, they 'hire' them to make progress in specific circumstances." A jobs to be done statement concisely describes the way a particular product or service fits into a person's life to help them achieve a particular task, goal, or outcome that was previously unachievable. Jobs describe the underlying human needs, not the features of the product. Jobs illuminate consumer insights on underlying motivations and struggles, not business objectives.

Example of Discord: Core audience: initially PC gamers Motivations: communicate synchronously while playing a game, find others and organize enough people to get a game going Barriers: split attention while playing a game makes it hard to use chat only, connecting with others who share your gaming interests and skill level What else are they hiring/firing: other social media, messaging apps

Discord JTBD: When I want to jump into my favorite game, but I don’t know if there are people around to play, help me safely coordinate with a group of like-minded gamers, so I can easily find a way to enjoy my favorite multiplayer game. This suggests features like making it easy to find people through public or private servers and switching easily from text to voice chat as you organize and jump into a game.

🗞In the news📱Technology👉 DALL-E, the Metaverse, and Zero Marginal Content (Stratechery) ➡️ The results are really impressive. 👉 What the press could learn from Discord (Platformer) 👉 The Future of Crowdfunding Creative Projects (Kickstarter) As a first step, we’re supporting the development of an open source protocol that will essentially create a decentralized version of Kickstarter’s core functionality. This will live on a public blockchain, and be available for collaborators, independent contributors, and even Kickstarter competitors, from all over the world to build upon, connect to, or use.

➡️ Should we open up Alan even more? 👉 German Tech Unicorn Personio Creates $66 Million Charity Fund (Forbes) Munich-based HR startup Personio has joined a growing number of startups like Twilio, Atlassian and Canva that have pledged to donate 1% of the company’s equity to charity. Unusually the Personio’s 1% equity commitment is non-dilutive and any new investors who join later rounds will also need to contribute. “So all our new investors have to live with slightly lower returns on their investments given that part of their returns will flow into the foundations and everyone has to sign on to that,” says Renner. “Initially this caused some confusion with many investors seeing this clause for the first time, especially their lawyers, because it reduces their economic upside but it was nice to see over time they saw why it was an important part of our culture.”

➡️ Interesting. Would you be interested in Alan giving 1% of our equity to our most active members? Do you think it would be a good idea to explore? 🏥 Healthcare👉 Weekly Health Tech Reads 4/10 (Health Tech Nerds) Oura, makers of the consumer wearable Oura ring, raised a "meaningful amount of capital" at a $2.55 billion valuation. Link Viz.ai, an AI imaging platform, raised $100 million at a $1.2 billion valuation. Link German startup Avi Medical raised 50 million euros as it seeks to build 10 new primary care clinics in Germany. Although note the funding will be to build out the tech platform, as Avi uses debt to finance clinic build-outs. Avi is free to patients, as its covered by the German healthcare system, and it now has over 20,000 patients. Link

👉 Two More Startups Cease Operations As VC Investors Step Back (Bloomberg) Ahead, which sold medication for treating ADHD onine, is shutting down, the company announced on its website. Founded in 2019, the San Francisco-based startup had raised $9 million in funding from telehealth company Truepill, according to financial data firm PitchBook. News of Ahead’s shut down was first reported by Bloomberg. The company is the second behavioral health startup to fold this week. New York-based Halcyon Health, which offered virtual addiction treatment, shut down after struggling to raise additional capital, Axios reported on Friday. Halcyon had previously raised $2.5 million in seed funding from Notation Capital, Version One Ventures and others. More than a dozen other startups have shut down so far this year, according to technology data provider CB Insights, as venture capitalists become less generous with their capital amid rising inflation rates, an ongoing war in Ukraine and a rout in tech stocks.

➡️ There might be some M&A opportunities in the coming months. 👉 Télémédecine: le Cnom s’inquiète d’un “mésusage” et cible les plateformes (tic santé) Renouvelle son appel aux pouvoirs publics à réglementer le secteur, en visant au premier chef les plateformes commerciales, et fait état de remontées des conseils départementaux sur l'implantation de "télécabines". L'avenant n°9 à la convention médicale de 2016, qu'il conteste devant le Conseil d'Etat, s'agissant de la suppression du principe de connaissance préalable du patient. L'ordre s'inquiète d'une prise en charge du patient "exclusivement en télémédecine", et s'oppose à une pratique exclusive de la télémédecine par le médecin, susceptible d'entraîner une perte d'expérience en le plaçant en situation d'insuffisance professionnelle. Le Cnom observe que "si le médecin téléconsultant n'exerce pas en présentiel dans le même territoire que le patient, la méconnaissance de la réalité du terrain par le médecin posera difficulté". Il juge inacceptable qu'un médecin prenne en charge un patient "sans possibilité de procéder à un examen clinique chaque fois que cela est souhaitable, sans aucun ancrage territorial ni aucune connaissance du tissu sanitaire et médico-social, sans se préoccuper de son parcours de soins [et] sans apporter une garantie que la continuité des soins pourra être assurée".

➡️ It would be great to spend time thinking about what would be the new “parcours de soin” in the world of technology and digital medicine, and unlock even more the power of geographic distribution. Il renouvelle ensuite ses critiques à l'égard des plateformes commerciales "se présentant en 'offreurs de soins' en dehors de toute organisation territoriale reconnue et de tout parcours de soins", en violation des stipulations conventionnelles. Il rappelle la fermeture d'un site internet promettant la délivrance d'arrêts maladie, ainsi que celle d'une plateforme de téléconsultations à laquelle il s'était adossé, dans un jugement rendu en novembre 2020 et actuellement frappé d'appel. Il rappelle qu'en amont de la téléconsultation, le patient et le médecin doivent être respectivement informés en parallèle "par l'interface fournie par le prestataire/plateforme commerciale" de l'identité et de la localisation de son interlocuteur. Le téléconsultant doit par ailleurs "s'assurer de la traçabilité de l'acte" et transmettre un compte rendu au médecin traitant. Le Cnom avertit contre le caractère illégal, retenu en première instance dans un jugement rendu fin 2020 contre une mutuelle, d'une campagne nationale de promotion de ces plateformes, qui "procurent aux médecins exerçant par l'intermédiaire de leurs sites" un avantage interdit aux autres médecins qui respectent le cadre de la télémédecine.

👉 Pursuit of value-based care brings potential significant pay-off, setup attractive for 2022; Initiate Managed Care (Goldman Sachs) Position the MCOs well to begin to bend the medical cost curve and capitalize on new profit streams. We see OSCR as most at risk given new competition in its key markets, its 2022 premium growth in its largest market FL is expected to be below cost trend, and its limited progress with per-member profitability per state insurance filings. UNH (Buy, $535 12-month price target): We are bullish on the near and long term opportunity for already-dominant UNH as the company drives earnings power through OptumCare. OSCR (Sell, $6.50 12-month price target): OSCR faces risk to its multi-year path to profitability given its exposure to the competitive IFP end-market and limited progress with profitability. The company has been successful in growing its IFP member base, and while plan members are usually less profitable in Year 1 and that improves over time, the company has not demonstrated improvement in per-member profitability in states like CA, TX, and NY. We would become more positive on the stock if the company demonstrated the ability to profitably scale or saw more traction with health plan partnerships as indication of the monetization of its technology platform investments. A look at 2021: COVID spikes drove higher cost trend than initially expected. In 2020, OSCR operated the cheapest EPO network plan in Florida, with its premiums priced 9% below the average for this plan type. While it took a low-single digit rate increase in 2021, it has applied for a rate decrease in 2022 and is poised to be the second lowest cost plan out of all the insurers. OSCR’s attractive pricing resulted in meaningful membership gains, and we estimate Florida now represents over 40% of OSCR’s HIX membership in 2021. OSCR priced aggressively in Florida, which resulted in membership gains but a significant net loss per member. It appears that OSCR is maintaining its low-price positioning for 2022. It is not clear that profitability of the business will improve significantly despite the increased scale of its member base. The company has been successful in growing its IFP member base, more than doubling membership in two years. We think this growth has benefited from attractive plan pricing below market averages. As a result, we see risk to OSCR achieving its goal of profitability for the insurance business by 2023. Three large states (FL, CA, TX) account for ~75% of OSCR’s membership, and OSCR will face additional competition in those markets in 2022. Despite being in the CA market for several years, OSCR appears to operate at a net loss per member, and this loss has been increasing. New York, OSCR’s first state, an example of what may be to come: New York is OSCR’s 4th largest state and one of its founding markets. OSCR has experienced declining enrollment in NY as it pulled back on its efforts in the state. While net loss per member has improved since 2016-2017, it has come at the expense of membership, and the improvement stalled a bit in 2019-2020. Despite over five years in the state, the company’s NY subsidiary is still not profitable. Faster than expected member growth, improvements in MLR/medical cost management, and growth in member profitability could represent upside to our estimates and importantly build confidence in the longer term model. 12-month price target: We apply an EV/NTM Sales multiple of 0.25x, given OSCR’s lack of profitability through our forecast period, an increasingly competitive end-market, and high rate of cash burn. Our 12-month price target of $6.50 is based 100% on EV/Sales of 0.25x on NTM estimates 12 months out. Tech platform opportunity a unique upside area though still early days: OSCR sees an opportunity to license its technology platform to various players healthcare system (i.e. other health plans) that may lack the capital and/or sophistication to build out certain insurance functions with high degrees of user experience, integration, or automation. A key customer win was HealthFirst, which will go live on 1/1/22 and could deliver $50mn of incremental revenue in 2022. Increased traction with the +Oscar offering could drive upside to revenue.

➡️ A bit of an old analysis of Oscar that shows how they are perceived. It is interesting to see the multiple of 0.25x EV/NTM Sales because of no path to profitability (we have a clear one), competition (we are in a better position) and their high rate of cash burn (we are significantly better). Still, I sincerely believe and hope they will prove everyone wrong :)

It’s already over! Please share JC’s Newsletter with your friends, and subscribe👇 Let’s talk about this together on LinkedIn or on Twitter. Have a good week! If you liked this post from 💡JC's Newsletter, why not share it? | |