The Daily StockTips Newsletter 04.26.2022

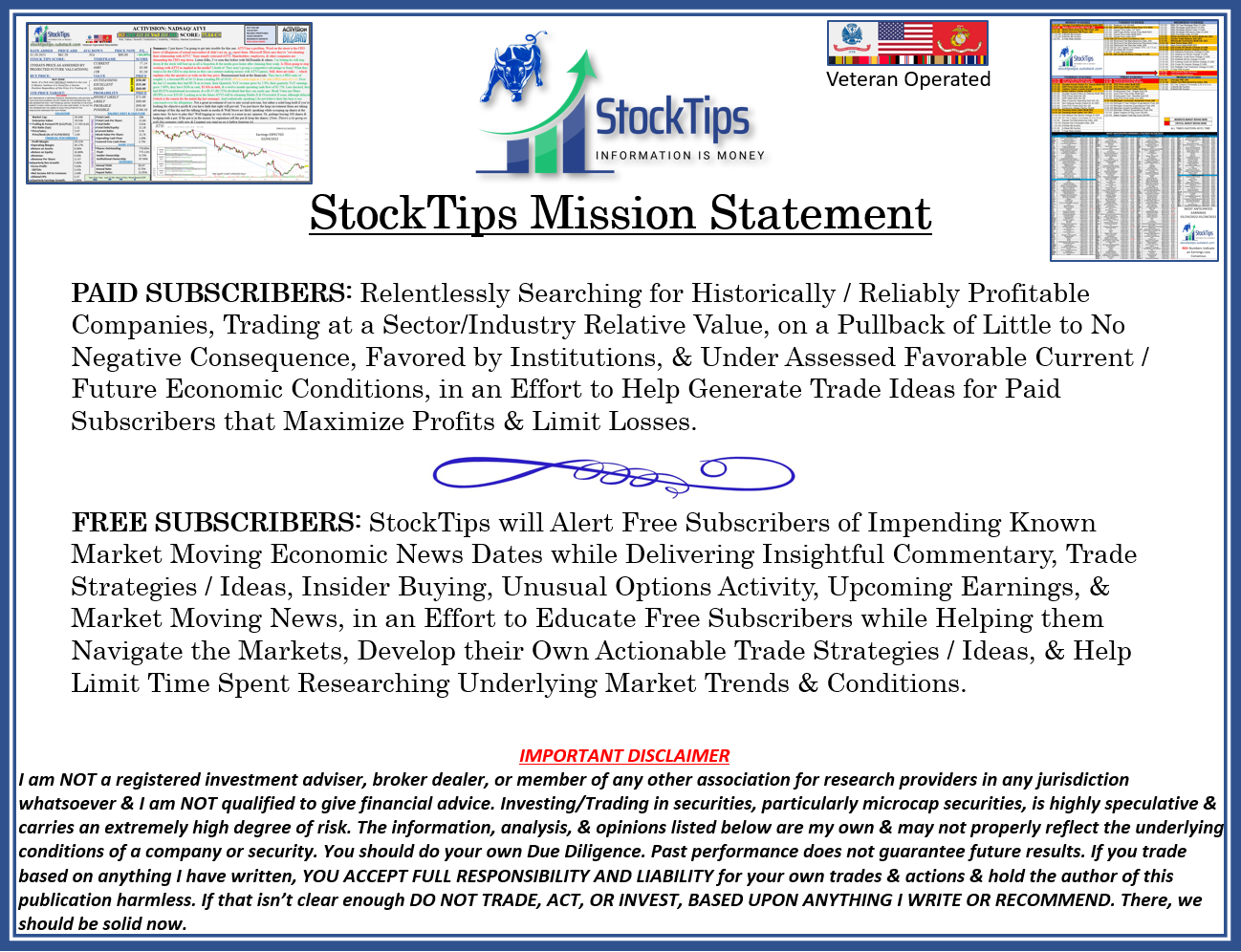

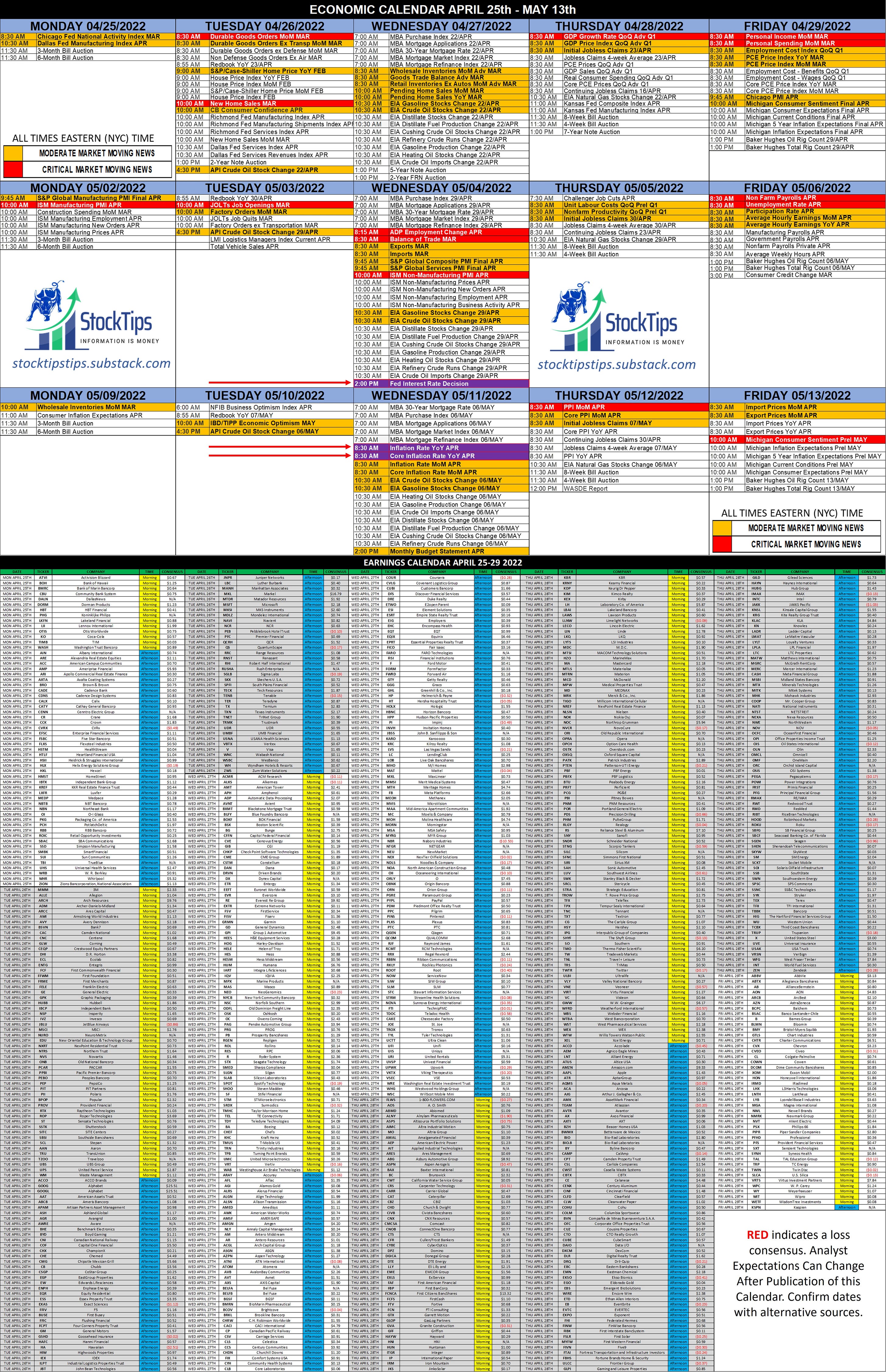

The Daily StockTips Newsletter 04.26.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)CLICK HERE TO SEE THE STOCKTIPS RECORD WE’RE ON YOUTUBE NOW! See HERE, HERE, & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings (Note: Red on the Earnings Calendar Indicates an Earnings Loss [Not Miss] Consensus), & Yesterdays Insider Buys. NEVER BE SURPRISED BY EASILY ANTICIPATED MARKET BREAKING NEWS. That’s our goal here. MOST RECENT INSIDER BUYING TODAYS COMMENTARY Get a Cup of Coffee & Enjoy Catching Up! If you aren’t reading this daily you are missing out on a wealth of information that could prevent unforced & unnecessary trading errors. BUY LIST UPDATE: So glad I’ve been holding off on adding to the BUY LIST. It is truly paying off right now. In this kind of market, he who loses least gains the most. Remember that investing & trading is 20% knowing what to buy, & 80% knowing when to buy. People say you can’t time the market, but I’ll be damned if it isn’t a noble pursuit. Indeed, if folks should be discouraged from entering at the right time on the right stock under the right economic circumstances, then big money wouldn’t have such large cash positions. I would seriously encourage you to watch some of the interviews of fund managers in the financial world right now. When asked what stocks they like or what they’re buying its always the same two replies. They either want to see what earnings have in store (Meaning they have no clue what to buy) or they’re investing in staples in the Dow with large cash positions on the side. Save, of course, the aggressive managers who have lost their ass over the last 3-4 months. I haven’t heard from Cathie Wood in a bit. Have you? Imagine making as much money as she managing a massive failure of a fund right now. Must be the life! In any case, there have been fewer positions added to the buy list as of late simply because 1) It’s the wrong time. 2) There isn’t much to be bullish about. However, I will be paying close attention to the banks. Remember that recent earnings aren’t really pricing in the Fed Rate hikes yet. This is because rate hikes didn’t happen until late last quarter. So they aren’t fully reflected in company earnings. BIG FIRMS ARE HOLDING LARGE AMOUNTS OF CASH: Large money managers & retirement firms are holding large cash positions right now. What does this mean? The pumps you saw last year are less prevalent this year. They wait for dumps, & buy more, wait for deeper dumps, & buy more, & so on. The thing is they are so diversified it truly doesn’t matter, & diversified in a way the common small account retail trader can’t. It’s their game folks, … got to play by their rules. Be careful! Indeed yesterdays wild trading session is indicative of a market waiting for deeper dip only to buy it … likely in the hopes that buzz can be generated this earnings season which will lift all markets. If that doesn’t happen they will likely take a breath, & wait for a deeper dip. They just aren’t buying like they used to … at least not equities. TODAY’s Earnings: UPS, GE, Microsoft, Alphabet (Google), Visa, Pepsi, 3M, Raytheon, JetBlue, Waste Management, DR Horton, Archer Daniels Midland, Range Resources, Texas Instruments, Enphase Energy, & QuantumScape, are all reporting today. Pay attention to Texas Instruments if you want a good feel of how semiconductors are still holding up. Indeed we have 4 semiconductor, passive semiconductor, or semiconductor related services on our BUY LIST. And no … they certainly have NOT pumped yet … nor are they overvalued by any stretch of the imagination or reasonable standard. 3 of them are reporting earnings VERY early next month. NEXT BIG ECONOMIC NEWS: Durable Goods Orders & New Home Sales will be reported today at 0800 & 1000 ET respectively. I spoke to these numbers in yesterdays newsletter. FED INTEREST RATE DECISION NEXT WEEK: Wednesday next week at 2:00 PM ET we will know how much the Fed will be raising interest rates. Expect half a percent. If they had any sense it would be more. YESTERDAYS EARNING RESULTS ATVI BOH BMRC CCBG CZWI DORM EBF ESQ FRBA FSFG LKFN LII NWBI OTIS BSRR SMBC KO WASH AIN ARE ACC AMP AXTA BRO CADE CDNS CALX CR CCK CVRX EFSC FLXS HSTM HTLF HSII HLX HXL IBTX KREF LXFR MEDP NBN OI PKG PCH RBB ROIC SBAC SSD SUI TBI UHS WRB WHR ZION Paid Subscribers can review all earnings results so far this season HERE. Significant News Heading into 04.26.2022:

PAID CONTENT IN THE PAYWALL BELOW:

👉CLICK HERE TO SEE THE DETAILS OF EVERY STOCK ON THE BUY LIST (AND SEE THE PRICE ASSESSMENT BASED WATCHLIST / THE STOCKS UNDER $20 LIST & THE HIGHLY SPECULATIVE LIST) LOGIN INSTRUCTIONS: You will need to login to see the detailed list. The “email login link” will send the link to login directly to your inbox (Click the link & it will automatically log you in). You can also choose the “login with password” option. You will need to set up a substack password for this option.Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 04.25.2022

Monday, April 25, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

POWW Why I'm so Bullish on Ammo Inc: A Forward Looking DD 23 April 2022

Saturday, April 23, 2022

A Possible 3x Bagger in the Making (Free to All StockTips Subscribers)

The Daily StockTips Newsletter 04.22.2022

Friday, April 22, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 04.21.2022

Thursday, April 21, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 04.20.2022 5x Stocks Removed From the Buy List Today!

Wednesday, April 20, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏