The Daily StockTips Newsletter 04.22.2022

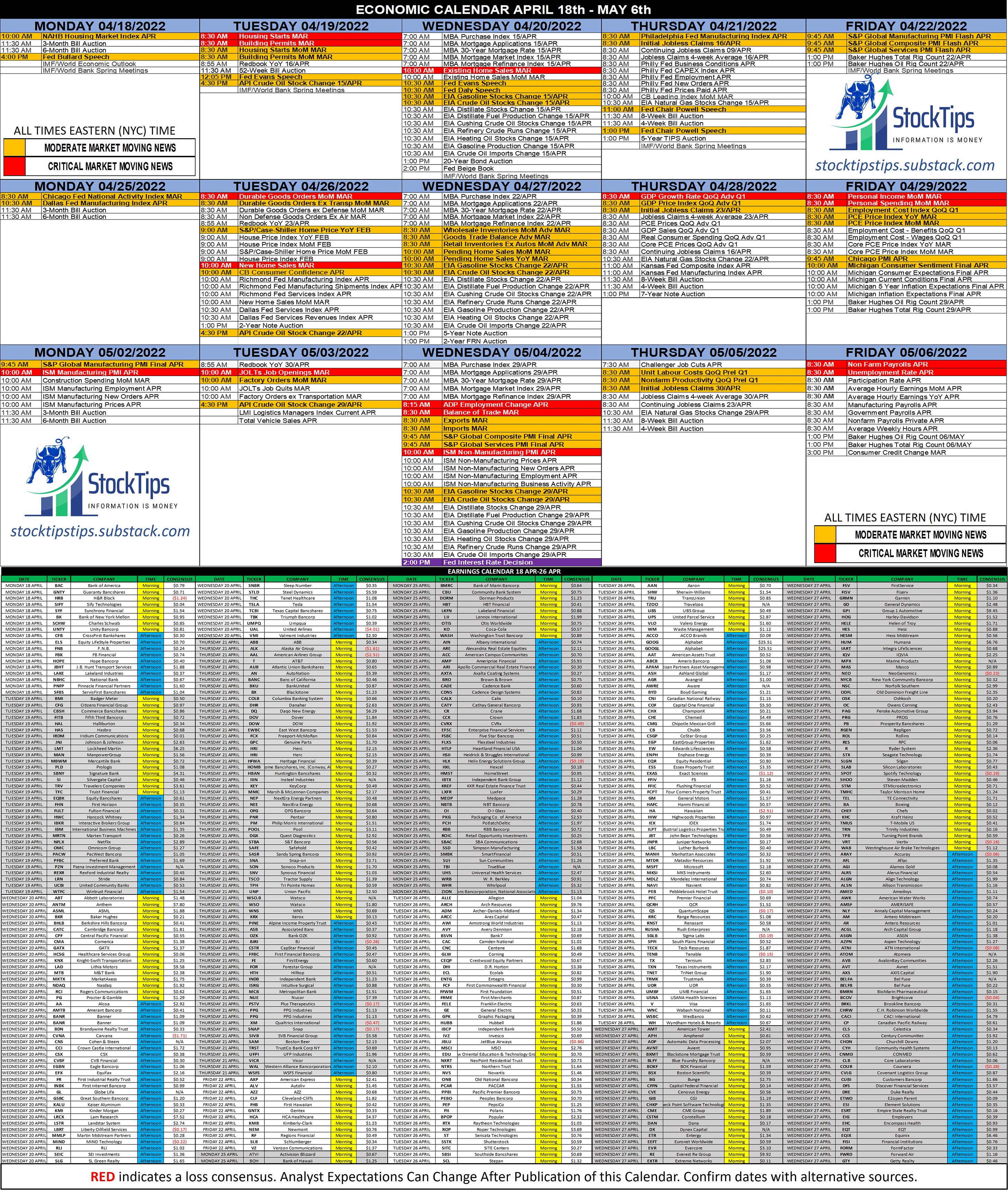

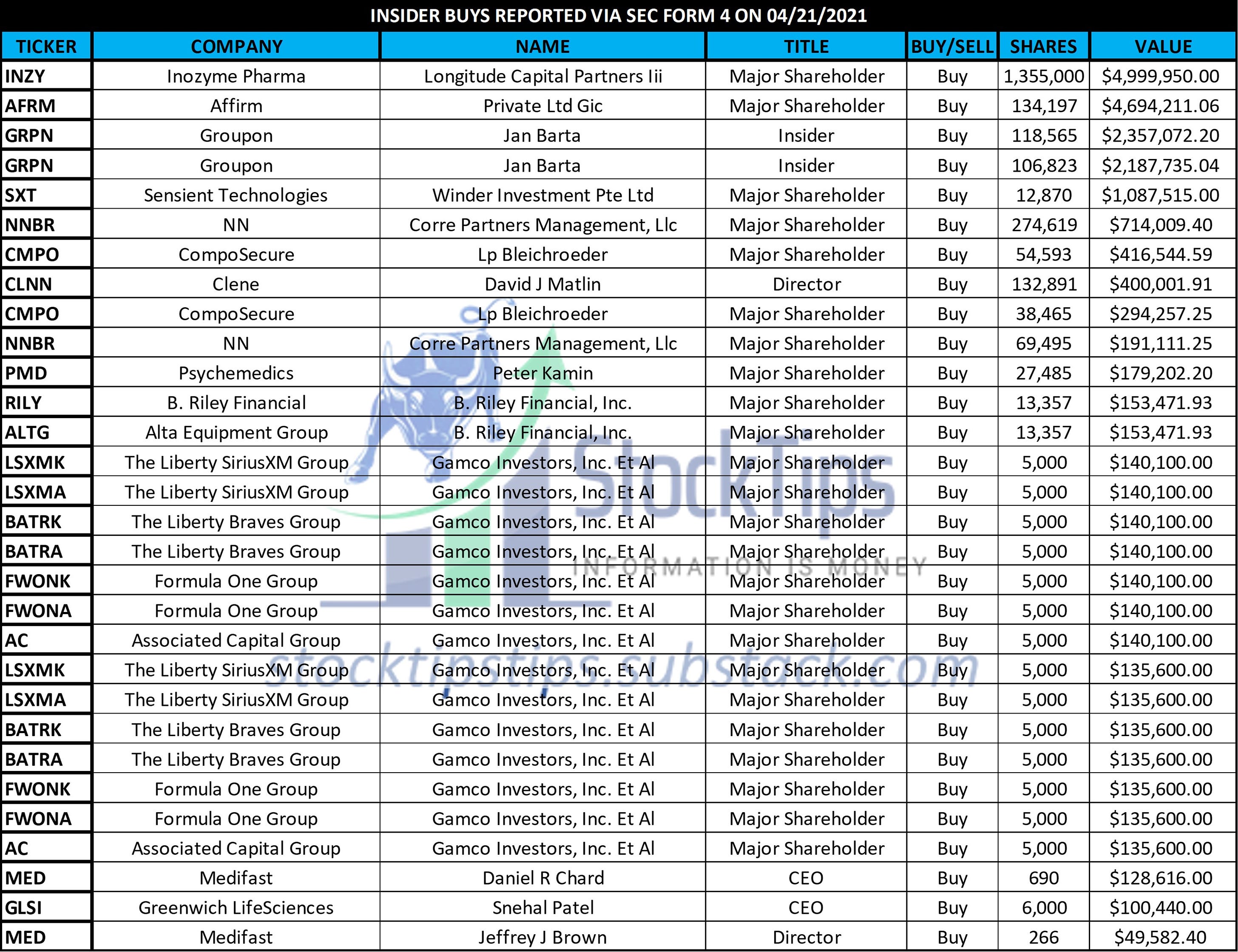

The Daily StockTips Newsletter 04.22.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)CLICK HERE TO SEE THE STOCKTIPS RECORD WE’RE ON YOUTUBE NOW! See HERE, HERE, & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings (Note: Red Indicates an Earnings Loss [Not Miss] Consensus), & Yesterdays Insider Buys.YESTERDAYS INSIDER BUYING TODAYS COMMENTARY Get a Cup of Coffee & Enjoy Catching Up! If you aren’t reading this daily you are missing out on a wealth of information that could prevent unforced & unnecessary trading errors. BUY LIST UPDATE: One Option Strategy Added Yesterday ADMINISTRATIVE NOTE: Yesterdays newsletter had a serious market moving catalyst … namely the Fed Chairs’ then upcoming speech. Unfortunately substack glitched & sent all writers an email noting that scheduled posts failed to send. They eventually resolved the issue but if this happens to you, remember you can visit StockTips online HERE. I hate it when this happens given how hard I work to provide you with what you need to know prior to the trading day. TRADING TODAY: The next big data release on the economic calendar (above) will be durable goods orders next Tuesday. This report covers new orders for US manufactured durable goods (That’s goods that are expected to last for 3 years or longer). In short, these are not your one time use goods like food, gas, chemicals, toiletries, etc … but rather furniture, household appliances, machinery, etc. They are generally more expensive than your temporary goods & can often be a “one time,” or “once in a while,” purchase. When inflation bites you can generally see it first in the durable goods market. People tend to forgo large expensive purchases when everyday items increase … effectively depleting their spending power. Last month durable goods came in at -2.2% month over month (MoM). Consensus at the time was -0.5%, a 1.5% spread to the negative below analyst expectations. In the next report analyst expect a 1% increase MoM. A higher or lower than expected swing in new durable goods orders has the tendency to move markets. Finally New Home Sales for March will be reported this Tuesday 10:00 ET. Analyst consensus is 776,000, slightly up from 772,000 the month prior. If we do in fact have a housing shortage, & I think we do, we should expect to see new home sales increase at a somewhat steady rate & existing home sales decrease. However, this market is hard to assess due to the fact that the average 30 year fixed interest rates are rapidly increasing (over 5% now). We should therefore expect some cooling in the housing market as rates go higher. Indeed increasing rates should be a disincentive to both building homes & apartments … which should make the housing situation worse. How so? People need a place to live. If folks aren’t taking out mortgages on new or existing homes, then they’re either renting, or living with someone else. And with such a high demand for housing leading to skyrocketing housing prices, rent’s ALSO increase. But what happens when the demand for rent increases as a result of no one wanting to take out a 5% interest rate on a 30 year fixed for a new or existing home? The answer is simple, … more expensive rent. And with home prices increasing, rents increasing, & interest rates increasing, people will pay more for their mortgage/rent which in turn leaves them less they can spend in the retail space. Housing inflation can often therefore be one of the largest destroyers of retail spending. DO YOU UNDERSTAND THE IMPLICATIONS OF WHAT YOU JUST READ!!??: Folks always complain that they don’t know what’s going on in the markets or what to expect. Well, I’m giving it to you! Understand the value of the information! Example: I warned folks for two full days that Powell was speaking yesterday & yet still folks were surprised when the markets tanked. It’s on the economic calendar folks! I commented on it for two days prior. This newsletter is money people! The information provided will help you! YESTERDAYS EARNING RESULTS XRX WNS WSO WSBF VRRM UNP TPH TSCO SNV SON SNA SASR SAFE STBA RBCAA DGX POOL PM PNR OFG NEE NEP MGP MMC KEY IIIN HBAN HFWA HRI HTLD GPC FVCB FCX EWBC DOW DOV DQ DHR COLB CBAN CHCO CHMG BX BCBP BCML BKU BANC AN AUB T AMNB AAL ALK ABB SRCE WSFS WSFS WAL WABC VICR UFPI TRST SAM SIVB SNAP XM PPG PSTV NUE MCB ISRG INDB HTH GBCI FE FFBC BJRI OZK ASB PINE Significant News Heading into 04.22.2022:

PAID CONTENT IN THE PAYWALL BELOW:

👉CLICK HERE TO SEE THE DETAILS OF EVERY STOCK ON THE BUY LIST (AND SEE THE PRICE ASSESSMENT BASED WATCHLIST / THE STOCKS UNDER $20 LIST & THE HIGHLY SPECULATIVE LIST) LOGIN INSTRUCTIONS: You will need to login to see the detailed list. The “email login link” will send the link to login directly to your inbox (Click the link & it will automatically log you in). You can also choose the “login with password” option. You will need to set up a substack password for this option.Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 04.21.2022

Thursday, April 21, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 04.20.2022 5x Stocks Removed From the Buy List Today!

Wednesday, April 20, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

EARNINGS TRACKER Q2 2022

Wednesday, April 20, 2022

TRACKING & AGGRIGATING EARNINGS TO IDENTIFY BULLISH SECTORS & TRENDS

The Daily StockTips Newsletter 04.19.2022

Tuesday, April 19, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 04.18.2022

Monday, April 18, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏