The Daily StockTips Newsletter 04.27.2022

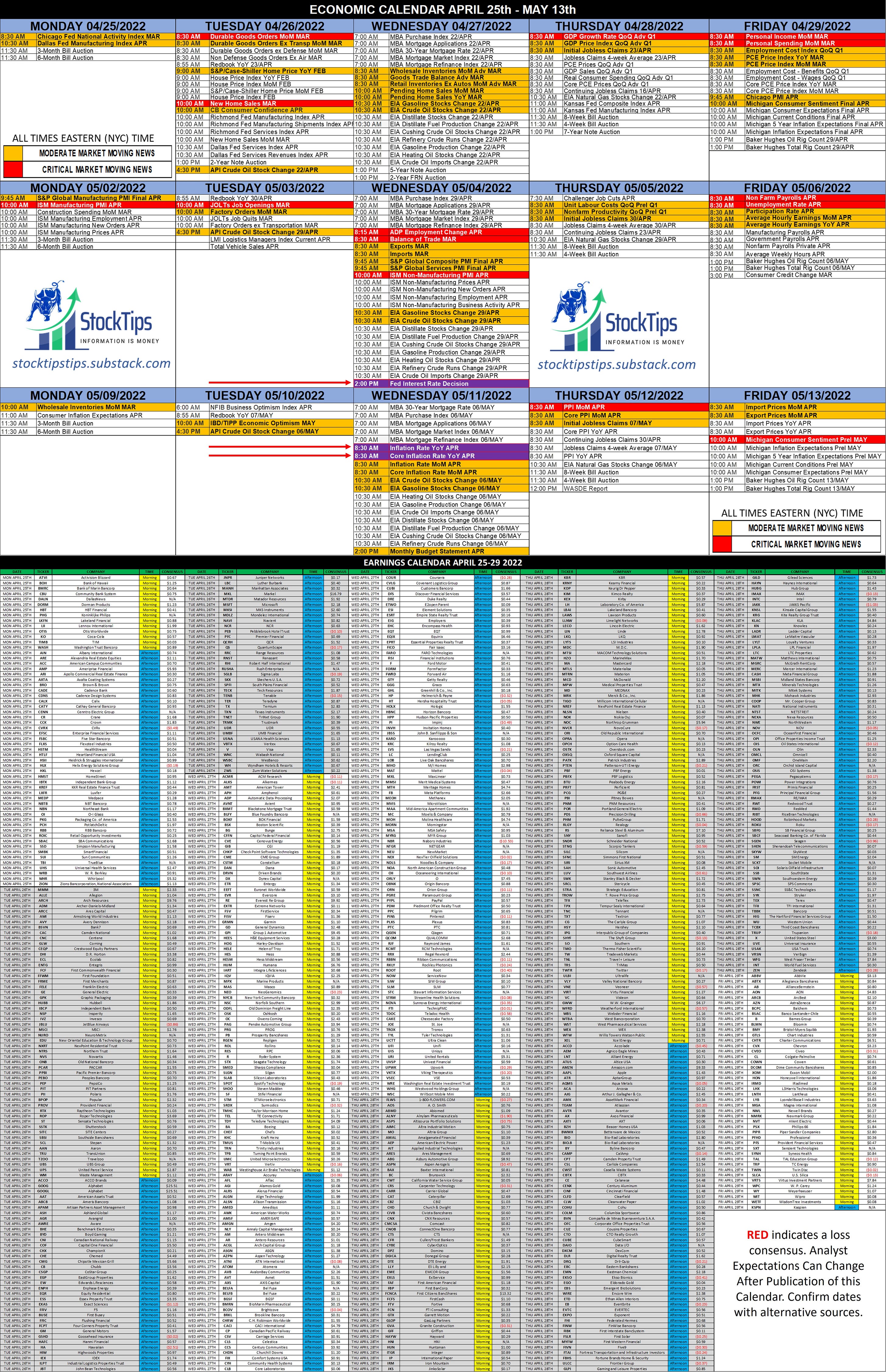

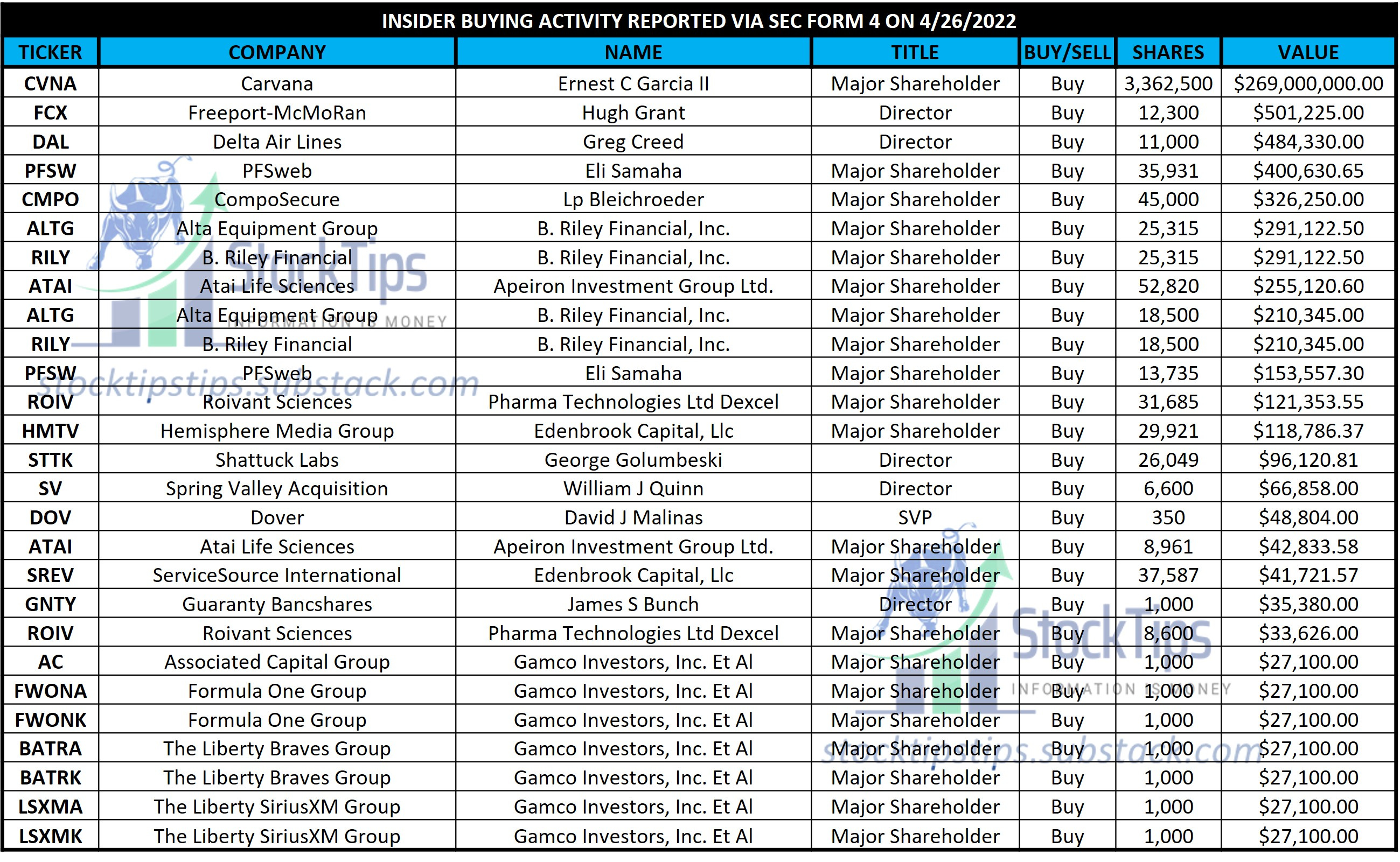

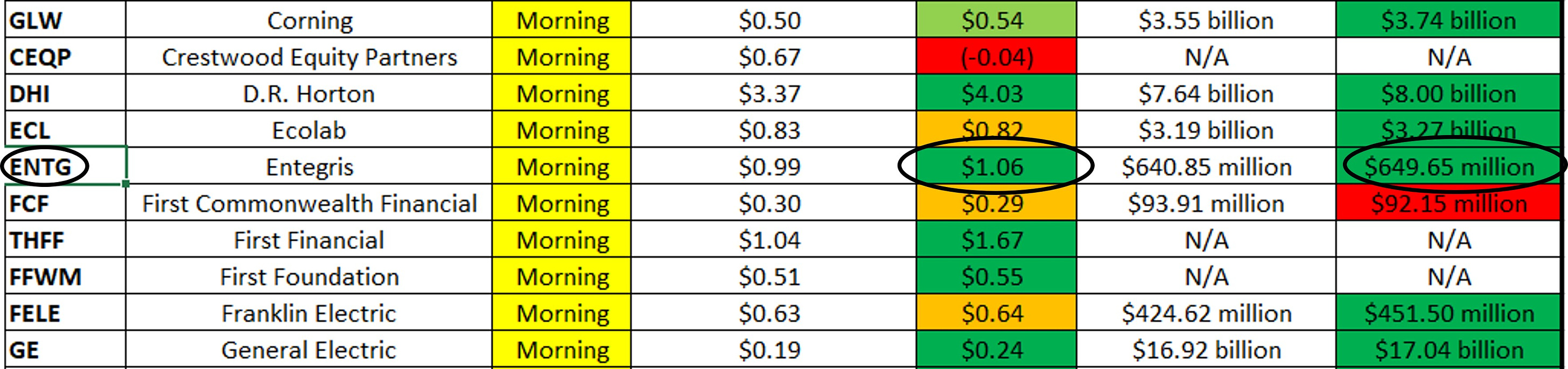

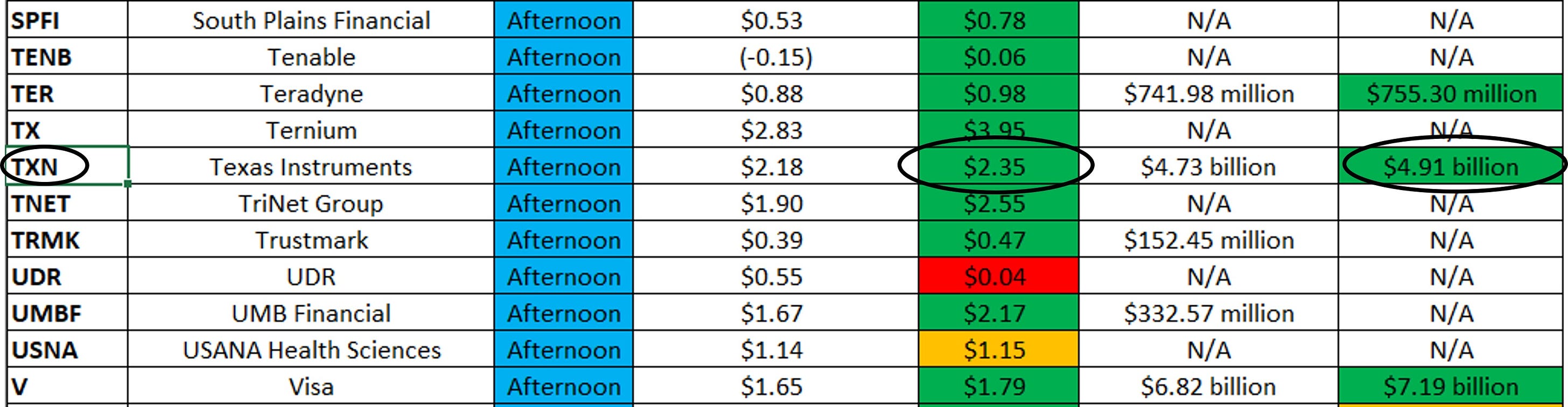

The Daily StockTips Newsletter 04.27.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)IMPORTANT DISCLAIMER: I am NOT a registered investment adviser, broker dealer, or member of any other association for research providers in any jurisdiction whatsoever & I am NOT qualified to give financial advice. Investing/Trading in securities, particularly microcap securities, is highly speculative & carries an extremely high degree of risk. The information, analysis, & opinions listed above are my own & may not properly reflect the underlying conditions of a company or security. You should do your own Due Diligence. Past performance does not guarantee future results. If you trade based on anything I have written YOU ACCEPT FULL RESPONSIBILITY AND LIABILITY for your own trades & actions & hold the author of this publication harmless. If that isn’t clear enough DO NOT TRADE, ACT, OR INVEST, BASED UPON ANYTHING I WRITE OR RECOMMEND. There, we should be solid now.CLICK HERE TO SEE THE STOCKTIPS RECORD WE’RE ON YOUTUBE NOW! See HERE, HERE, & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings (Note: Red on the Earnings Calendar Indicates an Earnings Loss [Not Miss] Consensus), & Yesterdays Insider Buys. NEVER BE SURPRISED BY EASILY ANTICIPATED MARKET BREAKING NEWS. That’s our goal here. MOST RECENT INSIDER BUYING TODAYS COMMENTARY Get a Cup of Coffee & Enjoy Catching Up! If you aren’t reading this daily you are missing out on a wealth of information that could prevent unforced & unnecessary trading errors. BUY LIST UPDATE: I have 4x Semiconductor or semiconductor related stocks on the BUY LIST, an industry that has some heavy exposure to China, which is why so many have dumped as of late. Two semiconductor names reported yesterday (ETGN & TXN). They weren’t on the buy list but both beat. Smooth sailing for the buy list correct? Not so fast! Texas Instruments had great earnings but guided lower than expected (within range of consensus but the range erred more lower than higher. “TI's second quarter outlook is for revenue in the range of $4.20 billion to $4.80 billion ($4.73B consensus) and earnings per share between $1.84 and $2.26($2.19 consensus). This outlook comprehends an impact due to reduced demand from COVID-19 restrictions in China. We continue to expect our 2022 annual operating tax rate to be about 14%.”Nevertheless my semiconductor & semiconductor related picks were already trading at a value on a pullback prior to the date they were added, & are therefore a great value right now. Given the locations of a few of them, the Shanghai lockdowns may actually improve their outlook. TODAY’s EARNINGS: Boeing, Meta, Spotify, PayPal, Ford, T-Mobile, Qualcomm, Oshkosh, Pintrist, Humana, Harley Davidson, Las Vegas Sands, Hertz, ADP, Teladoc Health, Teck, Cenovus Energy, & O’Reilly Auto Parts, are the most anticipated earnings for today. Of note, O’Reilly Auto Parts was one of two stocks that ended green yesterday. Indeed vehicle prices are so high people opt to maintain the ones they have. It seems folks didn’t want to sell O’Reilly prior to earnings.NEXT BIG ECONOMIC DATA: US GDP Growth Rate will be reported 0830 ET this Thursday (quarter over quarter). Consensus estimate is 1.1% & the previous growth rate a quarter ago came in at 6.9%. On Friday we get March Personal Income & Personal Spending month over month. Consensus income is 0.4% & consensus spending is 0.7%. A higher than normal increase in spending can result in a market rally whereas a lower than expected number can run things afoul. Late January, for example, the US experienced a higher than expected number which resulting in a partial market rally only to be stamped out later by inflation data. Personal income can have a like effect. Nevertheless, an increase in personal income & personal spending above expectations may seem great in the short run, but it often means higher than expected inflation in the long run. The more people make & spend the more money you have chasing at limited goods. YESTERDAY’S DURABLE GOODS ORDERS & NEW HOME SALES: February orders were revised from -2% to -1.7%. The consensus for March was +1% but came in at +0.8%. Commercial plane orders dove -10% while vehicles increased +5%. Core orders (An indicator of business investment) increased 10%. March New Home Sales were in line with expectations coming in at 763,000 with 765,000 expected. This is down from 835,000 in February. Home prices were up 19.4%-20% YoY for February depending on the data source. The Case Shiller Home Price Index is at an all time high. FED INTEREST RATE DECISION NEXT WEEK: Wednesday next week at 2:00 PM ET we will know how much the Fed will be raising interest rates. Expect half a percent. If they had any sense it would be more. YESTERDAYS EARNING RESULTS MMM ALLE ARCH ADM ARCC AWI AROW AVY BSVN BFST CNC GLW CEQP DHI ECL ENTG FCF THFF FFWM FELE GE GPK HBCP HUBB NSP IVZ JBLU LCNB MSCI NTRS NVS NVR ONB PCAR PPBI PFIS PEP PJT PII BPOP PROV RTX ROP ST SSTK SITC SBSI SCL SHW TRU TZOO UBSI UPS VLO WBD WM WNEB ACCO GOOGL ABCB APAM ASH AGR AWRE BHE BYD CNI COF CHE CMG CB CSGP EGP EW ENPH EQR ESS EXAS FFIV BUSE FCPT GSHD HAFC HA HIW IEX JBT JNPR LBC MANH MSFT MKSI MDLZ NAVI NCR PEB PFC QCRH QS RRC RNST RHI SKX SPFI TENB TER TX TXN TNET TRMK UDR UMBF USNA V WSBC WH ZWS Paid Subscribers can review all earnings results so far this season HERE.Significant News Heading into 04.27.2022:

Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 04.26.2022

Tuesday, April 26, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 04.25.2022

Monday, April 25, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

POWW Why I'm so Bullish on Ammo Inc: A Forward Looking DD 23 April 2022

Saturday, April 23, 2022

A Possible 3x Bagger in the Making (Free to All StockTips Subscribers)

The Daily StockTips Newsletter 04.22.2022

Friday, April 22, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 04.21.2022

Thursday, April 21, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏