Surf Report - Surf Report: Cultural Rot

You’re getting this email because you signed up for Surf Report, my weekly take on economics, investing, Bitcoin, and business. I really appreciate you being here, but if you’d like to leave, simply scroll to the bottom to unsubscribe.

Hi everyone—I’m so glad to have you here. What a week. I care deeply about the humanities—the subjects and studies centered around human society and culture. Things like history, anthropology, languages, philosophy, religion, literature, art, and rhetoric. This is a big part of why I keep studying, thinking about, and writing about the subjects of finance and money. They aren’t normally considered to be part of the humanities, but they are so intrinsically bound up in shaping the contours and qualities of a culture that I think they should be.

Morgen Rochard is a Certified Financial Planner and Chartered Financial Analyst who previously managed portfolios at UBS Financial Services for high net worth investors, and spent time at Merrill Lynch providing financial analysis for a large private wealth team. She now runs an “independent, fee-only practice dedicated to helping young families and professionals align their finances with their life goals” and also wrote a really great guide to personal finance that I recommend. I’ve been a fan of her thinking and approach for awhile now, but her recent conversation on the Investors Network Podcast delved into some of the cultural consequences of central bank irresponsibility and the moral hazard of printing money out of thin air, along with the long-lasting ripple effects it creates in a society. What begins as something propagandized as a necessary intervention quickly devolves into ongoing expectation and dependency.  First Squawk @FirstSquawk U.S. TREASURY'S YELLEN SAYS U.S. UNEMPLOYMENT INSURANCE SYSTEM NEEDS TO BE MODERNIZED-BROOKINGS INSTITUTION SPEECH || SAYS RECENT RECESSIONS HAVE REINFORCED THE NEED FOR MORE EFFECTIVE AUTOMATIC STABILIZERS, REACHING OTHER FORMS OF SOCIAL SUPPORTOur Treasury Secretary herself says “large negative shocks” are now inevitable and that it’s imperative to exit economic downturns “as quickly as possible.” Translation: expect more massive interventions. (I’m not just guessing. She told us her plan in 2016.) Part of the reason she’s saying large shocks are inevitable is because the US economy “unexpectedly” (😂) declined at 1.4% annual pace in the first 3 months of this year. The NASDAQ, the tech-heavy stock index that ballooned in 2020 while the laptop class worked from home, was down -4% on Friday, -13% on the month, and -21% YTD, making it the worst start of the year on record. >45% of its stocks are down 50%, >22% are down 75%, and >5% are down 90%. Not only that, the Japanese yen is in absolute freefall and that is a very bad thing. Why would Japan’s money matter so much for the US economy?:

Let’s see how close our government is to being there. Here’s a headline from this past week: Biden Eyes Student-Loan Forgiveness Starting at $10,000.

It’s so blatantly irresponsible that it’s almost hard to believe, but elections are this year so no price is too high even if you and your kids and your grandkids have to pay the bill. All this as food supply problems continue to expand in a seemingly deliberate and coordinated fashion. The country’s largest egg supplier brutally killed 5 million chickens as a fearful precaution (they culled their workers too, firing almost everyone), and 22,000,000 birds have been killed on farms across 28 other states. Timing is strange considering all the other food processing plants being destroyed for mysterious non-avian-flu-related reasons. I don’t know why this is happening, but I know it’s happening and that it provides a good excuse to print more money.

Bitcoin has held up quite well considering, and just this week Fidelity—the largest 401(k) provider—has also become the first major retirement plan provider to add bitcoin as an option for 401(k) plans. I recommend watching this 9-minute clip of Microstrategy CEO Michael Saylor speaking with CNBC about his decision to be the first company to offer this plan to its employees, as well as provide perspective on other bitcoin-related market dynamics. In a hilarious reaction from the Nobody-Asked-You section, the US Labor Department said they "have grave concerns with what Fidelity has done." I guess this government agency would rather you lose 70% of your money in 4 months in Netflix instead. The establishment with a monopoly on violence and coercion, who has the luxury of printing their own money, does not understand, like, or recommend anyone use the money that cannot be printed. Shocker. And the dystopian cherry on top of this chaotic week was learning that the very government that has been caught repeatedly lying to you has decided to go full 1984 and create its own Ministry of Truth, to make sure you in your stupidity don’t go thinking The Wrong Thing™. We now have a department of propaganda. Lovely.  The US government + Federal Reserve have become the saggy, sneering incumbent who, by repeatedly corrupting and distorting the money for decades, created a culture of non-savers (personal savings rate fell to 6.2% in March, lowest since 2013) and have developed a taste for seeing it as their duty to intervene in every aspect of your life and unwittingly make it worse. It’s important to remember this: that those with the keys to the money printer don’t trust you to make your own decisions or live your own life, and they certainly don’t like you. You are a nuisance, a drain on their resources. It’s like being in an abusive relationship and told you’re being beaten “for your own good.” We’re printing all this money! Why aren’t you grateful for this debasement?? I’m doing this because I care about you! But those who don’t have the keys to their own money printer and can make their own choices are increasingly choosing bitcoin.

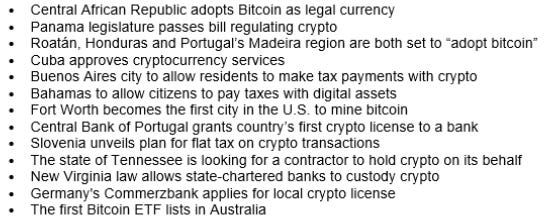

There appears to be a pattern developing in this world of foreign currency dependence and fiat expropriation through chronic inflationary debasement. Cries of “What if they ban it?” have become the awkward silence of “…What if they don’t?” 🤔 The culture is changing, and hands are being forced. There is no alternative.

When things feel hopeless and you feel like you’ll never get out of a hole you’ve been dug into, you’ll just give up. That’s the culture that’s spawning right now. This is why money is important. Not because it buys you things, but because it’s the tool you use to communicate value. To exchange with others and signal what is important to you as an individual. To express what matters to you. Break the money, break the culture. Fix the money, fix the world. Until next time 🤙, Recommended Resources For Plan ₿Swan. I became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 in bitcoin for free ✨ Fold Card. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨ Thanks for subscribing to Surf Report. If you liked this post, consider sharing it with someone else who might appreciate it! |

Older messages

Surf Report: Fury road

Sunday, April 24, 2022

Listen now | Issue 73: 04.24.2022

Surf Report: Dogs and tails

Sunday, April 17, 2022

Listen now (12 min) | Issue 72: 04.17.2022

Surf Report: Wakey wakey

Sunday, April 10, 2022

Listen now | Issue 71: 04.10.2022

Surf Report: You don't own me

Sunday, April 3, 2022

Listen now | Issue 70: 04.03.2022

Surf Report: Time to unwind

Sunday, March 27, 2022

Listen now | Issue 69: 03.27.22

You Might Also Like

🌎 Make international sourcing and shipping easier

Tuesday, March 4, 2025

How to prep your business for changing trade regulations. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 How was the masterclass with Arvid Kahl?

Tuesday, March 4, 2025

Your feedback matters + Access the recording ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Letter from the Editor: Why this year's Digiday Publishing Summit matters

Tuesday, March 4, 2025

It's a new era for the media industry. Eras, actually: There's the AI era, the streaming era, the podcast era, the post-cookie era. In other words, media companies are being forced to evolve,

11 social media skills to master (and how AI can help)

Tuesday, March 4, 2025

Perfect these skills now to stay ahead in 2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 The masterclass with Arvid Kahl starts in 15 minutes

Tuesday, March 4, 2025

Build In Public Without Giving Away Your Business Secrets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Age of Economic Chaos

Tuesday, March 4, 2025

Listen now (7 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The next level of content marketing

Tuesday, March 4, 2025

Content marketing isn't just about creating blog posts. If you're still stuck in that mindset, you're leaving money on the table. The best marketers go beyond traditional content and

📱 Google Gemini’s iPhone Hack

Tuesday, March 4, 2025

AI More human-like than ever. Ready to upgrade? ⚡

ET: March 4th 2025

Tuesday, March 4, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 BlueChew (trends) Chart BlueChew is a

🦅 Masterclass with Arvid Kahl: watch the live stream

Tuesday, March 4, 2025

At 10:00 AM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏