The Signal - Fat cats fund Musk's raid

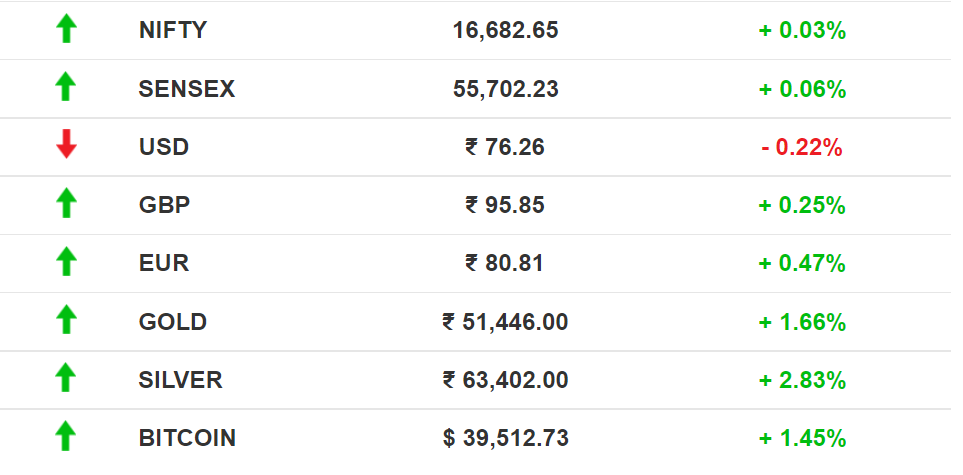

Fat cats fund Musk's raidAlso in today’s edition: Thrasio steps back; HSBC may be broken up; China’s crisis turns the heat on India; Eyeballs desert IPLGood morning! Remember Microsoft mascot Clippy? Y’know, the animated paperclip helper who’d assist you with Office tools? PC Gamer found that he’s now a gun buddy in the Microsoft-owned franchise, Halo Infinite Season 2. Once reviled to the point of being booted out from Office XP and Office 2007, Clippy is riding a nostalgia wave that fuelled his return to Microsoft 365 as an emoji. Reddit is even lobbying for him to become an AI assistant. The Market Signal*Stocks: The shock of Wednesday’s surprise RBI rate cut wore off quickly and domestic equities recovered in Thursday’s trade. Economists predict that the RBI may have to do more. LIC’s $2.7 billion IPO, meanwhile, was fully subscribed on the second day. In the US, Nasdaq fell 5%, the steepest descent since 2020 in what is being described as “capitulation trade”, the Financial Times reported. Early Asia: The US sell-off weighed on Nikkei 225 and Hang Seng indices, both of which sagged in morning trade. The SGX Nifty was down 1.83% at 7:45 am India time. E-COMMERCEThrasio Rolls Down On IndiaThrasio is reviewing its India strategy months after it acquired D2C consumer durables brand Lifelong and said it’d invest $500 million in the country. The development comes on the heels of the rollup commerce firm replacing its CEO and laying off employees. Thrasio will now focus on its core US market and launch its American brands in India. Dealbreaker: It’s not just Thrasio; online sellers that’d be acquired at eye-popping valuations are getting more conservative offers. Global corrections in startup valuations and funding are largely responsible. Speaking of: 2022’s tough love towards tech companies is resulting in hiring freezes and salary corrections. Meta is pausing hiring across the board. Netflix is reining in hitherto-uncapped pay packages. DoorDash and Google Cloud are also prioritising cost-cutting over headcounts. BANKINGWhere Will The HSBC Lions Go?The bronze lions—the roaring Steven on the left and the stiff-lipped Stitt on the right—that guard HSBC bank entrances are iconic symbols of the bank’s origins and history. Named after two British managers of the bank at Shanghai in the 1920s, they hark back to a time when the Hong Kong and Shanghai Bank was created to serve the colonial interests of Britain in the wake of the opium wars of the 19th century. The lion is an English badge too. Split wide open: Modern geopolitics and clashing interests of China and the west are now threatening to divide the institution into two. Its largest shareholder, Chinese insurer Ping An, wants to hive off the Asia business. HSBC has drawn flak from both Chinese authorities and British regulators often for obliging one over the other’s wishes. Past perfect: HSBC is a British institution that grew up in the ‘Orient’ and controls the flow of dollars through Hong Kong. But its Chi flowed through the lions. Rubbing the lions’ noses and paws was considered lucky. As China’s and the UK’s interests diverge, where will the lions stay, we wonder. ECONOMYIndia’s Summer WoesA scorching heat wave set April records for high temperatures and is set to sweep through May too. Demand for ACs and refrigerators is rising with the heat but Covid-19 curbs in China and production disruption in India due to long power cuts are impacting home appliances supply. What is happening? Chinese employees of the Shanghai port are unable to go to work because the city is smothered in a Covid security blanket. There is a beeline of unmoving cargo ships outside the port. That means components meant for Indian assembly lines will not be shipped for a while. Nearly 70% of compressors used in cooling devices come from China. No power: To add to the woes, factories in India are shutting down due to long power cuts. That’s mainly because production of coal, fuel for more than 70% of electricity generation, has failed to keep pace with requirements.

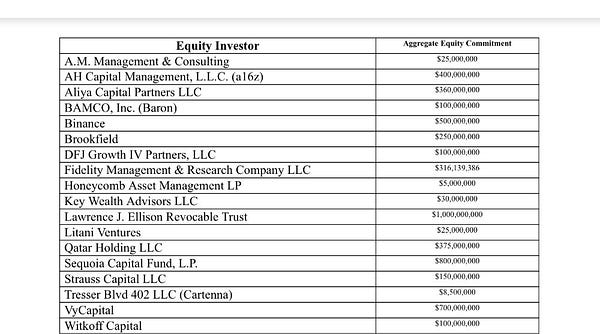

SOCIAL MEDIAMusk’s All-Weather Friends Plonk Billions For TwitterNearly two dozen investors have infused $7.1 billion to back Elon Musk's Twitter acquisition. The biggest investment of $1 billion is from Oracle co-founder and Tesla board member Larry Ellison. Cryptocurrency exchange Binance, VC firms Sequoia and a16z, and Qatar are among the benefactors. Surprise: Saudi prince Al Waleed bin Talal Al Saud, a Twitter shareholder who’d snubbed Musk, did a U-turn and praised the mercurial billionaire after pledging 35 million shares to retain his stake. Jacked out: We wonder what Jack Dorsey, who’s gung ho about Musk acquiring Twitter, makes of the development. The Twitter co-founder has sparred with a16z’s Marc Andreessen and is critical of VCs. Interestingly, Musk himself sly-tweeted against Web3, which a16z has major stakes in. But: Musk’s “free speech” push is making advertisers anxious about Twitter potentially turning toxic and shooing brands away. Elsewhere: Tesla’s India team has started servicing the larger APAC market amidst an import duty impasse with the Indian government.   SPORTSIPL’s No Longer The King Of Good TimesUntil a few years ago, Bollywood movies postponed their release date to make way for the grand IPL season. Much to their relief, the IPL craze is petering out. On the wane: Blame it on fatigue. Viewers have witnessed four IPL tournaments in the last 18 months. Fans are disappointed by the dismal performances by Mumbai Indians and Chennai Super Kings, the two most popular teams. The numbers tell the story. About eight million folks made up the heavy viewers segment. This year, it's dwindled to 2.7 million. The rest? They've moved on. That could also be one reason why IPL is no longer a threat to other entertainment options. Comeback story: Last week, Uday Shankar and James Murdoch-backed investment company Lupa Systems banded together to become a major shareholder in Viacom18 to foray into sports (read: IPL media rights, which is pegged to be around ₹36,000 crore). FYIBig split: Mahindra Group is breaking up its auto business into three companies: EVs, tractors and passenger vehicles. Branching off: State-owned lender Central Bank of India is shutting 13% of its branches and selling non-core assets to salvage its finances. IPO-bound: Logistics startup Delhivery has announced a price band of ₹462-₹487 per share for its IPO slated for May 11. Hot off the press: Gautam Adani is reportedly scouting for acquisitions in Indian media, just a week after Adani Enterprises incorporated a subsidiary called AMG Media Networks. Adani is already a minority investor in Quintillion Business Media. Mediator: Singapore-based e-commerce platform Zilingo has hired Deloitte to investigate the harassment charges by suspended CEO Ankiti Bose. Job cuts: Edtech platform Vedantu has laid off 200 employees, seven months after raising millions of dollars in fresh capital. Grim: About 14.9 million people around the world died due to Covid-19 between January 1, 2020 and December 31, 2021, fresh WHO estimates show. FWIWGuess who's back: The White House Correspondents Dinner last week got famous for Trevor Noah's monologue. Now, it may find infamy for being a superspreader event. A host of journalists and secretary of state Antony J. Blinken have tested positive for Covid-19. Coincidentally, Noah called the event “the nation’s most distinguished superspreader event”. Talk about an unfortunate jinx. Flip the pages: Bolivia has a novel way to get inmates to reduce their jail time. Detainees can get an early release—hours or days—depending on the number of books they've read. As of now, 865 inmates have signed up for the exercise. Thou shall not steal: A pastor has sued rapper Kanye West for 70 seconds of his audio sermon on his track Come to Life without permission. West has previously settled lawsuits with a Hungarian singer over a "sample theft". Want to advertise with us? We’d love to hear from you. Write to us here for feedback on The Signal. If you liked this post from The Signal, why not share it? |

Older messages

Data aborts privacy

Thursday, May 5, 2022

Also in today's edition: RBI springs a surprise; Musk may take Twitter public; Jeera could get dearer; Media biz eye TV

SRK takes guard on US pitch

Wednesday, May 4, 2022

Also in today's edition: Coke to jack up prices; More regulation for crypto? Thrasio is scaling down; India's biggest IPO opens today

Beijing is bleeding

Monday, May 2, 2022

Also in today's edition: India scorches; MeitY goes after VPNs; Insiders dish on Musk-Twitter drama; US-EU write the Internet's future

Modi’s dilemma

Saturday, April 30, 2022

India is caught between the strategic needs of its friends in the West and ensuring economic security of its citizens

Indians are mooching on OTT services

Friday, April 29, 2022

Also in today's edition: Musk trolls Twitter; Meta puts metaverse on the backburner; Nandan Nilekani plans to take on Amazon; Boeing hits a snag

You Might Also Like

🎟️The Quest is calling you

Tuesday, November 26, 2024

And why the HubSpot Blog ages in reverse ... View in browser hey-Jul-17-2024-03-58-50-7396-PM Don't write off a scavenger hunt as mere kids' play. A well-designed hunt can move attendees closer

New Pricing & Black Friday Deal

Tuesday, November 26, 2024

Some updates to my lead program for design agencies ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The BFCM Playbook To Millions In Sales

Tuesday, November 26, 2024

Come learn how to crush black friday cyber monday for brands

🦅 The once-in-a-lifetime deal is here

Tuesday, November 26, 2024

The new 𝕏 API costs forced our hand ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin Drops to $93K as Long-Term Holders Take Profits

Tuesday, November 26, 2024

Plus Saylor Buys $5.4B More Bitcoin Setting New Record at $97860

🕵️ 50%, then 35%, then 20%, then nothing

Tuesday, November 26, 2024

Steal Club BF offer is live :)

Rox

Tuesday, November 26, 2024

How to Manufacture Path Dependence in Applied AI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Are You Doing Cross Promotions Wrong?

Tuesday, November 26, 2024

Want Growth? Stop Sleeping on Cross Promos 🔑

This new ad format can boost sales by 15%

Tuesday, November 26, 2024

It's Thanksgiving Week, and online shopping activity will peak in a few days. You may be noticing more shoppable ads this year–interactive ads that allow customers to buy directly from the ad

Why Is Bitcoin's Price Dropping Right Now?

Tuesday, November 26, 2024

Listen now (3 mins) | Today's Letter is Brought To You By Range! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏