DeFi Rate - This Week in DeFi - May 6

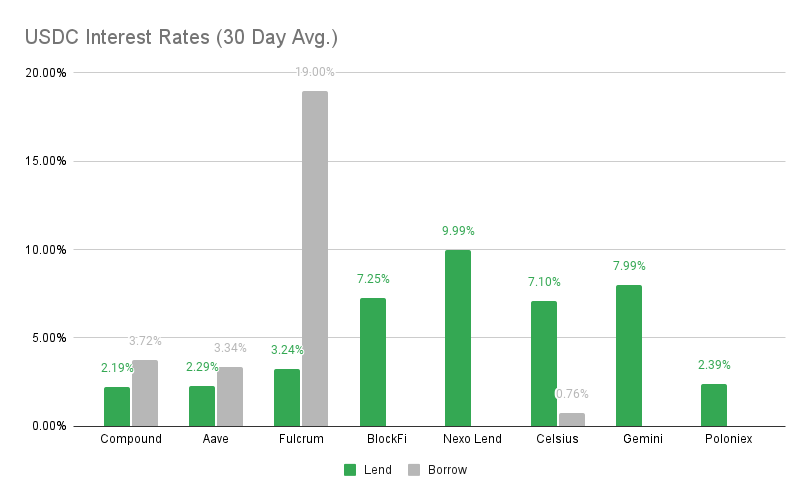

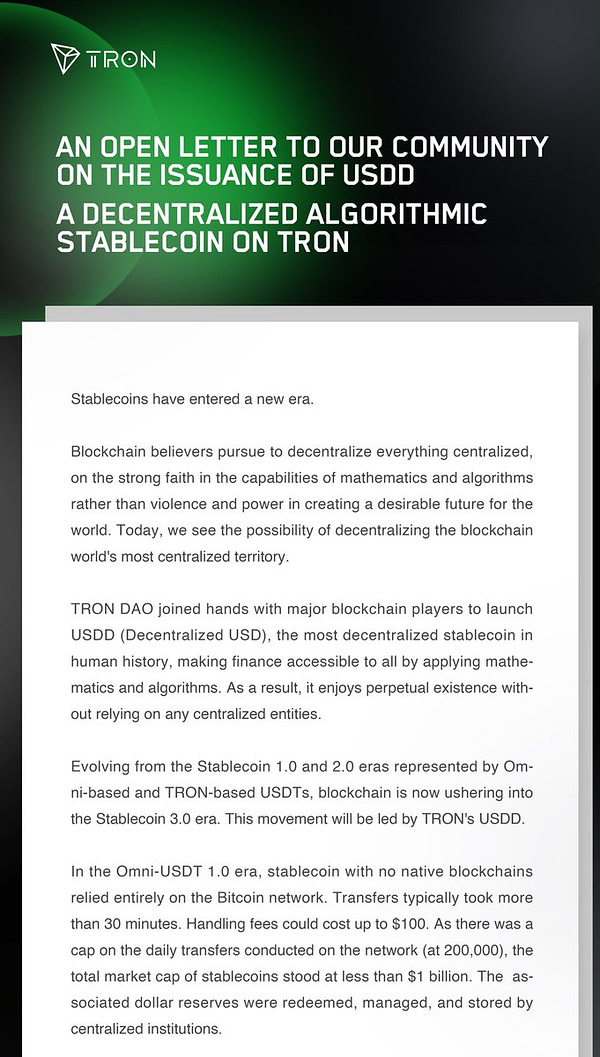

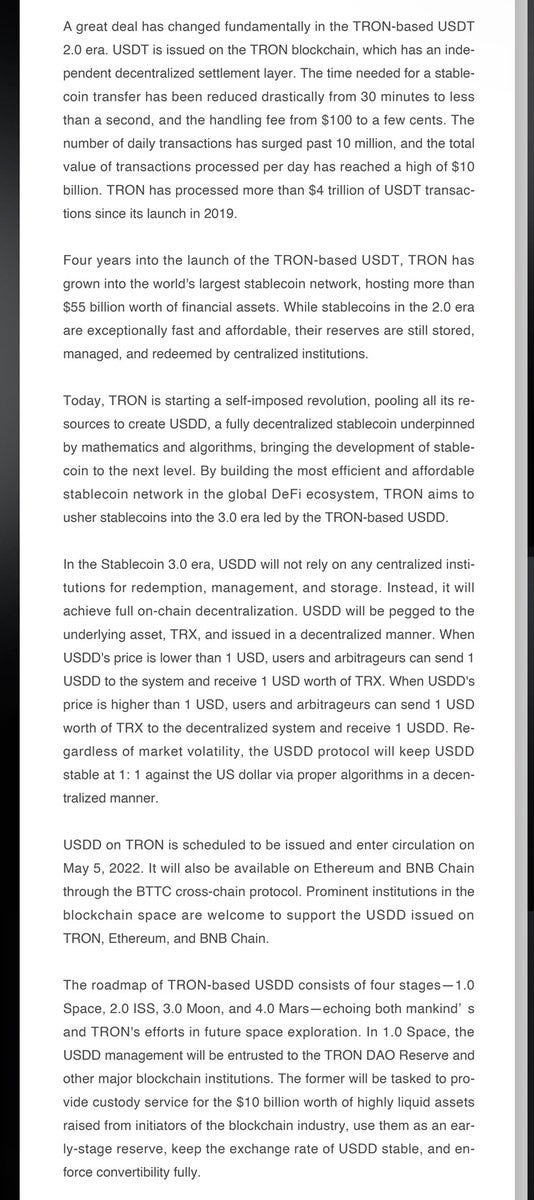

This Week in DeFi - May 6This week, Tron launches its USDD stablecoin with 30% interest, Opera integrates BNB Chain and a Virginia County pension fund looks to DeFi.To the DeFi community, This week Tron’s new algorithmic stablecoin USDD has gone live, with promises of a 30% annual yield. Following in the footsteps of the Terra USD’s Luna Foundation Guard, Tron DAO is seeking to accumulate $10 billion in reserves for the stablecoin to stabilize its price. If successful, USDD may suck some of the liquidity out of UST’s ecosystem as investors seek the highest stablecoin returns.     Opera has opened the doors to easier interaction with the BNB Chain ecosystem, as it enables direct access via its crypto browser. 350 million Opera users will be able to buy BNB tokens with fiat and receive it straight into the built-in wallet – then being able to immediately use DApps within the browser.   Virginia county may put itself on the map as the first to put pension funds into DeFi yield farming, as the Northern Virginia county of Fairfax seeks to get into the yield-farming space. The system aims to fund two new crypto-focused hedge fund managers over the next three weeks.  Polkadot has taken a major step in its multi-chain mission, as a new network upgrade locks in Parachain messaging – enabling DOT and Polkadot assets to be transferred between Parachains on the network. The network’s Parachain system is now officially fully interoperable, for the first time.  Polkadot @Polkadot After passing community vote, v0.9.19 has been enacted on Polkadot. This upgrade included a batch call upgrading Polkadot’s runtime to enable parachain-to-parachain messaging over XCM and upgrading #Statemint to include minting assets (like NFTs) and teleports. https://t.co/uqIB5di2Q1As mainstream enthusiasm about the crypto and DeFi markets tapers down with price action, technical progress still continues at a steady pace. Projects are fleshing out their platforms in relative silence, while crypto integrations into widely-used products and platforms also continue to occur. Adoption and buzz over niche applications such as the Ethereum Name Service (ENS) are also at all-time highs, showing that there is no shortage of sprightliness within the true believers of the DeFi space. Now will be the time where development is most important, with profound advancements no longer being drowned out by erratic price movements. For active traders, it may be a dull period. But for DeFi enthusiasts, this is when things may be the most exciting. Thanks to our partner: Nexo – Unlock the power of your crypto with up to 17% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, BlockFi at 8.50% APY Cheapest Loans: Celsius at 0.86%, Aave at 3.46% APY MakerDAO Updates DAI Savings Rate: 0.01% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Gemini at 7.99% APY Cheapest Loans: Celsius at 0.74%, Aave at 3.33% APY Top StoriesFed Raises Rates by 50 Basis PointsSEC Signals Crypto Crackdown with Beefed Up Enforcement ArmBinance joins funding for Elon Musk's takeover of TwitterValkyrie launches new trust holding AVAXStat BoxTotal Value Locked: $75.48B (down 0.09% since last week) DeFi Market Cap: $105.90B (down 9.87%) DEX Weekly Volume: $17B (up 30.77%) DAI Supply: 8.16B (down 4.78%) Bonus Reads[Jason Levin – The Defiant] – Solana Reckons With Seven-Hour Outage After Bot Swarm [Vishal Chawla – The Block] – Lido Finance overtakes Curve to become the biggest DeFi protocol by TVL [Timothy Craig – CryptoBriefing] – ENS Mania Continues as Three-Digit Domains Hit 15 ETH Floor If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week in DeFi - April 29

Friday, April 29, 2022

This week, Optimism announces its new governance system and $OP token distribution, Asymmetric announces a $1B crypto fund & 0x raises $70M.

This Week in DeFi - April 22

Friday, April 22, 2022

This week, Tron announces a stablecoin with 30% yield, Optimism may by launching a token, and Framework Ventures announces a $400M web3 fund.

This Week in DeFi - April 8

Friday, April 8, 2022

This week, UST and FRAX take on DAI on Curve, a new token standard is created on Ethereum and NEAR Protocol raises $350M.

This Week in DeFi - April 1

Friday, April 1, 2022

This week, the Fantom Foundation launches a $500M incentives program, 1inch releases a wallet for Android, and DeFi TVL recovers.

This Week in DeFi - March 18

Saturday, March 19, 2022

This week, Optimism raises $150m Series B, Sushiswap launches new AMM aggregator, Aave debuts V3, and Ethereum merges in Kiln

You Might Also Like

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask