DeFi Rate - This Week in DeFi - April 1

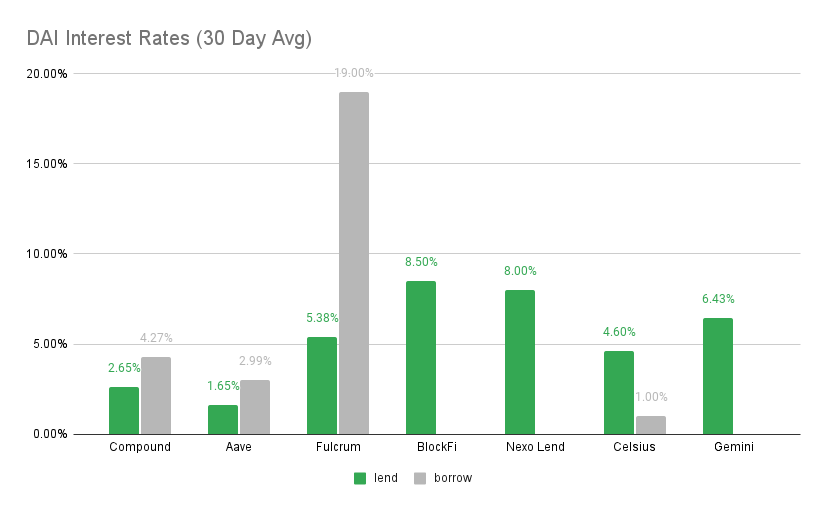

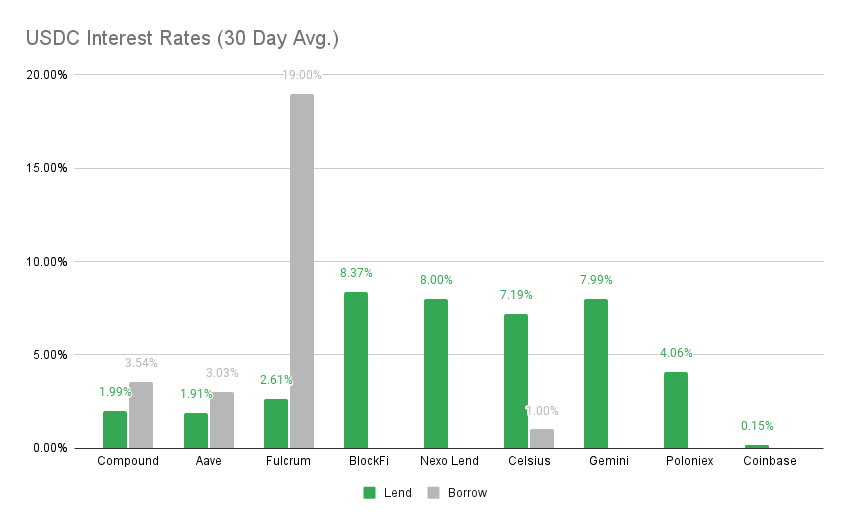

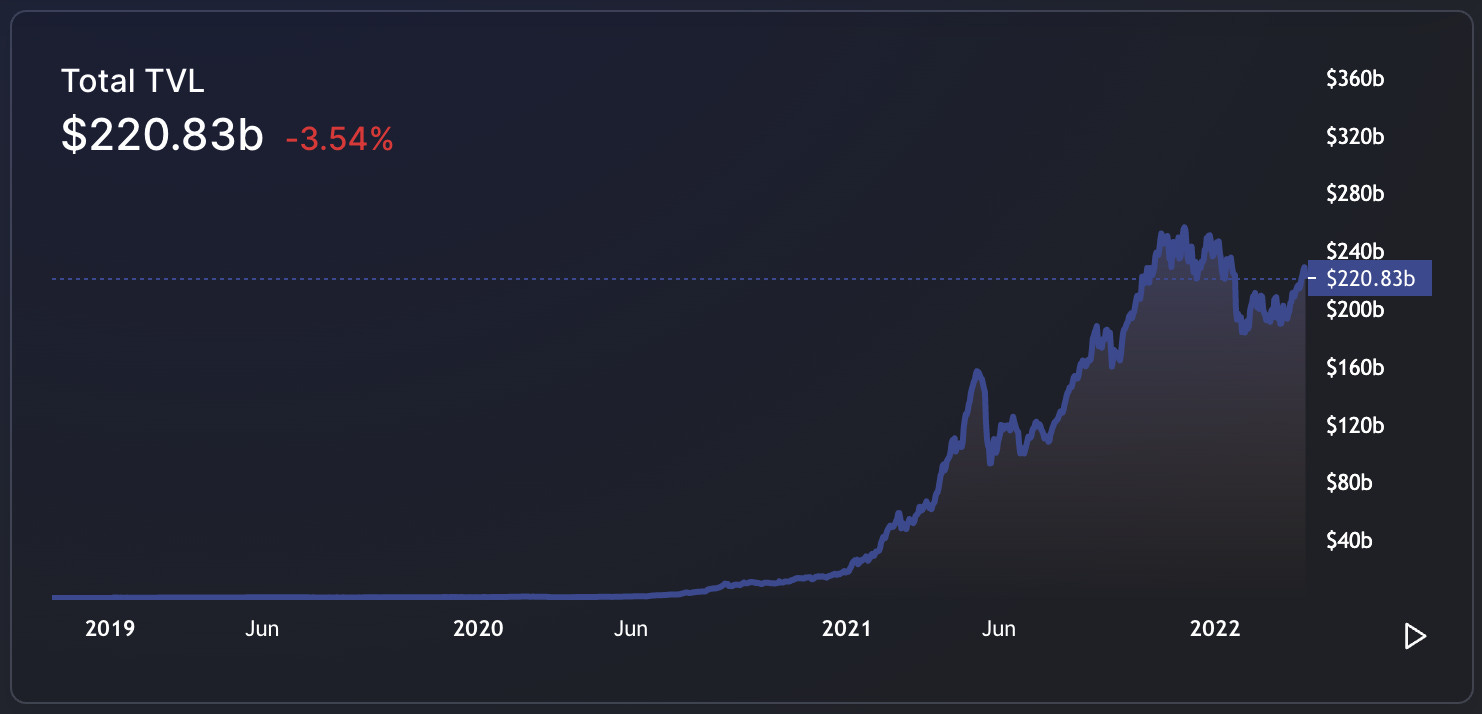

This Week in DeFi - April 1This week, the Fantom Foundation launches a $500M incentives program, 1inch releases a wallet for Android, and DeFi TVL recovers.To the DeFi community, This week the Fantom Foundation has announced a brand new incentive program, this time allocating 335 million FTM tokens – worth almost $550M – to boost development on the network. The foundation is working in partnership with Gitcoin, using the organization's Quadratic Funding system to match contributions for participating projects.   Cross-chain protocol LayerZero has raised $135 million in Series A funding from Sequoia Capital, a16z, FTX Ventures and others, at a $1 billion valuation. The protocol recently launched Stargate, a cross-chain bridge which attracted more than $2 billion in liquidity.  FTX: Ramnik @ramnikarora 1/ Today, we're thrilled to announce our co-lead of @LayerZero_Labs's Series A+ with our friends at @sequoia and @a16z . https://t.co/FaE5u60sY3Yet another fund has entered the space, as gumi Cryptos Capital (gCC) has raised $110 million to invest in early-stage blockchain start-ups, targeting DeFi, gaming, DAOs and more. Each investment is planned to be between $500,000 and $5 million, accepting both equity and tokens.   A MakerDAO improvement proposal is looking to onboard traditional loans by Huntingdon Valley Bank as collateral for use within the protocol. If accepted, it would be the first time that a traditional lender has been able to borrow against its assets via DeFi.   DeFi total value locked (TVL) is sitting back at the highest levels seen since late January, as the crypto market slightly bounced back from its recent slump. Decentralized finance and the traditional financial world are experiencing more crossover than ever, as the lines continue to blur significantly between the two areas. Protocols are beginning to consider more purposeful integrations of traditional financial instruments and real-world items, for both collateral and value-exchange. Venture capital continues to pour into the sector, while a growing number of DeFi basket funds now provide traditional investors with more exposure to DeFi assets. On the other hand, regulators continue to creep in with attempts to apply traditional financial rules to cryptocurrency wallets and users – a clash of values and principles indeed, this week headlined by a European Union move to de-anonymize self-custodied wallets. As traditional and decentralized finance continue to amalgamate, individual cryptocurrency ecosystems are also experiencing a merge of their own. Development and investment alike are beginning to pour more heavily into cross-chain compatibility, as previously garden-walled networks begin to more easily flow between each other. As scalability solutions proliferate and the system becomes more interconnected than ever, the applications and doors opened are more exciting than ever. Thanks to our partner: Nexo – Unlock the power of your crypto with up to 17% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: BlockFi at 8.50% APY, Nexo Lend at 8.00% APY Cheapest Loans: Aave at 2.99% APY, Compound at 4.27% APY MakerDAO Updates DAI Savings Rate: 0.00% Base Fee: 0.00% ETH Stability Fee: 2.00% USDC Stability Fee: 0.00% WBTC Stability Fee: 2.00% USDCHighest Yields: BlockFi at 8.37% APY, Nexo Lend at 8.00% APY Cheapest Loans: Aave at 3.03% APY, at Compound at 3.54% APY Top StoriesEuropean Parliament Moves Forward on Anti-Anonymity RulesDeFi sector TVL rises as investors return to a bullish crypto marketWeb3 ETF goes live on on Brazil’s B3 stock exchangeMicroStrategy Borrows Against Bitcoin to Buy More BitcoinStat BoxTotal Value Locked: $79.18B (up 2.37% since last week) DeFi Market Cap: $135.99B (up 13.56%) DEX Weekly Volume: $16B (up 13.98%) DAI Supply: 9.22B (down 2.33%) Bonus Reads[Camomile Shumba – CoinDesk] - 1inch Launches Wallet on Android [Tom Farren – Cointelegraph] - Chiliz launches public testnet for its new layer-1 blockchain [Timothy Craig – Crypto Briefing] - Acala Integrates Wormhole, Taking Polkadot Multi-Chain If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week in DeFi - March 18

Saturday, March 19, 2022

This week, Optimism raises $150m Series B, Sushiswap launches new AMM aggregator, Aave debuts V3, and Ethereum merges in Kiln

This Week in DeFi - March 11

Friday, March 11, 2022

This week, Kyberswap on Arbitrum, Avalanche announces $290m in incentives, Cega gets $3.4m for Solana derivatives, and Wirex adds Paraswap

This Week in DeFi - March 4

Friday, March 4, 2022

This week, Electric Capital raises $1b for Web3, 1inch intros P2P swaps, Nested raises $7.5m, and VALR gets $50m for crypto in Africa

This Week in DeFi - February 25

Friday, February 25, 2022

This week, Starkware beta and Opera browser integration, Yearn comes to Arbitrum, Zebec raises $15m for USDC payroll, and Celsius funds Maple

This Week in DeFi - February 18

Friday, February 18, 2022

This week, new Castle Island $250m fund, Curve on Moonbeam, Ref Finance raises $4.8m, and Gnosis Safe spins out into SafeDAO

You Might Also Like

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏