DeFi Rate - This Week in DeFi - April 22

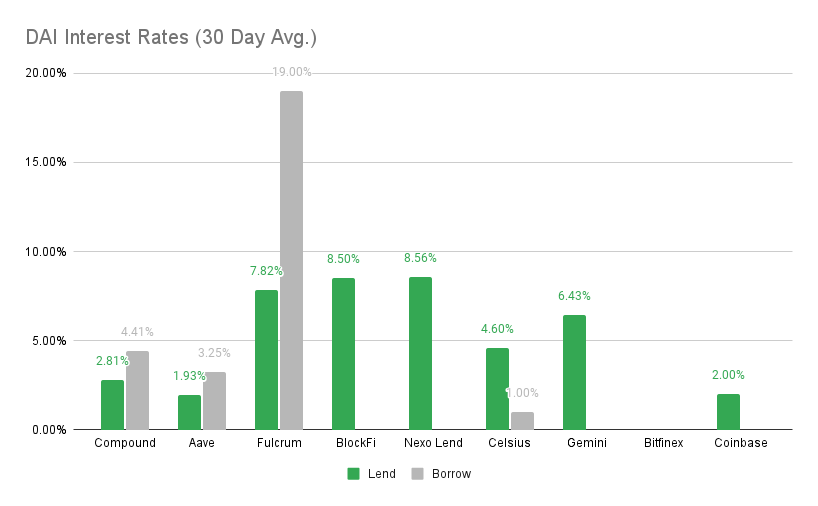

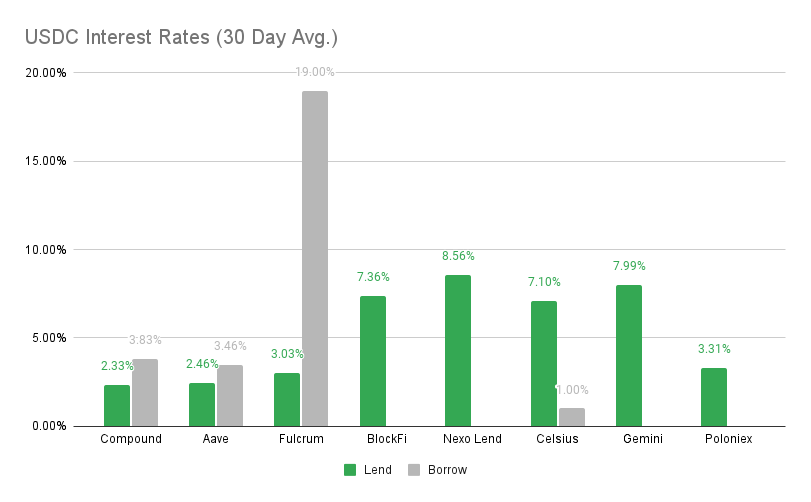

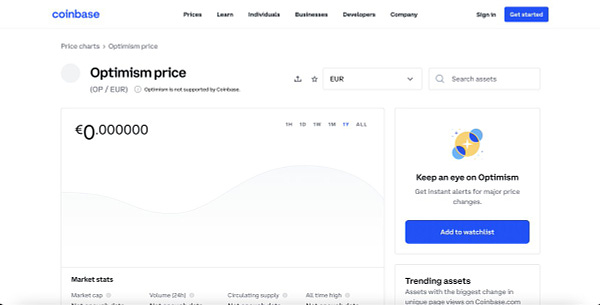

This Week in DeFi - April 22This week, Tron announces a stablecoin with 30% yield, Optimism may by launching a token, and Framework Ventures announces a $400M web3 fund.To the DeFi community, This week Tron crashed the algorithmic stablecoin party, announcing that it will launch its very own USDD stablecoin May 5th. The coin will be supported with TRX and $10 billion worth of crypto reserves – as well as offering 30% interest rate. This may be one to watch, as it attracts liquidity away from the dwindling UST and anchor protocol, as well as stealing the thunder from NEAR Protocol's budding USN.   Ethereum scaling platform Optimism may be the next Layer-2 solution to release its own token, following a development team blog post laying out plans for a move to community ownership and governance. Sparking additional excitement was a recently-discovered Coinbase price page for an Optimism $OP token – providing further evidence of a possible airdrop or other token distribution scheme.   DeFi Airdrops 🦇🔊 @defi_airdrops Rumours that a L2 is launching a token imminently. Is it @optimismPBC ? When in doubt go bridge into Optimism now and support the best projects 👇 - LP in @HopProtocol - LP in @lyrafinance - Stake $SNX - Trade @kwenta_io - Deposit in @PolynomialFi https://t.co/UaXpIAr58AFramework Ventures announces a new $400M Web3 fund directed at decentralized finance startups, as well as a significant allocation towards the blockchain gaming sector. It will be Framework’s third investment fund.  MakerDAO branches out to Ethereum Layer-2 scaling solution, StarkNet, to facilitate a cheaper Dai stablecoin ecosystem. The expansion will take place in four phases, beginning with a bridge that goes live toward the end of this month.   The algorithmic stablecoin craze has now expanded across almost every major blockchain, with each Layer-1 protocol now appearing to have announced its very own crypto-backed algorithmic solution. A large proportion of these stablecoins are accompanied by savings rate DApps that offer tremendous yields, in many cases designed to attract short-term liquidity into their respective ecosystems. With interest rates upwards of 20% (and now as high as 30% on the way for Tron's USDD), a majority of these new stablecoins are enticing participation through long-term unsustainable yields – in most cases, subsidized by "yield reserves" funded by development teams or governance systems. We can expect a short-term disruption across stablecoin markets as participants chase the highest yields for their capital – but this phase may be relatively short-lived. Eventually the yield reserves subsidizing these outsized, fixed-rate returns will run dry and capital will trickle back into long-term sustainable models. For now, however, we can expect some stablecoin market chaos. Thanks to our partner: Nexo – Unlock the power of your crypto with up to 17% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: Nexo Lend at 9.02% APY, BlockFi at 8.50% APY Cheapest Loans: Celsius at 1.00%, Aave at 3.25% APY MakerDAO Updates DAI Savings Rate: 0.01% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 9.02% APY, BlockFi at 7.36% APY Cheapest Loans: Celsius at 1.00%, Aave at 3.46% APY Top StoriesGoldman Sachs Reportedly Keen to Forge Ties With FTXCoinbase NFT Marketplace Goes Live. Can It Rival OpenSea?Sweden, EU Discussed Bitcoin Proof-of-Work BanKuCoin Launches $100M Web3 Creators FundStat BoxTotal Value Locked: $76.29B (down 0.50% since last week) DeFi Market Cap: $124.82B (up 3.21%%) DEX Weekly Volume: $14B (down 22.22%) DAI Supply: 8.71B (down 0.91%%) Bonus Reads[Yogita Khatri - The Block] – Aurora-based DeFi protocol Bastion raises $9 million in funding led by Three Arrows Capital [Samuel Haig – The Defiant] – Why Compound Might Ditch its Yield Farmers [Brian Quarmby – Cointelegraph] – Derivatives exchange dYdX to become '100% decentralized by EOY' [Osato Avan-Nomayo – The Block] – Kadena announces $100 million grant program for web3 developers If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week in DeFi - April 8

Friday, April 8, 2022

This week, UST and FRAX take on DAI on Curve, a new token standard is created on Ethereum and NEAR Protocol raises $350M.

This Week in DeFi - April 1

Friday, April 1, 2022

This week, the Fantom Foundation launches a $500M incentives program, 1inch releases a wallet for Android, and DeFi TVL recovers.

This Week in DeFi - March 18

Saturday, March 19, 2022

This week, Optimism raises $150m Series B, Sushiswap launches new AMM aggregator, Aave debuts V3, and Ethereum merges in Kiln

This Week in DeFi - March 11

Friday, March 11, 2022

This week, Kyberswap on Arbitrum, Avalanche announces $290m in incentives, Cega gets $3.4m for Solana derivatives, and Wirex adds Paraswap

This Week in DeFi - March 4

Friday, March 4, 2022

This week, Electric Capital raises $1b for Web3, 1inch intros P2P swaps, Nested raises $7.5m, and VALR gets $50m for crypto in Africa

You Might Also Like

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏