DeFi Rate - This Week in DeFi - April 8

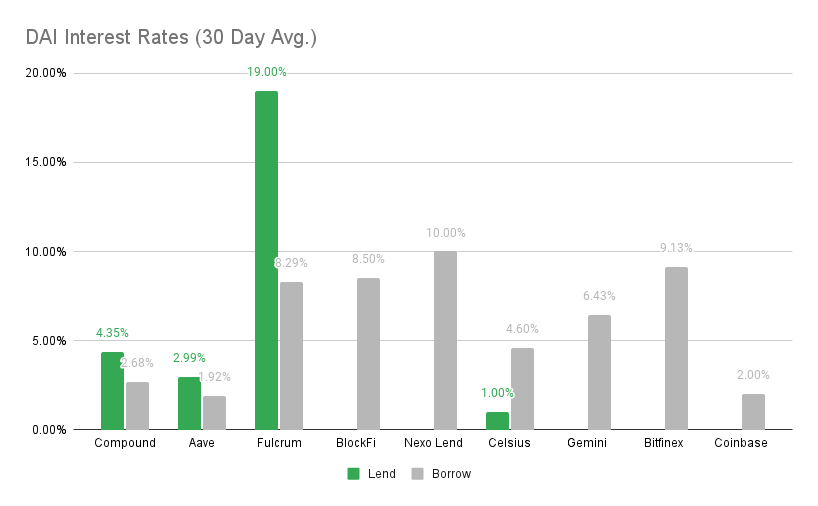

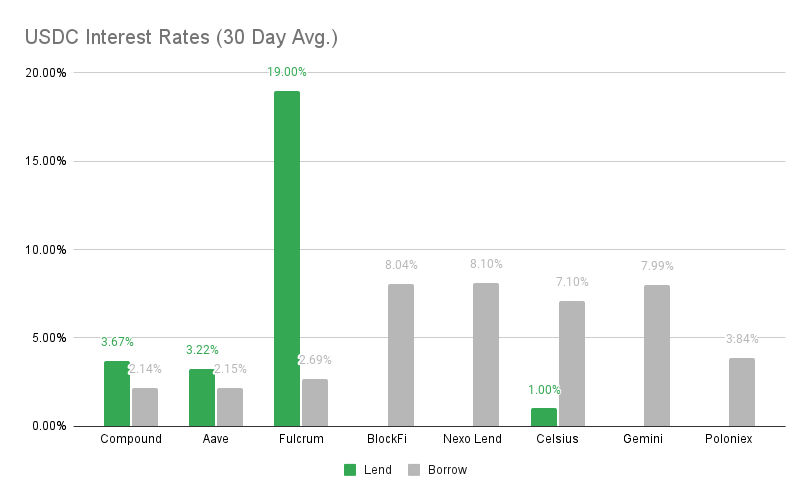

This Week in DeFi - April 8This week, UST and FRAX take on DAI on Curve, a new token standard is created on Ethereum and NEAR Protocol raises $350M.To the DeFi community, This week Terra founder Do Kwon has declared war against prominent Dai stablecoin (DAI), via the launch of “4pool” – a stablecoin liquidity pool on Curve with an emphasis on UST and FRAX. The pool is attempting to attract liquidity from “3pool”, a similar pool containing DAI, by using large quantities of CVX to drive incentives.  zon @ItsAlwaysZonny introducing the 4pool: @terra_money 🤝 @fraxfinance & a kickass partnership with the flappers: @terra_money 🤝 @redactedcartel https://t.co/CgDDvRUwGpGrayscale has shaken up its DeFi fund with the first quarterly rebalance of 2022, removing Synthetix (SNX) and Sushi (SUSHI) from its basket of assets. Both tokens failed to meet the minimum market cap threshold to remain in the fund. Taking their place are Avalanche (AVAX) and Polkadot (DOT).   A new Ethereum-based token standard is on the horizon, with proclaimed support from multiple high-profile protocols. The ERC-4626 token standard is designed for interest-bearing yield tokens, intended to be more secure and solve composability issues.  Joey 💚’s ERC-4626 @joey__santoro ERC4626 is a landmark interface for yield bearing vaults that will supercharge DeFi innovation ⚡️ On this rock we will build our empire 🏰 TLDR; adopt ERC4626 or ngmi Here is what this interface means for the Tribe, and for DeFi generally 🧵NEAR Protocol has raised a massive $350 million in funding from Tiger Global, FTX Ventures and others. The protocol has plans to blaze its own trail as a decentralized application (DApp) platform, already bridging to the Ethereum main chain. Stablecoins have become a very hot topic over the recent weeks, both directly in DeFi and broader cryptocurrency headlines. As we all know, stablecoins play an integral part across most DeFi protocols and will continue to do so for a long time – especially until major decentralized currencies reach a saturation point for adoption. Governments and regulators are slowly closing in with their own influences, as highlighted by Treasury Secretary Janet Yellen in yesterday’s speech; the US government is more closely inspecting stablecoins, along with the risks they may pose to the traditional financial system. This influence will likely most strongly impact centralized stablecoins, which may eventually find themselves in direct competition with central bank digital currencies (CBDCs). As a result, this is placing increasing importance on decentralized alternatives. Newer examples such as Frax and TerraUSD have climbed the ranks quickly as of late, giving the well-established Dai a run for its money. In other news, stablecoin use has even crept as far as Bitcoin’s Lightning Network, as the “Taro” protocol receives tens of millions in fresh funding. There’s a lot to be watching in the stablecoin space, with massive implications for the wider DeFi space – time will tell us how it all plays out. Thanks to our partner: Nexo – Unlock the power of your crypto with up to 17% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: BlockFi at 8.50% APY, Nexo Lend at 8.10% APY Cheapest Loans: Celsius at 1%, Aave at 2.99% APY MakerDAO Updates DAI Savings Rate: 0.01% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: BlockFi at 8.04% APY, Nexo Lend at 8.00% APY Cheapest Loans: Celsius at 1%, Aave at 3.22% APY Top StoriesYellen Focuses on Stablecoins in First Crypto SpeechCoinbase to invest in Indian crypto and Web3 amid tax regulation clarityLightning Labs raises $70M to add stablecoinsCertiK reaches $2 billion valuation with new funding from Goldman Sachs & othersStat BoxTotal Value Locked: $79.78B (down 0.75% since last week) DeFi Market Cap: $136.68B (down 0.51%) DEX Weekly Volume: $17B (up 6.25%) DAI Supply: 8.97B (down 2.71%) Bonus Reads[Aislinn Keely – TheBlock] – Convex Finance addresses bug that could've led to a $15 billion rug pull [Osato Avan-Nomayo and Vishal Chawla – TheBlock] – Frax Finance may buy large amounts of major cryptos to back its stablecoin [Omkar Godbole – CoinDesk] – Luna Foundation Guard Adds Nearly $230M of Bitcoin to Stack [Helen Partz – The Daily Gwei] – Ledger launches NFT-focused hardware wallet Nano S Plus If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week in DeFi - April 1

Friday, April 1, 2022

This week, the Fantom Foundation launches a $500M incentives program, 1inch releases a wallet for Android, and DeFi TVL recovers.

This Week in DeFi - March 18

Saturday, March 19, 2022

This week, Optimism raises $150m Series B, Sushiswap launches new AMM aggregator, Aave debuts V3, and Ethereum merges in Kiln

This Week in DeFi - March 11

Friday, March 11, 2022

This week, Kyberswap on Arbitrum, Avalanche announces $290m in incentives, Cega gets $3.4m for Solana derivatives, and Wirex adds Paraswap

This Week in DeFi - March 4

Friday, March 4, 2022

This week, Electric Capital raises $1b for Web3, 1inch intros P2P swaps, Nested raises $7.5m, and VALR gets $50m for crypto in Africa

This Week in DeFi - February 25

Friday, February 25, 2022

This week, Starkware beta and Opera browser integration, Yearn comes to Arbitrum, Zebec raises $15m for USDC payroll, and Celsius funds Maple

You Might Also Like

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏