Not Boring by Packy McCormick - The Invisible Hand's Visible Swarm

Welcome to the 1,336 newly Not Boring people who have joined us since last Monday! If you haven’t subscribed, join 114,947 smart, curious folks by subscribing here: 🎧 If you’d rather listen to this essay, head to Spotify or Apple Podcasts (and subscribe!) Today’s Not Boring is brought to you by… Masterworks I’m surrounded by bears. Not the good ones like Yogi, Smokey, or DA BEARS from Chicago. I’m talking about the ones who scream the sky is falling 24/7. As I pointed out in The Current Financial Thing, there’s a chorus of bears singing the same tune: 🎵 Inflation is at a 40 year high 🎵 Jpow is hiking rates (uhh ohhh) 🎵 Recession INBOUND (SCARY) But I’m not turning into a bear (or multiplying) like the image above suggests. I’m not even that worried. Why? Because I’ve diversified my portfolio with uncorrelated alternative assets. That helps me protect my portfolio without sacrificing alpha. And there’s one alternative that’s caught my eye. It has a -.04 correlation to equities according to Citi. Plus, when inflation is over 3%, its prices increase by 36% historically— more than 5x better than real estate and gold. So it’s no wonder Deloitte reported 85% of wealth managers want to offer it to clients. Spoiler Alert: it’s Contemporary art. I’m no art expert, but I can invest like one with Masterworks. In fact, I’ve invested with them 14 times. This fintech unicorn fractionalizes masterpieces by legends like Picasso for me. Plus Masterworks has results: They’ve sold three paintings and handed investors 30%+ net annualized return each time. That’s why so many offerings sell out in less than three hours. If you haven’t hit your diversification goals or are hunting for alpha, check out Masterworks. Skip the waitlist and join a community of savvy investors with my Not Boring Link. Hi friends 👋, Happy Tuesday! We’re coming at you one day later than normal thanks to Easter and Tax Day. Hope you all survived the latter. Recently, I’ve been reflecting on why I’m so optimistic about everything and what I think cynics get wrong. These are my in-process thoughts. We haven’t gotten good and weird for a while, figured it was time to change that. Let’s get to it. The Invisible Hand’s Visible Swarm(Click here ☝️☝️☝️ to read the full thing online from the start) In a March 2020 essay titled Back to the Future, Peter Thiel wrote:

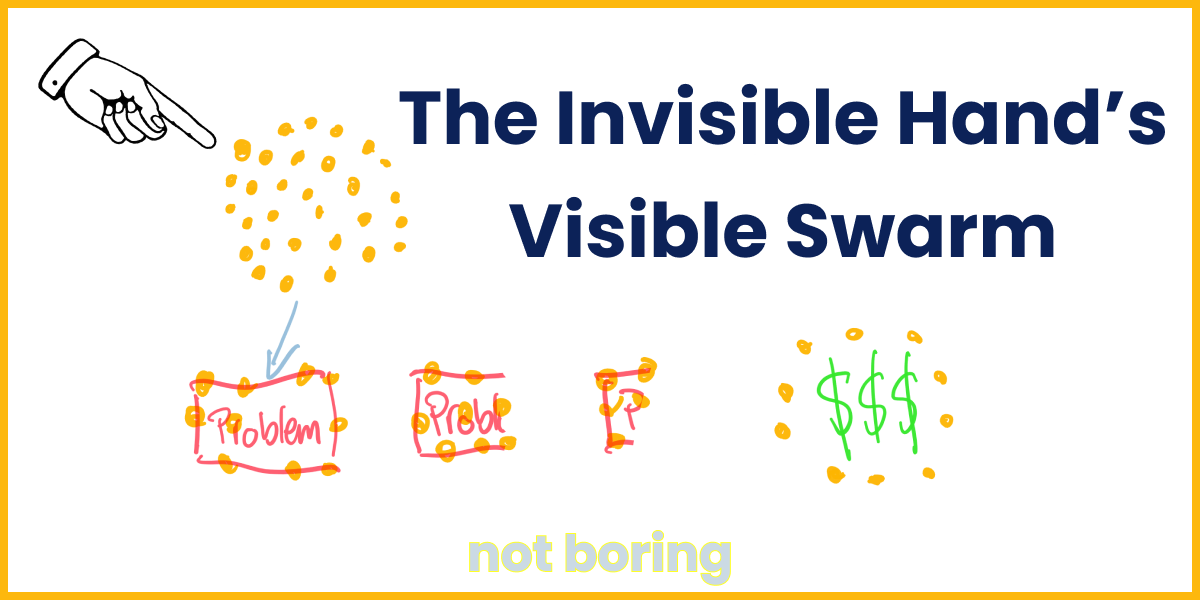

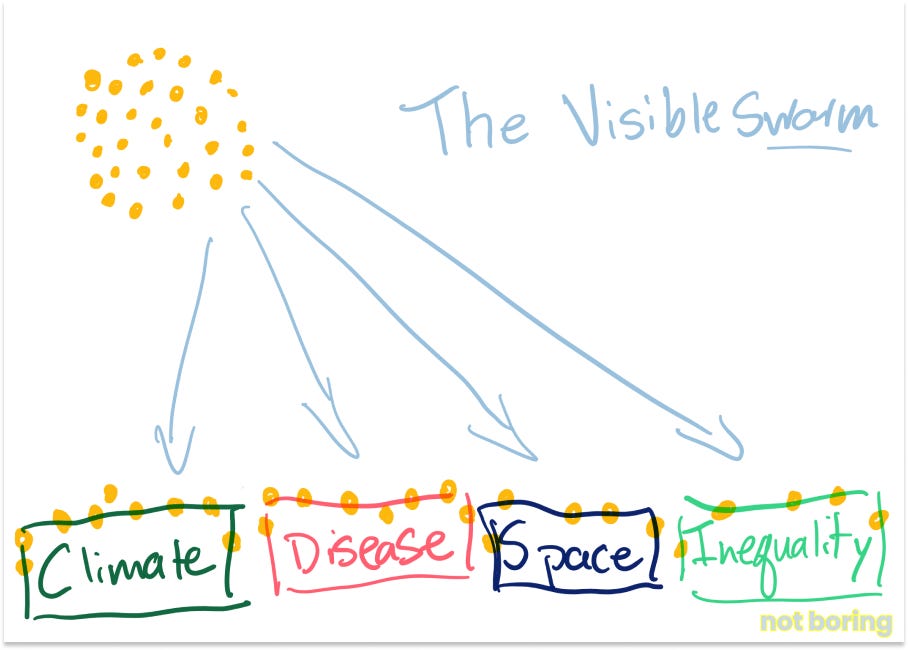

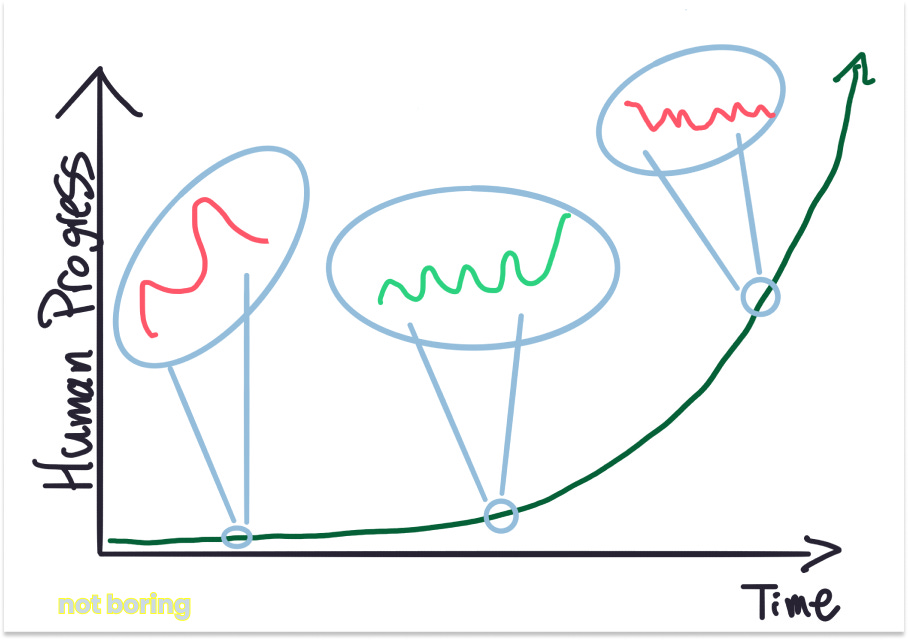

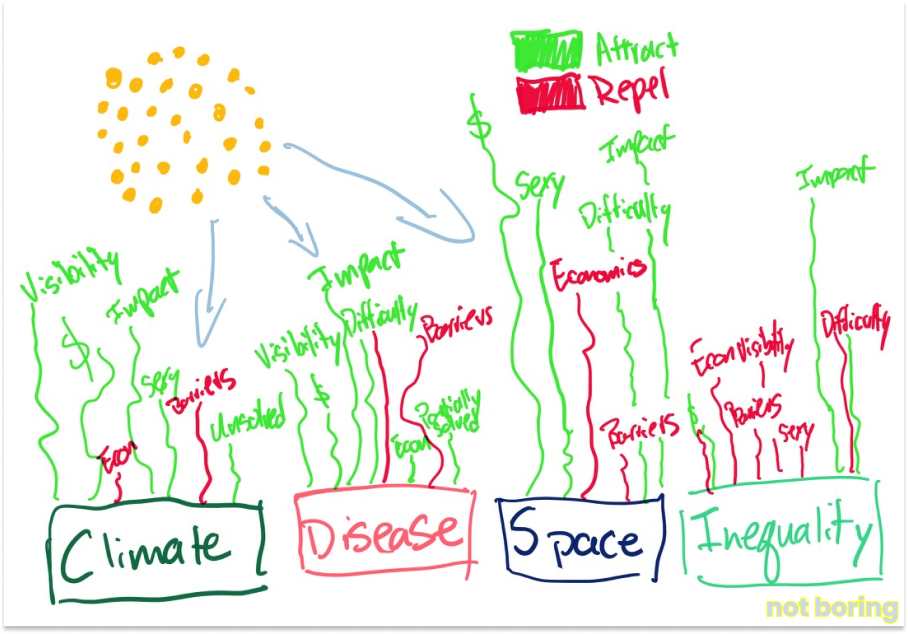

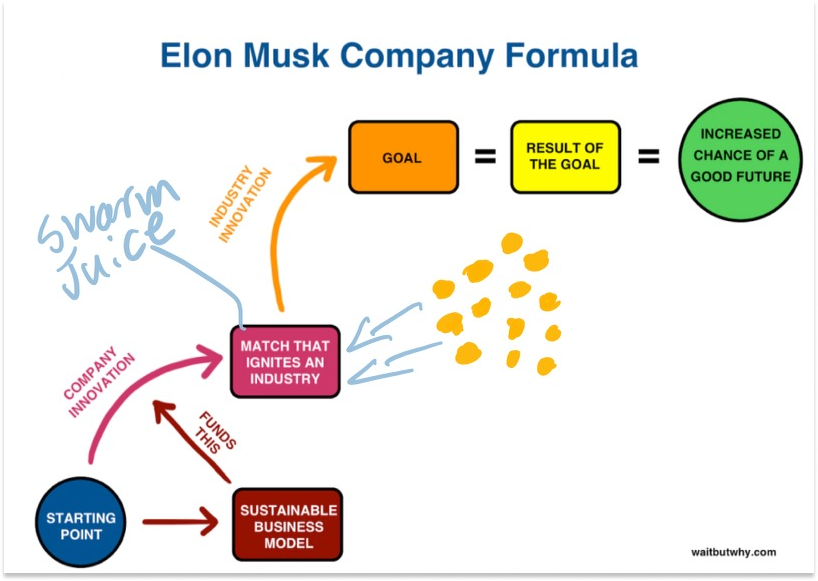

As an extreme optimist, that one made me pause and reflect. I think I’ve squared it. Individual actions matter deeply, but given enough time, the free market is shockingly good at directing those individuals’ actions and money at tackling the right really hard problems. (I don’t know where else to put this so I’ll put it here: I realize that the government plays an important role – climate tech, space, and even the internet aren’t where they are today without the government’s involvement, and some problems are best solved by the government until new models are developed. But this piece is about how free markets work and solve problems, so I’ll focus on that.) And we’re getting better at it as we improve our technology and grow our accumulated knowledge. This next decade is going to see unimaginable developments in health, space, economic design, VR, energy, and beyond. Of course there are and will continue to be winners and losers at the individual company level. Some promising technologies will fail. Certain industries will take longer to develop than others. But on a decade-scale and beyond, the market will somehow figure out how to put tremendous resources towards the biggest challenges. Which is amazing, given that we’re all just acting selfishly and doing whatever we think gives us the best chance of succeeding. That doesn’t mean the market is perfect. It’s not. There are challenges like homelessness with less clear economic upside that will need new models if they’re going to be solved via markets. And there are specific cases like Fast. Over the past couple of weeks, Twitter has been atwitter about the rise and fall of Stripe-backed one-click checkout company Fast. To some, Fast is the poster child for the excesses of venture capital, proof that the whole thing is a house of cards. To others, its controversial founder, Domm Holland, is a “man in the arena,” noble for having tried despite, and even because of, his failure. To me, Fast’s rise was a glitch in the system, a well-engineered hack of the way that capital and talent swarm promising opportunities. I find it frustrating that it’s now held up as an example of what’s wrong with venture, because it was such an obvious glitch. I’m on the optimistic end about tech companies until proven otherwise, but in April 2021, I wrote, “even though I love Stripe, I do not understand its investments in Fast.” That’s about as harsh as I get. But the market corrects. Fast’s swift fall, and redistribution of talent to more productive uses, was a triumph of free markets. It was probably a tough few days for Fast’s employees, who by all accounts were very talented, but the market moved quickly to find them new homes. Many were acqui-hired by Affirm, the rest seem to have been snatched up by a market hungry for talented people. As the dust settles, the ex-Fast crew will have a fun story to tell at dinner parties, some valuable lessons, and an opportunity to work on different problems. Schumpeter’s Gale blows again. But this piece is not about lending my voice to the chorus of dunkers. It’s about how resources – talent, capital, energy – swarm the problems that need to be solved. And it’s about how to hack the swarm for good. An Invisible SwarmOne way to think about entrepreneurship is as the invisible hand’s way of directing capital and talent towards solving problems, big and small, that move humanity forward. It’s the invisible hand’s visible swarm. The swarm is an evolved and highly legible manifestation of Adam Smith’s invisible hand, operating a layer up from the pin factory version, orchestrating the search not for equilibrium but for progress. The biggest challenges – disease, climate, space, inequality, and more – attract a swarm of talent and capital that grinds them down until they’re largely solved. Attract the swarm, solve the problem, with a lot of messiness, fits, starts, peaks, and of course, bubbles, in between. Bubbles are usually maligned, but from a “how do we throw people and money at solving our biggest challenges?” perspective, they’re incredibly useful. When you see a bubble, you’re often seeing the swarm in action. The cumulative efforts of countless swarms are responsible for human progress, even if those swarms can look bubbly and choppy in the moment. Thanks to a million little bubbles and a growing pile of Legos, human progress is accelerating. We’ve talked about it before, most clearly in Compounding Crazy. That should mean more volatility as the swarm moves faster and faster, but it should also mean that we’re knocking down problems at a higher and higher rate. The challenge, then, isn’t avoiding the volatility, but making sure that it’s being directed at the right problems. The invisible hand needs to know where to send the swarm. When Adam Smith began writing about an invisible hand, a metaphor for the market’s self-correcting mechanisms, in 1759, the world was very local, and information moved at a more leisurely pace. Twitter hadn’t been invented yet. There was no TechCrunch or The Information or PitchBook. Venture capital’s predecessor, whaling expedition financing, was still half a century away. And yet, Smith showed that as information spread, talent, capital, and “stock” would move as if guided by an invisible hand to the most productive opportunities in a dynamic system. In his examples, that might mean that the owner of a pin factory might need to hire labor to make more pins. His demand would drive up wages in the limited labor pool, which would hurt profits in the short-term, but higher wages would also increase the supply of labor, bringing wages back down. Think of it like slow-motion surge pricing. Today, information zips around the world instantly, the talent pool is becoming more liquid and global, venture capital has more money to deploy than ever before, and the scope of the world’s ambitions are getting bigger. Ideally, all of this combines into one big matching engine that puts the right people and capital to the right problems. How does the swarm know what to attack? In my head, I’m picturing different problems sending out pheromones to attract the swarm. The intensity of the signal each problem sends at any given time is determined by a bunch of factors, including:

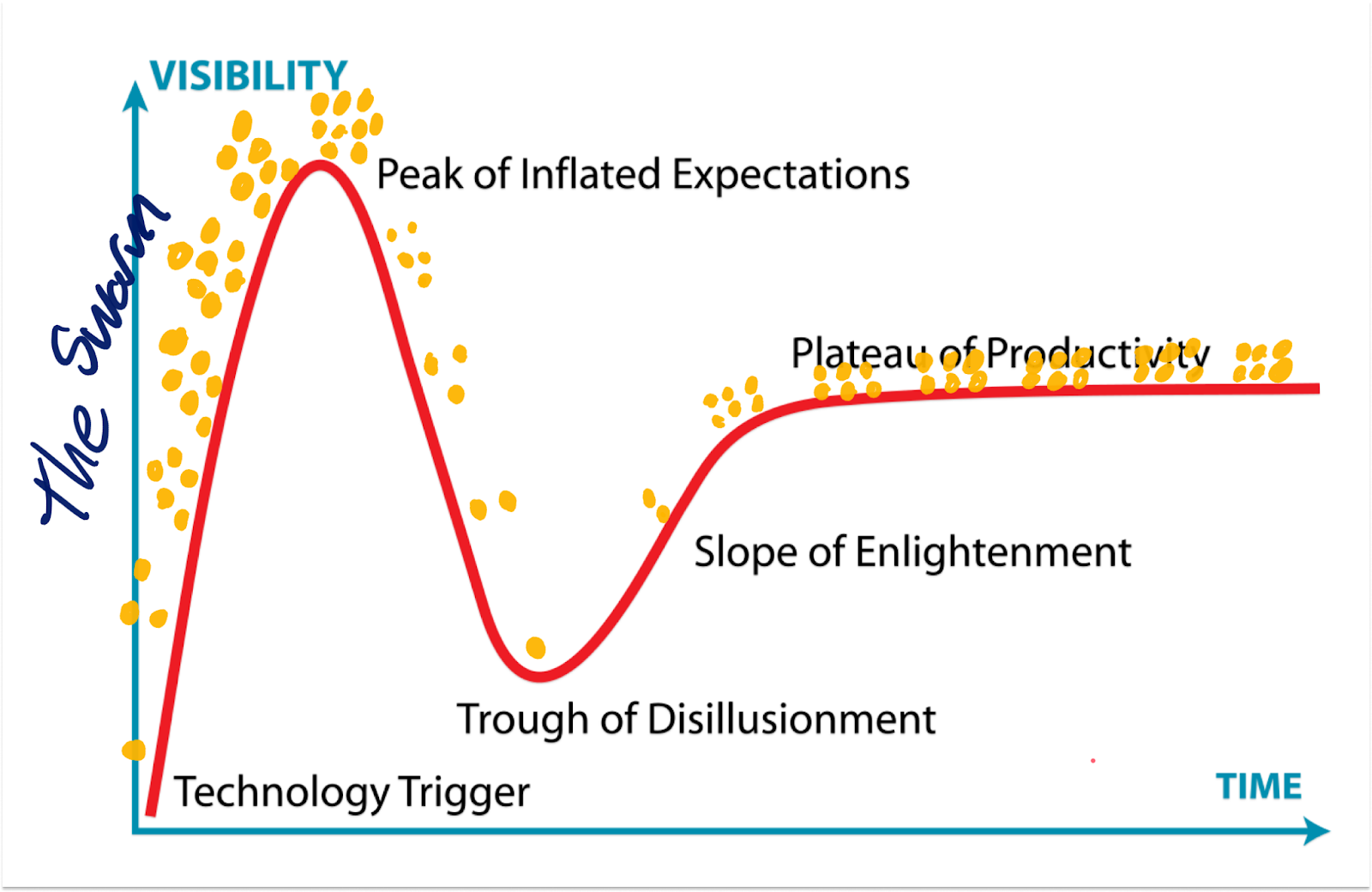

These combine and offset and balance each other, some factors attracting, some repelling. The ones with the highest net attractiveness attract the swarm most strongly, but each also has its own unique scent which can attract certain kinds of people out of the great global swarm. Over time, as the swarm attacks, the volume and types of people and capital each problem attracts evolves. The swarm can descend upon whole industries – like climate tech – or specific opportunities – like web3 UX. In either case, the problems that are able to attract and hold the swarm’s attention for long enough will undoubtedly get fixed. This is one of the things that cynics get wrong – the inability to see that the most obvious challenges are like big flashing FIX ME signs to the swarm. A bubble – too many good solutions swarming the obvious problems – is far more likely than the problem not getting solved! Not to be gross, but a swarm’s success in solving a problem that it’s identified is as inevitable as those videos in which swarms of ants eat food, like this:  That doesn’t mean that each member of the swarm will succeed, or that the swarm will behave rationally in the short-term. Often, the opposite is true: swarms are full of humans, and humans tend to get overexcited about the things that we get excited about, especially in groups. It often goes something like this:

This is where the bubbles come in, and why they’re a good thing. As Byrne Hobart wrote in the excellent essay Well-Behaved Bubbles Often Make History:

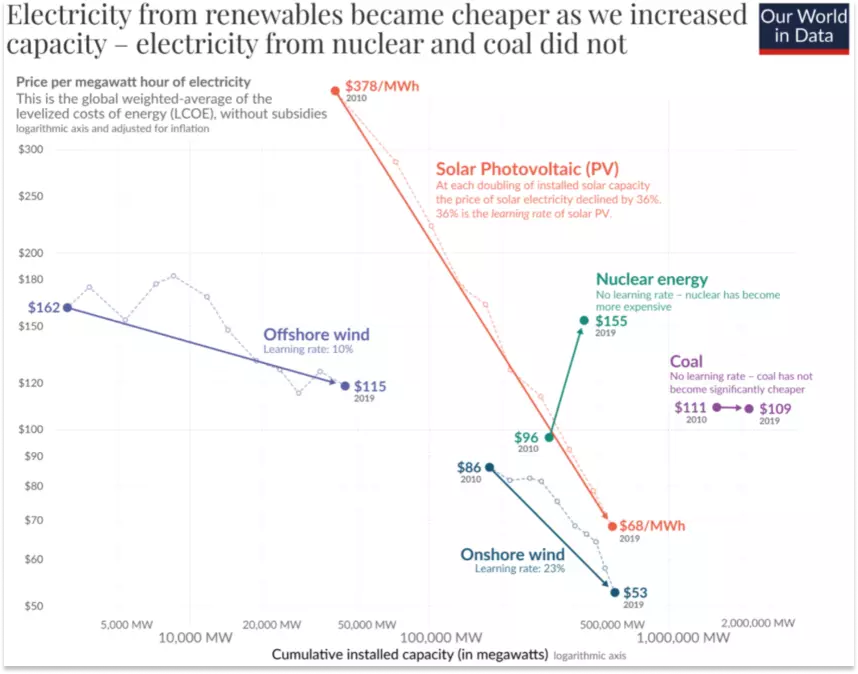

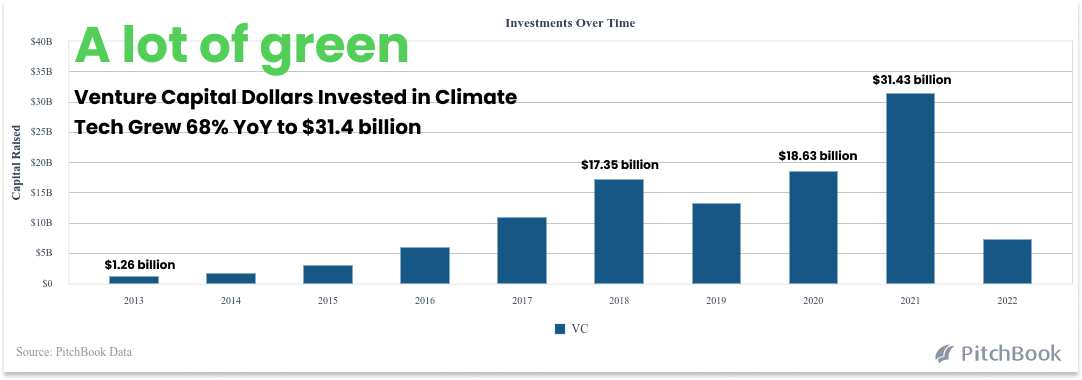

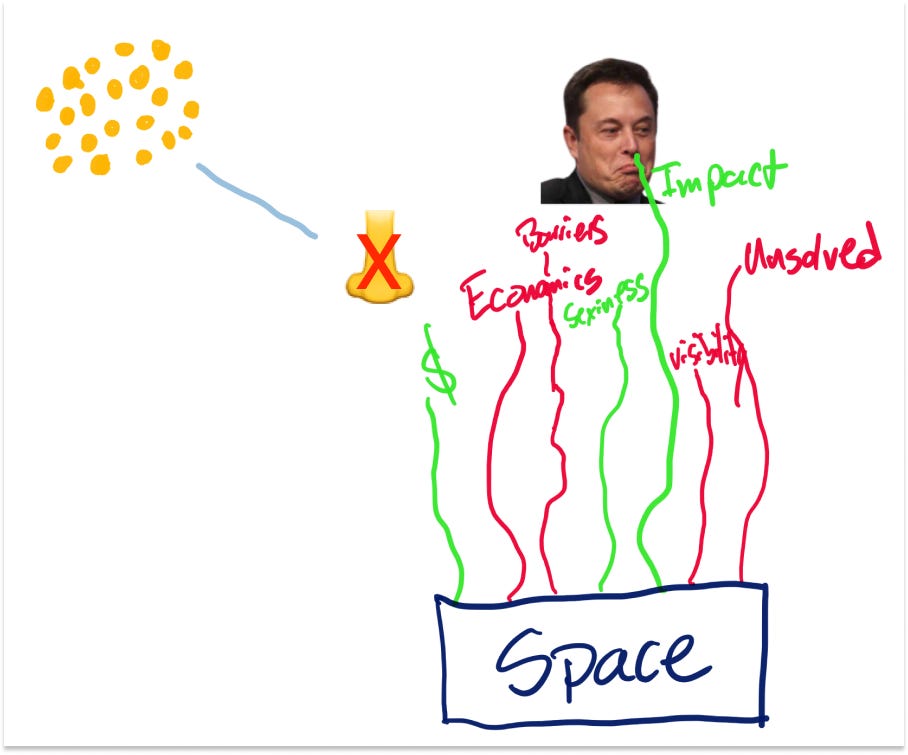

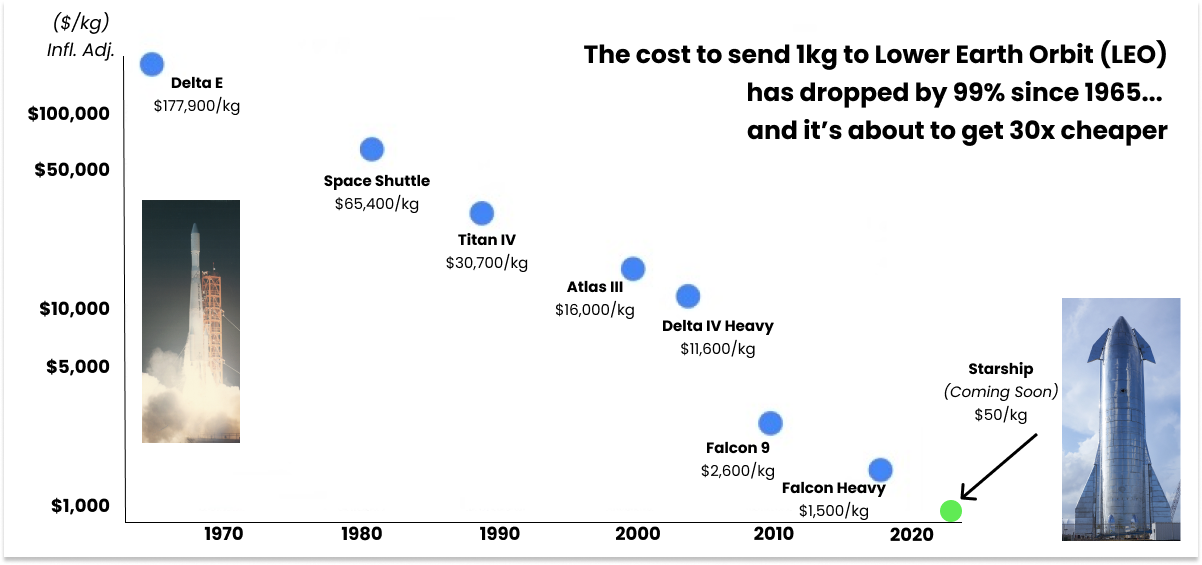

To stick with the swarm analogy, think of it like worker bees dying to protect the queen. In the long arc of history, it doesn’t matter which company succeeded or how many sacrificed themselves in the attempt, all that matters is that the swarm solved the problem. If that sounds familiar, it’s because the swarm explains the Gartner Hype Cycle. In fact, one way to think about how Hype Cycles happen is that exciting technological or business model breakthroughs send out signals to the swarm that a problem is now more solvable, and that there’s money to be made and impact to be had for solving it. The swarm attacks the problem with more people, companies, dollars, and dreams for the new technology or model until it becomes so competitive that it’s clear that not everyone will win and that some of the early ideas were a little dumb. Then the weaker part of the swarm, the part attracted more by sexiness or TAM than the technical challenge or impact, flies away while the passionate ones keep building until they have commercially viable solutions that gain traction. Their success attracts the part of the swarm attracted by a different risk profile, the ones who want to work on more sure things, once the dust has settled. This is where an industry like B2B SaaS is today, on the Plateau of Productivity, or in what Carlota Perez calls the Deployment Period. Things that once seemed impossible become mundane. It’s pretty amazing. This same pattern plays out over and over, across industries. Companies rise and fall, but humanity progresses. The example Byrne provided – the Dot Com Bubble – is a canonical example. The swarm tried a million things, most of which failed, some of which (like Amazon and Google) became wildly successful. Even the failures contributed to bringing the world online in big and small ways. Today, connecting humans across the globe with each other, all of the world’s information, and an infinite inventory of things is a solved problem. That’s wild. So the swarm turns its attention to new frontiers, some worthy and some… not. Let’s look at three – climate, space, and web3 – that show different ways the swarm operates, and how it can be hacked for good. ClimateIn 2007, Kleiner Perkins Partner John Doerr said, “Going green is bigger than the Internet. It could be the biggest economic opportunity of the 21st century.” That opportunity attracted Kleiner Perkins enough to commit $200 million to investing in greentech in 2006, and to launch the $500 million Green Growth Fund in 2008. Greentech investing proved famously disastrous for Kleiner Perkins and tarnished the firm’s previously sterling reputation and standing among the top tier venture firms. The biggest problem was that the economics didn’t make sense – renewable energy wasn’t cost competitive with fossil fuels, and most people can only be bothered to help save the planet when it doesn’t cost them anything (no judgment, I’m guilty here too). But big pools of money from Kleiner Perkins and others attracted a swarm of entrepreneurs, and those entrepreneurs got to work building new solutions and scaling deployment of existing ones, and over the past decade, the cost of energy from renewable sources has come down dramatically. The 2006 period is often referred to as a “greentech bubble” or “cleantech bubble,” with all of the negative connotations that come with the term, but I think a more useful way to describe the period is as the first wave of the swarm. Certain of the industry’s characteristics – TAM, visibility, impact, sexiness, technical difficulty, unsolved problems – attracted a swarm of talent and capital, both of whom were probably a little overly optimistic about their ability to solve some of the industry’s tougher characteristics – like economics – in the short-term. But their efforts contributed to grinding down those tougher characteristics and exposing new opportunities. Like the Dot Com bubble, the first wave of greentech investing helped build the infrastructure. Individual companies, projects, and investors lost money, but that doesn’t really matter to the swarm. What matters is making progress against the goal, and the bubble helped make that happen. Today, a new climate boom is underway. According to PitchBook, venture capitalists invested $31.4 billion in climate tech companies, an increase of 68% over 2020. Climate tech investing didn’t grow as fast as venture capital as a whole did in 2021, but I suspect that’s going to change. People like Chris Sacca are hacking the swarm for good. In an interview with Harry Stebbings, Chris Sacca said of his investments at Lowercarbon Capital, “I have multiple companies in the portfolio right now that have the trajectory to become multi-trillion dollar companies." The quote rhymes with Doerr’s prediction that going green could be the “biggest economic opportunity of the 21st century,” which may prove to be prescient. The opportunity isn’t just defensive – to save the planet – but offensive – to create a shitload of cheap, clean energy – as Cleo Abram explains well here:  Climate, which for a while felt like a space for hippie do-gooders, now packs a one-two punch that’s irresistible to the swarm: impact and TAM. As the space matures and needs to attract the next wave of the swarm to attack all of the many problems that contribute to rising CO2 levels, champions like Sacca are turning their focus from impact to greed, highlighting the multi-trillion dollar opportunity up for grabs in remaking the world’s energy and replacing aging infrastructure. Understanding that the second wave of the swarm – the big wave – needs to see the dollar signs, and positioning accordingly, is a brilliant way to hack the swarm for good. Sacca’s playing the game on a different level by realizing that this is a problem that needs to be solved, and that there’s no better way to solve a problem than by attracting the swarm. I think that’s the difference between a situation like Fast – which hacked the swarm to focus on one company’s solution to a relatively unimportant problem – and the approach that Sacca is taking – hacking the swarm to attract it to an entire industry and solve a very important problem. No one’s better at doing that than Elon Musk. SpaceIn Fount and the Body’s Magical Future, we covered Tim Urban’s Elon Musk Company Formula. Another way of framing the formula is that Elon is a master at hacking the swarm for good by solving really hard problems at the intersection of technology and business model, making the solutions sexy, and pointing the swarm to areas where there’s a lot of money and impact to be had. Take space. Space exploration in the United States had been stagnant for decades when Elon Musk launched SpaceX in 2002. As we discussed in Hadrian: Ex Machina Ad Lunam, the US hadn’t returned to the moon since its last trip in 1972. It cost $16,000 to launch a kilogram into space on an Atlas III launch vehicle. Reusable rockets were an unsolved problem. Plus, space exploration was something that government agencies did, not private companies. Space wasn’t just unattractive to the swarm, it was barely even visible. The business case for space looked abysmal, but Elon was attracted to one particular pheromone that stood out above all of the negative signals: impact. (Funny side note: apparently Elon really does have a heightened sense of smell.) Space travel was the only thing with the potential to make the human species multi-planetary, which would dramatically increase our odds of survival. And the physics worked: nothing about reusable rockets or lower launch costs were physically impossible to solve, just really hard. As Musk’s ex-PayPal colleague Peter Thiel wrote in that Back to the Future essay, “A renaissance will require motivational goals. To be motivational, a goal must be both ambitious and achievable… For technologists, that means pursuing goals that are difficult but possible.” In SpaceX, Elon pursued something that was difficult but possible. By laying out his vision and plan, he was able to attract the most adventurous and passionate part of the swarm to help make it a reality. Over the past two decades, Elon and the SpaceX team have shown that the ambitious is possible. They’ve brought down launch costs from $16k/kg to $1,500/kg, and are expected to get it even lower, to $50/kg with the launch of Starship.

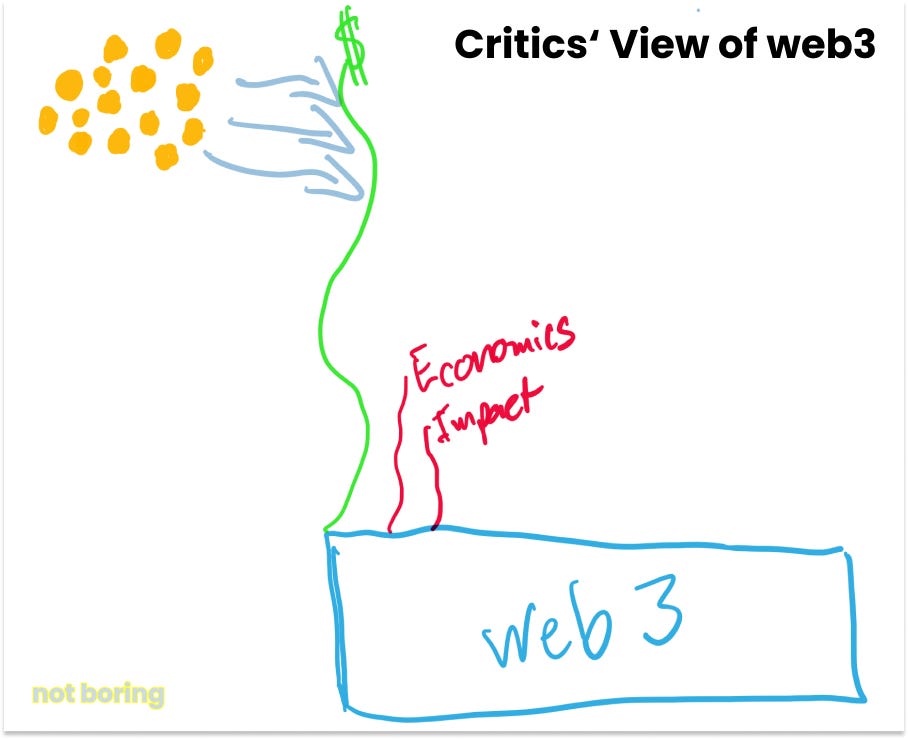

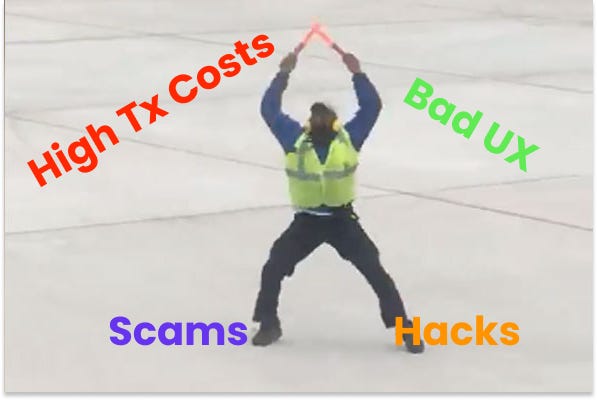

In this case, Elon was contrarian and right, and SpaceX is now a $100 billion private company as a result. By definition, contrarians see opportunities before the swarm arrives. Being contrarian and right could also be seen as front-running the swarm. SpaceX has likely secured the biggest prize in this space tech cycle, as it should for its counterintuitive contributions to the category. More importantly from the perspective of progress, it opened up the category to the swarm. SpaceX has made the economics of space technology more favorable, and it’s also amplified other pheromones for space tech. Space is sexier now, the TAM looks bigger, barriers are lower, it’s more visible, and potential outcomes are bigger. It kicked off a renaissance in space exploration and commercialization. Elon been so successful in making space commercially viable that there are bubbles in certain sub-categories of space tech now. From humanity’s perspective, that’s a phenomenal thing. Talent and capital is swarming problems whose solutions might mean multi-planetary life, access to cheaper energy sources, and new frontiers that allow humanity to continue to grow. SpaceX did the near-impossible over the course of two decades in order to finally attract the swarm, which will now aid in the effort to open up space. So Elon hacked the swarm for good, and it looks like Sacca is doing the same. What about web3? web3The swarm explains why web3 is so controversial. To some, it’s Fast on steroids. To others, it’s Elon in smart contract form. To critics, web3 looks like the ultimate swarm hack: a product with money baked in, designed to attract talent and capital despite having no real impact. To critics, JPEGs of monkeys and incestuous DeFi protocols shouldn’t be able to hack the swarm’s attention like they have. Undoubtedly, there are projects that fit that characterization – unscrupulous money grabs with no real impact – but like Fast, those projects are glaringly obvious to anyone paying attention. To me, these are like businesses adding “.com” to their name in the late 90s: it works when the swarm is in its initial frenzy, it won’t over time. Scams and the other challenges of web3 – UX issues, mini-bubbles in categories like DAO tools, high transaction costs, and more – are classic cynic traps. They’re things that critics can point to as glaringly obvious shortcomings, but by pointing at them, they’re only directing the swarm to solve those problems, like those fun dancing tarmac traffic directors. In fact, that might be the role of cynics in this whole thing: to uncover opportunities for the swarm and yell about them until they’re fixed. So those will be solved. The UX will improve. Hacks will be less frequent. Transactions will cost less, and make the space more approachable. The question, then, is impact, or, “So what?” I’m bullish on web3 for a lot of reasons that I’ve written about, but in this case, the most relevant reason I’m excited about web3 is that I think it can be a key tool in solving another one of the swarm’s shortcomings, and maybe its biggest: its lack of interest in problems with no clear, first-order economic opportunity. These problems are ones typically left to governments – things like homelessness and inequality – but that I suspect would be better solved by the market assuming there were a way to align incentives and attract the swarm. This is where I think web3 will shine, by using tokenomics to better align incentives among large groups of people. To me, this is the promise and potential of web3. That was the thesis of the first essay I wrote this year, The Laboratory for Complex Problems:

The big opportunity for web3 is to provide the tools and incentives to hack the swarm for good, to direct it to work on hard unsolved coordination challenges that we didn’t have the tools to address through markets previously. That may be through things as simple as internet-scale X Prizes for hard challenges, with NFTs or tokens as a visible artifact of participation and desire to solve a particular problem. It might be through baking money into problems that otherwise might not have made economic sense in the past. It might be by better aligning incentives and changing the economic equation. As one example, Not Boring Capital portfolio company Vibe Bio wants to get drugs for certain rare diseases to market by working directly with patient communities. Aligning incentives with patients might shift the ROI math and make a wider swath of therapeutics commercially viable, and more importantly, available to cure diseases. As another, which I’ll tell you more about next week, the ReFi movement is aiming to lend firepower to the climate fight by building more sustainable economic models and coordinating economic interests across large groups (and time). In both cases, web3 tools can serve as infrastructure for attracting and coordinating the swarm to solve problems across industries. A Formula for OptimismThis is why I’m optimistic, not because there aren’t any problems – there are so many problems! they’re glaringly obvious! – but because the swarm is attracted to big problems and has proven its ability to solve them. Companies come and go, technologies get hyped up and fade away, but eventually, the swarm smooths out problems until the sexiest, most challenging things are just boring, normal industries. Everything that we take for granted today seemed nearly impossible once, before the swarm got to it. Looking at Fast, climate, web3, and space, I think there are just three questions that you need to ask to understand whether or not the swarm will fix an industry’s shortcomings:

That’s it. If any of the answers are no, the cynics are right. If they’re all yet, the optimists are. In Fast’s case, the answers were yes, yes, no, so when the going got rough, the swarm dissipated. The space industry is the best at this way of thinking. Robert Zubrin’s The Case for Space is 408 pages of taking seemingly impossibly futuristic problems (like colonizing Mars, mining asteroids, or traveling to distant stars), breaking them down to their physics and costs, and explaining what will need to be true for solutions to be possible. Given the near-infinite stakes and potential impact, Zubrin treats even the hardest challenges as a matter of when, not if. While the laws of the economy aren’t as clean as the laws of physics, I believe that solutions are equally inevitable as long as they answer “yes” to all three of those questions above. Whether via web3, VC, or good old fashioned free markets, the swarm is why I’m so optimistic about technology and humanity’s future. It’s why I’m bullish on democracy and America, despite the division and seemingly insurmountable challenges. Yesterday, a16z Partner Katherine Boyle wrote an essay titled The Case for American Seriousness. In it, she identifies a pervasive lack of seriousness as one of America’s biggest meta-challenges. Instead of government intervention, she proposes entrepreneurship as the solution. In true Andreessen fashion, she proposes that Americans need to build:

The way I read it is that we need to do everything possible to let the swarm attack the biggest problems. Some are obvious and are already being swarmed. Others need Elons to see opportunities where others see walls, Saccas to appeal to the swarm’s greed for good, or web3 tools to align incentives and develop new models where current ones won’t quite fit. Extreme optimism doesn’t necessarily lead to apathy. I’m extremely optimistic that the swarm will solve the world’s biggest challenges and move humanity forward, but the swarm is just the best efforts of billions of people solving the pieces of the problem that they can day after day until one problem fades and we move on to the next. Thanks to Dan for editing. Not Boring is Hiring! We’re hiring two roles that touch both the media business and venture fund: Atoms Research Analyst and Bits Research Analyst. If you’re a smart, curious person with deep knowledge about any of the categories we discussed today and an ability to write about your space clearly, you should apply: Thanks for reading, and see you next week, Packy If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

The Not Boring Liquid Super Team

Monday, April 11, 2022

Not Boring Turns Two, Fund Quarterly Update, and Growing the Team

Hadrian: Ex Machina Ad Lunam

Monday, April 4, 2022

Meet the Anti-Decline Company Building to Keep the Solar System Free

The Current Financial Thing

Monday, March 28, 2022

Everyone's a Bear. Does that mean you have to be, too?

Ramping Up

Monday, March 21, 2022

Ramp raises $750 million at $8.1 billion in Founders Fund-led Round

TrueAccord: Unsexiness-as-a-Moat

Thursday, March 17, 2022

Bringing Debt Collection Into the New World

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month