The Daily StockTips Newsletter 05.23.2022

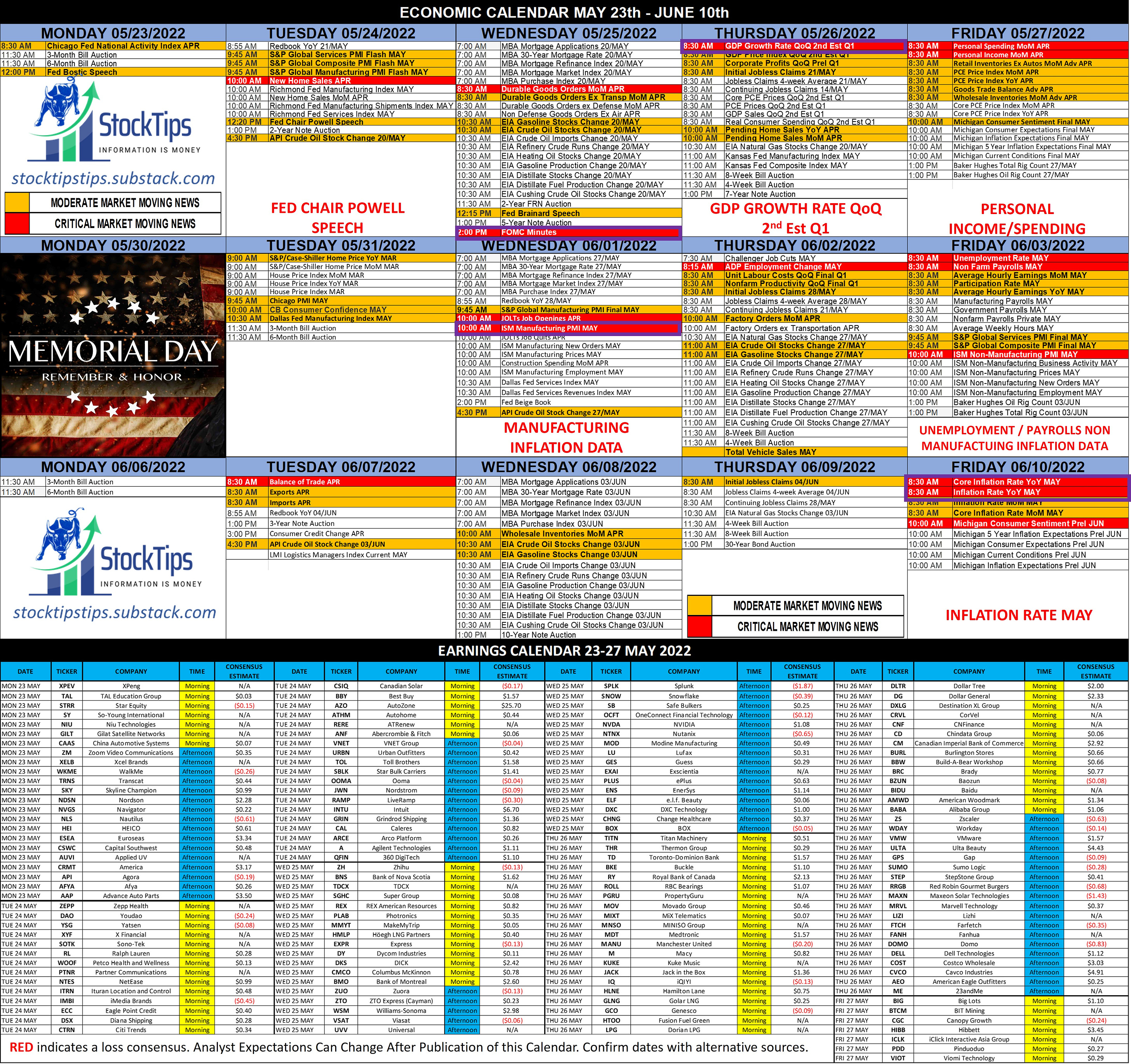

The Daily StockTips Newsletter 05.23.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)CLICK HERE TO SEE THE STOCKTIPS RECORD WE’RE ON YOUTUBE NOW! See HERE, HERE, & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings (Note: Red on the Earnings Calendar Indicates an Earnings Loss [Not Miss] Consensus), & Yesterdays Insider Buys. NEVER BE SURPRISED BY EASILY ANTICIPATED MARKET BREAKING NEWS. That’s our goal here. TODAYS COMMENTARY Get a Cup of Coffee & Enjoy Catching Up! If you aren’t reading this daily you are missing out on a wealth of information that could prevent unforced & unnecessary trading errors. BUY LIST UPDATE: Naturally there is little to add to the BUY LIST in this market. Nothing, & I mean NOTHING seems safe. Stocks are overvalued, & to the extent that some industries are bullish, there are alternative risks as a result of war, OPEC, the Fed, & Shanghai lockdowns. HOWEVER … I am making some headway on the short list. For now, I have 5 options on the Short List under the Price Assessment Based Watchlist. Indeed I knew I should have added TTCF as a short to the BUY LIST, but I needed confirmation on the underlying economic conditions. I believe I have that now after carefully tracking this seasons earnings. Stand by folks. INFLATION INVENTORIES & RETAILER EARNINGS: Walmart & Target both recently reported earnings. Walmart made record revenue but missed analyst EPS consensus by 12%. Target similarly enjoyed record revenue, but missed analyst EPS consensus by 28.6%. In short, despite enjoying the same or higher revenue as the same quarter year prior, Walmart & Target scored lower Earnings Per Share than the same quarter the year prior (WMT -23% YoY EPS / TGT -40% YoY EPS). Walmart reported that their customers were “switching from gallons of milk to half gallons,” & "switching" from products in deli, lunch meat, dairy, and bacon to lower-cost items. Target reported “lower-than-expected sales in discretionary categories.” ROSS, another large discount retailer, came in shy of the previous years record revenue, missed analyst EPS consensus by but 3%, & YoY EPS came in at -28%. ROSS assessed “the health of our customer, they're being squeezed to full -- food and fuel prices with inflation there, means they have less to spend on discretionary items." WMT & TGT are what happens when you move heaven & earth to keep your inventories full during a supply chain crisis resulting in paying more for the same stuff, only to realize once prices reach a zenith that suddenly you’re having trouble selling your overpriced stuff. Trust me when I tell you they want to pass the cost on to the consumer. However they can’t. Their inventories are full with merchandise they can’t move at higher prices & remain competitive. There is only so much the consumer can take in price increases. So where do retailers take the hit? In the profit margin! I’ve noted this trend throughout this earnings season. Companies enjoy record revenues, although significantly lower EPS than the same quarter last year. This is the derogatory affect of inflation. Prices are increasing on the store shelves, but so too are energy costs, shipping costs, labor costs, utility costs, construction costs, & other inputs. The same goes for the consumer, whereas wages are going up, but buying power is faltering. And we are nowhere near out of the woods. In fact, this earnings season is but a taste of things to come. Remember that while inflation was already chipping away at consumer buying power prior to the War in Ukraine, prior to the the supply constraints & the sanctions thereof, & prior to the China covid lockdowns, THIS EARNINGS SEASON REPRESENTS ONLY A PARTIAL EFFECT OF THESE INFLATIONARY PRESSURES. Putin invaded the Ukraine on February 24th. China began their lockdowns on March 28th. This earnings season reflects a reporting period primarily between Jan 1st & March 31st. This means the earnings you see reflect conditions that encompass but 36 days of Ukraine & 3 days of Shanghai Lockdowns. Now you can add 15 to 30 days depending on how each company differs in quarterly reporting periods, but on the whole, this holds true. Particularly when we account for the fact that in many aspects these events took a while to effect economic conditions. The company earnings we see today reflect but a portion of the War in Ukraine & the China lockdowns ... which will both be represented in all their glory NEXT earnings season. And I didn’t even mention the effects of Fed rate hikes & offloading the balance sheet. UPCOMING MARKET MOVING ECONOMIC NEWS:

The two items that have the largest chance of rocking the markets next week are FOMC Minutes on Wednesday & the revised Q1 GDP numbers on Thursday. For those of you who don’t know, The Federal Open Market Committee Minutes are the transcripts released from the last Fed Meeting (Where they made the interest rate decision). Yes, this can seriously move markets. Significant News Heading into 05.23.2022:

PAID CONTENT IN THE PAYWALL BELOW: (BUY LIST WILL BE UPDATED SOON)

👉CLICK HERE TO SEE THE DETAILS OF EVERY STOCK ON THE BUY LIST (AND SEE THE PRICE ASSESSMENT BASED WATCHLIST / THE STOCKS UNDER $20 LIST & THE HIGHLY SPECULATIVE LIST) LOGIN INSTRUCTIONS: You will need to login to see the detailed list. The “email login link” will send the link to login directly to your inbox (Click the link & it will automatically log you in). You can also choose the “login with password” option. You will need to set up a substack password for this option.Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 05.20.2022

Friday, May 20, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 05.19.2022 (AMKR & SAFM REMOVED)

Thursday, May 19, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 05.18.2022

Wednesday, May 18, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 05.17.2022

Tuesday, May 17, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 05.16.2022

Monday, May 16, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Issue #275: You're preapproved… to spend a bunch of money

Wednesday, March 5, 2025

plus Soup Watch 2025 + snacking cakes ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Harry's Take 3-5-25 Economy Suddenly Weakens: Recession Coming Soon?

Wednesday, March 5, 2025

Harry's Take March 5, 2025 Economy Suddenly Weakens: Recession Coming Soon? I've been seeing the economy as the most stretched in history after the longest $27T US stimulus program, by far.

💀 RIP, world's biggest dividend

Tuesday, March 4, 2025

Aramco slashed its billion-dollar handouts, the US faced retaliation, and bitcoin went up against organs | Finimize Hi Reader, here's what you need to know for March 5th in 3:14 minutes. Aramco –

RIP to the 4% Rule

Tuesday, March 4, 2025

How to ignore the retirement strategy ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

President Trump is asserting extraordinary power over independent agencies. Is the Fed next?

Tuesday, March 4, 2025

The rise and potential fall of independent agencies. View this email online Planet Money Not-so-independent agencies anymore? by Greg Rosalsky President Trump vs. the independent agencies. It's a

No Sales, No Survival - Issue #514

Tuesday, March 4, 2025

What smart businesses are doing to win in the long run. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏