The Signal - Summer quaffs India's brew

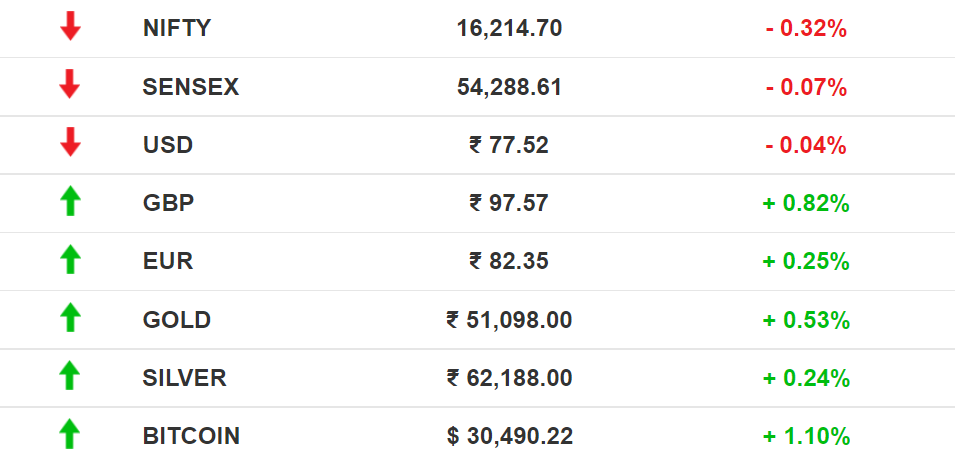

Summer quaffs India's brewAlso in today’s edition: Amazon tries a Dunzo; Rapid action Zepto; RBI curbs “daylight exposure”; China, India are a team on this oneGood morning! It's not a good day to be Stuart Kirk, who was ironically HSBC’s head of responsible investing. HSBC was left red-faced after Kirk gave a presentation titled “why investors need not worry about climate risk”. He made light of environmental issues and even compared the climate crisis to the Y2K bug. To be sure, the presentation and its contents were approved internally well in advance, the Financial Times reported. He's been suspended since. Moral of the story: don't be a Kirk. If you happen to find our newsletter in your Promotions on Gmail, please move us to the Primary tab. If we are already on Primary, share it with family and friends. The Market Signal*Stocks: New export duties on iron and steel intermediates and key steel products sank the indices today. Metal stocks suffered. The RBI Governor hinted at another interest rate hike in June to fight inflation. Zomato's revenue jumped 75% during the January-March period, while its losses increased to ₹360 crore. The stock lost 2.15% value. Early Asia: The SGX Nifty was down 0.15%. Nikkei 225 was trading 0.31% below its previous close and Hang Seng fell 0.20% at 7:30 am India time. DEMAND & SUPPLYNo Chill In This SummerHot girl summer is here, but there's little beer to go around. No, really. Dry days: An intense heatwave is driving beer demand but there are not enough kegs, thanks to capacity limits and changes in excise norms (looking at you, Delhi and Haryana). Red hot: Coca-Cola is operating full tilt while rival Pepsi is adding capacities but will be ready only by the next season. Ice cream makers can't keep up. Sales have soared 45% in the past three months. AC sales hit record highs in April but production is down 20%-30% due to a shortage of components arriving from China. What’s happening? People are emerging from their Covid-19-enforced hibernation. Bars, offices, schools, travel plans, and the heatwave (we told you about the cold chain crisis here) have opened up across the country. On the bright side, economists expect the excise duty cut on petrol and diesel to bring down retail inflation by 20-40 basis points. 🎧 The summer is coming for your beer, ice cream, AC and cola. Why? Tune in. RETAILUS Retail In Need Of TherapyEven before US interest rates rise further, retail investors are in a tizzy about the state of the American consumer. Target and Walmart reported their worst earnings since 1987. Analysts are shaking their heads after almost all American giants, including Kohl’s, reported lacklustre earnings. What’s happening: Inflation-hit consumers are shortening their shopping lists, a shift that will weigh down US economic recovery. Companies are saddled with inventories as consumers shun costly merchandise. Flex distribution: Meanwhile, Amazon is rolling out its own version of fast delivery. It’s piloting a service where Amazon Flex drivers pick up and deliver packages from retailers directly to customers. QUICK COMMERCEZepto To Speed Up DrugsZepto may have finally found an apt use case for its instant, 10-minute delivery service: medicines. After ultrafast tea and coffee delivery, the company, Times of India reported, might begin shipping meds. Crowded field: Zepto will be foraying into a den of established players such as Reliance-owned Netmeds, Tata’s 1mg, PharmEasy, and Apollo Pharmacy, among others. Flipkart Health+ and Amazon Pharmacy are also circling around. This hasn't gone down well in some quarters. OTC+: Quick commerce companies typically cater to micro categories around health such as sexual wellness (contraceptives), personal hygiene, balms, and pain-relieving sprays. But OTC drugs such as Paracetamol could make for a good starting point.

🎧 Ten-minute grocery delivery service Zepto wants to deliver medicines, one that already has established players. This foray may not be a walk in the park. Check out our deep dive. STOCK MARKETBanks Shut Out Brokers’ DaylightThe stock markets, already reeling from global uncertainties and hawkish central banks, are bracing for another blow as the RBI has told banks not to finance brokers’ day trade without security. Payment bridges: Stockbrokers use a banking facility called “daylight exposure”, which is a current account-linked credit line. They use it to bridge payment mismatches in intra-day funds flow from clients. The RBI has made changes to the operation of current accounts. It has asked private banks, which usually offer this facility, to not finance brokers unless they put up collaterals worth at least 50% of the amount they borrow during the day. It could be fixed deposits or saleable securities. Impact: The new rule reduces operational flexibility for brokers, especially small ones. GEOPOLITICSStalking Fish And Staking WheatFirst there was India’s glocal wheat problem and the Centre's navigation of its strategic relationship with western countries. Turns out India is now walking another tightrope in the realm of food geopolitics: with the Indo-Pacific region on one side, and the WTO on the other. Fish fight: India and Quad partners Australia, Japan, and the US will launch satellite-based surveillance to check China’s illegal fishing in the Indo-Pacific. Beijing insists it’s a “responsible fishing country”, but no dice. Its aggression in international waters is fomenting pushback in the strategically-important region. Wheat wagon: Even as it joins hands with India for all things Quad, the US (and other western countries) may stymie India’s WTO campaign for a permanent solution to food stockholding. This is in the context of the West accusing India for “hoarding wheat”; never mind the US’ own history of using wheat as an arm-twister. The irony is that China may have India’s back on this one. FYIGigantic deal: Semiconductor giant Broadcom is reportedly in advanced talks to acquire hybrid cloud computing company VMWare for around $50 billion. Beyond e-commerce: Flipkart will enter the home services business, competing with the likes of Urban Company. It’ll start with at-home AC repair and then washing machines. Wipe clean or else: The UK joined Australia, Italy, and France in ordering facial recognition company Clearview AI to delete all data relating to its residents. It also fined the company £7.5 million. Metabust: Invact Metaversity, the metaverse edtech startup co-founded by former Twitter India head Manish Maheshwari, is likely to wind down its operations within months of starting up. (What went wrong? Listen here). In the bag: Hyperlocal shopping and retail distribution company 1K Kirana raised $25 million in a Series B round. Uber CEO Dara Khosrowshahi is among those backing former Sequoia partner Amit Jain’s new crypto payments venture Zamp. Enterprise spatial mapping company NextBillion.ai also closed a $21 million round. Chinese checkers: Didi’s shareholders have voted to delist the under-fire Chinese ride-hailing giant from the New York Stock Exchange. Tencent co-founder Pony Ma isn't too pleased with China’s zero-Covid policy. FWIWHidden forest: Cave explorers in the Guangxi region of China have found a secret ancient forest hidden inside a 630-foot-deep sinkhole. Trees here grow a staggering 130 feet tall. It could also be home to species that have not been studied before. They also found the mouths of three caves inside the sinkhole. You’ve got scammed: Digital artist Beeple’s Twitter account was hacked in a phishing incident, with scammers fleeing with more than $70,000 in Ethereum. Beeple’s account shared a link on Twitter to a dodgy website pretending to be a “raffle” of Beeple’s Louis Vuitton collaboration. He had some nice things to say in a tweet. Make way for makgeolli: Korea's ancient drink, makgeolli, is what Old Monk is to college kids: the price makes up for its taste. The traditional rice wine, made of half-steamed rice, homemade yeast, and water, was the answer to Japan’s sake (or local soju). The drink survived plenty of disruptions: World War II and the Korean War worsened the rice shortage. Since then, it's gotten somewhat of a glow-up. The result? It has found takers at home and overseas. Want to advertise with us? We’d love to hear from you. Write to us here for feedback on The Signal. If you liked this post from The Signal, why not share it? |

Older messages

Apple takes a bite of India

Monday, May 23, 2022

Also in today's edition: Outward remittances hit an all-time high; Crypto's rep sinks; Monkeypox is swinging about; Zilingo row gets murkier

India’s cold chain faces the heat

Saturday, May 21, 2022

Rising temperatures will compound problems and increase costs for an already-flailing supply chain.

Metaverse MBA goes kaput

Friday, May 20, 2022

Also in today's edition: Scandal hits Axis Mutual Fund; US lures India with arms aid; DoJ goes after private equity; Netflix subscriber base shrinks further

Not a safe period

Thursday, May 19, 2022

Also in today's edition: Tech job cuts far and near; Buyout financiers make hay; China's man made crisis worsens; Get ready for road trips

The Musk-Twitter 💩 show

Wednesday, May 18, 2022

Also in today's edition: Digital platforms under CCI's gaze; Shell out more for budget smartphones; To be super Uber app; Reliance wants the beauty aisle

You Might Also Like

The BFCM Playbook To Millions In Sales

Tuesday, November 26, 2024

Come learn how to crush black friday cyber monday for brands

🦅 The once-in-a-lifetime deal is here

Tuesday, November 26, 2024

The new 𝕏 API costs forced our hand ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin Drops to $93K as Long-Term Holders Take Profits

Tuesday, November 26, 2024

Plus Saylor Buys $5.4B More Bitcoin Setting New Record at $97860

🕵️ 50%, then 35%, then 20%, then nothing

Tuesday, November 26, 2024

Steal Club BF offer is live :)

Rox

Tuesday, November 26, 2024

How to Manufacture Path Dependence in Applied AI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Are You Doing Cross Promotions Wrong?

Tuesday, November 26, 2024

Want Growth? Stop Sleeping on Cross Promos 🔑

This new ad format can boost sales by 15%

Tuesday, November 26, 2024

It's Thanksgiving Week, and online shopping activity will peak in a few days. You may be noticing more shoppable ads this year–interactive ads that allow customers to buy directly from the ad

Why Is Bitcoin's Price Dropping Right Now?

Tuesday, November 26, 2024

Listen now (3 mins) | Today's Letter is Brought To You By Range! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: November 26th 2024

Tuesday, November 26, 2024

Exploding Topics Logo Presented by: Semrush Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Scent Beads (trends) Chart Scent beads are dissolvable

Who's hit hardest by Northvolt losses?

Tuesday, November 26, 2024

GP stakes hit annual high; VC funding for decentralized AI triples; Halcyon takes home $100M Series C Read online | Don't want to receive these emails? Manage your subscription. Log in The Daily