VC Monthly Report:$4.219 billion in May, down 38.2% from April 2022 and up 97.8% from May 2021

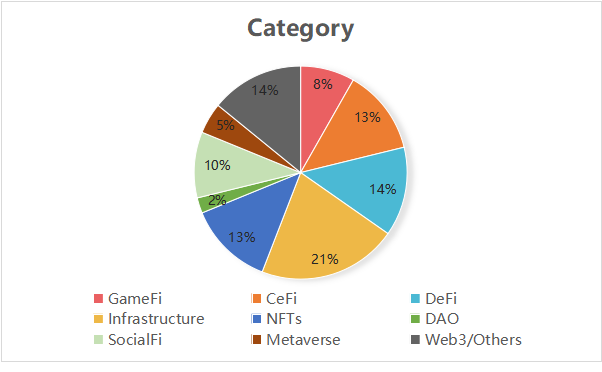

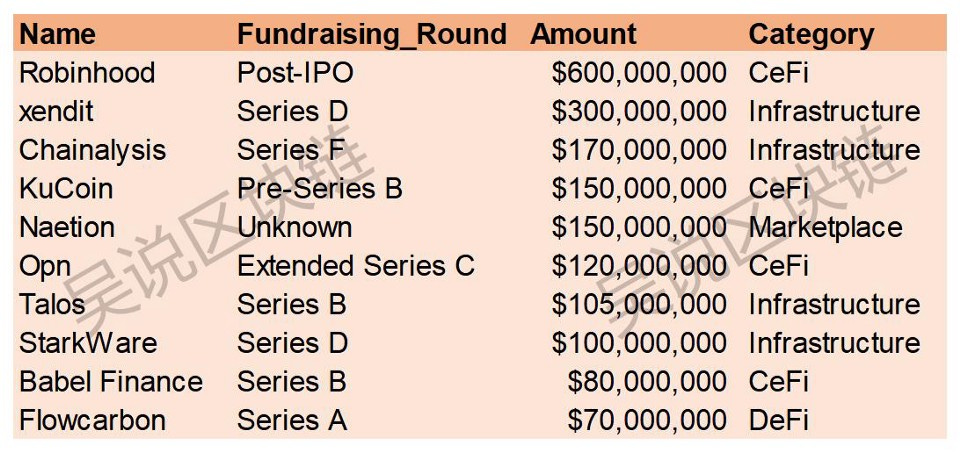

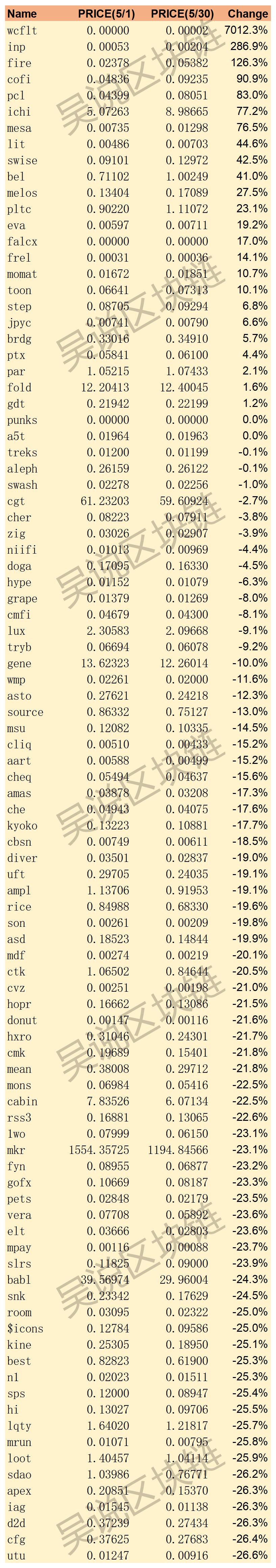

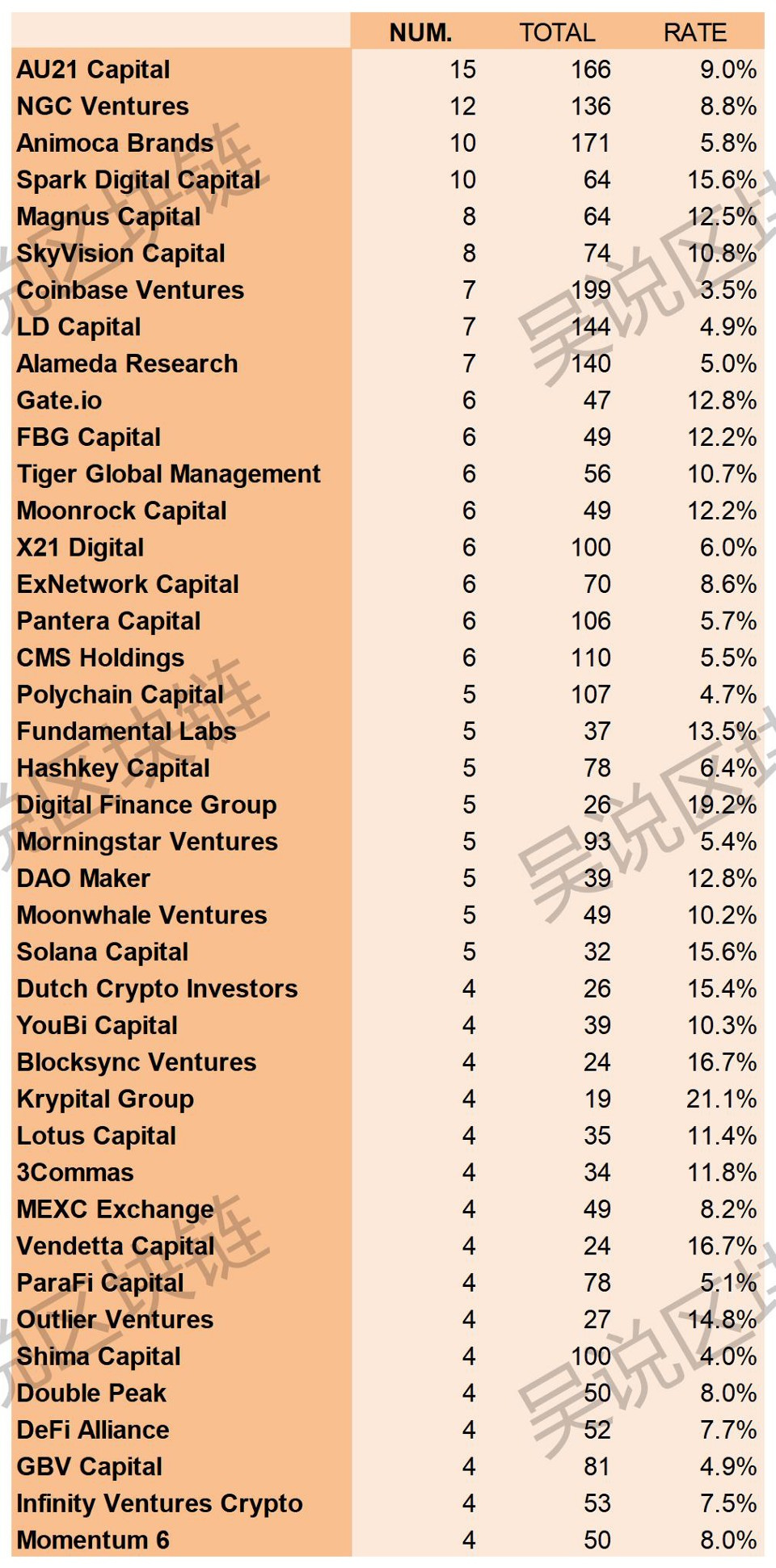

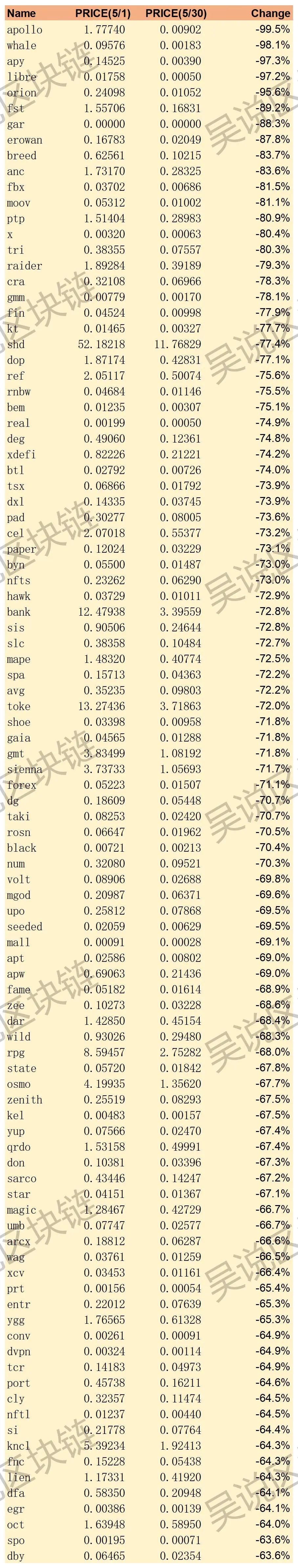

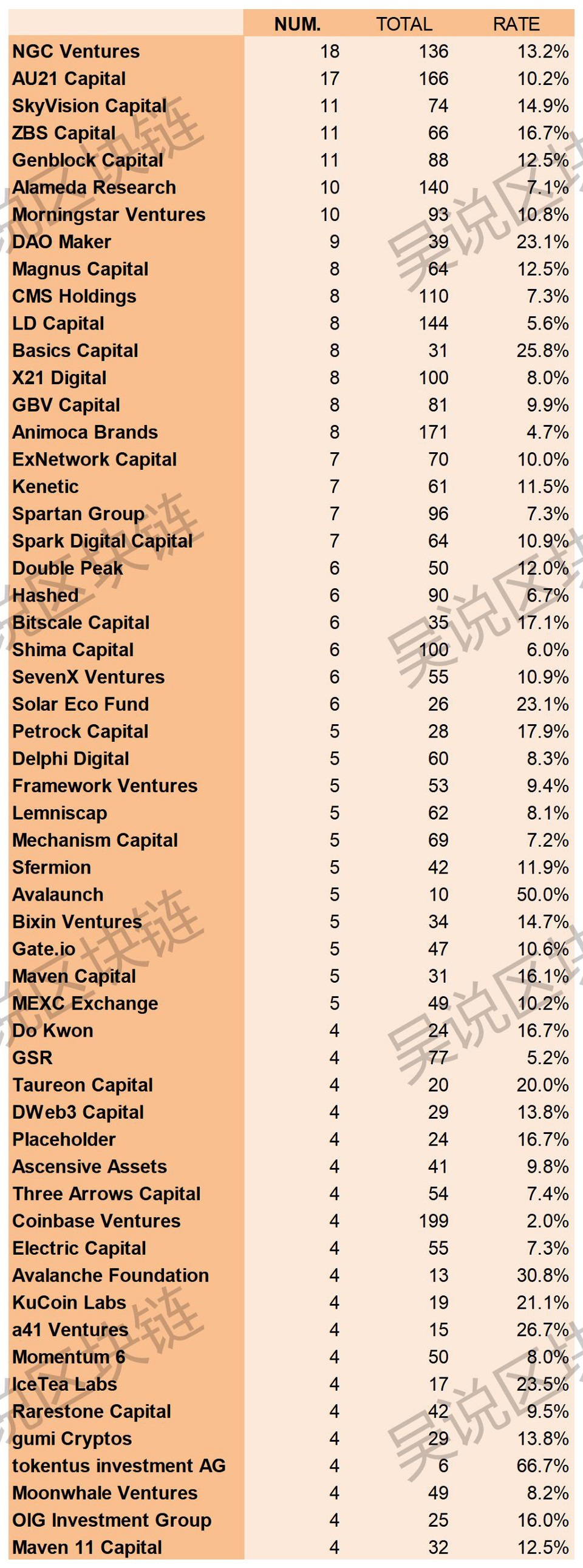

According to Dove Metrics, there were 169 open investment projects of crypto VC this month, including 170 rounds, down 24.2% from the previous month (224 rounds in April 2022), and 28.8% from the previous year (132 rounds in May 2021). The secondary industry breakdown is as follows. The secondary industry classification is as follows: Among them, infrastructure industry has the most projects, accounting for 21%, followed by DeFi, CeFi and NFT industry, and DAO industry has the least projects. Total funding for the month was $4.219 billion, down 38.2% from April 2022 ($6.829 billion) and up 97.8% from May 2021 ($2.233 billion). The top 10 financing rounds are as follows: A brief introduction to less well-known decentralization projects: Xendit, an Indonesian unicorn founded in 2016, is a fintech company focused on converged payment platform. Headquartered in Denmark, Naetion is committed to building the world’s largest on-chain career platform. Talos, currently valued at $1.25 billion, is emerging as the latest unicorn, aiming to provide institutional investors with optimal trading solutions. Its products help clients view prices from trading platforms and market makers in a one-stop shop, and issue trading orders and even complex algorithms. Flowcarbon is a carbon credit-enabled platform on the Celo chain that Tokenizes institutional carbon credits for collateralized lending or payment sales, or to redeem underlying real-world credits. Price performance in MayFinally, we have a brief count of the price performance of all projects (issued tokens) that have had a public funding record since July 2020 for this month. The total number of rounds is 821, containing 684 tokens. Among them, the top 100 tokens in terms of price increase in May. A total of 614 VCs have invested in these projects, of which 41 have invested in more than 3, which are listed as follows in number (the second column represents the total amount of investment projects since 2020.7) : Tokens in the bottom 100 in terms of price increase in May. A total of 692 VCs have invested in these projects, of which 56 have more than 3, which are listed as follows in number (the second column represents the total amount of investment projects since 2020.7) : Follow us If you liked this post from Wu Blockchain, why not share it? |

Older messages

TSE Sponsored:Global Crypto Mining News (May 23 to May 29)

Monday, May 30, 2022

1. Ethereum Core developers seem to be in consensus that ETH's difficulty bomb should be delayed by two to four months. Furthermore, Ethereum developers are keen on not delaying the difficulty bomb

Conflux co-founder How did StepN on BNBchain collapse?

Sunday, May 29, 2022

Author: @forgivenever Stepn is currently in a recession, where the Solana chain is still maintaining the economic cycle, but the Bsc chain has completely burst the bubble. This article is a brief

WuBlockchain Weekly:Terra2.0、STEPN CHINA BAN、Winter is coming and Top10 News

Friday, May 27, 2022

1、Terra releases airdrop details, 2.0 is coming, and everything seems to be settling down link Terra officials have now confirmed that Terra 2.0 is expected to on May 28th, 2022 at around 06:00 AM UTC,

In-depth: NFT lending is on the rise Exploration and prospect of financialization

Thursday, May 26, 2022

With CryptoPunks, BAYC and others out of the loop and the exploration of the metaverse on and off the field, more and more users and institutions are running into NFT. Although it is still niche, but

TSE Sponsored :Global Crypto Mining News (May 16 to May 22)

Monday, May 23, 2022

1. BitFarms announces that it mined 961 Bitcoin in Q1 2022 at an average cost of $8700/Bitcoin and revenues improved to $40 million in Q1 2022, up 42% from $28 million in Q1 2021. Bitfarms presented a

You Might Also Like

Texas doubles down on crypto with new $250 million Bitcoin reserve bill

Tuesday, March 11, 2025

Texas' second crypto bill seeks to enhance state and local government participation in digital asset investments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How-ey Can Get Out of Here

Tuesday, March 11, 2025

How On-Chain Data Can Clarify the Regulation of Cryptoassets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

February CEX Data Report: Significant Decline in Trading Volume Across Major CEXs - Spot Down 21%, Derivatives Dow…

Tuesday, March 11, 2025

In February 2025, the spot trading volume of major CEXs decreased by 21% compared to January. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

El Salvador defies IMF, continues Bitcoin purchases amid market downtrend

Monday, March 10, 2025

El Salvador's Bitcoin holdings grow to $504 million, challenging IMF directives amid sharp price declines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🖊️ Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO …

Monday, March 10, 2025

Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO for a Cronos Strategic Reserve; Texas's Senate passed bitcoin reserve bill SB-21 ͏ ͏ ͏

Vitalik TAKO AMA: ETH Positioning, Sequencer Centralization, L1 vs L2, Governance, and Success Metrics

Monday, March 10, 2025

On the evening of February 19th at 12 PM UTC and lasting until 12 PM UTC on February 20th, Vitalik Buterin, the founder of Ethereum, was invited to participate in a flash text interview on Tako (a

Donald Trump Creates U.S. Bitcoin Reserve

Monday, March 10, 2025

March 10th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Donald Trump Creates US Bitcoin Reserve Diddy Shows 'Kindness' To Sam Bankman-Fried Robinhood Conducts $1M Crypto Trivia

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏