Coin Metrics' State of the Network: Issue 158

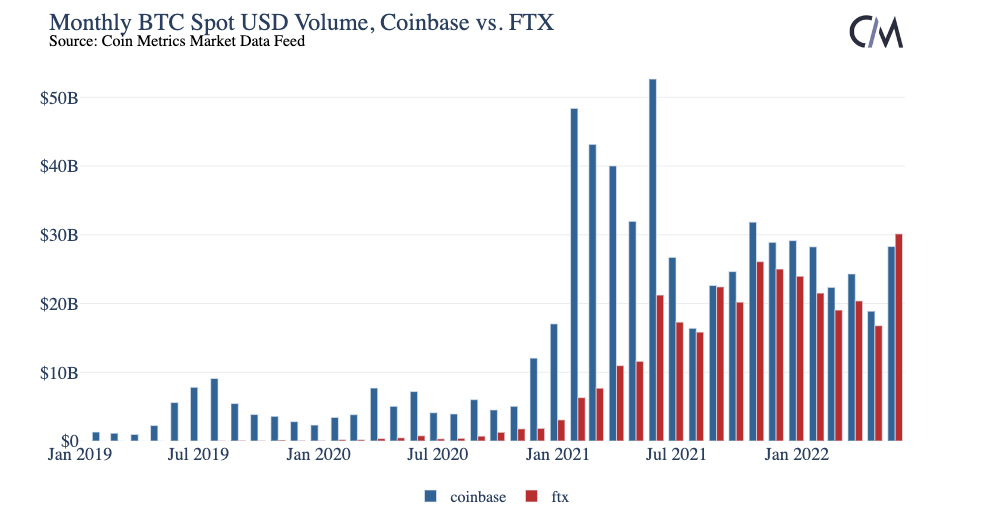

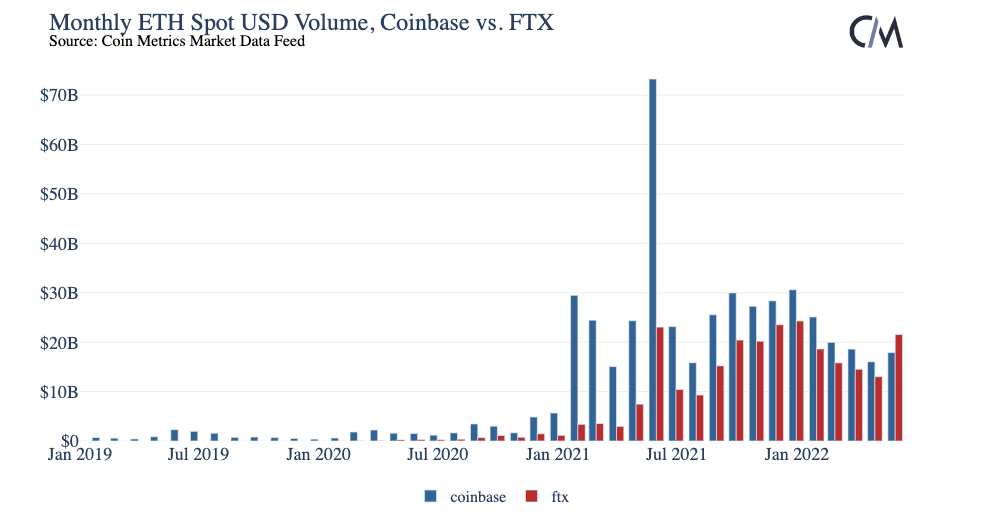

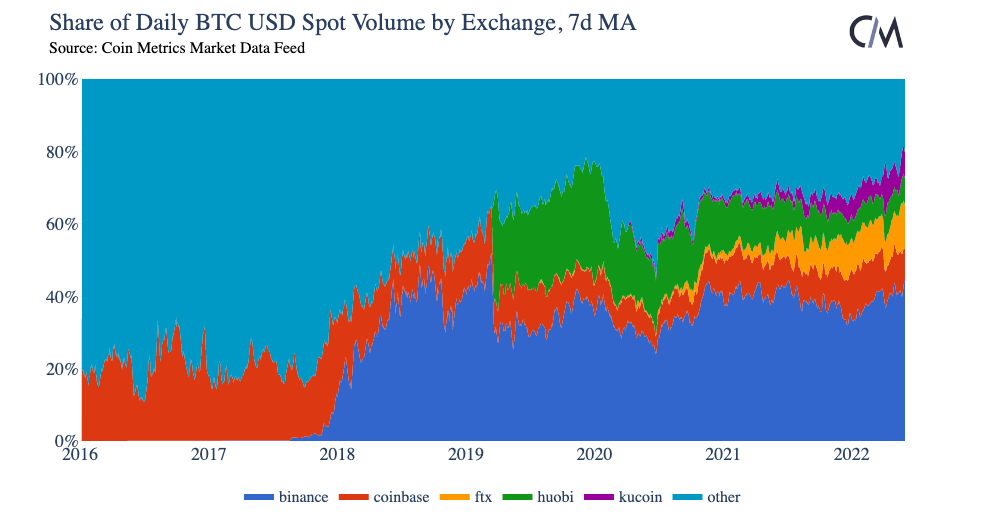

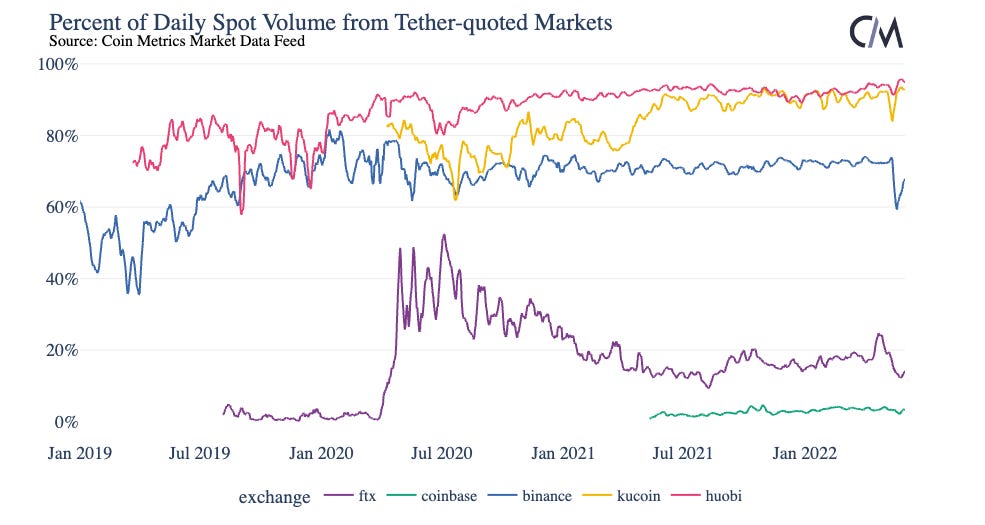

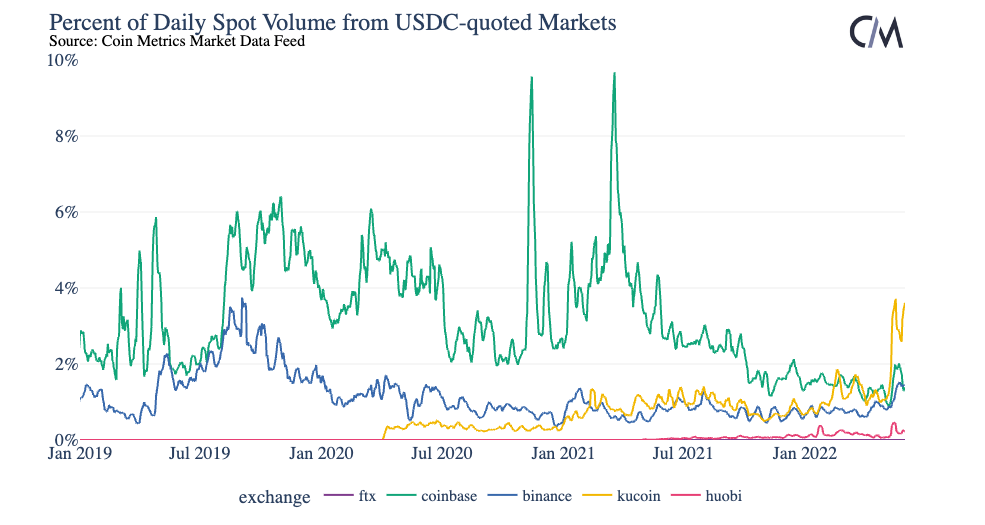

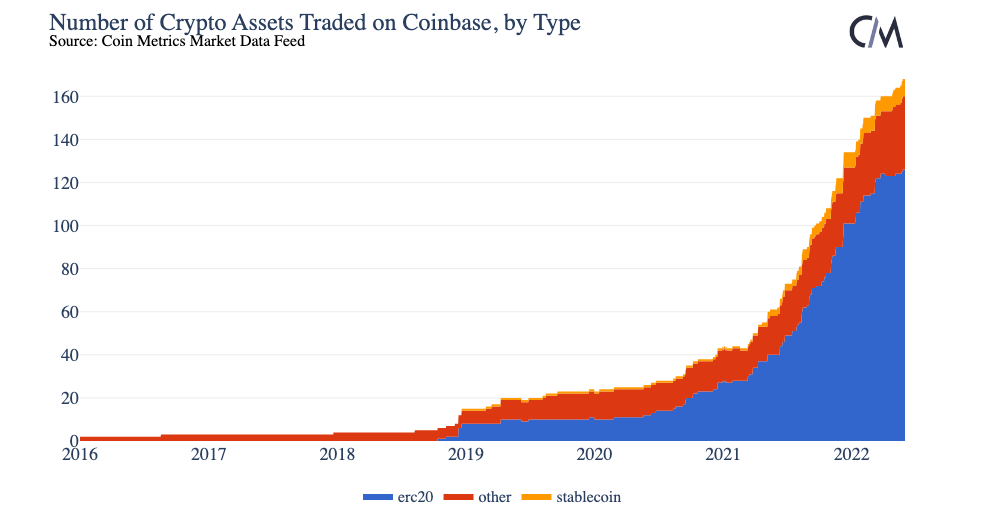

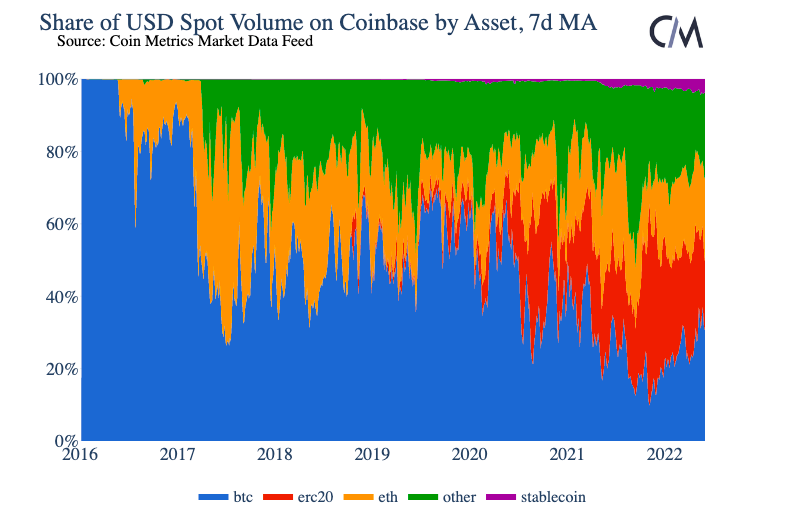

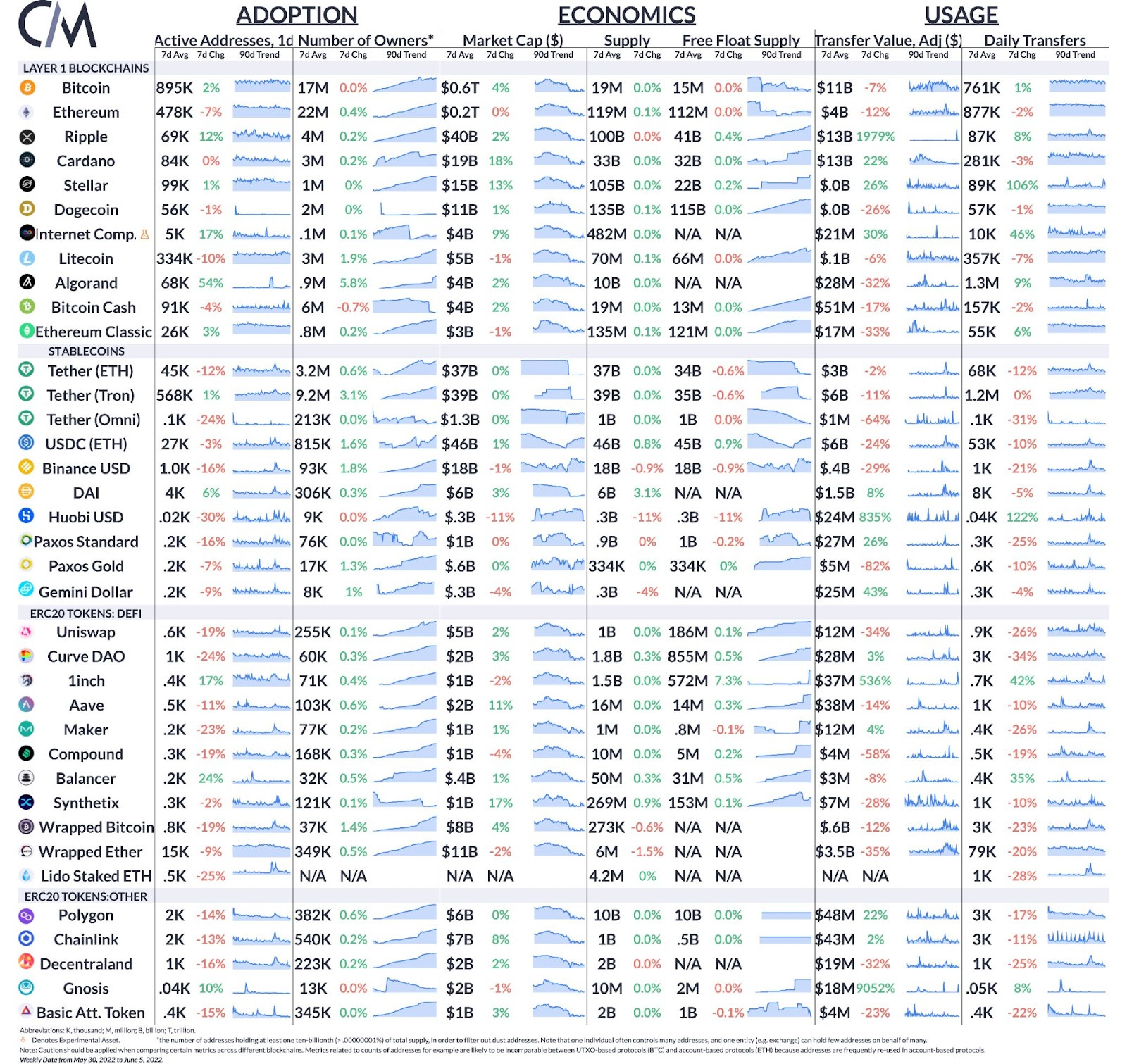

Get the best data-driven crypto insights and analysis every week: Analyzing FTX & Coinbase Spot Volume TrendsSource: Coin Metrics Market Data Feed May was also the first month where ETH spot volume on FTX was higher than on Coinbase. Source: Coin Metrics Market Data Feed Source: Coin Metrics Market Data Feed Historically, about 70% of all daily spot volume on Binance has come from USDT-quoted markets. This quickly fell last month when USDT briefly de-pegged from $1 amid the meltdown of the ‘algorithmic’ stablecoin TerraUSD (UST) and Terra’s LUNA. The volume share of USDT-quoted markets on Binance has since recovered somewhat as USDT has recovered its peg. Source: Coin Metrics Market Data Feed Despite the intensified scrutiny around USDT, the share of all volume from USDC-quoted markets has remained much lower by comparison. Binance and Kucoin have both seen an uptick in USDC-quoted market volume from last month but those markets in aggregate still make up single-digit percentages of all spot volume on those exchanges. In US-domiciled exchanges like Coinbase, direct crypto to fiat trading is the far more popular option, with crypto to stablecoin pairs seeing much less volume. Source: Coin Metrics Market Data Feed Finally, the composition of spot volume by asset continues to fluctuate on exchanges. Last week Source: Coin Metrics Market Data Feed ERC-20 tokens now make up a nearly-equivalent share of spot volume on Coinbase as ETH. On June 1st, 2022, total spot volume on Coinbase was $2.5B, with $980M BTC volume, $570M of ETH volume, and $370M coming from ERC-20 tokens On June 1, 2022, the top-5 ERC-20 tokens by spot trading volume on Coinbase were: 1. Chainlink (LINK): $43M 2. Shiba Inu (SHIB): $36M 3. Polygon (MATIC): $27M 4. Bored Ape Yacht Club (APE): $20M 5. NuCypher (NU): $19M Source: Coin Metrics Market Data Feed But as the altcoin rally has quieted, BTC’s share of spot volume has ticked back up on the exchange, but is still far below its level of dominance pre-2021. Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Pro On-chain activity was mostly flat over the week with Bitcoin daily active addresses averaging around 895K, an increase of 2% over the past week. Ethereum activity ticked slightly downward with daily active addresses averaging below half a million for the first time since 2020. Adjusted on-chain transfer value also fell for both BTC and ETH over the week. However, at $11B and $4B per day, both chains are still seeing activity well above 2020 levels. Looking at stablecoins, the nominal differential between USDC and Tether (USDT) free float supply on Ethereum hit a new high of close to $11B. USDC free float supply on Ethereum stood at 44.93B as of June 5th, rising close to 3.5B since May 10th. Network HighlightsThe effects of the Ethereum difficulty bomb are slowly starting to show on the network. On June 4th the mean time between blocks was 14.6 seconds, the longest since November 2019. Daily block production has fallen to ~6.1K per day. Source: Coin Metrics Formula Builder The difficulty bomb was first introduced just after Ethereum’s genesis in 2015 as a scheme to guarantee a hard fork and move away from PoW to PoS. The original idea was to implement a sudden exponential rise (hence the ticking time bomb analogy) in the difficulty of mining new blocks on Ethereum, rendering PoW obsolete. However, as the ambitious early timeline for PoS shifted, the difficulty bomb has been disarmed and pushed out into the future many times now via hard forks (noticeable on the chart above). But as Ethereum’s move to PoS via “The Merge” appears to be approaching, Ethereum core developers are currently determining whether another hard fork will even be necessary. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. © 2022 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. If you liked this post from Coin Metrics' State of the Network, why not share it? |

Older messages

Coin Metrics' State of the Network: Issue 157

Wednesday, June 1, 2022

Wednesday, June 1st, 2022

Coin Metrics' State of the Network: Issue 156

Tuesday, May 24, 2022

Tuesday, May 24th, 2022

Coin Metrics' State of the Network: Issue 155

Tuesday, May 17, 2022

Tuesday, May 17th, 2022

Coin Metrics' State of the Network: Issue 154

Tuesday, May 10, 2022

Tuesday, May 10th, 2022

Coin Metrics' State of the Network: Issue 153

Tuesday, May 3, 2022

Tuesday, May 3rd, 2022

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏