The Daily StockTips Newsletter 06.15.2022

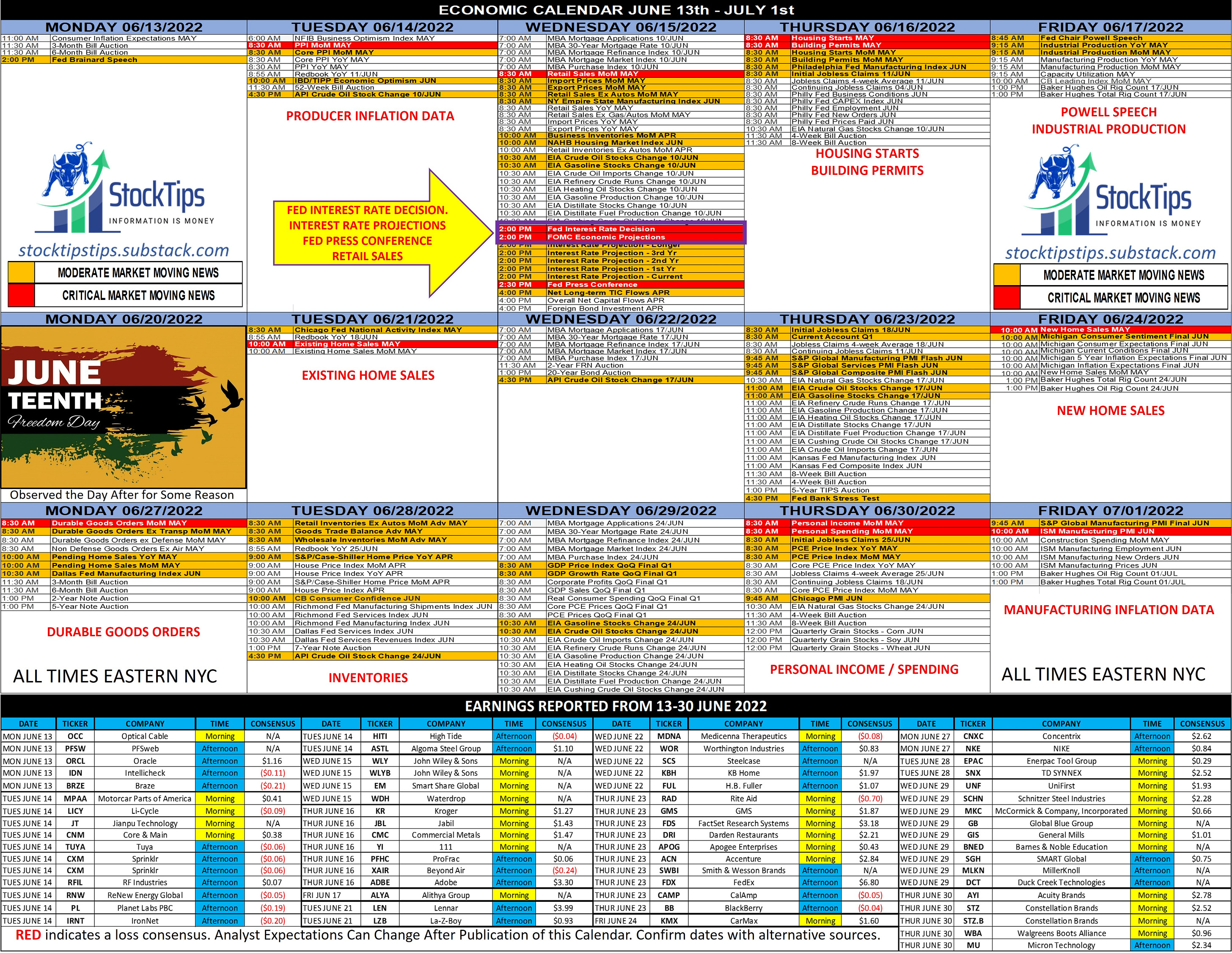

The Daily StockTips Newsletter 06.15.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)CLICK HERE TO SEE THE STOCKTIPS RECORD WE’RE ON YOUTUBE NOW! See HERE, HERE, & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings (Note: Red on the Earnings Calendar Indicates an Earnings Loss [Not Miss] Consensus), & Yesterdays Insider Buys. NEVER BE SURPRISED BY EASILY ANTICIPATED MARKET BREAKING NEWS. That’s our goal here. StockTips is NOW on Odyssey. Its like Discord … only Better in my Opinion. Android device access coming soon! TODAYS OBSERVATIONS: I could certainly be wrong on this. I have a moderate, not a great deal, of confidence on what I’m about to tell you. Indeed it is important that I weigh how much value I hold in the following before getting into the weeds here. If I’m wrong, I’m wrong … I’m not afraid to be wrong. But I feel its good for folks to come up with their own assessment, so let the conversation start here. I DO NOT think the Fed is going to implement a 75-bps rate hike. The Fed has already noted less than a month ago that they weren’t entertaining a 75-bps hike. They’re going to erode away further credibility if they stray from this, although this isn’t the primary reason for my assessment. The primary reason I think The Fed will NOT implement a 75-bps rate hike is that the current & future rate hikes are amplified when we add in the fact that the Fed has just started to offload their balance sheet (Started on June 1st). It stands to reason that they will want to see how sucking money out of the economy will affect inflation before they commit to additional dis-incentivization of money creation. Remember, we have perhaps the most reactive, not proactive, Federal Reserve in my 41 year lifetime. Moreover the Fed is completely out to lunch as to their fault in creating this inflationary environment, choosing instead to blame external factors. External factors no doubt have their place in all of this, but if you believe that Ukraine, supply chains, oil disruption, & economy reopening are the primary drivers on inflation, while forgoing the demand fueling monetary reasons for inflation which was created by the Fed & government spending, you are less inclined to raise rates higher than projected. In truth the supply chain issues did create inflation ... but the Feds loose & easy money policies amplified, encouraged, exacerbated, & were an important factor in helping to create the supply chain crisis, as the markets did not have a chance to react naturally, & low interest borrowing helped firms mitigate the increase in prices. The question is, if I am correct, how will traders react to anything less than a 75-bps rate hike? Common consensus is, historically, anything less than the expected rate hike will result in a market rally. Given the current environment however, I believe if Powell announces anything less than a 75-bps rate hike it will result in a market dump. Such a scenario will be taken by investors & traders as “the Fed isn’t serious on tackling inflation.” However I would not expect a bed of roses either if they announce a 75-bps hike. There may be … “MAY BE” … a small market rally … but the implications of a 75-bps hike is serious! You had better believe Powell is cognizant of how these rate hikes will affect the poor & middle class. He knows the implications on the housing & finance markets. As a result he will be very hesitant to raise rates high & fast as he also seeks quantitative tightening, which but amplifies the effects of current rate hikes. There are implications on the value of the dollar & the balance of trade as well. As I said before, I could be wrong. The Fed could certainly announce a 50-bps rate hike & the market may rally. They could announce a 75-bps rate hike & the market may dump. Both these scenarios go against what I’m assessing here. Yes, I know the big financial institutions are all announcing that they believe there will be a 75-bps hike … but given their shadiness in 2008 I would not put it past them to signal to the Fed their wish list while establishing a net short position on affected markets … which they likely have a hefty profit on already. Moreover the financial institutions make a killing on high interest rates. So trust them if you dare! At 2:00 pm ET you will know if the Fed will implement a 50 or 75-bps rate hike. At 2:30 pm ET you will hear from Fed Chair Jerome Powell. If there is one thing I can promise you, it’s that today will be confusing & volatile … not only at market open … but also the closer we get to 2:00 ET & as Powell speaks at 2:30 ET. Now lets see if my assessment rings true. BUY LIST UPDATE: It’s always tough after a market dump to add either long or short plays. Be patient folks. All of the suggested short plays I posted earlier worked marvelously! But I’m hesitant to add more given the market lows. It seems to me that shorts are holding & when they cover the markets will rally. TODAYS EARNINGS: WDH EM WLYB WLY … I would post a chart but there are no consensus estimates for these companies. Earnings season is effectively over. PAID CONTENT IN THE PAYWALL BELOW: 1 Stocks on the BUY LIST near/at/above the Buy Zone (Waiting to Swing) / 1 Options Strategy / A Detailed Breakdown of Yesterdays Earnings Beats & Misses / Most Recent Insider Buys/Sells / IPO Lockup & Quiet Period Expirations / 19 Stocks on the Price Based Assessment Watchlist / 3 Stocks on the Stocks Under $20 List (Read the Warning/Disclaimer) / 3 Stocks on the Highly Speculative Highly Volatile Small Cap List (Read the Warning/Disclaimer) / 5 Stocks on the short possibilities list. 👉CLICK HERE TO SEE THE DETAILS OF EVERY STOCK ON THE BUY LIST (AND SEE THE PRICE ASSESSMENT BASED WATCHLIST / THE STOCKS UNDER $20 LIST & THE HIGHLY SPECULATIVE LIST) LOGIN INSTRUCTIONS: You will need to login to see the detailed list. The “email login link” will send the link to login directly to your inbox (Click the link & it will automatically log you in). You can also choose the “login with password” option. You will need to set up a substack password for this option.Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 06.16.2022

Friday, June 17, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 06.14.2022

Tuesday, June 14, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 06.13.2022

Monday, June 13, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 06.10.2022

Friday, June 10, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 06.09.2022

Thursday, June 9, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Issue #275: You're preapproved… to spend a bunch of money

Wednesday, March 5, 2025

plus Soup Watch 2025 + snacking cakes ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Harry's Take 3-5-25 Economy Suddenly Weakens: Recession Coming Soon?

Wednesday, March 5, 2025

Harry's Take March 5, 2025 Economy Suddenly Weakens: Recession Coming Soon? I've been seeing the economy as the most stretched in history after the longest $27T US stimulus program, by far.

💀 RIP, world's biggest dividend

Tuesday, March 4, 2025

Aramco slashed its billion-dollar handouts, the US faced retaliation, and bitcoin went up against organs | Finimize Hi Reader, here's what you need to know for March 5th in 3:14 minutes. Aramco –

RIP to the 4% Rule

Tuesday, March 4, 2025

How to ignore the retirement strategy ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

President Trump is asserting extraordinary power over independent agencies. Is the Fed next?

Tuesday, March 4, 2025

The rise and potential fall of independent agencies. View this email online Planet Money Not-so-independent agencies anymore? by Greg Rosalsky President Trump vs. the independent agencies. It's a

No Sales, No Survival - Issue #514

Tuesday, March 4, 2025

What smart businesses are doing to win in the long run. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏