| Dear friends,In JC’s Newsletter, I share the articles, documentaries, and books that I enjoyed the most in the last week, with some comments on how we relate to them at Alan. I do not endorse all the articles I share, they are up for debate. I’m doing it because a) I love reading, it is the way that I get most of my ideas, b) I’m already sharing those ideas with my team, and c) I would love to get your perspective on those. If you are not subscribed yet, it's right here! If you like it, please share about it on social networks! Share 💡JC's Newsletter

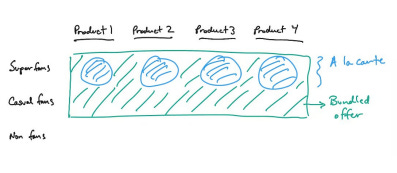

💡 BundlingOne amazing interview of Shishir Mehrotra and some good examples of bundling strategies in three other articles. 👉 An Interview with Coda Founder (and Bundle Expert) Shishir Mehrotra (Stratechery) What to bundle: When most people think about building a bundle, they start the opposite way. They run a survey, the New York Times goes and runs a survey and says, “Who should we be bundled with?” What does the survey say? The survey says The Washington Post. Now, the truth is, those have high overlap. If you bundle those together, all you’re doing is you’re obviously super-serving that audience, the superfans of both products, but you’re actually not creating new economic value. The right thing to bundle with is actually things that are very different. It’s very counterintuitive, it’s hard to execute as well. Cable channels have done it famously with like, ‘Oh, you get history and sports from the same people.'

➡️ Bundling, and the importance of not having too much super-fan overlap. This is a very counterintuitive but a very smart way to think about bundling products. Marginal Churn Contribution : The mistake many people make is they try to correlate usage with MCC, with marginal churn contribution, and it’s generally wrong. The core idea of “people value access over usage” is a really interesting idea. This idea of marginal churn contribution actually applies to products in general. You’re building a product, and you like Coda, and you say, “Hey, what should I do next?” You kind of have two choices. You have things that are going to drive usage and things that are going to drive new users, you’re going to create MCC. You can apply the exact same philosophy the same way, “I’m going to add this thing, I think it’s going to add new users”, or prevent them from churning, versus things that are going to increase usage.

You think about marginal impact, which is much more powerful than some of the other way of measuring success.

➡️ I think that it is very important for us and our health services. It is not necessarily about increasing usage, it is about having a lot of perceived value. Do we need to have 100% of the employees who use Alan Mind or if we have 10% that are very active, will we make sure that the company will never churn because the employees would be very vocal about it? Because having 10% engaged increases the productivity of the full company? I believe our new features should be mostly about the marginal new value we create and not necessarily about pushing always for more usage. A whole thing about Microsoft products themselves, that the company understands that so many other companies don’t, which is yes, 80% of the users only use 20% of the features, but that 20% is different for every single user.

➡️ Very interesting! And will apply for us in terms of healthcare services. Brand:

➡️ Interesting that they use “all-in-one”. We played with it too. Type of products and How to fight entrenched competitors In the productivity space, products tend to be one of three modes. You’re either a single player product, an all player product, or a multiplayer product. It’s really hard to use Gmail if everybody in the company doesn’t use it. Multiplayer products where you can use it by yourself, you can use it with everyone, but it doesn’t require everyone to agree in order to use it, and that’s definitely Coda. It can go team by team.

➡️ What product would be team by team for Alan? If you’re going to build a product in this space, and you’re going to go up against two players that are deeply entrenched in Office and Google Docs, you don’t want to come at them head on, you want to come at them with a way for people to gradually work their way into the product, learn, understand, evangelize, and then have the conversation on what can be replaced.

Culture: “Great companies have a small list of golden rituals, and golden rituals have three criteria. Number one, they’re named Number two, every employee knows them by their first Friday, Number three, they’re templated.”

If you take those three criteria and look at different companies, Bing uses examples like Amazon has six pagers and Google has OKRs and Salesforce does a thing called V2MOM. Many companies have these iconic rituals.

➡️ I love naming rituals, that is something that really sticks in company culture. Dory and Pulse. It’s a pretty simple idea, but the way Coda meetings work is, instead of everybody blurting out questions, you add them to a table, we call it a Dory, and you vote them up and down. So we organize a discussion that way, Dory’s the fish who asks all the questions, and then we do this thing called Pulse. So when we’re ready to make a decision, you go into this other table and you say what your viewpoint is, but everybody else’s viewpoints are hidden until you enter yours, and so you get this unbiased view of what the pulse of the team really is.

➡️ How could we apply this to our written issues? 👉 Bundle & the NY Times: Thread by Rob Litterst (Ping Thread) The entire purpose of a bundle is unlocking CasualFan revenue. Bundles capture more $ from SuperFans, and pull in CasualFans that wouldn't buy otherwise.

When most people think of NYT they think News. However, for a while now NYT has actually offered 2 other paid products: Here's how each product is priced independently (without promotions): The only way NYT will capture $301 from a consumer is if they are a SuperFan of all 3 products. The NYT team understands how rare this is, which is why they offer a bundle of all 3. The All-Access Bundle costs $182 per year, a ~40% discount off the combined retail price. The bundle gives users unlimited access to News, Games, & Cooking, but there's a kicker: It includes a bonus subscription. This is genius - it doubles the likelihood that someone is a CasualFan of 1 of the 3 products, making the subscription stickier. Let's make this real...Take a couple where one person loves crossword puzzles and the other is a casual newsreader.

👉 Disney Earnings, Disney and Linear TV, Disney+ Ads (Stratechery) The bundle is really efficient in terms of churn, and that gives us a lot of bullishness when it comes to the idea of bigger offerings from Disney. The bundle that Chapek is referring to is Disney+, Hulu, and ESPN+ for $13.99/month; subscribing to all three services separately would cost $21.98/month ($7.99 for Disney+, $6.99 for ad-supported Hulu, and $7/month for ESPN+). That’s a great deal for customers, but it’s also good for Disney because one of the biggest costs for a subscription service is customer acquisition; it is far better to have a customer that doesn’t churn because (1) they feel like they are getting a deal and (2) they have more things they might want to watch.

👉 What Twitter learned from subscriptions (Platformer) When Twitter Blue arrived in Canada, it felt mostly like a cosmetic offering. The service let you change your app icon; put threads in a dedicated “reader mode” for easier consumption; and organize bookmarks into folders. YouTube Premium this was not the case. As of today, though, Twitter Blue offers features that are purpose-built for its biggest fans: news junkies! One, the company has revived Scroll, which enables ad-free consumption of news articles from many popular sites — while directing subscription revenue to those same sites. And two, its new Top Articles feature allows you to see which articles were most widely shared in your network over the past 24 hours — mimicking the beloved Nuzzel, a standalone service that Twitter shut down earlier this year. The other new power user features in Blue are nice, too, Customizable navigation, longer video uploads, pinned conversations in direct messages, and a (kludgey) “undo tweet” feature. More than anything, I’m impressed by the overall package: a large and useful set of features, aimed at the people who use Twitter the most, for three bucks a month.

➡️ Who are our biggest fans and how can we build things for them? 👉 Don’t forget Microsoft (luttig’s learnings) Consumption-based pricing is a bet on yourself: Consumption-based pricing is the business model that is most aligned with customers. The opposite is simply a poor customer experience: why pay for something before you receive it, or if you may not use it at all? Unsurprisingly, many of the fastest growing companies have some version of consumption-based pricing: AWS, Azure, GCP, Snowflake, Twilio, Scale. It may feel less “safe” than pure SaaS because the customers are not guaranteed to renew, but it lowers the barrier to adoption. Consumption-based pricing is the best way to bet on the quality of your own product: it perfectly aligns product, customer success, and sales. If customers are engaging with your product, it is a win-win.

➡️ Very different from bundling but a good inspiration for other ways to price your product.

🗞In the news: market environment📱Technology👉 The Markets (ICONIQ Weekly) European Central Bank interest rate hike: The European Central Bank (ECB) announced this week that it will end its longstanding bond-buying program on July 1st and raise the key interest rate, currently at -0.5%, by 25 basis points next month. Moreover, the statement said that the ECB expects to also raise rates in September, but that the calibration of the adjustment may depend on inflation expectations, making a 50-basis-point increase an option. May saw the Consumer Price Index—which measures the weighted average market prices of consumer goods and services purchased by households—reach an all-time high of 8.1% in the euro zone, well beyond the ECB's target of 2%. This will be the ECB's first rate increase in more than a decade in an attempt to better control historically high inflation.

👉 Thread by Gokul Rajaram about the market (PingThread) I’ve been speaking with leading private / public market investors, to get a sense of how they’re thinking about valuing growth stage or public companies. Primacy of FCF margins: investors are looking for a company that they believe can structurally get to 30% free cash flow margin (adjusted for stock based comp) at terminal state (typically defined as when the company is growing 10% YoY) This is becoming a hard and inflexible rule, versus the past few years where it was lax. Investors believe there are many good public companies that are growing 50-60% YoY but have no believable path to a 30% FCF margin due to structural or other reasons. Muted revenue multiples. Growth investors are still willing to give fast growing companies a multiple on their revenue (as long as there is a believable path to 30% FCF margins). The revenue multiple will depend on the growth rate (rough median multiple I heard was 10x for $100m forward revenue growing 50% YoY and running at break even or slightly negative margin - a very high bar). To summarize, growth investors plan to take concentrated positions in the absolute best companies that have a clear path to 30% FCF margins, and are willing to pay a muted revenue multiple to do so. Most of these investors are still on the sidelines with billions in dry powder, but everyone is doing their work right now to get ready. Just to clarify, FCF = "operating cash flows" aka "cash flows from operations". Amazon had low FCF for many years because they used their positive operating cash flows to invest in fulfillment centers and data centers. Investors are fine with that and like that.

🏥 Healthcare👉 Opinion | Pour un véritable système de santé (Les Echos) Moins d’hôpitaux sur le territoire mais plus de centres de santé de proximité où les soins de base pourraient être dispensés, ainsi que davantage de prévention, propose Guy Vallancien. La priorité devrait être donnée au premier recours dans ces lieux de proximité sanitaire ou les populations seraient à la fois informées des recommandations à suivre pour rester en forme, suivies pour leurs pathologies aigues bénignes et chroniques et aidées au travers d'une rééducation et d'une réhabilitation à la vie active. Objectif visé : éviter les hospitalisations ou les rendre les plus brèves possibles. En chirurgie, des variations du simple au triple des taux de décès et de complications selon le nombre d'interventions effectuées par an sont observées, mais jamais publiées. Evaluer en temps réel la pertinence et de la qualité des pratiques médicales est la deuxième clef d'un système de santé efficient. Alors que le nôtre est bancal, coûteux, aux résultats finalement assez médiocres pour une dépense élevée (12,4% du PIB en 2020). Croire que la proximité garantit la qualité des soins est une grossière erreur, n'en déplaise aux élus locaux.

👉 Weekly Health Tech Reads 6/12 (Health Tech Nerds) Cerebral's tailspin continues this week, with a Forbes report out that Aetna has cancelled its in-network contract with Cerebral and a WSJ report digging into the growth of the business and how the desire to scale led it to make a number of decisions that appear very questionable in terms of patient impact. (Forbes) (WSJ) Cerebral had approximately 1,000 patients with serious mental illness who were Aetna members, and it is not hard to envision other payors follow suit after seeing Aetna make this move. The WSJ article includes the astonishing fact that between January and May 2022, Cerebral spent $13 million on TikTok advertising, the third largest advertiser behind HBO and Amazon. It is hard for me to imagine a world where it is a desired state to have healthcare providers among the highest advertisers on social media platforms.

➡️ The amount of marketing seems very high, but to be compared to their scale. A good New Yorker article looking at the rise of fertility coaches and how those coaches are both serving a gap in health care for people trying to conceive, but can also exploit that and price gouge. The fertility space provides a unique lens into how complicated it can be when an empowered consumer hires a "coach" who questions the decisions of the provider, and how hard that can be on the patient who is now stuck between their coach and a provider when they disagree. While it certainly generally seems like a good thing that coaches are available to support people in this manner, it also isn't without its complexity (and potential for exploitation by bad actors). Link

➡️ I believe that fertility coaching could be a huge topic for us in the future, and it needs to be done well.

It’s already over! Please share JC’s Newsletter with your friends, and subscribe👇 Let’s talk about this together on LinkedIn or on Twitter. Have a good week! If you liked this post from 💡JC's Newsletter, why not share it? | |