The Signal - Dark Cloud hangs over Alibaba India

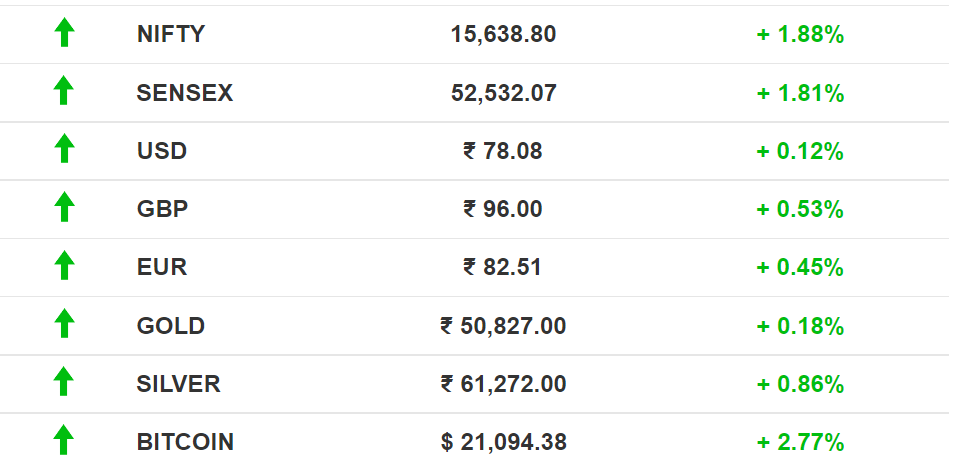

Dark Cloud hangs over Alibaba IndiaAlso in today’s edition: Paramount goes global; RBI is banking on SFMS; Life insurers could sell mediclaim; Ford-GM spar over EVsGood morning! Fancy a bhaang ka sandwich? Or hemp coffee? You can order all this and more from recently-launched The Hemp Cafe, in Pune. Yes, it's legal since everything on the menu has less than 0.3% of THC. If you enjoy reading us, why not give us a follow at @thesignaldotco on Twitter and Instagram. 🎧 Anti-Instagram apps are here. 🎧 For our deep dive, we look at how smartphone maker Realme fought Samsung and Xiaomi. It seems to be winning. The Market Signal*Stocks: Domestic benchmark indices climbed for the second straight day, right after US Treasury Secretary Janet Yellen suggested that a recession in the US is not "inevitable". Stocks are on track for a relief rally despite rising recession fears. Brent crude traded above $115 per barrel. Investors became richer by ₹5.8 lakh crore on Tuesday. Early Asia: The SGX Nifty slumped 0.83% in early morning trade. The Hang Seng Index was down nearly 0.49%. Nikkei 225 was 0.03% below its previous close at 7.30 am. TECHNo Silver Lining For Alibaba CloudAlibaba is in trouble again, this time in India. An investigation by the Ministry of Corporate Affairs (MCA) and the Mumbai Police into Alibaba Cloud’s India unit found that some documents filed with regulators were ‘false or fabricated’. What happened? According to the report in The Economic Times, the investigation revealed that Alibaba Cloud’s Indian-origin partner resigned shortly after it was incorporated in March 2017. Additionally, chartered accountant Anand Kidambi helped incorporate the unit by filing fabricated documents, including a fake address. Alibaba is one of 700 companies with Chinese nationals currently under the Indian scanner. No reprieve: Alibaba Cloud was reviewed by the Biden administration as a potential threat to US national security. Its growth is also stagnating in China as government officials increasingly favour state vendors. STREAMINGParamount Does A NetflixParamount+ is taking a leaf out of Netflix’s playbook. It’s betting big beyond the US despite subscription fatigue, Netflix’s depressing last quarter, and Disney contending with a potential subscription slowdown after it ceded its exclusive IPL rights. Gameplan: Paramount+ will employ the global-to-local strategy with its 150 original content projects as it dips its toes in new markets: the UK, Germany, Spain, Italy, and Mexico. What’s more, it’ll launch in India in 2023 in partnership with Viacom18. Paramount has a stake in Viacom18, the media juggernaut that just bagged IPL streaming rights. Except: Paramount+ secured 6.8 million subscribers in its first quarter of 2022, a stark contrast to Netflix's story. That’s enough to want to float its plans outside the US. Will subscribers cough up for one more service? Paramount remains hopeful. BANKINGRBI To Step Out Of India To Take On SWIFTThe RBI is planning to take its Structured Financial Messaging Solution (SFMS), the competitor of the global interbank secure messaging service, SWIFT, international. Going places: It also plans (pdf) faster and smoother payments processing, including using central bank digital currency for domestic and international transactions, as part of its Payments Vision 2025. While the RBI hopes to improve “customer centricity”, the burden of ensuring secure transactions will be on intermediaries such as banks and fintech companies.

INSURANCELife Insurers May Double As Health InsurersUntil now, life insurance companies could only sell fixed benefit health plans. But they may soon sell mediclaim policies. The Insurance Regulatory and Development Authority of India (IRDAI) is considering new guidelines. Corollaries: Non-life insurance (health, motor, fire) penetration is a meagre 1% in India. According to IRDAI, 75% of individuals pay for medical expenses from their pockets. As more people consider getting health coverage, life insurance players can leverage their extensive distribution networks, good underwriting skills and high cash reserves. This means premiums could probably decrease by 5%-10%. Potential cumbers: Pricing health insurance is knotty. Lower pricing may invite losses, and overpricing may repel potential customers. Life insurers will also have to keep up with health insurers’ claim processing abilities and hospital networks. ELECTRIC VEHICLESAmerica’s Oldest Carmakers Battle To Become Future ProofEVs have taken centre stage in one of the world’s fiercest business rivalries. GM and Ford—America’s biggest automakers—are duking in a bid to thwart Tesla. 101: Tesla sold 13x as many EVs as Ford and GM combined in Q1 2022, but the duo has the edge with affordable e-pickup trucks and SUVs. GM and Ford are pulling all stops here: pre-emptive PR strikes, price undercutting, and dissing each other’s strategies. Ford’s F-150 Lightning will hit market before GM’s Chevrolet Silverado, but GM has more models and a two-year headstart on battery factories. Taking charge: The war is trickling down to charging infrastructure. While Ford has the largest public charging network in the US, GM is developing smart chargers for homes and establishing a dealer network; about 90% of Americans live within 16 km of a GM dealership. FYICutting corners: Officials from Biocon Biologics, a subsidiary of Biocon, allegedly offered a ₹4 lakh bribe to the joint drugs controller to waive a phase-three trial for an insulin product. Fresh dough: Matrix Partners is looking to raise its fourth India-focused fund worth $450 million, according to regulatory filings. Beyond the papers: Facebook whistleblower Frances Haugen is raising money for a nonprofit aimed at holding social media accountable. Haugen intends to call it “Beyond the Screen.” Fined: Reliance Industries Limited and two of its officials were fined by SEBI [notice] for failing to properly disclose Meta’s $5.7 billion investment into Jio Platforms in 2020. No more fines: Google will not be required to pay more fines after addressing regulatory concerns in France over payments to news publishers. However, it wasn't as lucky in Germany, where Google Maps is under antitrust investigation. Three-way split: Kellogs is splitting its businesses into three companies, with cereal, snack, and plant-based food as separate business units. Easy peasy: The Madhya Pradesh government found a unique way to end illegal mining in the National Chambal Sanctuary: it made it legal. FWIWWhen in Rome: Restaurants in Mallorca, Spain have imposed a dress code to curb "anti-social" behaviour. The list includes football jerseys, strapless tank tops, swimsuits, glow in the dark hats. Buttoned-up outfits at a resort could seen be the norm. Make it make sense. Wheat, what?: A property developer in China—Central China Real Estate—has come up with a strategy to attract potential buyers. It will now accept wheat and garlic as down payments. This is aimed mainly at farmers in the central province of Henan; the developer is paying as much as $24,000 for wheat. Out and about: Elon Musk's teenage child has come out as a transwoman, dropped her famous surname, and has severed ties with her father. The petition was filed in California. Musk, a self-anointed "free-speech absolutist” was under fire in 2020 for tweeting “pronouns suck”. Good for her. Want to advertise with us? We’d love to hear from you. Write to us here for feedback on The Signal. If you liked this post from The Signal, why not share it? |

Older messages

Air India gets jet set

Tuesday, June 21, 2022

Also in today's edition: China stocks get booster shot; Agnipath's damp reception; India embarks on INSTC journey; Zilingo's not spoilt for choice

TikTok changes its tune

Monday, June 20, 2022

Also in today's edition: The great crypto meltdown; Exotic fruits bloom at home; No alternative for plastic straws; Musk is Musking

Talking stock

Saturday, June 18, 2022

A mid-year assessment shows that Indian equities could be close to the bottom

Airfares go full throttle

Friday, June 17, 2022

Also in today's edition: TVS eyes EVs; Facebook 🤝 TikTok 👀 YouTube; NY goes cold on crypto mining; Books are back with a bang

5G springs into auction

Friday, June 17, 2022

Also in today's edition: India's job corps; Streaming plays the waiting game; Amazon's flipping properties; New rule book for Big Tech

You Might Also Like

The BFCM Playbook To Millions In Sales

Tuesday, November 26, 2024

Come learn how to crush black friday cyber monday for brands

🦅 The once-in-a-lifetime deal is here

Tuesday, November 26, 2024

The new 𝕏 API costs forced our hand ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin Drops to $93K as Long-Term Holders Take Profits

Tuesday, November 26, 2024

Plus Saylor Buys $5.4B More Bitcoin Setting New Record at $97860

🕵️ 50%, then 35%, then 20%, then nothing

Tuesday, November 26, 2024

Steal Club BF offer is live :)

Rox

Tuesday, November 26, 2024

How to Manufacture Path Dependence in Applied AI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Are You Doing Cross Promotions Wrong?

Tuesday, November 26, 2024

Want Growth? Stop Sleeping on Cross Promos 🔑

This new ad format can boost sales by 15%

Tuesday, November 26, 2024

It's Thanksgiving Week, and online shopping activity will peak in a few days. You may be noticing more shoppable ads this year–interactive ads that allow customers to buy directly from the ad

Why Is Bitcoin's Price Dropping Right Now?

Tuesday, November 26, 2024

Listen now (3 mins) | Today's Letter is Brought To You By Range! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: November 26th 2024

Tuesday, November 26, 2024

Exploding Topics Logo Presented by: Semrush Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Scent Beads (trends) Chart Scent beads are dissolvable

Who's hit hardest by Northvolt losses?

Tuesday, November 26, 2024

GP stakes hit annual high; VC funding for decentralized AI triples; Halcyon takes home $100M Series C Read online | Don't want to receive these emails? Manage your subscription. Log in The Daily