Not Boring by Packy McCormick - Web3 Use Cases: Today

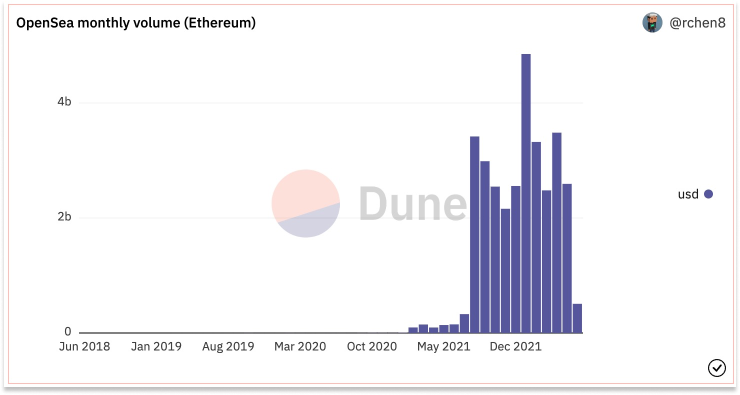

Welcome to the 2,539 newly Not Boring people who have joined us since the last essay! If you haven’t subscribed, join 133,524 smart, curious folks by subscribing here: 🎧 If you’d rather listen to this essay, head over to Spotify or Apple Podcasts Today’s Not Boring is brought to you by… Causal Our mission at Not Boring is to make the world more optimistic – but optimism needs to be paired with smart planning, and that’s where Causal comes in. Causal is a spreadsheet built for number-crunching — financial modeling, business planning, but really anything involving calculations. It's like Excel minus the arcane formulas (no more Sheet1!$E$4 or VLOOKUPs), plus live data integrations (accounting systems, CRMs, etc), and really cool shareable dashboards. Given current market conditions, every startup needs a solid financial model to steer the ship. I've worked with the Causal team to create the Startup Suite — a set of 4 template models for early stage companies: They've put together detailed video walkthroughs for each model in their documentation. Use one of my templates above as a starting point, or click below to just sign up for the product and start playing around: Hi friends 👋, Happy Thursday! I was off earlier this week celebrating my dad’s 65th birthday with the family (happy birthday, Dad!) so we’re coming at you today with the first part of a two-part essay on web3 use cases, present and future. When I flubbed a use case argument on Cartoon Avatars a few weeks ago, I unintentionally helped spark a debate about whether crypto actually has any real use cases. It’s been fascinating to watch since, as Zach Weinberg has successfully pigeonholed people into very narrow use cases to prove that the whole thing is overhyped. My conversation with Zach has lived rent-free in my head ever since, but the more I think about it, I’m most upset with myself for walking into such a narrow debate space and conceding so much. Today, as it stands, web3 has real use cases, even if some seem silly or early or flawed. So today and Monday, I want to walk through some of the current use cases, and then explain why I believe that over the next decade, web3 will power products, networks, and models that will impress even today’s biggest skeptics. To be clear: I’m not here to defend crypto as a whole, or to pretend to speak on behalf of everybody involved in the space. There are people who are actually building things who are much better champions. But I do think it’s a particularly good time to step back and take stock of this last cycle’s real use cases, and to share what excites me about web3 personally. Let’s get to it. Web3 Use Cases: TodayWeb3 Use Cases: TodayCrashes aren’t only painful because of price declines, although it’s never fun to see your account balances slashed relentlessly, day after day. Crashes are also painful because belief drains from the market as quickly as cash does. And those who never believed in the first place rush in to fill the void with a chorus of schadenfreude-laced I told you so’s. If you felt smart a couple of months ago, you feel less smart now. If you were proud to tell people about what you’re building a couple of months ago, you’re less proud now. Nothing you’re doing has changed – you didn’t get dumber, your idea didn’t get worse – but the sentiment has shifted around you. (The opposite is true, too: if you’ve been calling the top, calling crypto a scam or a bubble, you’re feeling very smart right now.) That’s not to say nothing is different. The market has undoubtedly changed. The prices of BTC and ETH have tumbled 76% and 69%, respectively (nice). Many alt coins are worse off than that. A big part of it is that macro conditions have changed dramatically. After two years of COVID-induced free money, the Fed is tightening rates. Worse, the US faces 8.6% inflation and there’s doubt that hiking rates will be effective in slowing it down. Worse still, there are supply chain issues and inventory issues and a war, which is bad in its own right and also bad because it means higher food and energy prices. Growth assets are selling off in the private and public markets, big layoffs are a daily occurrence, and inflation is hitting people hard. Real world challenges, like struggling to put gas in your car or food on your table, are more important than a pullback in asset prices. In the world we cover in Not Boring, no sector has been harder-hit than crypto and web3. In addition to declining prices, crypto implosions have wiped out peoples’ entire life savings. First, there was LUNA and USTerra, which Jon Wu explained in Not Boring:  I’ve seen tweets in which people describe having put their life savings into Terra to earn 20% yields via Anchorage without telling their significant other and lost everything. Multiple people in Korea, where Luna was based, have reportedly committed suicide. It’s worse than reckless; it’s tragic. Recently, the centralized DeFi (CeDeFi?) platform Celsius became insolvent…  People who put their money with Celsius expecting it to be safe are left wondering if they’ll ever get their money back, and if so, how much? On the less explosive side of things, many companies are struggling with early tokenomic models that seem to have worked a lot better when prices only went up. NFTs have been a lot less attractive to potential buyers in this early bear market, too. OpenSea’s volume, which is representative of the larger NFT space, has plummeted in June: The month isn’t over yet, but two-thirds of the way through, that’s a real drop. NFTs aren’t alone. The Total Value Locked (TVL) in DeFi is down 65% from a November peak of $107 billion to a current $37 billion total, according to DeFiPulse. More shoes will undoubtedly drop. If ETH drops as much as it did in the last crash, it could end up trading in the $200s (not saying it will, but it’s not impossible). More funds will blow up. Companies and projects will go bust. There are a lot of people on Crypto Twitter calling the bottom, calling this a generational buying opportunity, and maybe it is, but anyone pretending to know that with certainty is full of shit. One of the challenges of having money baked into the product, tradeable by anyone with an internet connection, is that it attracts a lot of grifters and false prophets. While tech stocks (and startup valuations) and crypto prices are both down bad, there’s a big difference between the two. Even the most bearish people on tech generally are simply predicting that multiples will compress, prices will fall further, and some companies that haven’t been managed well could fail. They’re not calling for the end of tech. The crypto skeptics are loudly yelling that the whole thing was a scam all along, and that there’s no value in the space whatsoever. While some of the vitriol is a proportionate response to the grifters who’ve been telling non-crypto folks to “have fun staying poor” or that they’re “ngmi,” a group I hope gets washed out in this bear market, the constant onslaught of skepticism from a lot of smart people (and, of course, some talentless hacks piling on) has to be making some people who are in crypto for the Right Reasons™️ question whether they should be in it at all. So I was staring at my computer on Saturday, trying to figure out what to write in this environment, and doing what I do when I can’t think of anything – mindlessly scrolling Twitter – when I came across this tweet from my friend and Every co-founder Nathan Baschez:  Plenty of people replied with examples of people who’ve kept tweeting and writing useful things through the crash – and pointed out that what he was saying was true of equity investors, too – but the point stands. It’s easy to tweet and write when things are going well; it’s harder to do it when things are going badly and the bears are waiting to pounce on any glimmer of optimism. But if the thing that many of us have been saying the whole time – that we’re not excited by the price, we’re excited by the technological and social aspects – then now is the very best time to write about web3, when price clearly can’t be the exciting thing. Let’s discuss some use cases. The DebateOver the past few weeks, Logan Bartlett’s red hot new podcast Cartoon Avatars has taken my corner of the internet by storm with a series in which Flatiron Health co-founder and Operator Partners GP Zach Weinberg debates crypto people about whether there are any real crypto use cases. The series kicked off when he wiped the floor with me in a debate over DeFi use cases a few weeks ago, and over the past two weeks, Mike Dudas and Jon Wu have tried their hands at explaining what about crypto excites them the most (more successfully than I did). Despite the egg on my face, I’ve been a big fan of the ongoing conversation; debate is healthy, and I think it’s been useful to have to think through where the logic holds and where we’re relying a little bit more on hope. I’ll have a little Zach Weinberg asking questions in my head whenever I look at an investment now. Over the weekend, Zach summarized his position on Twitter:  Essentially, he believes that there’s too much hype and risk relative to actual valuable use cases being created, which is particularly problematic when regular people are able to invest and/or speculate, and that the tens of billions of dollars VCs are pouring into the space could be better deployed elsewhere. On the second half of his point, I understand the argument that dollars could be more productively deployed to other things – it would be great if VC-backed entrepreneurs could fix education, healthcare, energy, housing, infrastructure, and other critical industries. I’m investing in all of them at Not Boring Capital. But it’s also a red herring. Since the Global Financial Crisis, we’ve lived in a regime of cheap and abundant capital; very few strong projects have failed for a lack of funding. In fact, as this crash in both public and private market valuations implies, investors pumped too much money into too few strong companies. There’s probably some blame to be doled out to the government for not doing things to funnel all of the excess cash to infrastructure, education, and other projects that would improve the lives of all Americans, but I don’t think there are a lot of VCs who were choosing between building new bridges or investing in DeFi protocols. LPs don’t seem to be choosing to fund web3 VCs instead of climate VCs; they’re doing both. There’s simply been more money sloshing around, and it’s the fault of the whole system, not web3 or any one industry, that we haven’t emerged from this period into this world: There’s a related point, which is that people who could be working on solving really hard atoms challenges end up working in web3 instead. This, too, is overstated. According to a report by Electric Capital, there were 18,416 monthly active developers in web3 in December 2021. Google alone employed over 27,000 engineers the last time it reported the figure in 2016. Combined, Google and Meta employ nearly 200,000 people, and it’s pretty easy to make the argument that each marginal person at those companies contributes a lot less than each marginal developer in web3. To read about disruptive innovation and today’s real use cases…Thanks to Dan for editing! Alt MintAlt is something we can all agree on: it’s backed by both Not Boring Capital and Zach’s Operator Partners. Yesterday, Alt launched Alt Mint, which lets you mint NFTs backed by physical trading cards. Holders have the right to redeem their NFTs for trading cards ranging from $700 - $10,000 in value or to hold on to them for access to community benefits and rewards. Thirty Not Boring readers received VIP spots, but if you missed out, you can mint today: Mint Your Alt Mint That’s all for today. Have a great weekend and see you Monday! Thanks for reading, Packy If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

Ginkgo Bioworks: The Organism Company

Monday, June 13, 2022

Elliot Hershberg joins Not Boring and introduces us to synthetic biology

Optimism

Thursday, June 9, 2022

Why it's worth trying the world more optimistic

Not Boring Founders Podcast: Amjad Masad, Replit

Thursday, May 26, 2022

Listen now (102 min) | Decentralizing software creation & the alpha in being authentic online

Designing Token Economies

Tuesday, May 24, 2022

A Collaboration with Station's Tina He

The Founder's Letter: Mackenzie Burnett, Ambrook

Thursday, May 19, 2022

Building sustainable and resilient agriculture through better financial products and pragmatic environmentalism

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month