MARKET RUNNING ESTIMATE & OBSERVATIONS Q1 2022

IMPORTANT DISCLAIMER: I am NOT a registered investment adviser, broker dealer, or member of any other association for research providers in any jurisdiction whatsoever & I am NOT qualified to give financial advice. Investing/Trading in securities, particularly microcap securities, is highly speculative & carries an extremely high degree of risk. The information, analysis, & opinions listed above are my own & may not properly reflect the underlying conditions of a company or security. You should do your own Due Diligence. Past performance does not guarantee future results. If you trade based on anything I have written YOU ACCEPT FULL RESPONSIBILITY AND LIABILITY for your own trades & actions & hold the author of this publication harmless. If that isn’t clear enough DO NOT TRADE, ACT, OR INVEST, BASED UPON ANYTHING I WRITE OR RECOMMEND. There, we should be solid now.EXECUTIVE SUMMARY:

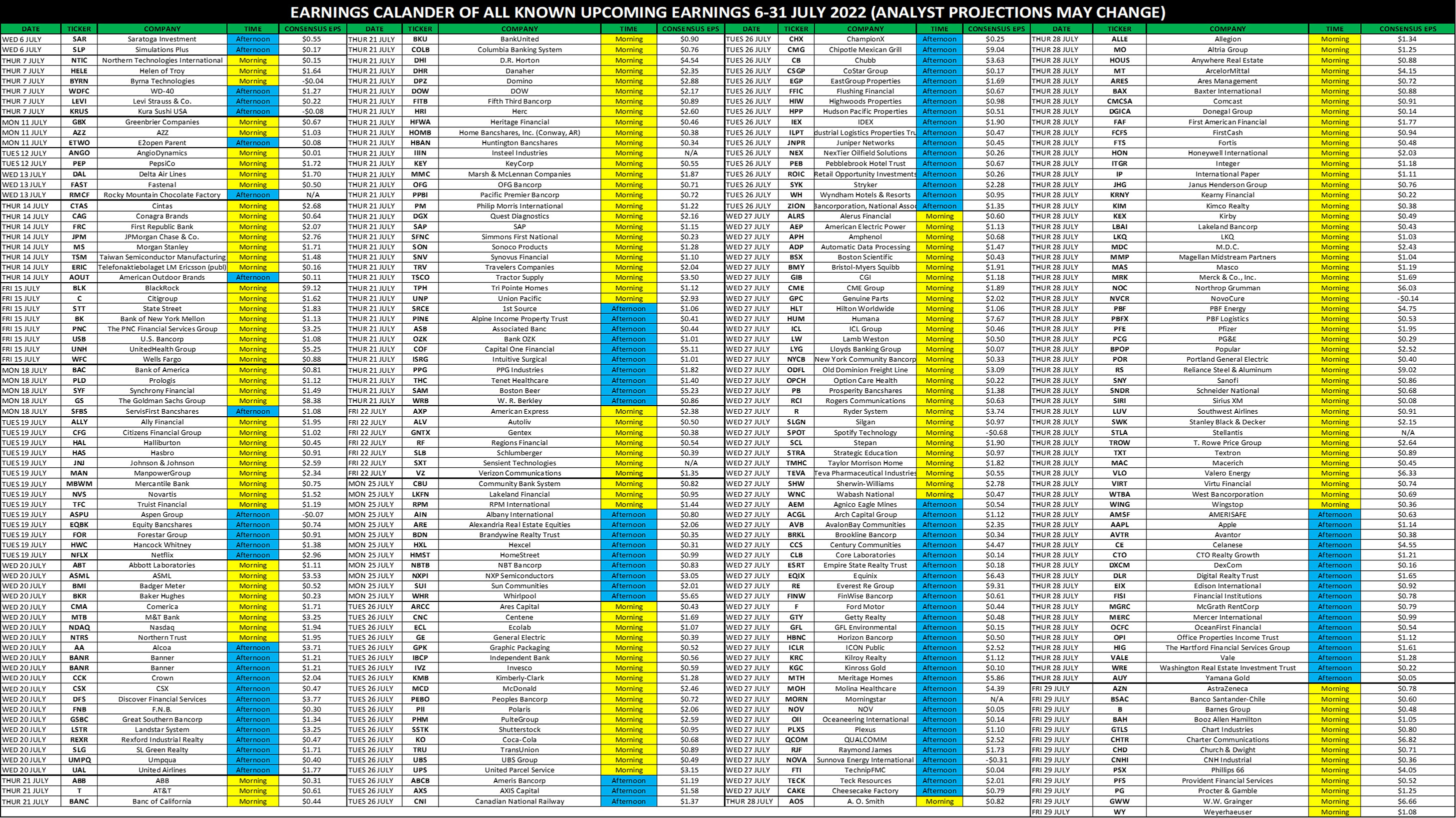

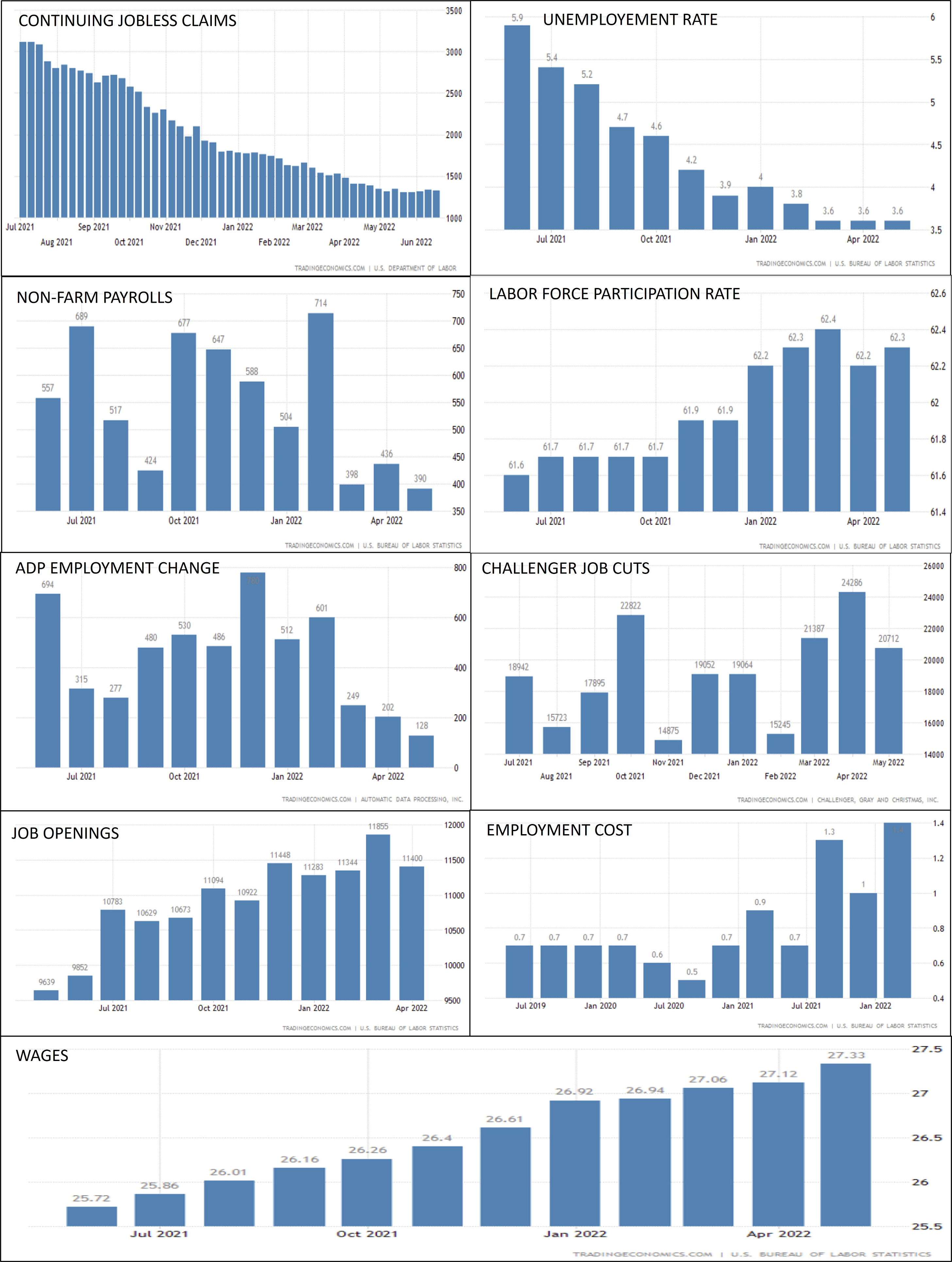

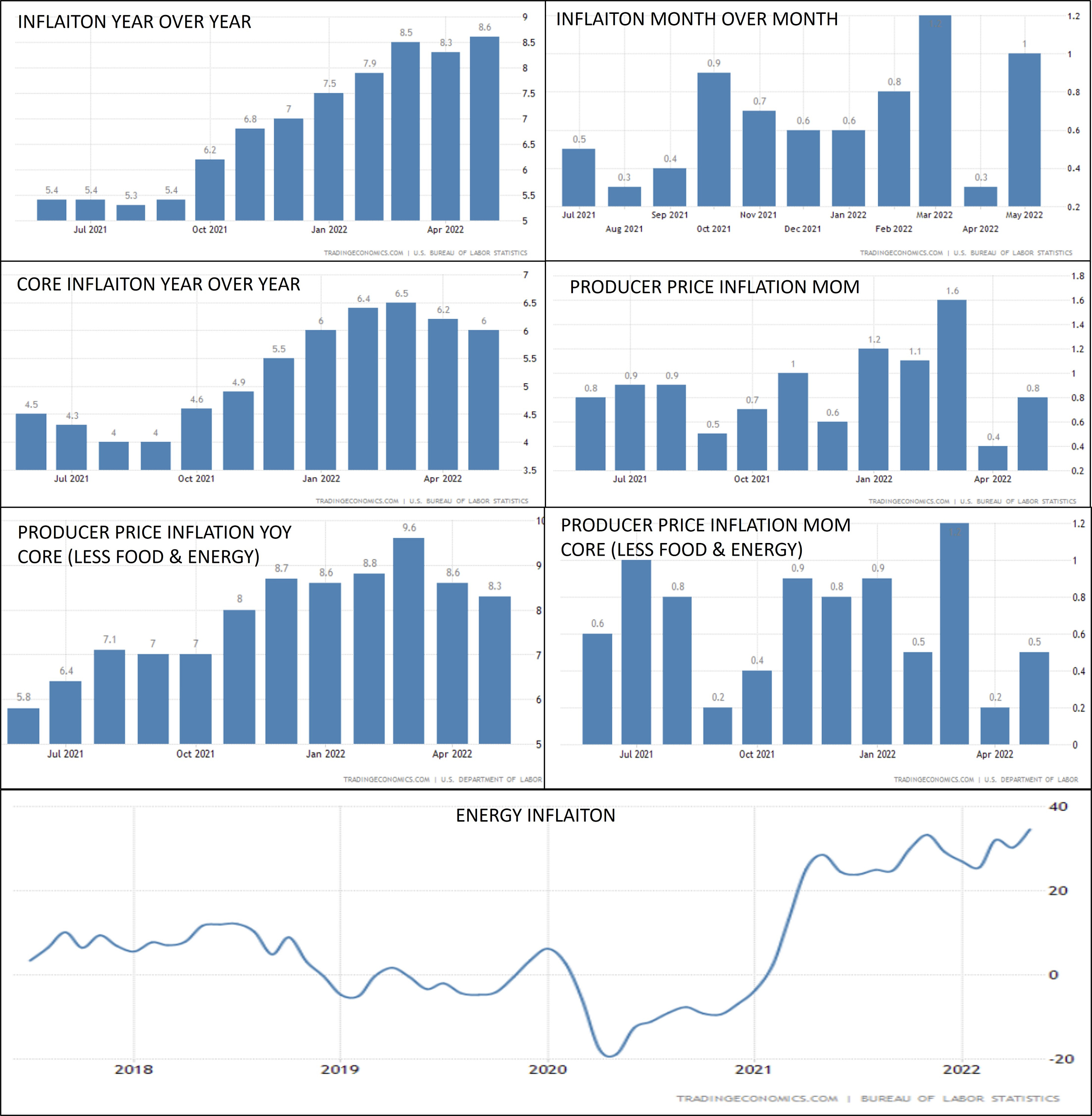

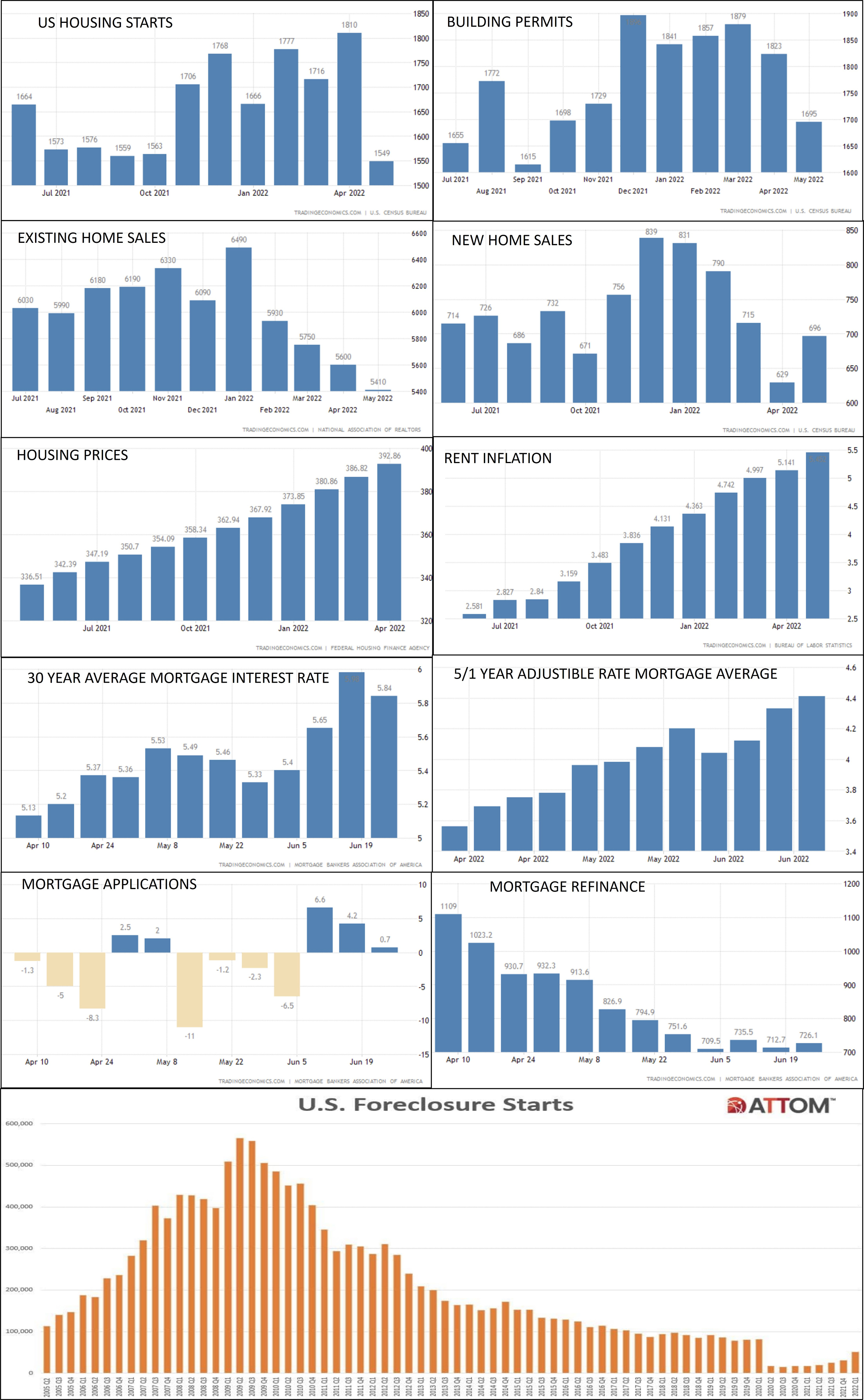

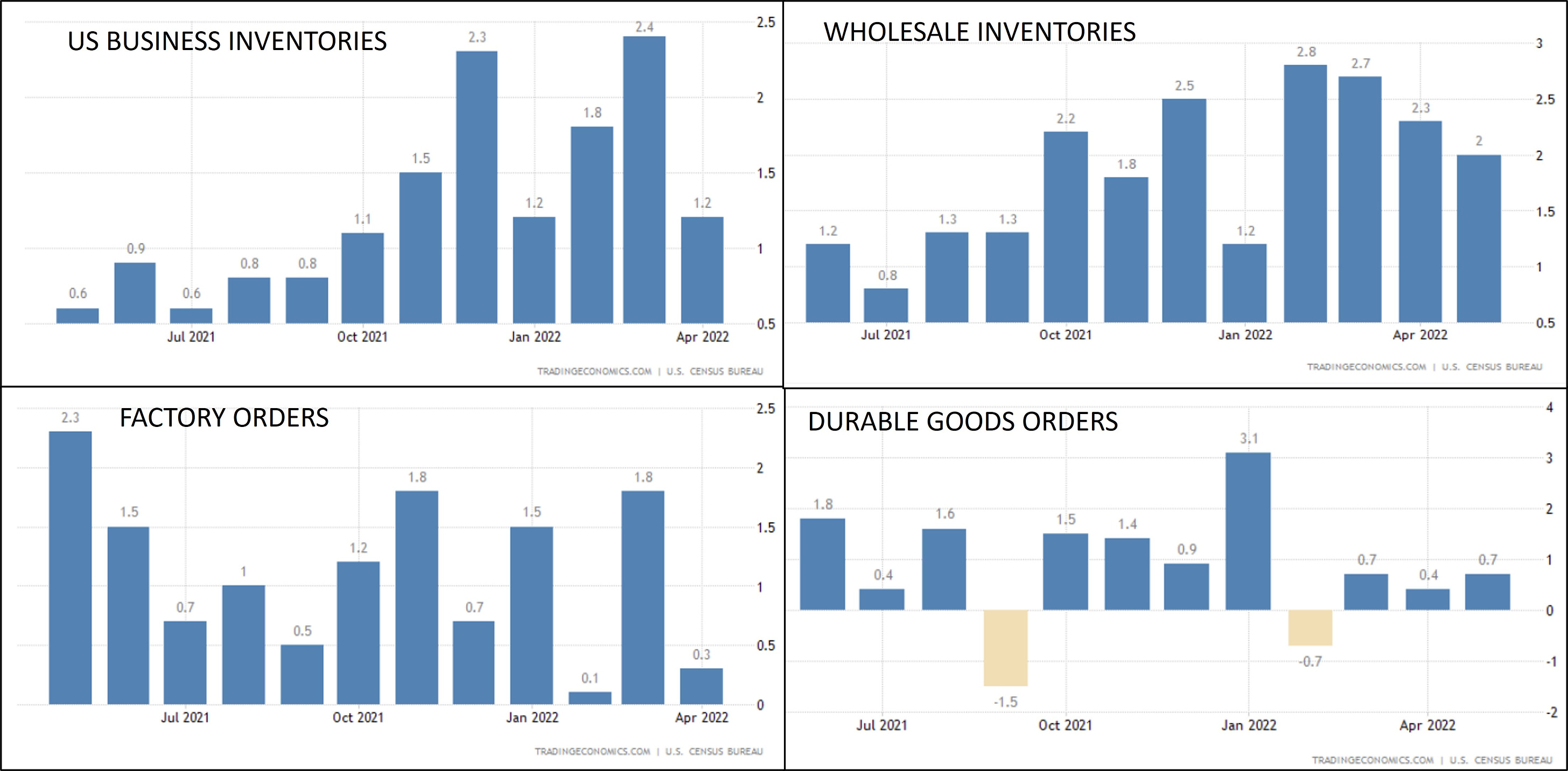

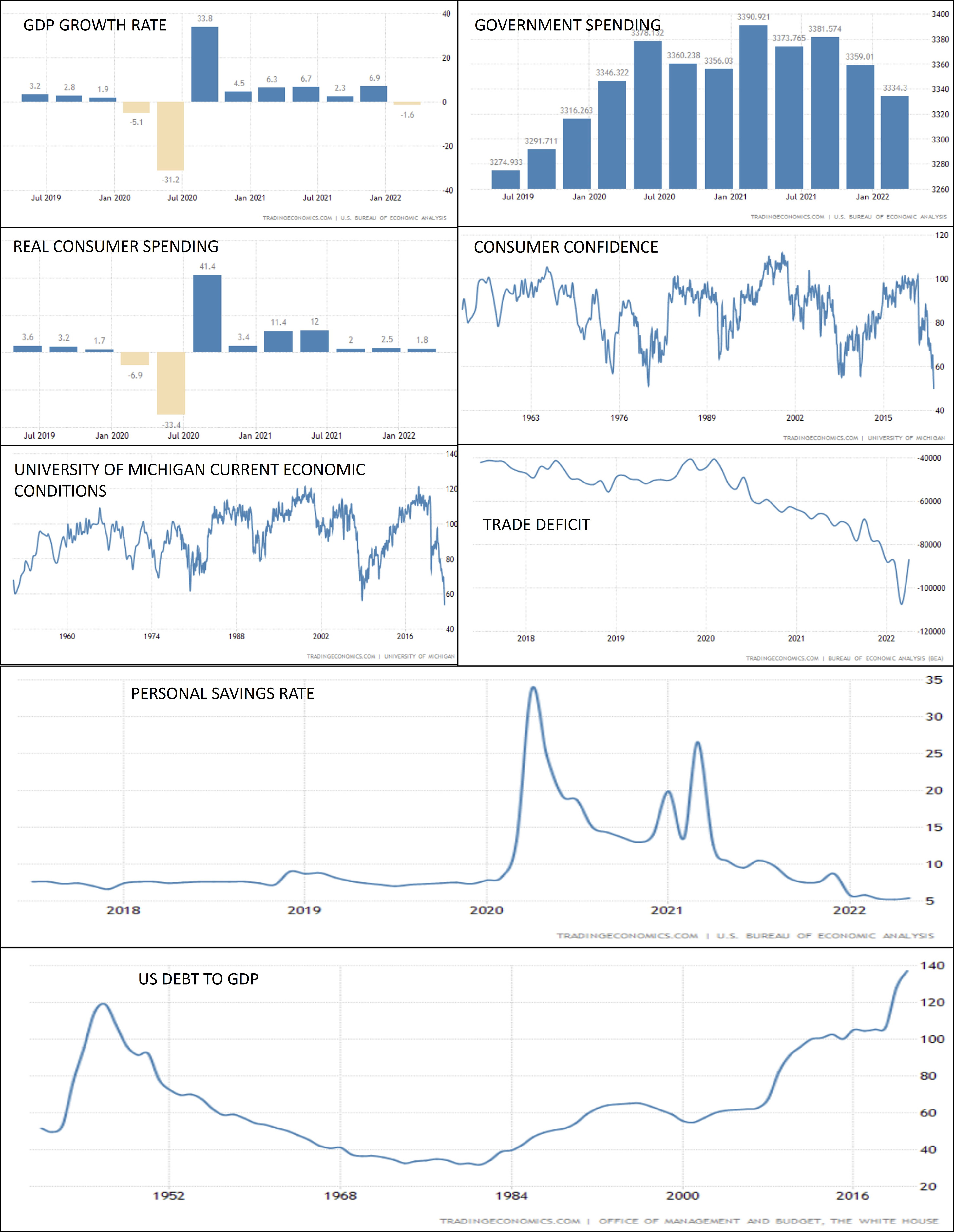

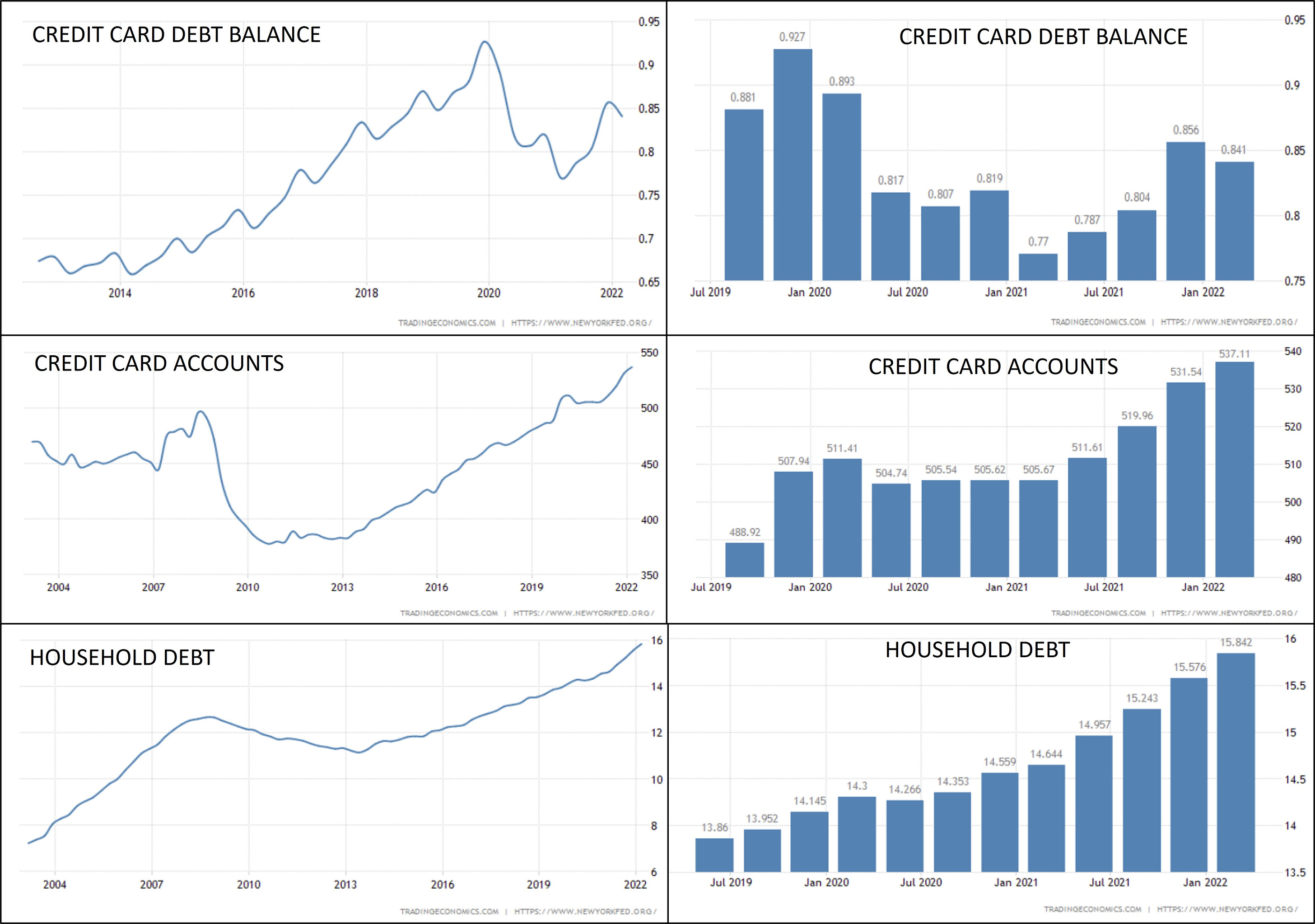

OUTLOOK: Consider the high growth Big Tech Firm layoffs the canary in the coalmine. As they are often the most affected by inflation & economic slowdowns, it’s only natural that they be the first to start laying off employees. Don’t fool yourself! This is happening. It’s only a matter of time. Prepare yourself for a brutal Q2 earnings season. Also remember that this earnings season, unlike Q1 earnings, fully encompasses the invasion of Ukraine & China lockdowns. TRUST THE DATA! The only question’s is how are firms going to perform moving forward into Q3, & is Q2 already priced in? Will energy costs subside? Not likely. Food? Not likely. Housing? Who knows? What I can tell you is everything is happening much faster than initially predicted by both the Fed & the big institutions. And the Fed seems to be getting less confident of their ability to reign in inflation leading to more & more drastic measures … so as long as equities gradually decline & the bottom doesn’t fall out of the market. JOBS SUMMARY: The job market remains tight with a very small increase in labor force participation. Wages remain at all time highs. So as long as labor force participation remains low/steady, & job openings remain high, wages & the cost of labor will continue to increase adding to inflation. Perhaps the most predominate indicator as to if the Fed’s actions are working is a reduction in the quantity of labor demanded, resulting in an increasing unemployment rate. INFALTION: Inflation has reached a point to where people are starting to economize on their needs & cut back on their wants. Energy inflation continues to drive up the price of everything. The scarcity of food & shelter continue to drive up the overall CPI. Current CPI YoY is 8.6% YoY; the highest level in over 40 years. Aside from pandemic era stimulus & increasing post pandemic demand, sanctions against Russia combined with the invasion of Ukraine are the primary drivers of both food & energy inflation. Both phenomena were exacerbated by a complete lack of foresight on sound traditional energy policy. HOUSING: Housing & rent prices remain at all time highs & seem unaffected by inflationary demand destruction as a result of an overall lack of supply. So as long as the housing supply remains low, we can safely assess that prices will continue to increase. Higher that usual mortgage interest rates may have cooled the demand a little, but as the supply remains low the decreased demand may be a non-factor insofar as prices are concerned. At least for now. It seems that a significant increase in foreclosures may be the only substantive remedy to booming housing prices. And foreclosures, though increasing, remain near historic lows. ORDERS & INVENTORIES: Amid supply chain shortages businesses sought to build up inventories through large orders many months early so as to satisfy pandemic/post-pandemic customer demand. This sharply increased the demand for scarce supplies, & therefore, the price. Through repeated stimulus efforts driving up demand, inflation became such that people started cooling on purchases of discretionary goods. As a result, many businesses in the retail space are sitting on expensive inventories they can’t move. Expect factory orders to follow after. Company earnings in Q1 2022 reflect lower earnings per share despite achieving record revenues. There’s no reason to assess Q2 will not follow this trend, unless of course we experience even lower EPS amid declining from record revenues; a phenomena that is likely inevitable anyway. GDP: Gross Domestic Product = [(Consumer Spending + Investment + Government Spending) + (Exports - Imports)]. [(C+I+G)+(X-M)=Y]. Q1 2022 reflected negative GDP growth rate of 1.6%. Two subsequent quarters of negative GDP growth is the technical definition of a recession. The Atlanta Fed’s GDPNow gauge sees the second-quarter running at negative 2.1%. HOUSEHOLD/CREDIT CARD DEBT: Overall household debt is on the rise & credit card debt has recently started to decline. As seen amid the covid crisis, people used much of their stimulus to reduce their debt profile in uncertain times. Naturally when people were losing their jobs, they were talking out less debt. Credit card debt only began to increase again once the economic outlook was stronger. People no longer have such sentiment, and as a result, are less likely to spend on credit. The implications on consumer spending are numerous. There may come a point when prices become so high that people have no choice but to bridge the gap on credit card debt. Thus far this remains to be seen. SO WHAT?:

BIG TAKEAWAY: All indicators point to people economizing on their needs & cutting back on their wants. GDP is registering negative growth, energy prices are gouging away at spending power, businesses are having a tough time selling inventory, home prices just wont quit, food is at all time high’s, household debt is on the rise, people are starting to cut back on credit card spending, & consumer confidence is as low as its been in recorded history. You WILL see these results in company earnings! People are preparing for the worst & spending accordingly. OUTLOOK: Consider the high growth Big Tech Firm layoffs the canary in the coalmine. As they are often the most affected by inflation & economic slowdowns, it’s only natural that they be the first to start laying off employees. Don’t fool yourself! This is happening. It’s only a matter of time. Prepare yourself for a brutal Q2 earnings season. Also remember that this earnings season, unlike Q1 earnings, fully encompasses the invasion of Ukraine & China lockdowns. TRUST THE DATA! The only question’s is how are firms going to perform moving forward into Q3, & is Q2 already priced in? Will energy costs subside? Not likely. Food? Not likely. Housing? Who knows? What I can tell you is everything is happening much faster than initially predicted by both the Fed & the big institutions. And the Fed seems to be getting less confident of their ability to reign in inflation leading to more & more drastic measures … so as long as equities gradually decline & the bottom doesn’t fall out of the market. IMPORTANT DISCLAIMER: I am NOT a registered investment adviser, broker dealer, or member of any other association for research providers in any jurisdiction whatsoever & I am NOT qualified to give financial advice. Investing/Trading in securities, particularly microcap securities, is highly speculative & carries an extremely high degree of risk. The information, analysis, & opinions listed above are my own & may not properly reflect the underlying conditions of a company or security. You should do your own Due Diligence. Past performance does not guarantee future results. If you trade based on anything I have written YOU ACCEPT FULL RESPONSIBILITY AND LIABILITY for your own trades & actions & hold the author of this publication harmless. If that isn’t clear enough DO NOT TRADE, ACT, OR INVEST, BASED UPON ANYTHING I WRITE OR RECOMMEND. There, we should be solid now.You’re a free subscriber to StockTips Newsletter. For the full experience, become a paid subscriber. |

Older messages

The Daily StockTips Newsletter 07.01.2022

Friday, July 1, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

Removing Ammo Inc (POWW) From the BUY LIST

Friday, July 1, 2022

Gone but Not Forgotten

The Daily StockTips Newsletter 06.30.2022

Thursday, June 30, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 06.29.2022

Wednesday, June 29, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 06.28.2022

Tuesday, June 28, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

Issue #275: You're preapproved… to spend a bunch of money

Wednesday, March 5, 2025

plus Soup Watch 2025 + snacking cakes ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Harry's Take 3-5-25 Economy Suddenly Weakens: Recession Coming Soon?

Wednesday, March 5, 2025

Harry's Take March 5, 2025 Economy Suddenly Weakens: Recession Coming Soon? I've been seeing the economy as the most stretched in history after the longest $27T US stimulus program, by far.

💀 RIP, world's biggest dividend

Tuesday, March 4, 2025

Aramco slashed its billion-dollar handouts, the US faced retaliation, and bitcoin went up against organs | Finimize Hi Reader, here's what you need to know for March 5th in 3:14 minutes. Aramco –

RIP to the 4% Rule

Tuesday, March 4, 2025

How to ignore the retirement strategy ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

President Trump is asserting extraordinary power over independent agencies. Is the Fed next?

Tuesday, March 4, 2025

The rise and potential fall of independent agencies. View this email online Planet Money Not-so-independent agencies anymore? by Greg Rosalsky President Trump vs. the independent agencies. It's a

No Sales, No Survival - Issue #514

Tuesday, March 4, 2025

What smart businesses are doing to win in the long run. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🇺🇸 The president's crypto fund

Monday, March 3, 2025

Crypto's back in favor and European defense stocks got an, uh, arm up | Finimize Hi Reader, here's what you need to know for March 4th in 3:15 minutes. The US president announced plans for a

CDs supercharge your savings

Monday, March 3, 2025

You could earn up to 4.10% for a 1 year term ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI's Impact on the Written Word is Vastly Overstated

Monday, March 3, 2025

Plus! VC IPOs; Sovereign Wealth Funds; The Return of Structured Products; LLM Moderation; Risk Management; Diff Jobs AI's Impact on the Written Word is Vastly Overstated By Byrne Hobart • 3 Mar

Know you’re earning the most interest

Sunday, March 2, 2025

Switch to a high-yield savings account ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏