Not Boring by Packy McCormick - The Good Thing About Hard Things

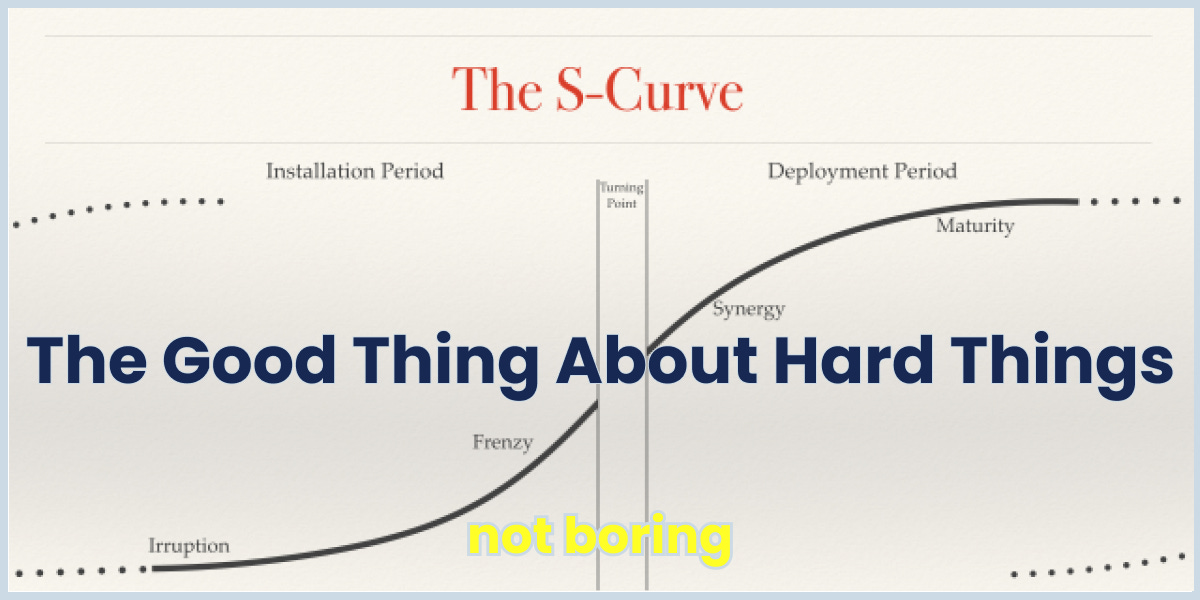

Welcome to the 678 newly Not Boring people who have joined us since Thursday! If you haven’t subscribed, join 137,816 smart, curious folks by subscribing here: Today’s Not Boring is brought to you by… WorkOS Building for the enterprise is typically complex, time-consuming, and distracting. Deals sometimes slip away due to strict requirements and technological demands from IT admins. With WorkOS, startups can sell to large enterprise customers from day one. It’s a set of building blocks for quickly adding features like Single Sign-On (SAML), Directory Sync (SCIM), and Multi-Factor Authentication (MFA) with just a few lines of code. Fast-growing B2B SaaS companies like Loom, Hopin, Airbase, and many others use WorkOS to abstract the integrations between dozens of identity providers. Webflow uses WorkOS to serve customers like Zendesk. Vercel leverages WorkOS to land enterprise customers like The Washington Post. WorkOS is an API that increases your TAM. You can try it now – WorkOS is free to get started and scales with you as you grow. Hi friends 👋, Happy Monday! Each quarter since I started Not Boring Capital, I’ve been sharing my LP Updates in the newsletter. This quarter, there was one specific question that I wanted to address in the LP Update that I ended up going so deep on that I actually finished this part before I finished the rest of the update, so that’s what I’m sending today. The question: why invest in hard startups? I’m learning how to be a better venture investor every day, so this is a work-in-progress and a snapshot of how I’m thinking about it today. Don’t take it as gospel — push back! — but I thought it would be interesting to share how I’m thinking through it. Let’s get to it. The Good Thing About Hard Things(Click the title to read in the browser) In a 2015 blog post, The Carlota Perez Framework, USV’s Fred Wilson wrote:

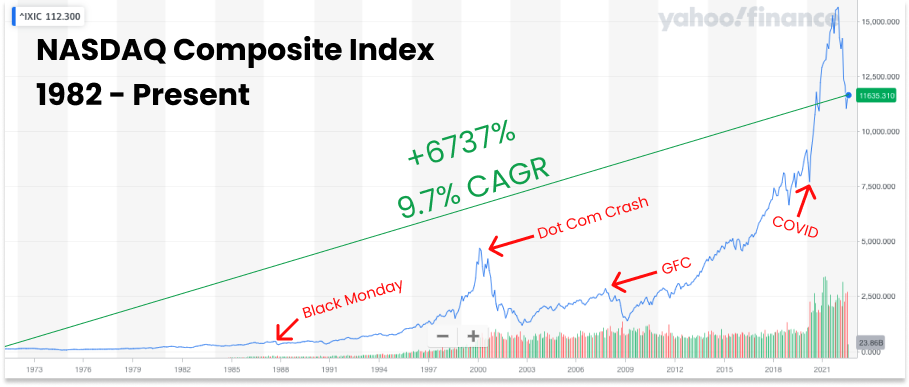

Now that the market has crashed – with Nasdaq down 28% from November highs – it’s become popular to talk, tweet, and write about the fact that companies like Uber and Airbnb were born in the midst of the Global Financial Crisis. And that of course there were a lot of scams in the dot com bubble, but there was Amazon, too. And that Google came public in the aftermath, the same year Facebook was founded, the year after Tesla was founded. Those four companies – Amazon, Google, Facebook, and Tesla – are now four of the eight largest non-Saudi companies by market cap in the world. History bears Wilson’s experience out. It makes sense to invest in the post crash cycle. Prices are cheaper. The weaker companies get shaken out, leaving the strong companies with less competition for customers and employees. Historically, the Nasdaq has recovered and exceeded previous highs after every crash (eventually). The more important question is in the third sentence: how to invest intelligently post-crash? The answer has a couple parts: when and what. When the exact right time to invest is is a tricky question that no one has the answer to. Historically, if you’d invested after a crash, you would have had a positive ROI, but timing does have IRR implications. I have neither the crystal ball nor the intelligence to nail the timing. The part that’s more in an investor’s hand is the what. In other words, what should we invest in coming out of this crash, and as importantly, what should we not invest in? Typically, the same companies and categories that lead the previous run-up aren’t the ones that produce the best returns on the other side of a crash. In Not Boring Capital’s last LP Update, I shared that we were tightening our focus: we’ll remain generalist, but put a “strong emphasis on the frontiers of bits and atoms – web3, AI, ML, and security on one side, climate, energy, space, defense, healthcare and bio, on the other.” Putting web3 and defense in the same bucket seems odd. If I’m being critical of myself, that list seems a bit “buzzword BINGO.” What do those categories have in common? They’re hard. They don’t have playbooks. They require “speculative Financial Capital.’” As Ben Thompson wrote in October’s The Death and Birth of Technological Revolutions:

I believe that investing intelligently in venture post-crash means investing in businesses for which the playbook is unknown. There are two filters that I’m trying to apply more consistently:

I’ve written about the “So what?” filter before. Essentially, the way I like to frame this question is “What does the world look like in a decade if this company succeeds?” That’s important to me on a personal level: I want to back companies that make an impact. It’s important on the Not Boring level: companies with good “So what?” answers have more compelling stories. And I think it will be important for returns: the smartest, most driven people want to work on solving the biggest problems, and there are a lot up for grabs. If that world is compelling, I dig in further. I look at the usual things: exceptional founders, big markets (or the potential for big markets), business models that make sense at scale, strong customer understanding and product chops. Then I ask the question: “How hard is it?” Investing in hard businesses might seem counterintuitive, but at this point in the cycle (the long arc of history, not specifically the current market cycle), I think investing in hard businesses is the best way to generate outsized returns. I’ll explain. The Hard Thing About Easy ThingsOne of the first Not Boring pieces that did really well, back in August 2020, was Shopify and the Hard Thing About Easy Things. A play on the title of Ben Horowitz’s book, the piece was about the fact that with so many pieces of the ecommerce stack built out, DTC brands, with rare exceptions, are largely forced to compete on brand and paid acquisition. It’s a tough position to be in. I wrote:

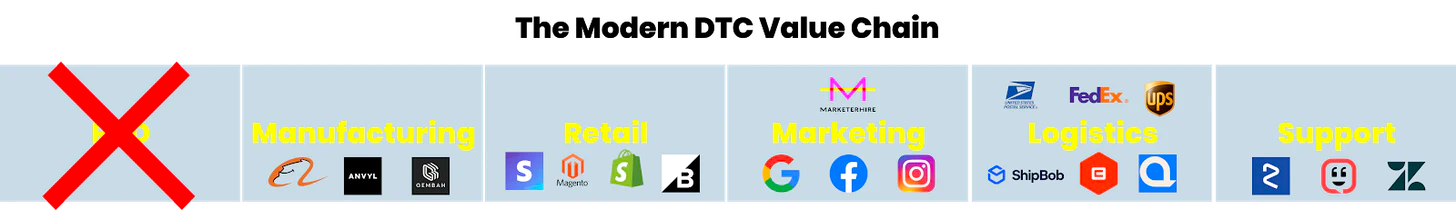

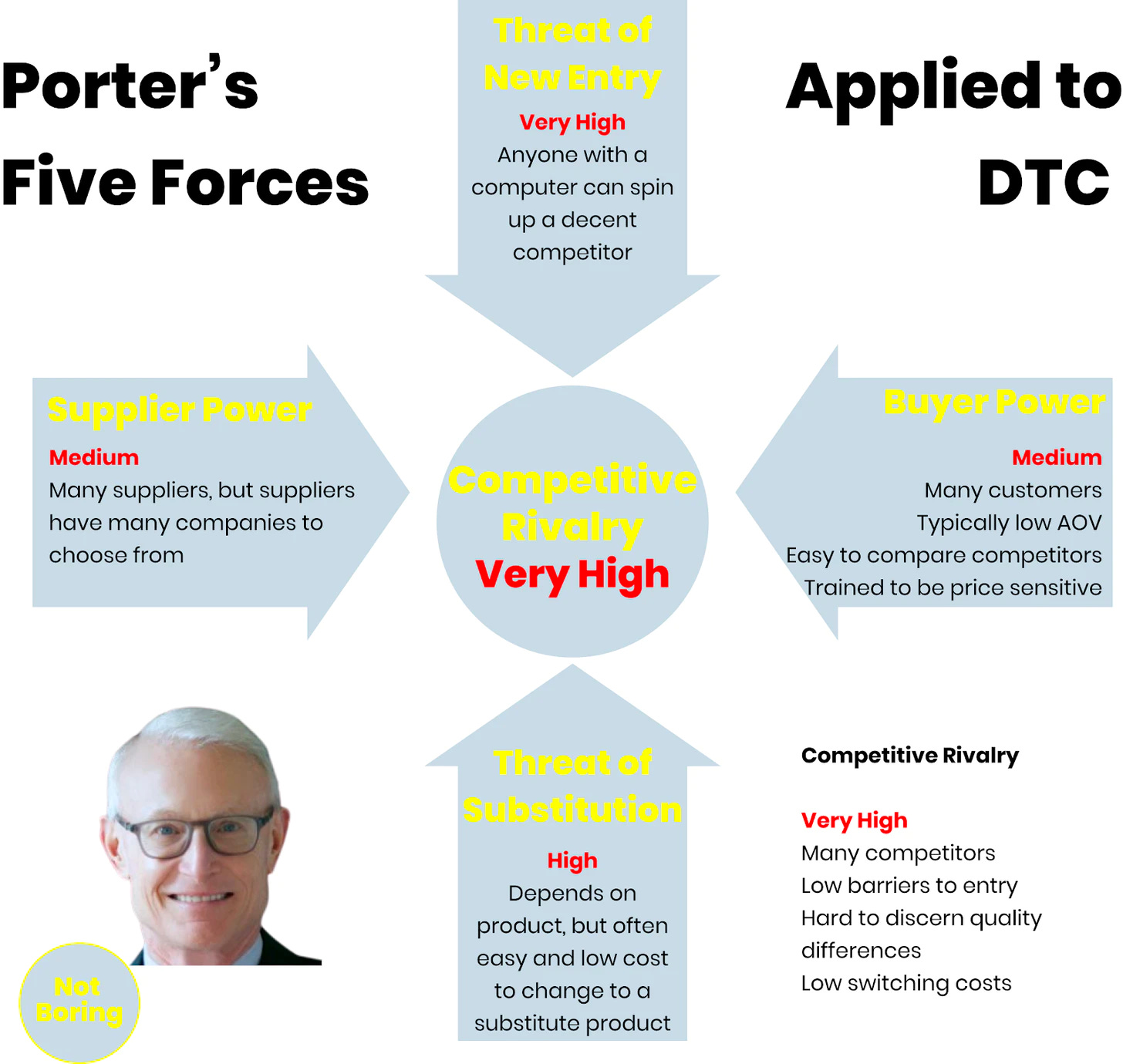

To describe why that’s true, I used two Michael Porter concepts – Five Forces and Value Chain – to explain why it’s so difficult to build venture-scale DTC companies. It wasn’t obvious in the early days of DTC that DTC brands would rarely generate enormous, venture-scale outcomes. Great VCs invested in a ton of DTC brands. But the success of pioneers like Harry’s and Warby Parker’s, along with Shopify’s improving product, attracted a bunch of other DTC companies, which attracted a bunch of software and services companies to serve the new wave of DTC companies. As I wrote, “There are so many high-quality, modularized inputs, that one person with a computer can spin up a company and start shipping product in under a week.” All of a sudden, Porter’s Five Forces painted a dire picture for DTC brands. The threat of new entry was very high, the threat of substitution was high, both suppliers and buyers had a bunch of customers and products to choose from, and all of it created a situation in which the competitive rivalry in the space was very high. The battlefield moved to brand, which works for some category leaders, and paid acquisition, where it’s expensive to compete and you get practically no long-term competitive advantage from doing so. This has gotten worse as Google and Facebook and even Amazon get more expensive and harder. The worst part is this: even if you have a better product than competitors or substitutes, you still have to compete for the same ad slots with them, and you have to pay to educate consumers on the superiority of your product. This is now obvious to everyone reading this. It’s fairly easy to build a $1 million revenue DTC brand. It’s reasonably easy to build a DTC brand to a $50-100 million outcome, which is an incredible outcome if you don’t raise a ton of money. It’s practically impossible to create a venture-scale, multi-billion-dollar outcome in DTC. The companies who have the best shot use DTC as a channel, but really have some differentiated and hard ways to create an obviously better product. Cometeer comes to mind; it’s a frozen coffee company that happens to use DTC as its first channel. Anyway, we don’t really invest in DTC or CPG companies at Not Boring Capital, so why did I just spill all that ink on them? I don’t think I went far enough in the original piece. The piece was about DTC companies (or any CPG-esque ecommerce retail business), but increasingly, the hard thing about easy things describes software companies. The Hard Thing About the Easy Thing About SoftwareThere’s this Ben Thompson line that I can’t find but am pretty sure that he wrote, something to the effect of, “New models hit media businesses first, because those businesses are simpler, before hitting other industries.” That holds for ecommerce, too. Maybe it’s something like: Media → Ecommerce → Software → Harder, More Complex Businesses After decades of pure-play software businesses generating huge returns, I think that trade is on the decline. Software has spent a decade eating the world, gorging on the low-hanging fruit first, and it’s getting full. On August 20, 2011, nearly eleven years ago, Marc Andreessen penned his famous essay in the Wall Street Journal, predicting:

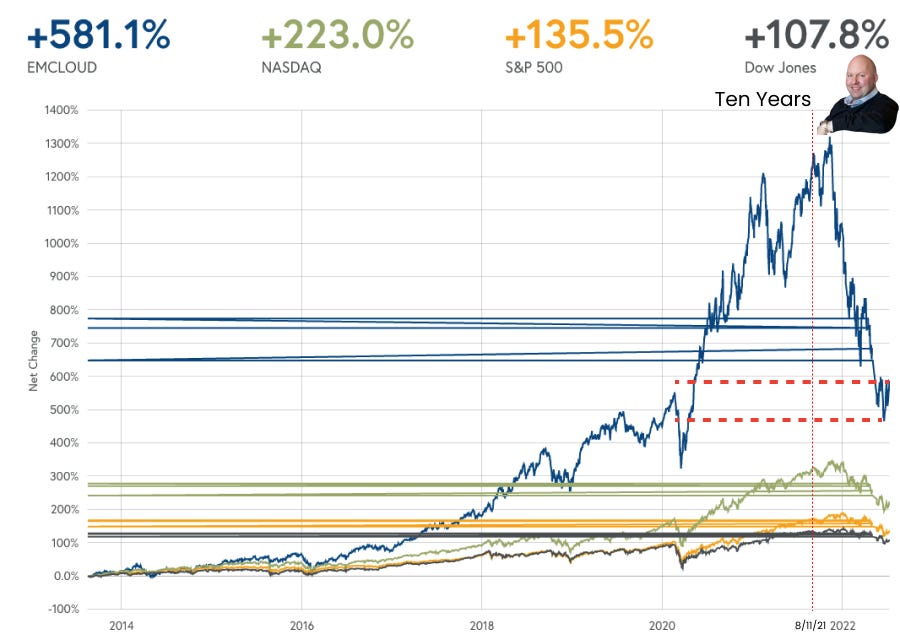

He was, of course, spot on. The decade from August 11, 2011 to August 11, 2021 saw the tech-heavy NASDAQ rise 514.6% compared to 291.9% for the S&P 500 and 230.89% for the DJIA. That’s a rough proxy, and it doesn’t capture the transformative impact that software has had on so many industries and our daily lives, but you get the point. It was a great decade for software. Eerily, almost exactly a decade later, three months after the essay’s anniversary, the NASDAQ hit its peak in November 2021. It has fallen 28% since. The BVP Nasdaq Emerging Cloud Index, which is “designed to track the performance of emerging public companies primarily involved in providing cloud software to their customers,” was up over 1300% since its 2014 inception before dropping 52.1% from its November high. At one point, it traded below pre-COVID levels, and today, it’s trading just above the pre-COVID high. Software is not dead. There are other reasons that tech stocks have struggled alongside, and even worse than, the rest of the economy in recent months. A lot of software spend was pulled forward during COVID; they over-earned. Discount rates are higher and tech companies’ projected cash flows are further in the future, so they get hit harder. And there was too much exuberance. Founders Fund’s John Luttig wrote an excellent piece, Reversion to the mean: the real long COVID, exploring many of the factors. But it’s more than the market. Luttig wrote a more prescient piece, two years too early, in April 2020: When Tailwinds Vanish. I highly recommend you read it; it’s more appropriate now than ever. In different words, Luttig talks about the same challenges I wrote about in The Hard Thing About Easy Things. Specifically, he writes that competition among internet startups is becoming more zero-sum as all of the easiest opportunities have already been seized:

It’s easier than ever to build the average software company – plug into AWS, snap in a bunch of APIs, follow established playbooks – and harder than ever to make it really big. Modularized inputs and playbooks lead to more competition, smaller opportunities, and lower margins. This isn’t true for the exceptional, ambitious software companies. Luttig wrote a piece called Rippling and the return of ambition, with the subtitle “In an era of software incrementalism, Rippling is bringing ambition back.” Rippling is a SaaS company on its face, but it would fit my criteria. Ramp and Replit are two examples of ambitious software companies in the portfolio, and there are more. I’d invest in those all day. It’s software incrementalism I’m avoiding. It won’t be as easy for the average, or even very good, software startups to get really big as it was in the past decade. There’s too much competition. Worse, competitors have many of the same weapons. The incumbents that new entrants face will themselves be relatively new startups. They’ll be able to adjust more quickly to the new entrants’ attacks, and if the new entrant succeeds, there will be another, newer new entrant there to try to steal the prize. To learn more about hard startups and the good thing about hard things… Thanks to Dan for editing! That’s all for today! We’ll be back on Thursday with a Deep Dive on one of the most important companies in crypto. Thanks for reading, Packy If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

Weekly Dose of Optimism

Friday, July 8, 2022

Week 2

Making Moonshots

Thursday, July 7, 2022

Rahul Rana joins Not Boring to discuss the history and future of deeptech

The Founder's Letter: Jordan Singer, Diagram

Thursday, June 30, 2022

On Design

Web3 Use Cases: The Future

Monday, June 27, 2022

Will web3 justify the hype?

Web3 Use Cases: Today

Thursday, June 23, 2022

Jumping Back Into the Web3 Debate

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month