DeFi Rate - This Week In DeFi – July 8

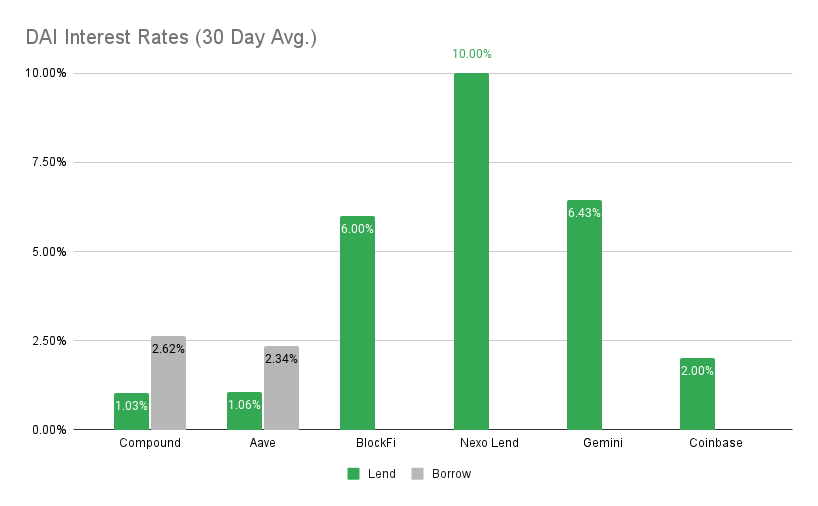

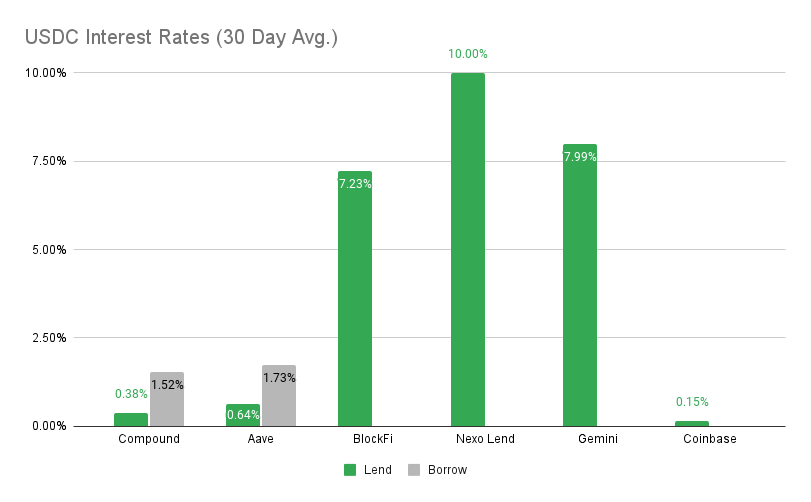

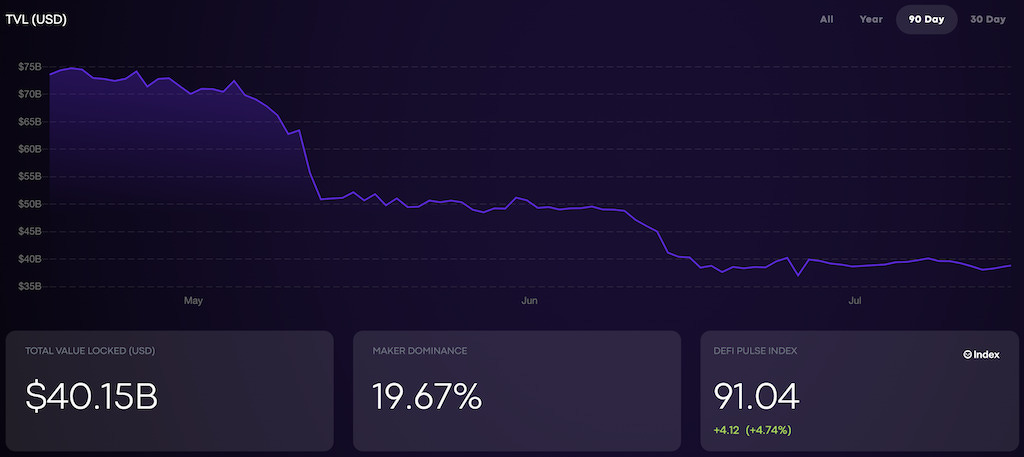

This Week In DeFi – July 8This week, Multicoin announces a new $430 Web3 fund, StarkNet confirms a token and Celsius files for Chapter 11 bankruptcy.To the DeFi community, This week, Multicoin raised $430 million for "Venture Fund III," the company's third venture capital fund in the crypto space. The fund will be allocating between $500k and $25 million to early stage projects, with up to $100 million toward more established companies. Multicoin's focus for the fund is web3 infrastructure, DAOs and “proof of physical work" – protocols that incentivize verifiable work to build real-world infrastructure.  StarkWare has confirmed the launch of a token for its StarkNet Layer-2 scaling platform on Ethereum, however will not be airdropping any tokens until next year. 10 billion tokens have already been minted off-chain, going live on StarkNet in September. 51% will go to the StarkNet foundation, 32.9% to StarkWare core contributors and 17% to StarkWare investors.   CeFi lending platform Celsius has officially filed for Chapter 11 bankruptcy in New York, as shown by court filings. The company has declared between $1 billion and $10 billion in assets and equal liabilities, with 100,000 creditors on the books. A Celsius statement says statement by the company says it has $167 million in cash to support certain operations during the restructuring process. Customer withdrawals with remain frozen.  Retail trading platform Robinhood has listed Uniswap's UNI governance token, bringing the total number of crypto assets available on the app to 13. The announcement was made via Twitter yesterday and assisted in the token's 20% advance over the last day of trading. Thanks to our partner: Nexo – Unlock the power of your crypto with up to 17% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Gemini at 6.43% APY Cheapest Loans: Aave at 2.34% APY, Compound at 2.62% MakerDAO Updates DAI Savings Rate: 0.01% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 1.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Gemini at 7.99% APY Cheapest Loans: Compound at 1.52% APY, Aave at 1.73% APY Top StoriesUS Inflation Gauge Jumps to Fresh 4-Decade High of 9.1%; Bitcoin FallsBlockchain venture funding declined roughly 22% in Q2China's central bank to expand deployment of e-CNYG20 regulators call for new global rules on cryptocurrenciesStat BoxTotal Value Locked: $40.15B (down 3.0% since last week) DeFi Market Cap: $40.88B (up 2.7%) DEX Weekly Volume: $10B (down 17%) Bonus Reads[Tom Matsuda – The Block] – Gnosis Safe raises $100 million led by 1kx as it rebrands to Safe [Vishal Chawla – The Block – Uniswap liquidity provider hacked for $8 million in phishing attack [Tom Mitchelhill – Cointelegraph] – Cred Protocol unveils its first decentralized credit scores [Fran Velasquez – CoinDesk] – MATIC Surges as Disney Chooses Polygon for Accelerator Program If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week In DeFi – July 8

Friday, July 8, 2022

This week, Aave looks to launch a stablecoin, Shiba Inu is expanding its ecosystem and MakerDAO lends to a legacy bank.

This Week In DeFi – July 1

Friday, July 1, 2022

This week, FTX looks to acquire a distressed BlockFi, Compound goes multi-chain and ConsenSys partners with StarkWare.

This Week In DeFi – June 24

Friday, June 24, 2022

This week, dYdX decides to ditch Ethereum scaling for its own chain on Cosmos, Solend stirs up governance drama and Uniswap steps into NFTs.

This Week In DeFi – June 17

Friday, June 17, 2022

This week, Circle announces a new euro-pegged stablecoin, while Celsius and Three Arrows battle solvency issues – also involving stETH.

This Week In DeFi – June 10

Friday, June 10, 2022

This week, Ethereum completed its Ropsten testnet merge, Wintermute unveiled its DEX aggregator and TronDAO decides to overcollateralize USDD

You Might Also Like

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask