| Dear friends,In JC’s Newsletter, I share the articles, documentaries, and books that I enjoyed the most in the last week, with some comments on how we relate to them at Alan. I do not endorse all the articles I share, they are up for debate. I’m doing it because a) I love reading, it is the way that I get most of my ideas, b) I’m already sharing those ideas with my team, and c) I would love to get your perspective on those. If you are not subscribed yet, it's right here! If you like it, please share about it on social networks! Share 💡JC's Newsletter

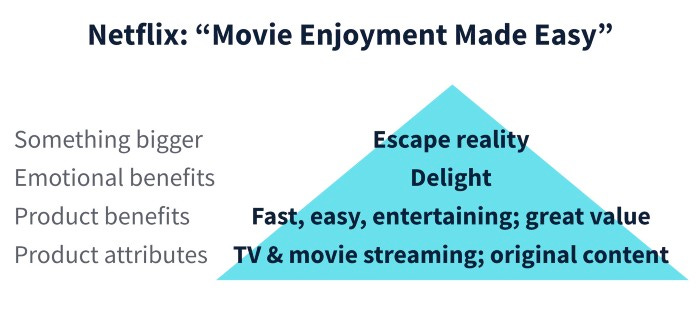

💡Must-read👉 Branding for Builders (Gibson Biddle) ➡️ Interesting framework on how to think about the brand. Since the beginning of Alan, we have iterated around our brand, with always the same vision, but trying to find the right words around it. One big question for us was also how to pitch ourselves to the external world, at the different stages of the company. Talking too much about the long-term vision felt void when we were only covering a few thousands members on our simple digital health insurance. Now that our product is more mature, we work a lot more on our one-stop health partner vision. The framework below is really useful, and we will likely use it to keep iterating. We also loved working with FNDR on those topics a few years ago!

— Remember when Netflix announced its plan to split its streaming and DVD service with the launch of “Qwikster” in 2011? 800,000 customers canceled Netflix that quarter. I mention the car brand, “Volvo?” For most, the response is “safety.” This example demonstrates Volvo’s ability to place an idea in your head, relative to competitors, and that’s the definition of positioning. Here’s the model applied to Netflix: What is Netflix? A monthly subscription service for TV & movies How does Netflix benefit its customers? It’s fast, it’s easy, it’s entertaining, it’s a great value What is Netflix’s personality? Straightforward, friendly

Use clear, precise sixth-grade language. Consumers are busy and don’t have time to parse complicated ideas. Be brief. Most teams begin with lots of complicated ideas. The key is to simplify and focus on a few, easy-to-communicate ideas. Defining the personality of your product describes how you want your brand to relate to customers. Volvo is a ninety-year-old company. They have spent billions of dollars on advertising and have consistently invented new safety features to own the word “safety.” Why does the brand model incorporate emotion? The simple answer: it makes things memorable.

Product attributes. What are your product's features or components that consumers buy or use to enjoy the benefit of your product? In the early days of Netflix, it was 100,000 movies on DVD, with one-day delivery, no late fees, and a website where you built your queue. Today, it’s tens of thousands of streaming movies & TV shows and, increasingly, original content. Product attributes can and will change over time — that’s where the innovation happens. The other levels of the pyramid, however, stay relatively constant. Emotional benefits: Make sure the words describe feelings. Something bigger. Many teams struggle with this part of the exercise. My coaching: Think Big. Apple delivers revolutionary innovation, Nike enables customers to fulfill their full human potential, and SpaceX is working to save the human race by colonizing Mars. The “something bigger” is meant to inspire your team to build a great product and company over fifty years.

➡️ For European companies, it is often harder to think bigger, because we are not used to it, and you will have voices even internally that will tell you we are too far from there yet. The headline. It took Apple tens of millions of dollars to create their “Think Different” campaign. So don’t expect a few hours of work to be as impactful. In the case of Netflix, “Movie Enjoyment Made Easy” was not intended to be seen by customers, but the headline summarized the brand pyramid in a way that I can still remember. While many regard brand as amorphous and hard to measure, Netflix did its best to measure its impact. We continually A/B tested different positioning and branding approaches on the non-member homepage.

➡️ I don’t know if we have the volumes for it, but I feel that testing on the homepage would be an interesting way.

🏯 Other great articles on Brand & Scale👉 Great Startups Deserve Great Brands – Build a Strong Foundation by Avoiding These Mistakes (First Round Review) Mistake #2: Overcomplicating your purpose Nike: “Their line is so iconic: ‘To bring inspiration and innovation to every athlete* in the world. *If you have a body, you are an athlete.’” Stripe: “‘To increase the GDP of the internet’ Ring’s ‘We exist to make neighborhoods safer’

Mistake #3: Not carefully considering your category Make a modification: “This is when you take an existing category that people have a good understanding of and tweak it. My favorite example is Nest. For years, thermostats were boring, sat on your wall and didn’t do much. And Nest had this brilliant idea to just add the word ‘learning’ to the word ‘thermostat,’ carving out a sub-segment of that category that they could own. Prose is another good consumer example, with ‘custom shampoo.’ But there are tons of B2B examples as well, like Marketo with ‘marketing automation,’ and Sprig with ‘continuous research’”

Mistake #5: Emphasizing emotional instead of functional benefits in your early messaging ‘What is the most bare bones, functional way I could phrase this?’” Poke the problem. “Don’t dive straight into feature, feature, feature, before telling the broader story of the problem. Even for technical products, start by asking: What's the problem and how does your audience address this problem today?”

👉 Dominik Richter - HelloFresh: Delivering on Process Power (Just Colossus) Metrics: 8 million active customers 15 markets globally. Our product is that you become a member to HelloFresh We then push our menu of 30 to 40 weekly meals to your phone, to your desktop. 3.8 billion euros in revenue last year and more than 10% EBITDA

Customer proposition: We went down in pricing by about 30% from when we started How can we make the customer proposition better and better so that it becomes more and more relevant to all the different customer segments out there?

➡️ Very relevant on how to continuously improve the customer proposition. Brand & marketing: But I think the framework to apply is that it usually takes consumers between 5 and 10 touch points with a brand to actually make a purchase decision. To push people over that barrier to actually make that purchase, very often you incentivize that, which is making a really good offer. And especially in an auto renewal model like ours, And we have built our own marketing tooling suite over the last couple of years, which I think is actually like a big part of our success. We've always had the philosophy of building a lot of things in-house to collect a lot of data and combine a lot of data in-house that just allows us to make better decisions and to justify spend in certain advertising categories where you wouldn't be able to justify it if you just looked at it on a channel by channel view or in a very siloed view.

➡️ Building tools in-house to be superior in marketing. Business model & how to manage complexity:

➡️ We have better than that. Our business model is incredibly complex. You need to be world class in engineering. You need to be world class in procurement. You need to be world class in fulfillment. You need to be world class in building a brand. You need to be world class in obviously having the greatest meals possible in front of a customer. You need to be a world class athlete. And if you only pull one of your muscles, you can't compete on the highest level. And so I don't actually know what the muscle was that some of our competitors have maybe pulled or that they haven't developed as much in tune with the other muscles that they had.

➡️ Great analogy. I think we are in a similar situation. But I think for us, we've always been thinking about that we need to develop all of the muscles in tune and if just one of them fails or is not performing to the high standards that it requires for that type of complex business model that we have, then it's just going to be very, very hard to build a world class business. So that's the one point.

➡️ You need to be excellent at all your different muscles to be widely successful. And the other point is once you have an advantage and then can use that advantage and have it compound over many, many years, then you just end up with vastly different outcomes. So I wouldn't say that there is anything that we are 10 X better than any of our competitors. But we're maybe 2% better in this and we're maybe 5% better in customer acquisition. It all compounds over time and you don't see that after one year or two years, but you really see that after five years or 10 years, then it's a massive, massive difference.

➡️ Operational excellence compounds a lot. ➡️ I’d like to do that with our business reviews. International: Secondly, we've been very successful in scaling internationally. I think in the last couple of years, we've launched about one to two new geographies each year. I think that's a clip that we find very healthy. We have a very good playbook in place, very great teams that have launched operations in multiple geographies over the years.

➡️ Talk with them?

🗞 In the news📱Technology👉 Practical tips for a better life: 100 Tips for a Better Life ‘Where is the good knife?’ If you’re looking for your good X, you have bad Xs. Throw those out. If you want to find out about people’s opinions on a product, google <product> reddit. You’ll get real people arguing, as compared to the SEO’d Google results.

🏥 Healthcare👉 Weekly Health Tech Reads 7/10 (Health Tech Nerds) 👉 The Oscar Puzzle (Not Boring) Numbers: Its combined ratio is greater than 100%. In Q3 2021, Oscar put up an adjusted EBITDA loss of $189 million on $673 million in revenue. Oscar’s stock had started to recover into Q3 earnings, but fell when the company reported that its medical loss ratio (MLR) – the percentage of premium it pays out for care – shot up from 82.4% in Q2 to 99.7% in Q3 Oscar’s membership grew 41% YoY, from 420k to 594k Adding just one layer of complexity, the ACA requires insurers to pay out at least 80-85% of premiums in claims (80% for individual and small group insurers and 85% for large group insurers), and then refund any leftover money to members if they don’t. So the name of the game is to get your MLR as close to 80-85% as possible, and keep administrative costs relatively low. When margins are capped, it’s all about scale.

➡️ We don’t have this problem of upside limitation. Though, we built a very different business model where we target to sell insurance at 100% Loss Ratio and we had a membership fee on top of it to access our platform where we make our margin in a fair and transparent way. For 2021, Oscar expects to lose somewhere between $450 and $480 million on an Adjusted EBITDA basis, adding $100 million to expected losses since Q2 estimates after a worse-than-expected medical loss ratio in Q3.

➡️ Very large loss. Typically, Oscar launches in a market with 7-8% market share, and grows to 15% by year three. Oscar has an NPS of 40, compared to an health insurer average of 3, according to Forrester Research.

+Oscar: In 2018, Oscar launched what would become +Oscar, its tech platform that lets health systems and other insurers tap into all of the tech that Oscar has built over the past decade. Turning its tech into a platform for third-parties will build scale into both the insurance and tech businesses, which will help improve care and lower costs. Insurance Business: More scale means more leverage over the participants in its supply chain, better terms with reinsurers (reinsurance makes up a huge chunk of insurers’ costs), more ability to convince providers to join the network, and a lower admin ratio (amortize administrative costs over more members). By opening its tech up as a set of primitives for others in the ecosystem to build with, it will get more data on which types of interventions digital and physical, work best for which types of patients, and any campaigns it builds for one partner can be copy-pasted and used by any partner, building network effects into the system. More knowledge should lead to better long-term outcomes, and lower costs.

+Oscar takes everything that Oscar has built over the past decade -- the risk engine and payment engine, virtual care delivery, population health management, campaign management, Care Teams, and engagement tools -- and delivers it as a set of APIs and services to partners. Cleveland Clinic + Oscar, the company’s first partnership when it launched in 2018, serves both the individual and group markets. Members get access to the Cleveland Clinic’s network of physicians, nurses, hospitals, and health and wellness centers in addition to Oscar’s apps, Care Teams, virtual care, and fitness incentives. For this partnership, Cleveland Clinic and Oscar split risk 50/50, although future partnerships will likely see Oscar as a software and service provider, and let health systems take all the risk. Each partner that works with Oscar can choose to have Oscar power their whole stack, build custom plans, or choose a la carte from the four +Oscar components: 1. Acquire Risk. This is essentially sales and marketing, which Oscar is well-suited to as a digitally native company. With Montefiore, for example, Oscar powers renewals and recommends plans to members based on their previous usage. 2. Member Engagement. Partners can white-label Oscar’s digital experience, offer virtual care, and even use its Care Teams to coordinate members’ care. Everything described in the last section can also be made available to +Oscar members. 3. Campaigning and Campaign Building. Partners can tap into campaigns that Oscar has already run that have proven successful, and can use its campaign builder to create their own. Montefiore members might have very different needs and respond differently to incentives than Cleveland Clinic members, and each can design campaigns, on their own or with Oscar’s guidance, to incentivize actions that lead to better long-term outcomes. 4. System of Record and Administration. Health systems want to get into the risk business, but they probably don’t want to get into the claims processing business. Even if they want to handle all other aspects of care themselves, they can still use Oscar’s claims system on its own to make that part of the process easier.

➡️ Here is an overview of +Oscar. I don’t think it is the direction we want to take for many reasons (including I find it hard to see the strategic differentiation they are building over time), but interesting to see what they do. Valuation & comparables: As The Abstract Investor summarized, the challenge, and opportunity, is that: Many tech analysts aren't paying attention to insurance, while insurance analysts won't quite know how to look at a highly tech-stacked insurance company. That presents a potential opportunity for those that can figure out the murky puzzle. Bright is essentially a rollup and partnerships play with little meaningful tech; Clover is a tech player in the Medicare Advantage space with only a quarter of the “lives under management” that Oscar has, and no platform play like +Oscar to achieve scale.

It’s already over! Please share JC’s Newsletter with your friends, and subscribe 👇 Let’s talk about this together on LinkedIn or on Twitter. Have a good week! If you liked this post from 💡JC's Newsletter, why not share it? | |