The Daily StockTips Newsletter 07.19.2022

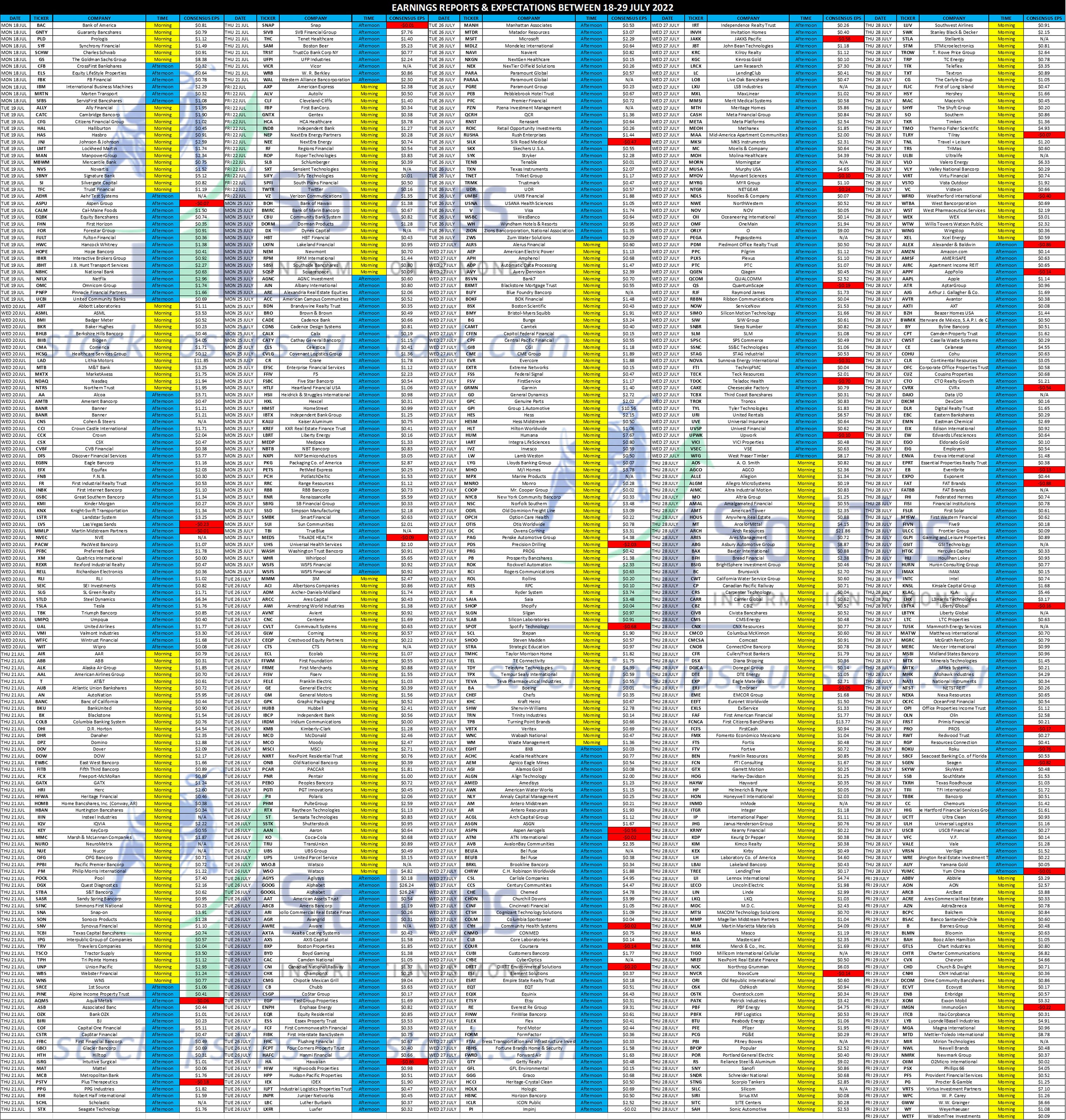

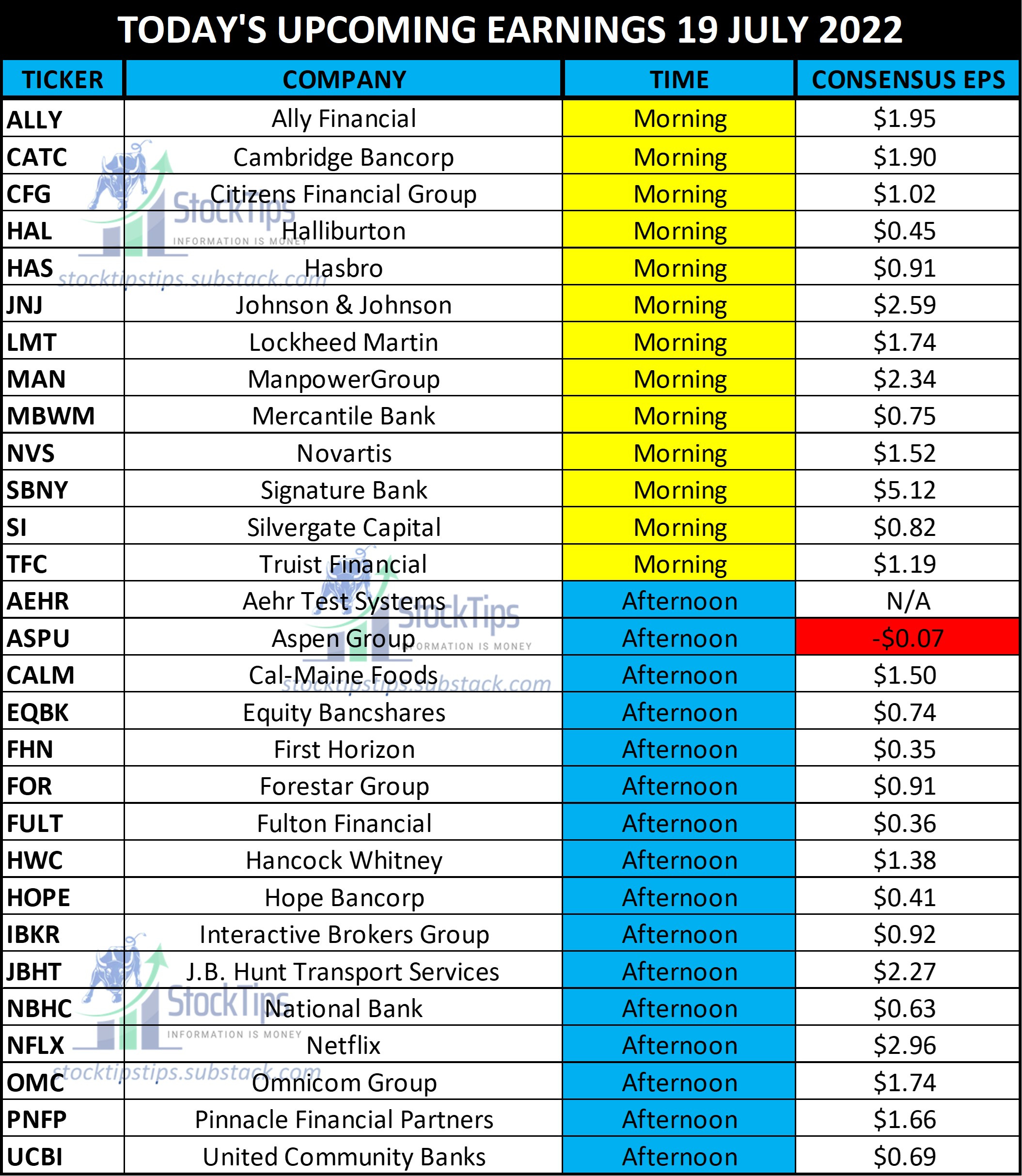

The Daily StockTips Newsletter 07.19.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)WE’RE ON YOUTUBE NOW! See HERE & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings. NEVER BE SURPRISED BY EASILY ANTICIPATED MARKET BREAKING NEWS. That’s our goal here. PAID SUBSCRIBERS: The last three short plays netted those who followed about 10-15%. I have added another short play as of yesterday, but neglected to mention it in the top half of this newsletter. You will find it right above yesterdays earnings results & insider trading activity. KEEP AN EYE ON THE BANKING SECTOR!: Yesterday I wrote a rundown of what to expect this earnings season. But we should also keep our eyes on next earnings season. Bank of America $BAC reported an earnings miss yesterday, but rallied premarket on higher than expected revenue (has since come down … justifiably in my view). Nevertheless this was odd. We’ve seen many companies report record revenue lately (Speaking about companies other than banks as well). Despite record revenue, inflation has destroyed their earnings. In the case of Bank of America, I can only think of two reasons for the streets initial reaction. 1. Investors are looking for any sign that the rate hikes are benefiting banks. 2. There’s some awfully big firms sitting on cash looking for excuses to put it somewhere. Of course, it could have been your typical pre-market low volume short squeeze on the former reason. But much of this market is heading toward the latter category. Whenever you see a bunch of large money managers show up on the financial news outlets talking to the market bottoming, talking to how the markets have priced in the current economy nicely, & talking to how bear markets usually rally for the second half of the year, you can bet your ass there’s an agenda behind it. They desperately want to talk up a bad situation, to construct a new normal, to get people satisfied with current valuations. They’re looking for anything to throw some money at … & right now the confidence just isn’t there. I began by writing “we should also keep an eye on next earnings season.” Well they will throw money at something but what? It will be those companies that are demonstrating favorable results under current market conditions. Banks are a natural choice. The higher the Fed raises interest rates, the more money banks typically make. And although they aren’t bringing in the bumper profit yet, even an indicator may be investment worthy. Institutions aren’t looking so much as to this quarter, but the quarters to come. There’s nothing like a high interest rate for a bank, given a likely recession, when the Fed will eventually need to flip course & lower rates again. Borrowers will be stuck with high rates, & the rates at which banks borrow can be easily adjusted lower over time. They’re built for this kind of endeavor. In an inflationary environment where people are quickly getting priced out of the market, where people are saving less & less, & spending more & more, this upcoming holiday season will be marked with debt. What seemed as an affordable lifestyle amid the pandemic, is no longer, & people WILL resort to debt. Banks love debt! We went from a time when commodities rallied from high demand & scarcity, the oil companies made a resounding post pandemic comeback, & now, the winds are blowing to the banks. And they pay dividends. Indeed if I told you to invest in Chevron in November of 2021 you would have called me crazy. Watch the banks! Of course, not all banks are created equal, but I will be keeping a very close eye on the banking sector this earnings season. Yes, they burned me in early 2022, but their day is coming. UPCOMING ECONOMIC NEWS: I included the analyst expectations of this weeks most pivotal economic data on yesterdays newsletter. WORLD MARKETS:

RECOMMENDED:

Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 07.18.2022

Monday, July 18, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 07.15.2022

Friday, July 15, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 07.14.2022

Thursday, July 14, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 07.13.2022

Thursday, July 14, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 07.12.2022

Tuesday, July 12, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

RIP to the 4% Rule

Tuesday, March 4, 2025

How to ignore the retirement strategy ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

President Trump is asserting extraordinary power over independent agencies. Is the Fed next?

Tuesday, March 4, 2025

The rise and potential fall of independent agencies. View this email online Planet Money Not-so-independent agencies anymore? by Greg Rosalsky President Trump vs. the independent agencies. It's a

No Sales, No Survival - Issue #514

Tuesday, March 4, 2025

What smart businesses are doing to win in the long run. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🇺🇸 The president's crypto fund

Monday, March 3, 2025

Crypto's back in favor and European defense stocks got an, uh, arm up | Finimize Hi Reader, here's what you need to know for March 4th in 3:15 minutes. The US president announced plans for a

CDs supercharge your savings

Monday, March 3, 2025

You could earn up to 4.10% for a 1 year term ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI's Impact on the Written Word is Vastly Overstated

Monday, March 3, 2025

Plus! VC IPOs; Sovereign Wealth Funds; The Return of Structured Products; LLM Moderation; Risk Management; Diff Jobs AI's Impact on the Written Word is Vastly Overstated By Byrne Hobart • 3 Mar

Know you’re earning the most interest

Sunday, March 2, 2025

Switch to a high-yield savings account ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Longreads + Open Thread

Saturday, March 1, 2025

Hackers, Safety, EBITDA, More Hackers, Feudalism, Randomness, CEOs Longreads + Open Thread By Byrne Hobart • 1 Mar 2025 View in browser View in browser Longreads A classic: Clifford Stoll on how he and

🚨 This could be a super bubble

Friday, February 28, 2025

An expert said we're in the third-biggest bubble ever, the US poked China one more time, and OpenAI's biggest model | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Boring, but important

Friday, February 28, 2025

For those life moments you might need . . . ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏