Circle & USDC: Building a Stable Platform

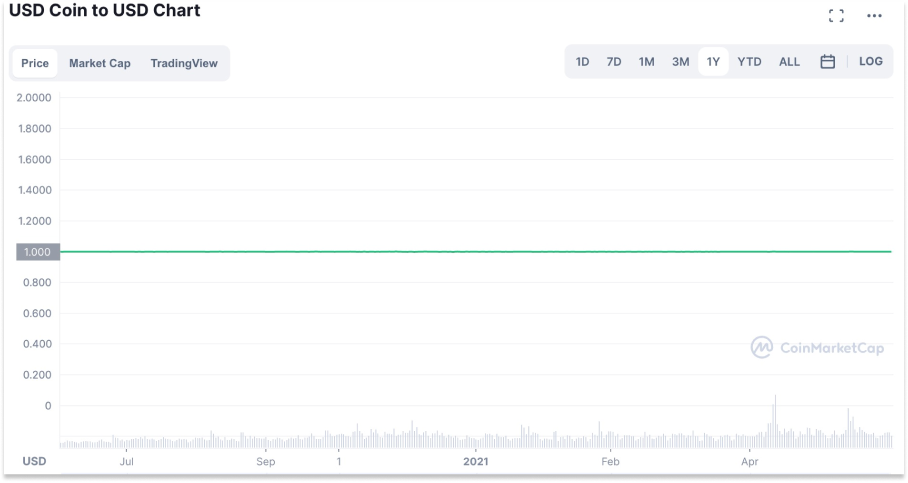

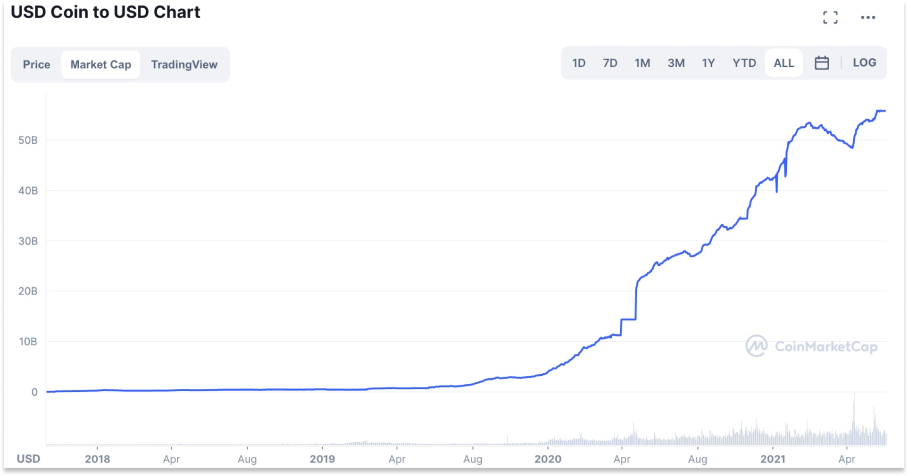

Circle & USDC: Building a Stable PlatformA Very Deep Dive on Stablecoins, USDC, and a Platform for a New Financial SystemWelcome to the 778 newly Not Boring people who have joined us since Monday! If you haven’t subscribed, join 140,394 smart, curious folks by subscribing here: 🎧 This is a long one! To listen to me read it instead, head over to Spotify or Apple Podcasts. Hi friends 👋, Happy Thursday! As the dust has begun to (hopefully) settle on the crypto crash, people have begun sorting through the rubble to figure out which products from this last cycle were useful and real, and which were hypes and ponzis. I’ve thrown my hat into this ring too many times, including two pieces on web3 use cases: Today and in the Future. One category that seems to be unanimously viewed as useful, outside of the most skeptical skeptics, is stablecoins. It’s one of the use cases I highlighted a month ago. And among the stablecoins, the consensus seems to be that USDC is the stablest of them all. Stablecoins are sneakily fascinating because they’re both a digital currency and a sort of platform on top of which new applications can be built, or old ones improved. But to achieve that promise, they need to actually be stable. A dollar-denominated stablecoin, like USDC, needs to be redeemable for a good ol’ fashioned US Dollar, every time, everywhere. If a stablecoin can be trusted to perform that foundational obligation, then developers can begin to build financial products on modern digital rails. Sometimes, they’ll build entirely new applications, like DeFi protocols. Others, they’ll rip out pieces of old, creaky financial infrastructure and replace them with newer rails. The revolution does not need to be total to be impactful. Circle is a case study in compromise. It’s a centralized company facilitating the growth of a decentralized financial system. It’s used by web2, web3, and web2.5 companies alike. It’s happy to sit in the background, facilitating fast, cheap, global payments and loans while others build shiny interfaces and sturdy guardrails on top. After seeing USDC’s outperformance during the bear market – its market cap has grown as the overall market has shrunk – and seeing a lot of people I respect point to USDC as a gold standard, I decided to team up with Circle to tell the story via a Sponsored Deep Dive. You can read more about how I choose which companies to work with on Sponsored Deep Dives here. In this case, I realized that I didn’t know nearly as much about stablecoins as I should, and I was pumped that they were willing to work with me to help understand and then explain. As always: this is not financial or investment advice. I’m an idiot, and I’m learning as I go – you would be foolish to allocate your cash based on anything I write. Do your own research. But I hope that it’s an entertaining and informative look into one of crypto’s key building blocks. Let’s get to it. Circle & USDC: Building a Stable Platform(Click the link to read the full thing online) Yes, I know. This newsletter is called Not Boring. But I’m going to start this essay off by showing you the Most Boring Chart in All of Crypto. That’s the 1 year price chart of USD Coin (“USDC”), the fiat-backed, fully-collateralized, dollar-denominated stablecoin issued by Circle. I dare you to find me a more boring chart. For the entire past year, as prices of other crypto assets rollercoastered up and down and up and very down, USDC hugged the $1 line tightly. 🥱 For stablecoins, boring is good. Boring is the goal. And being the most boring stablecoin results in a chart that isn’t very boring at all:

That’s USDC’s market cap since its inception in October 2018, which represents the total USDC in circulation. At the time of writing, July 20th, 2022, that number stands at $54.8 billion. Circulating USDC has more than doubled in the past year, after growing 25x between July 2020 and July 2021. Since its price is pegged to $1, increases in market cap mean that there’s more usage of USDC (the inverse is also true – the market cap declines when people redeem their USDC for Dollars). Boring is a feature, not a bug. It’s key to Circle’s first product value proposition – digital dollars – and it’s key to Circle’s mission: To raise global economic prosperity through the frictionless exchange of financial value. If you’ve heard of Circle, it’s likely because of USDC. That’s the company’s first killer product. Recently, it announced that it’s launching a second, Euro Coin (EUROC). But thinking about USDC and EUROC as just stablecoins misses the company’s ambitions to become:

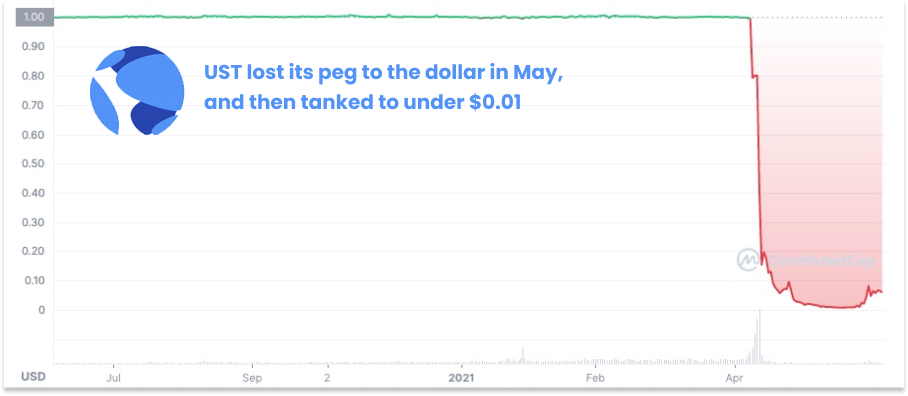

It’s an ambitious bet in a competitive space, and one dogged by both valid and invalid concerns, many of which we’ll cover in this piece. Circle is trying to differentiate on trust, the necessary foundation for its ambitions. Increasingly, it seems to be working. I didn’t give much thought to stablecoins until Luna’s UST blew up a couple of months ago. But as I’ve dug in, I’ve realized that they’re one of the most solid use cases in web3 today, and a fundamental building block in the much bigger visions entrepreneurs in the space are building towards. Once the idea of programmable, permissionless money worms into your brain, it’s hard to see where stablecoins wouldn’t provide an improvement over the status quo. But let’s start with the basics and build up from there:

What Are Stablecoins?If you’ve followed the crypto markets recently, you might’ve heard the word “stablecoin” and chuckled. “Stablecoin, huh?” you’d quip, “Not very … stable 😂.” It’s a funny joke. In May, UST (Terra’s stablecoin) lost its peg to the dollar (translation: it became worth less than $1). It flushed hard, bringing the entire Luna ecosystem down with it. Ultimately, it brought down crypto hedge fund Three Arrows Capital (“3AC”) which contributed to the downfall of Celsius, BlockFi, Voyager, and other Centralized Finance (“CeFi”) lenders. Friend of the newsletter Jon Wu wrote a great thread / Not Boring essay on Terra-Luna and UST, and Arthur Hayes wrote the definitive piece on the 3AC collapse in case you want to read more gory details. The UST situation brought to light something that was apparent to anyone who dug into the math or simply walked through the logic: not all stablecoins are created equal. Not all stablecoins are … stable. The goal of a stablecoin is to stay pegged to its reference asset. For most stablecoins, that’s the US Dollar. So one (1) USD stablecoin – like USDC – should be worth $1. As Alex Danco wrote in 2018:

“Reasonable” is doing a lot of work here. People should always be able to redeem their stablecoins for genuine dollars. There are three main models stablecoin issuers pursue to make that happen:

We’ll start last, first. Algorithmic stablecoins, like UST, aren’t backed by dollars, a basket of cryptos, commodities, or anything, really, outside of what they create themselves. Instead of explaining this insanity myself, I’ll turn it over to the inimitable Matt Levine: Here is how an algorithmic stablecoin works:

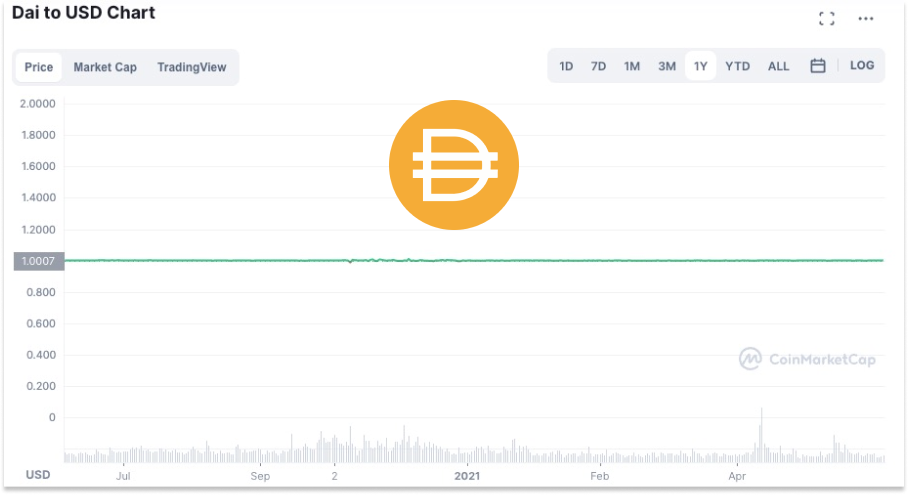

“All of this is,” Levine writes, “quite straightforward and correct, except for Point 7, which is insane.” $UST and $LUNA rose in tandem, and they fell in tandem. After UST’s collapse, the market for algorithmic stablecoins will likely be muted for a long time, so we don’t need to spend more time here. Cryptocurrency-backed stablecoins are backed by a basket of cryptocurrencies and are typically overcollateralized, meaning that the dollar value of cryptocurrencies in the reserve exceeds the dollar value of stablecoins outstanding. They achieve this by requiring each user to deposit more in another token, like ETH or BTC, than they pull out in stablecoin. The leading example here is MakerDAO’s stablecoin, DAI, with a $7.2 billion market cap. Here’s how it works:

The disadvantage of borrowing DAI is that you need to put up a lot of collateral – currently, to borrow DAI with ETH requires a minimum collateral ratio of 170%, meaning I’d need to put in at least $17,000 worth of ETH to get 10,000 DAI. I also have to pay a Variable Annual Fee, currently at 0.50% for ETH deposits. Plus, if the price of ETH drops to a point that breaks that ratio – in this case, if it drops even one cent – the smart contract liquidates me by selling the ETH. That could mean that you might be forced to sell at an inopportune time. The advantage of DAI to the borrower is that it’s completely on-chain, without the need for a centralized intermediary, and works well with your existing crypto holdings. If you want to hold onto your ETH but take out a little walking around money, you can just lock up the ETH, get DAI, and use it for any of the things you might use stablecoins for. The advantage of DAI as a protocol is that, by being overcollateralized and liquidating below certain thresholds, it can maintain stability and keep the promise that users can redeem their DAI for their ERC-20 tokens in any reasonable scenario. As a result, even during the recent turmoil, DAI has held up well. DAI’s chart isn’t quite as boring as USDC’s, but it’s pretty boring: At the time of writing, it’s trading at around $1.00, as designed. There are other crypto-backed stablecoins that are pegged to the dollar, with more launching regularly, others pegged to assets besides the US Dollar, and others still that aren’t pegged to anything at all. Some just want to be reserve currencies themselves. OlympusDAO, for example, has a mix of tokens in its reserve, backing its “Future Decentralized Reserve Currency,” Ohm. If you’ve seen the (3,3) or (something, something) meme on Twitter, that comes from the game theory behind Ohm, that it’s better for everyone if everyone just stakes their Ohm and holds. Ohm has had a bumpy ride, falling from a peak of $420 to a current price of $52. There are other promising crypto reserve currency projects, all vying to build an internet-native reserve that isn’t tied to the value of any fiat currency, but they’re different than stablecoins and outside the scope of this piece. That brings us to fiat-backed stablecoins, like USDC. Circle’s USDC stablecoin is the most straightforward of the major stablecoins: for every dollar of USDC in circulation, Circle holds $1 worth of straight cash and US Treasury Bills, for which there is the deepest and most liquid market of any asset in the world.  If you want to redeem 1 USDC for $1, no magic needs to happen. The dollar is sitting there, either right in the USDC reserve bank accounts at BNY Mellon and other large banks, or invested in short-term Treasuries that are easier than anything else in the world to exchange into dollars. Circle posts weekly reporting and monthly attestations on its website. To learn so much more about stablecoins, Circle, and USDC…Thanks to Jesse, Peter, and the Circle team for working with me on this piece, and to Dan for editing! That’s all for today! See you back here tomorrow for some Weekly Optimism. Thanks for Reading, Packy If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

Intertwining Threads

Monday, July 18, 2022

Imagining the wild things that might happen when we mix and remix new technologies

Weekly Dose of Optimism #3

Friday, July 15, 2022

James Webb, Space Bubbles, Fusion, Guinea Worms, Cancer (+ some Bonuses)

The Good Thing About Hard Things

Monday, July 11, 2022

Software has spent a decade eating the world. What's next?

Weekly Dose of Optimism

Friday, July 8, 2022

Week 2

Making Moonshots

Thursday, July 7, 2022

Rahul Rana joins Not Boring to discuss the history and future of deeptech

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month