Not Boring by Packy McCormick - Go Fork Yourself

Welcome to the 1,169 newly Not Boring people who have joined us since last Monday! If you haven’t subscribed, join 142,501 smart, curious folks by subscribing here: 🎧 I’m going to try to record the audio version later today, we wrote down to the wire! Programming Note: We’re due with our second kid any day now. Whenever she comes, I’m taking off for a month. We’ll still have some great guest posts and the Weekly Dose of Optimism, but this Thursday, if we make it there, will be the last essay I write until September! Today’s Not Boring is brought to you by… Masterworks During my paternity leave, I’m trying to stay as far away from a keyboard, and the markets, as possible. That’s why I’m happy I’ve been investing with Masterworks. Nobody is panic selling Picassos. On Masterworks, anyone can easily invest in blue-chip contemporary art, at a level that makes sense for their own portfolio. Why art? It's a $2 trillion asset class that's outpaced equities by 3x in the last 25 years, remains relatively insulated from macro shifts, and is actually an inflation hedge. Masterworks’ team of experts scours the blue-chip art market, gives members the opportunity to invest in pieces they like, and decides when to sell. Since inception in September 2019, their art investments have generated 15.3% net annualized appreciation¹. I don’t need to look at my portfolio except when I want to admire the art. The only problem? I’ve wanted to complement my Basquiat and Warhol with a Banksy for months. So of course when I finally had a chance 2 days ago, the shares sold out in 14 minutes and I missed it. Don’t be like me. Skip the waitlist with the Not Boring link²: Hi friends 👋 , Happy Monday! If you read “governance” and thought about skipping today because that sounds boring, I implore you to read on. Flipping DAO governance models is one of the most fascinating rabbit holes I’ve gone down recently. Incentivizing dissent over consensus creates both an internet-native model for organizing humans and directing resources, and a source of real differentiation versus incumbents. But like Tokenomics, for which we needed to borrow Tina He’s brilliance to explain, DAO governance is a topic so complex and fast-evolving that we needed to tap not one, but two, people who live and breathe the topic. Today, I’m teaming up with two of my favorite people / writers in web3:

Luca and David are two of my favorites because they’re simultaneously optimistic about web3, vocal about its shortcomings, and actively engaged in building solutions. If you don’t already, follow them on Twitter and subscribe to their newsletters to get a sense of what I mean. Bringing old models online isn’t the goal. Creating new ones that weren’t possible offline is. Let’s get to it. Go Fork Yourself(Click this 👆 to read the whole thing online) In video games, “speedrunning” means completing a video game as fast as possible. The world record speedrun for Super Mario 64, for example, belongs to the inimitable cheesecheese, who beat the entire game in 1:37:50 while singing and responding to Twitch commenters.  Crypto has borrowed the term. It’s speedrunning the history of financial markets. It’s speedrunning the history of governance. Speedrunning is a catchy analogy, but it’s not quite perfect. For one, the best speedrunners play games that they’ve played thousands of times nearly flawlessly. For another, a speedrun video game ends at the same place that a game played at regular speed does. What’s happening in crypto is different. No one is playing flawlessly. DeFi protocols (and CeFi entities) are doing many of the things that have been done in the financial markets, making many of the same mistakes, and learning many of the same lessons. DAOs are experimenting with the same governance models – from direct democracy to representative democracy, from direct shareholder vote to boards and management – that local and national governments and corporations have tried. They’re just doing it really fast, compressing thousands of years of experiments into less than a decade. In a piece by the same name for a16z, Andy Hall and Porter Smith call it Lightspeed Democracy. That gets closer. But the game shouldn’t end there. Just like online advertising started out as a copy-paste of print ads in the form of banner ads and evolved a richer and more sophisticated toolkit than would ever be possible offline, DAO governance can and should move beyond offline models. We think that DAO governance should be more like a biological process run at internet speed: Internet-Native Evolutionary Governance. The goal shouldn’t be to recreate offline governance, online, after a period of trial-and-error. Internet-native organizations can’t and shouldn’t operate like geographic governments because they don’t face the same constraints. Once online governance models evolve past a certain point, they should be both different from and superior to offline ones because of the speed, scale, granularity, programmability, composability, and unboundedness of the internet, and the blockchain. So what if we flipped the model? What if we viewed the goal of DAO governance not as a way to agree on a limited number of decisions proposed from the top, but as a way to force people to disagree on a whole host of decisions proposed by the community—so that larger groups that are unwieldy to coordinate could continue dividing into smaller, more efficient ones while building value for each other? The real promise of DAO governance might be forking: using governance to get people to disagree and through the process, discover subcommunities where they're aligned and create their own version of a project. Forking, in that sense, is the ultimate form of decentralization. And it enables governance to become the basis of social graphs where people find others who share their interests so they can pursue those. In its simplest form, this kind of governance is just a process of decentralized curation to incentivize a community to share and rank its preferences: good governance is just good user research. Through healthy dissent, governance can be used to lead to the formation of subDAOs, and to encourage evolutionary growth in the ecosystem. As non-crypto people know, forking leads to procreation. Viewed through that lens, governance mechanisms might become less defensive – focused less on protecting against hacks that threaten the entire DAO – and more offensive and fun – focused more on governance as a means of entertainment, social discovery, and propagation.  To be clear, there’s no one-size-fits-all model for DAO governance, and we’re not proposing that every DAO turn on its heels and encourage forking, which should often be a last resort. What we’re proposing is something else. Having different types of governance is a strength that lets different groups with different metrics optimize for what's important to them according to their own system. As in nature, biodiversity protects the entire ecosystem. There are challenges with this model, too, most notably that fragmentation might reduce liquidity, lower talent density, and add complexity. We’ll discuss these, and ways that DAOs might address them. But if we’re experimenting and making mistakes anyway, we should make productive mistakes. We should experiment in a direction that doesn’t lead to the same endpoint, and take advantage of new tools and lessened constraints to create new internet-native opportunities. Maybe one day, those new models will circle back and influence the way that humans coordinate offline. Maybe the lines between online and offline will blur to the point that governments and companies adopt new models born through this evolution. Today, we’ll explore the history, present, and a proposed future of governance:

To start our journey, let’s hop in the time traveler and head back to Ancient Greece. A Very Brief History of GovernanceFirst things first, what is governance? Governance is the process of overseeing the control and direction of something, like a government, business, or organization. It’s how groups of people decide what their group should do, and ensure that those decisions get enacted. Humans have been trying to figure out governance since the beginning of time. In Pieces of the Action, Vannevar Bush wrote of organizations:

“Building more and more complex organizations with which to carry on our affairs” is a good summary of the history of governance models, but we’ll take a slightly longer walk. Most of us learned this stuff in school, but it’s worth going over quickly in this context to ground ourselves in the basics before we get weird. For most of human history, people lived under autocratic rule, a system in which the power over the state is concentrated in the hands of one person: a king, queen, empress, emperor, or dictator. Whatever the autocrat decrees, the people must follow. Oligarchic rule, also popular throughout history, feels similar to those being governed, but differs slightly in that the power is concentrated in the hands of a small group of people instead of one person. Autocratic rule was so popular early because it’s the simplest form of governance – one person decides and that’s it – but history has shown that it has some uhhh flaws. In the 5th Century BCE, the Ancient Greeks implemented a new form of governance (one practiced by tribal societies far earlier): democracy. In Ancient Athens, one of democracy’s earliest homes, all citizens – defined as native-born free men – were required to take an active part in government. Those who didn’t were fined and occasionally shamed with a splash of red paint. Athenian democracy worked kind of like very long jury duty, in that each year:

This form of governance, in which every citizen can vote on every decision, is called direct democracy. Every citizen has their say, and then all must follow what the majority decides. Direct democracy worked in Ancient Athens because the scale was small and local, and even then, the Athenians eliminated 70% of eligible voters (women, slaves, and immigrants) in order to maintain a small group. Even though the Ancient Greeks introduced democracy 2,500 years ago, and Rome remained ruled by a republican government between 500 and 27 BC, autocracy remained the dominant form of governance around the globe, with a few exceptions, until the United States Constitution came into force in 1789. But while direct democracy worked well enough in the context of ruling a city, the American experiment required a governance model that could handle 13 colonies (and eventually 50 states) spread over a large area. As Hall and Smith highlighted:

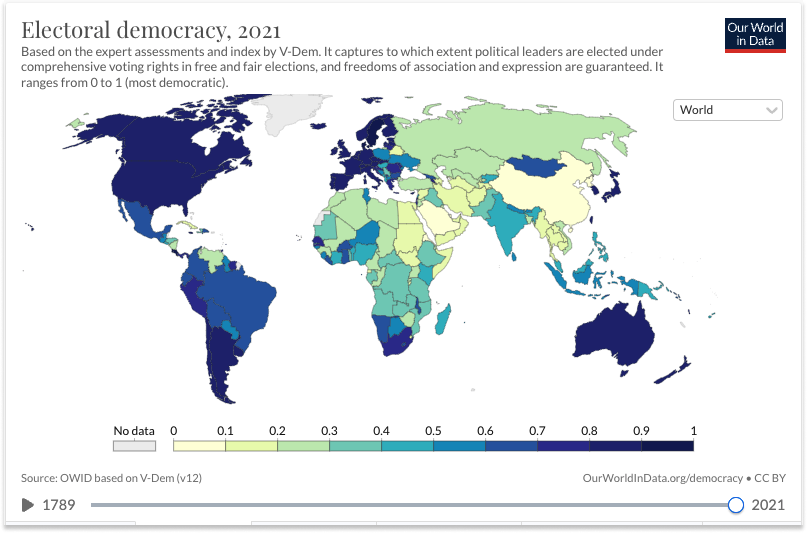

New contexts require new forms of governance. America’s Founding Fathers built a republic, a form of representative democracy. The people elect their representatives, and the representatives propose and pass legislation. Since then, the world has been on a bumpy but inexorable march towards representative democracy.

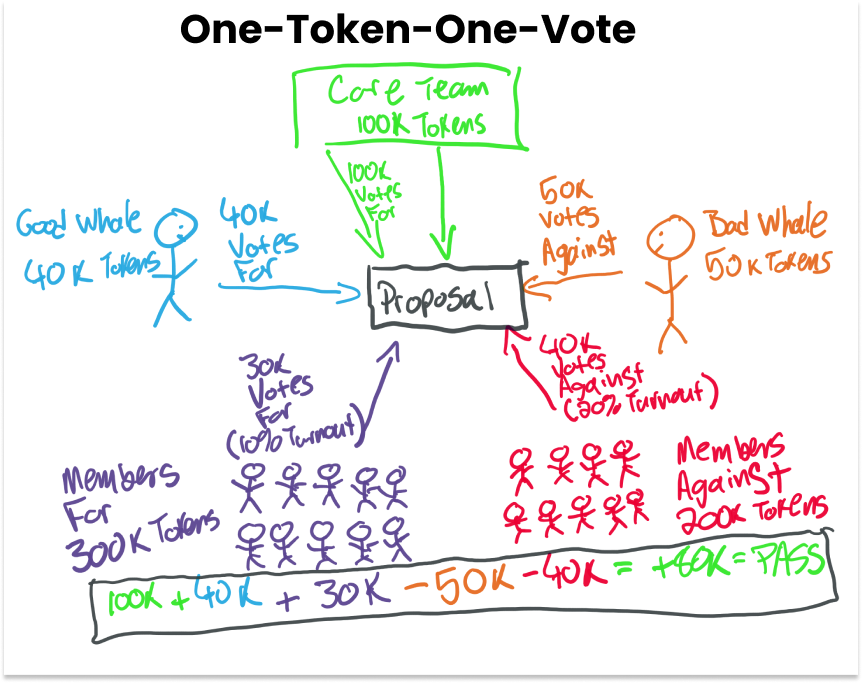

A 2019 Pew Research report found that 57% of countries with populations over 500,000 are democratic. Modern democracy is representative democracy. Corporations, too, most often behave like representative democracies. Shareholders elect the board, and the board hires and fires the management team, who in turn hire and fire employees, and run the company day-to-day. Unlike a national election, votes in the corporate setting are weighted by the number of shares each party holds, and the number of votes each of those shares has. While representative democracy has its issues, it appears less bad than previous forms of governance. As British Prime Minister Winston Churchill famously quipped, “Democracy is the worst form of government – except for all the others that have been tried.” The whole history of governance has been a series of attempts to find solutions that are less bad than their predecessors, and that best fit the context and capabilities of their time. It would have been hard to imagine the rise of national representative democracy before the invention of the printing press, for example. As Thomas Jefferson wrote, “a well informed electorate is a prerequisite to a democracy.” New tools, challenges, and constraint sets open the door for new models. The best system of governance for a large nation comprised of colonies connected by wagons and ships that needed to unify for economic and military reasons might not be the ultimate form of human governance, or the one best-suited to internet-native organizations with very different goals, challenges, and capabilities. Governance can and should keep evolving. While it’s not easy for countries or even companies to try new forms of governance, DAOs have the opportunity to rapidly experiment in ways that are only possible on the internet. DAO Governance History and ChallengesTo date, however, DAO governance models have mostly been skeuomorphic versions of national and corporate ones. (For a primer on DAOs, check out Packy’s The DAO of DAOs.) Most (if not all) governance mechanisms in crypto today revolve around some sort of implementation of the one-token-one-vote concept, akin to token-weighted direct democracy or shareholder democracy. When DAOs have strayed from one-token-one-vote, mechanism designers have used novel on-chain capabilities to fortify the old model, as opposed to experimenting with entirely new ones. Among the more popular enhancements are:

There are others, but the majority of variations seem to focus mainly on deploying protection layers to improve productivity and mitigate or delay the effects of governance hacks – so called Optimistic Governance – but not much more. All are important improvements, but they don’t answer a key question: are the underlying governance frameworks adopted able to incentivise virtuous behaviors while tackling complex tasks? Our guess is that, for the vast majority if not totality of DAO governance models out there, the answer is no. To dive deeper into the wonderful world of forking…Thanks to Luca and David for all the good stuff in the piece, and to Dan for editing! Have a great week, and see you back here later this week (baby permitting). Thanks for reading, Packy 1 “Track Record” is intended to provide Masterworks' internal estimate of the performance of the overall Masterworks portfolio for a given period with proportionate weight given to the size of each offering..This presents a measure of Masterworks performance assuming investment allocations proportional to the size of the offerings. Accordingly, Masterworks Track Record is the dollar-weighted aggregate average change in estimated fair market value of each issuer offered via the Masterworks platform on an annualized basis, excluding all offerings completed within the last six months of the given performance period which we believe are not reflective of Masterworks’ performance, after deduction of all fees and pro forma for estimated profit sharing represented by Class B shares held by Masterworks For Masterworks issuers that continue to own artwork, the estimated net asset value of the Class A shares sold to the public is based on Masterworks internal appraisals, which are performed on a quarterly basis as of the end of each calendar quarter. For offerings that were completed between six-months and one-year prior to the end of the applicable performance period and for which no public auction comparable sale has occurred, the fair market value of the artwork is appraised to be equal to the aggregate offering price which represents the price at which the artwork was sold to investors. If all offerings completed within the last six months of the performance period were included in the calculation of Masterworks’ Track Record as of June 30, 2022, the result would be 14.1%. For purposes of such calculation, the fair market value of the artwork included in offerings completed during the last six months of the performance period is appraised to be equal to the aggregate offering price. Artwork appraisals are performed by Masterworks in conformity with the 2020-21 Uniform Standards of Professional Appraisal Practice (USPAP) using a sales comparison approach, provided that Masterworks may have potential conflicts of interest. For more information on Masterworks appraisal methodology, potential conflicts of interest and other important considerations, click here. For issuers that sold a painting during the relevant period, actual realized returns, net of all fees and expenses, have been used. Masterworks may waive or forfeit fees to which it is entitled, but to date any such waivers or forfeitures, which affect all shareholders in a given issuer equally, have been immaterial. Transactions occurring on the Masterworks secondary market are not deemed relevant to the determination of Masterworks Track Record.2 See important Regulation A disclosuresIf you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

Weekly Dose of Optimism #5

Friday, July 29, 2022

CHIPS Act, Inflation Reduction Act, Protein Folding, Garbage Removal, Carbon Capture

Amplified Tribalism

Monday, July 25, 2022

And how we get out of it

Weekly Dose of Optimism #4

Friday, July 22, 2022

Brain-Computer Interface, Mars Mission, Climate, Hard Work, Kim Stanley Robinson

Circle & USDC: Building a Stable Platform

Thursday, July 21, 2022

A Very Deep Dive on Stablecoins, USDC, and a Platform for a New Financial System

Intertwining Threads

Monday, July 18, 2022

Imagining the wild things that might happen when we mix and remix new technologies

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month