The Daily StockTips Newsletter 08.08.2022

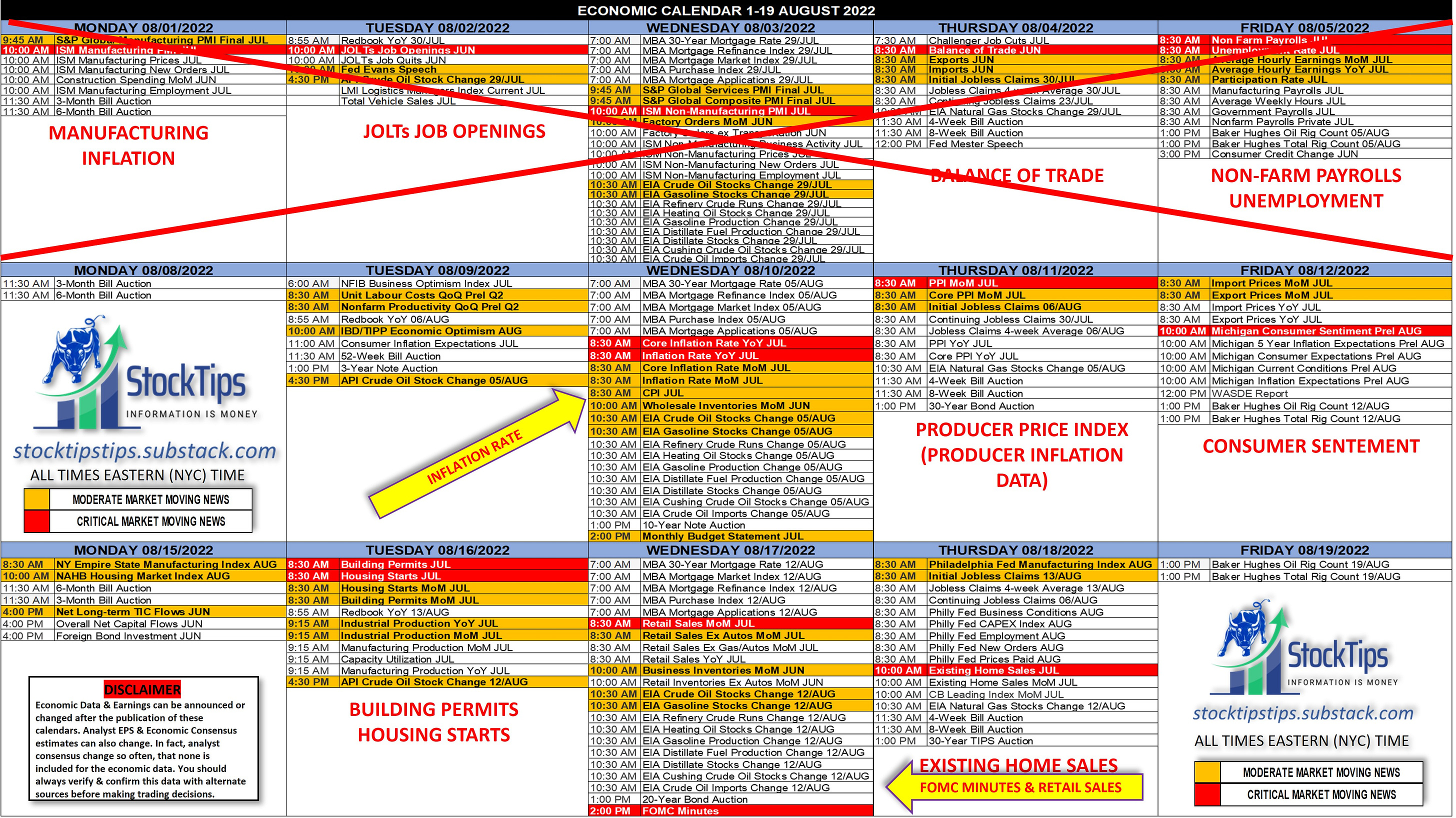

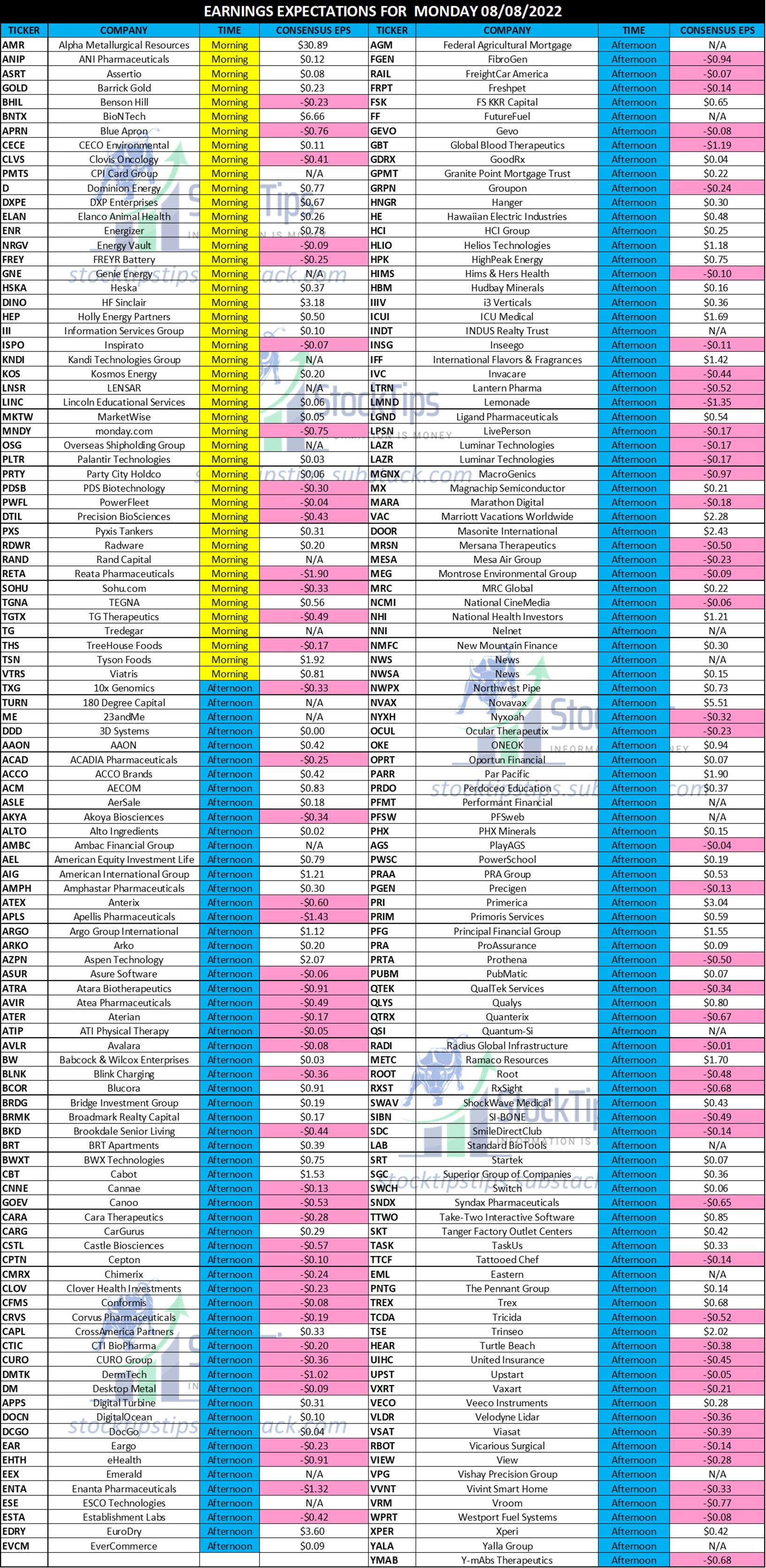

IMPORTANT DISCLAIMER: I am NOT a registered investment adviser, broker dealer, or member of any other association for research providers in any jurisdiction whatsoever & I am NOT qualified to give financial advice. Investing/Trading in securities, particularly microcap securities, is highly speculative & carries an extremely high degree of risk. The information, analysis, & opinions listed above are my own & may not properly reflect the underlying conditions of a company or security. You should do your own Due Diligence. Past performance does not guarantee future results. If you trade based on anything I have written YOU ACCEPT FULL RESPONSIBILITY AND LIABILITY for your own trades & actions & hold the author of this publication harmless. If that isn’t clear enough DO NOT TRADE, ACT, OR INVEST, BASED UPON ANYTHING I WRITE OR RECOMMEND. There, we should be solid now.Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings. NEVER BE SURPRISED BY EASILY ANTICIPATED MARKET BREAKING NEWS. That’s our goal here. PAID SUBSCRIBERS: I am considering some major changes but I haven’t got them lined up just yet. That short play? I covered & flipped it into an Iron Condor (Expiring Next Month) to salvage the loss. … & it’s STILL kicking my ass. The changes I’m considering is making the whole newsletter paid & significantly lowering the price of a subscription. But before I do that I need to consult with substack because there are some provisions I would like to make for long term subscribers, & I want to ensure I get it right. There are so many changes I want to make, but I want to get this right first. I had to work through the weekend so I apologize for not having this weeks earnings ready. Will be updates tomorrow. For now todays earnings estimate is posted below. CONSENSUS INFLATION EXPECTATIONS ARE LOWER: I checked the consensus inflation data this morning. The YoY inflation cut this Wednesday is expected to come in at 8.7%, likely as a result of decreasing gas prices. YoY core inflation is expected to rise to 6.1%. Month over Month numbers are expected to rise with inflation increasing 0.2% & Core inflation 0.5%. I think from here the inflation rate will seesaw as energy prices fluctuate, but still increase over time. However, the true threat to increasing prices is the hot job market. So as long as the labor force participation rate remains low, & unemployment remains low, firms will need to pay more & more for scarce labor, which means more & more of that cost will be passed to the consumer. Remember that for most firms labor is the number one expense. THE INFLATION REDUCTION ACT GOES TO BIDEN’S DESK: I think we all know that the inflation reduction act isn’t going to lower inflation. The name was a gimmick that few fell for. Many of the provisions will not be in effect for a number of years. It seems thus far the market is pricing in the long term benefit of the bill for green energy companies, without necessarily taking into account the long term tax implications. The Bill raises taxes by a minimum of 15% for businesses making $1b or more in INCOME. Meaning if the business makes a billion dollars in profit, they will pay at minimum 15% on that profit. It also levies a 1% tax on share buybacks … so expect a round of buybacks before this bill takes effect. If you are confused as to how this will work for businesses you may be invested in, there is a good breakdown here: “Companies with at least $1 billion in income would be required to calculate their annual tax liability two ways: one using longstanding tax accounting methods, which is 21% of profits less deductions and credits; the other by applying the 15% rate to the earnings they report to shareholders on their financial statements, commonly known as book income. Whichever amount is greater would be what they owe.” WASHINGTON POST WORLD MARKETS:

Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 08.05.2022

Friday, August 5, 2022

(Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 08.01.2022

Monday, August 1, 2022

(Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 07.29.2022

Friday, July 29, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 07.28.2022

Thursday, July 28, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

I Accidently Published the Newsletter Early This Morning

Wednesday, July 27, 2022

All, I was setting the newsletter up to go out at 0730 as I do every day & I accidently hit the “publish now” button. I tell you this just in case you're looking for it but can't find it at

You Might Also Like

President Trump is asserting extraordinary power over independent agencies. Is the Fed next?

Tuesday, March 4, 2025

The rise and potential fall of independent agencies. View this email online Planet Money Not-so-independent agencies anymore? by Greg Rosalsky President Trump vs. the independent agencies. It's a

No Sales, No Survival - Issue #514

Tuesday, March 4, 2025

What smart businesses are doing to win in the long run. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🇺🇸 The president's crypto fund

Monday, March 3, 2025

Crypto's back in favor and European defense stocks got an, uh, arm up | Finimize Hi Reader, here's what you need to know for March 4th in 3:15 minutes. The US president announced plans for a

CDs supercharge your savings

Monday, March 3, 2025

You could earn up to 4.10% for a 1 year term ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI's Impact on the Written Word is Vastly Overstated

Monday, March 3, 2025

Plus! VC IPOs; Sovereign Wealth Funds; The Return of Structured Products; LLM Moderation; Risk Management; Diff Jobs AI's Impact on the Written Word is Vastly Overstated By Byrne Hobart • 3 Mar

Know you’re earning the most interest

Sunday, March 2, 2025

Switch to a high-yield savings account ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Longreads + Open Thread

Saturday, March 1, 2025

Hackers, Safety, EBITDA, More Hackers, Feudalism, Randomness, CEOs Longreads + Open Thread By Byrne Hobart • 1 Mar 2025 View in browser View in browser Longreads A classic: Clifford Stoll on how he and

🚨 This could be a super bubble

Friday, February 28, 2025

An expert said we're in the third-biggest bubble ever, the US poked China one more time, and OpenAI's biggest model | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Boring, but important

Friday, February 28, 2025

For those life moments you might need . . . ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Last Trader Standing

Friday, February 28, 2025

The Evolution of FX Markets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏