| 👉 Stripe 2021 Update (Stripe) ❓ Why am I sharing this article? They are great at articulating their mission. Good learnings in terms of distribution especially for very large, and I’d like us to use a similar argumentation. Talking often to customers with clear owners for each product externally.

Mission:

➡️ I like the way they translate their mission into simple actionable items. I’ll work on it for us. Distribution:

➡️ How do we make sure that every company started in France use us? ➡️ I like this sales pitch for Large / Very Large. Culture: We look for people who aren’t put off by that intensity and rigor. Nobody enjoys postponing a launch or redoing a page for the third time, but we try to find people who’d rather do that than ship something subpar. We’re delighted when Stripe users share ideas for what they’d like to see improved or expanded—it’s likely that the leader of your favorite Stripe product is reachable on Twitter, and we personally love receiving emails from Stripe’s customers.

➡️ How could the product team connect more with our customers?

👉 Telegram: How to Counter-Attack (The Generalist) ❓ Why am I sharing this article? Assessing if Telegram is a good channel in France for distribution. Street marketing tactics are always very creative and worth digging into. I liked how they thought about hiring and attracting talents (contests).

VK: Like Facebook, VK began by targeting university students, growing campus by campus through invitations. Durov also incentivized sign-ups through a competition: users were encouraged to get as many friends as possible to sign up. Whoever proved the best referrer was promised a new iPod. This tactic alone helped VK secure thousands of early adopters.

➡️ I love those creative “street marketing” tactics. I don’t know how they could apply to us, but it should open our thinking. Just six months after launching the company's beta, VK had become Russia's second-largest social network with more than 100,000 users. A little over a year later, VK had pulled into first place, surpassing Odnoklassniki and reaching 1 million.

Telegram: There are popular channels for memes, pictures, news, quotes, and more. More than 400 million people view a Telegram channel each day. The company is following a similar trajectory with video, leveling up from calls to group calls to pseudo-streaming. Telegram can now support up to 1,000 synchronous viewers and allows for easy recording and watching. There are several more "nice-to-have" additions like this, including text recognition, a suite of bots capable of auto-posting emails or launching game experiences, and extra identity features.

Culture: The former employee I spoke to noted that VK had almost no managers while they worked there. Instead, small pods worked on products, moving quickly. Telegram has reportedly done an exceptional job recruiting engineers. It has taken creative measures to support that talent pipeline, launching "contests." On contest.com (what a domain!), Telegram runs "Developer Challenges" to improve its product and find new teammates. For example, the company recently ran a "GIF Contest" to create more "GIF-style reaction videos." The winner was given $50,000. According to an employee, thousands compete in these contests. From this pool, Telegram hires the "top two or top three." This is part of the reason the company has managed to remain lean throughout its life; the engineers it recruits are, quite literally, in the top 0.1%.

👉 Being scrappy (Platformer) ➡️ Wow! ➡️ I love it!

👉 Salesforce: The Cloud & SaaS Pioneer (Join Colossus) ❓ Why am I sharing this article? Metrics: The business has 150,000 customers including 90% of the Fortune 500. Salesforce has about 90% retention. If you look though over the years, that customer generally expands. So they actually have over 100% retention. The software itself has a high gross margin. So 70% plus, 73% gross margins.

Mini-apps: They built this low code, no code force.com. It had a language apex on top so you could really start to build anything. And that just created a tremendous amount of stickiness. There's this whole saying that customers would come for the application but they stayed for the platform. And I think that still rings true today. AppExchange is an enterprise application store kind of like the Apple app store. And really what that did was that allowed you to spin up third-party applications like a DocuSign and instead of connecting and having to do the work of connecting directly to the APIs and pulling the data in and going and doing all the engineering work. You just went in, you go into Salesforce, you go to the app store, and bam, you're going to AppExchange. And then the third thing was just the robustness of the APIs.

M&A & investment fun: They started doing a number of smaller acquisitions, talents acquisitions and built up that muscle over time. Probably one of the more early significant acquisitions was they acquired InStranet which is founded by Alex Dayon, who ended up being the chief product officer for Salesforce. I ran Salesforce Ventures. When I first started, we were investing about $10 million, $20 million dollars a year. When I left, we're investing about a billion dollars a year and had $4 billion on the balance sheet. It started out as very tactical. It wasn't very visionary by the last. It was we're going to be the best enterprise software investor. Our goal was to help accelerate and grow the ecosystem around Salesforce. The early days seems a little more tactical and so we would start by investing in system integration partners. We've been investing on companies that were building on AppExchange.

Philantropy: 1-1-1 model. And this was like integrated philanthropy, donate 1% of your time, 1% of your product, 1% of your equity to philanthropic purposes.

👉 The Inevitability of UiPath (The Generalist) ❓Why am I sharing this article? It is possible to have crazy high growth, even in mature companies. Understand what RPA is. Good benchmark in terms of payback for growth. The voting power of the CEO.

Some numbers about UIPath: In the last fiscal year, $PATH brought in $607.6 million in revenue, up 81% from the year prior. Gross margins approached 90% and dollar-based net retention hit a remarkable 145%. UiPath’s big break was in partnering with Ernst & Young’s (EY) Romania team. Partnering with a global firm gave the company the chance to not only win domestic clients but extend its capabilities around the world. The following year proved another inflection point. In 2018, UiPath increased its number of clients by 611%.

What is RPA: RPA solutions automate tasks by emulating human behavior on computers: Bots move the mouse, click on screens, and type on keyboards virtually. In essence, these bots follow a set script, performing the same actions a human might have done previously.

If you're going to use it like you would a macro in Excel, it can be great, and it can really empower the people that are using it. If you're going to use it for integrating 2 systems together, then a better solution is to build an integration between the 2 systems than to code a robot to make clicks on one screen and copy things over. Just from a point of failure standpoint, you introduce more points of failure that way than by just having a program do it... Up to 50 % of RPA deployments fail.

Sales motion: UiPath sells in three ways: direct to customer, with a partner, or to a partner. According to a former sales executive from the company, selling directly to the end customer typically takes six months, regardless of customer size. The partner purchases UiPath’s technology to subsequently white-label and resell to customers. Over the last 12 months, Sales & Marketing expenses represent 63% of total revenue, the seventh-highest of all cloud businesses.

Competition: Corporate structure:

👉 Nubank: Finding Brilliance in Brokenness (The Generalist) ❓ Why am I sharing this article? Increasing LTV: Referring back to Nubank's strategy, it's evident how initiatives like Vida advantageously alter unit economics: customers that buy an insurance policy significantly increase their LTV but require no additional customer acquisition spend. Nubank has reported a $9 CAC with an LTV topping $305, a ratio of 34x.

Engineering: Corporate hires report being surprised by the degree to which engineering determines the prioritization of new products. Technical debt is said to be a total non-issue, with Nubank consistently renovating and improving its stack, a significant difference from the legacy infrastructure duct-taping together the Big Five.

👉 Sarah Friar (Nextdoor) - Building The Local Graph (Just Colossus) ❓ Why am I sharing this article? Include customers: Public affairs for growth: We will do neighbor to neighbor invitations. When we launched Toronto, we brought the mayor in meritory. Then often, we'll go to public agencies. We've found throughout our time that working with the local mayor or working with FEMA in the United States or working with UK government, these are institutions that almost immediately see the power of it.

Reprioritize. We just did this with our product roadmap in the middle of the year. I almost feel like every six months you need to take a very hard look at what you're doing and why you're doing it. At Square, as we got bigger, people will get real excited with new product ideas. Like, "This can do 100 million!" I'm like, "Yeah, I actually don't care. Don't care. Come back if you think it's bigger. But if it's not bigger, let's kill it, and let's move those people to another place where they can do something more at scale."

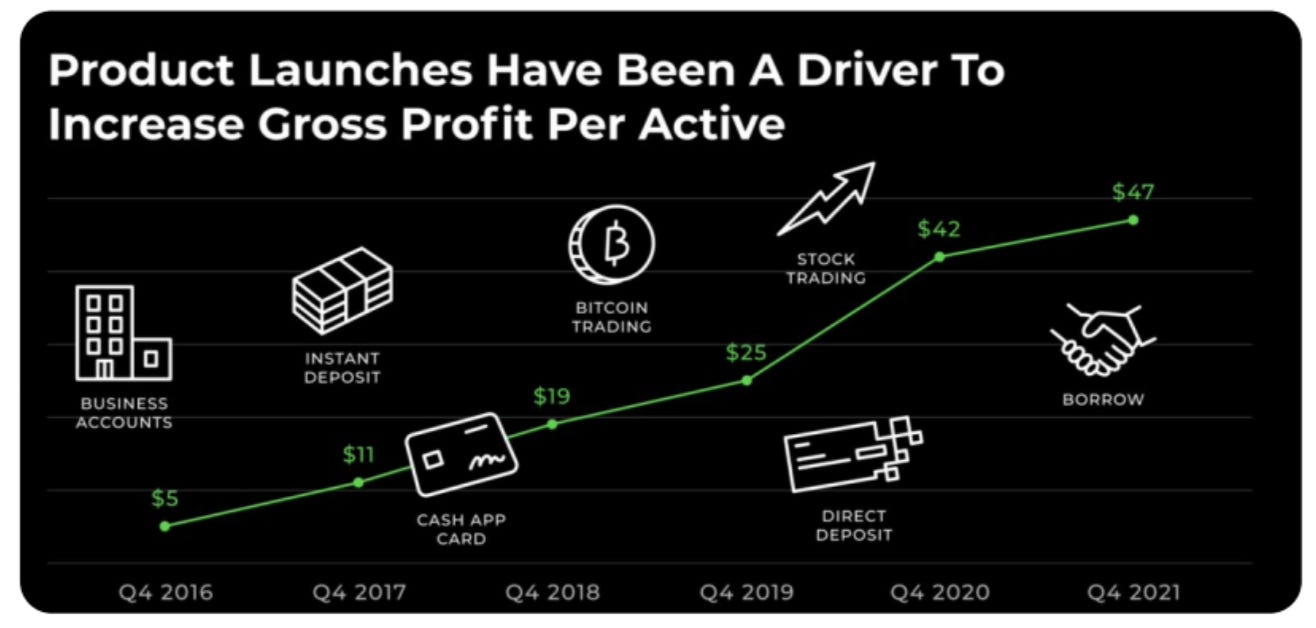

👉 Thread by Rex Woodbury about CashApp (PingThread) ❓ Why am I sharing this article? CashApp took the risk to have a very distinctive brand and I think it is something we should not be afraid of. They turned to pop culture and made it resonate. How could we do the same? They thought about communities and social, which I think is something that could be of a lot of value to us too. They kept shipping more and more features at a very fast pace.

Most financial services companies approach their businesses like a bank. Cash App approaches its business like a consumer social company. Just look at its design—splashy, loud, fun. Who else would showcase their product suite like this? No one. In order to make money relatable & accessible, Cash App turned to pop culture. Rappers were already rapping about Cash App, so the Cash App team leaned into it. They gave away $100K as part of a promo with Travis Scott. They sponsored Joe Rogan and e-sports teams. Cardi B tweeted: y'all made #WAP amazing!! weʼre partnering with Twitter and Cash App to give away a total of $1 million dollars to celebrate all you powerful women out there. tell us why you or a woman you know can use a piece of the $. drop your $cashtag and use #WAPParty.

Cash App acts like a social network because it *is* a social network. Cash App sees a 31 percentage point increase in retention when a user has 4+ friends on the app. Cash App's virality means lower customer acquisition costs. Whereas retail banks pay $300+ to acquire a user and neobanks pay $30+, Cash App gets users for just 10 bucks.

Last year, Cash App was the 8th-most-downloaded app in the US. You don't often see finance apps alongside the likes of TikTok & Instagram. Cash App won finance by realizing that slick design, social features, and a *coolness* factor shouldn't be limited to other categories.

It’s already over! Please share JC’s Newsletter with your friends, and subscribe 👇 Let’s talk about this together on LinkedIn or on Twitter. Have a good week! | |