Coin Metrics’ State of the Network: Issue 179

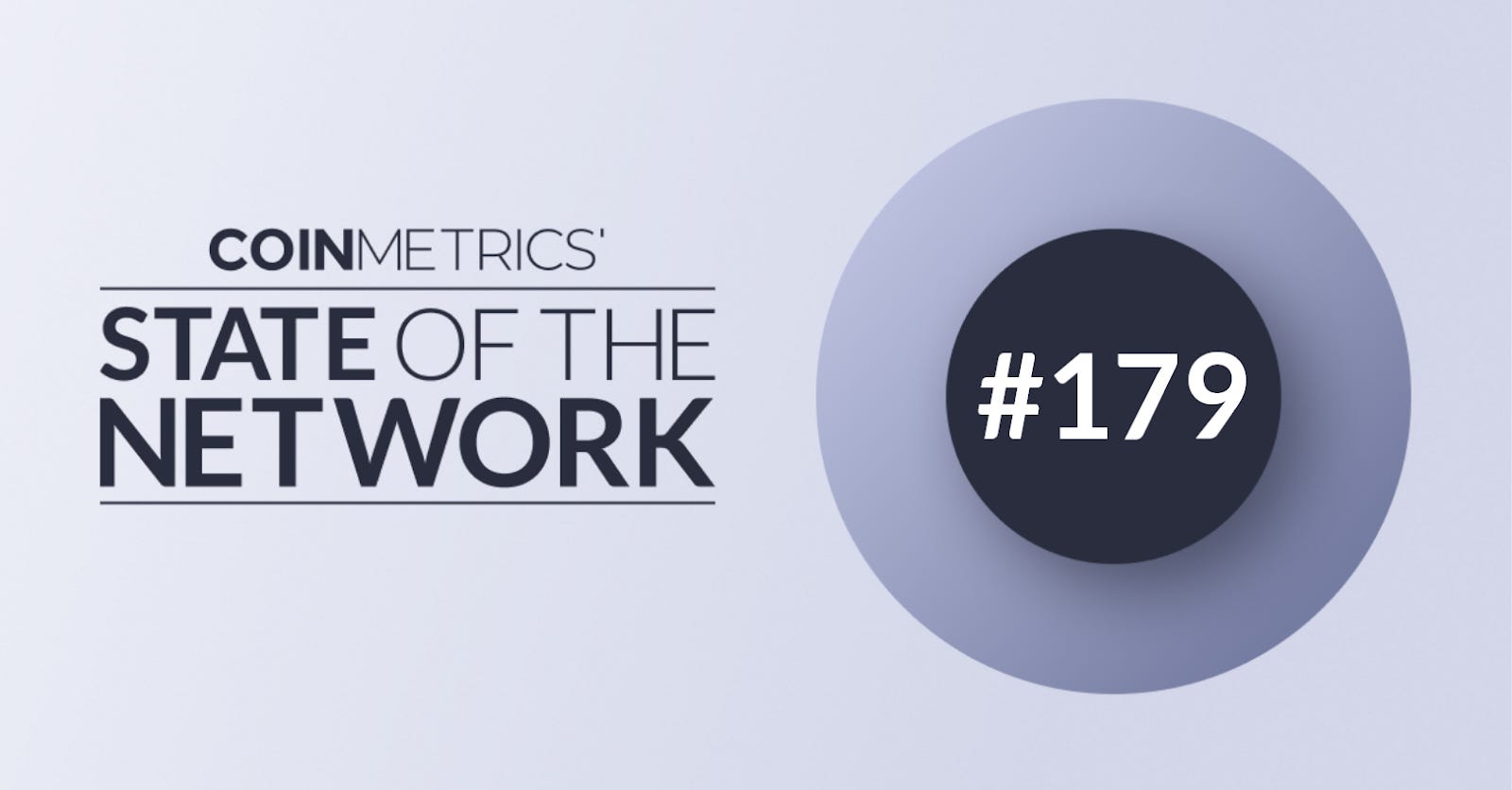

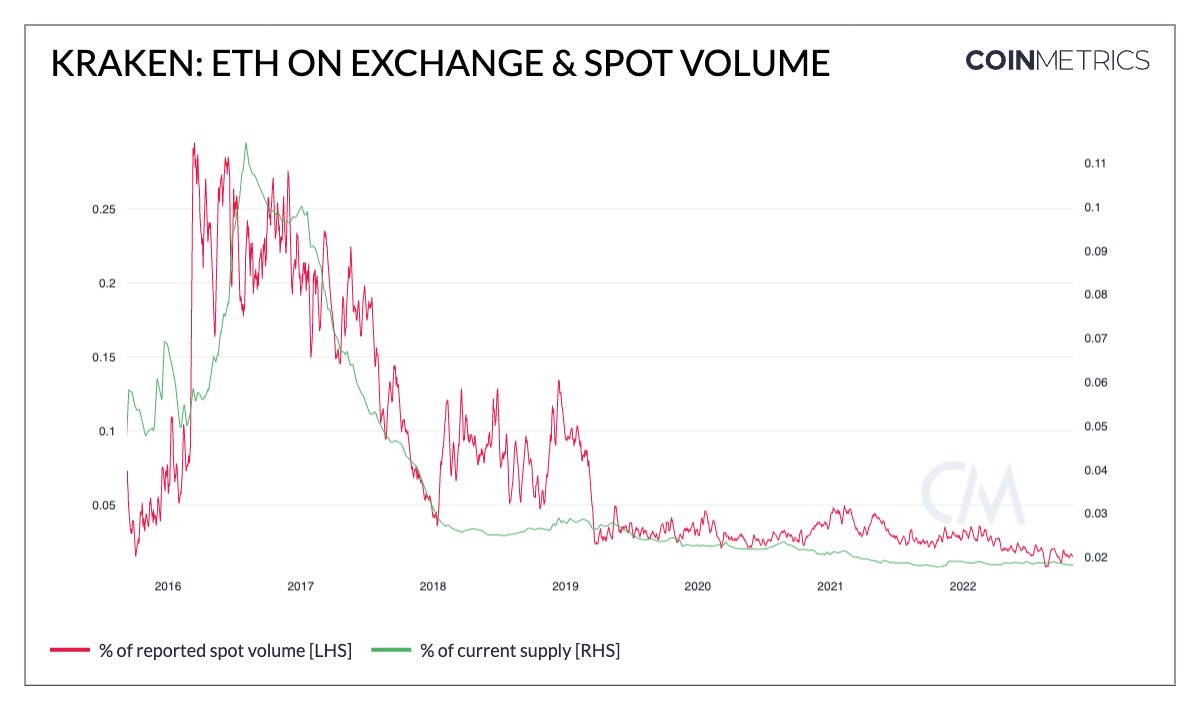

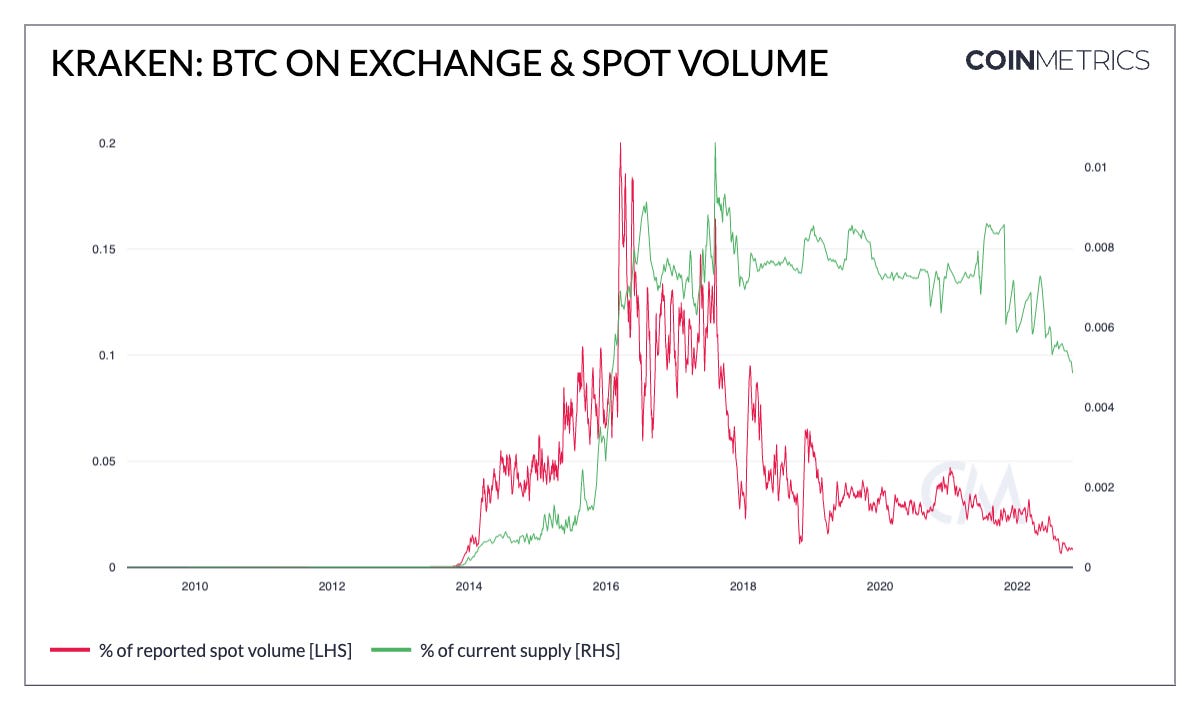

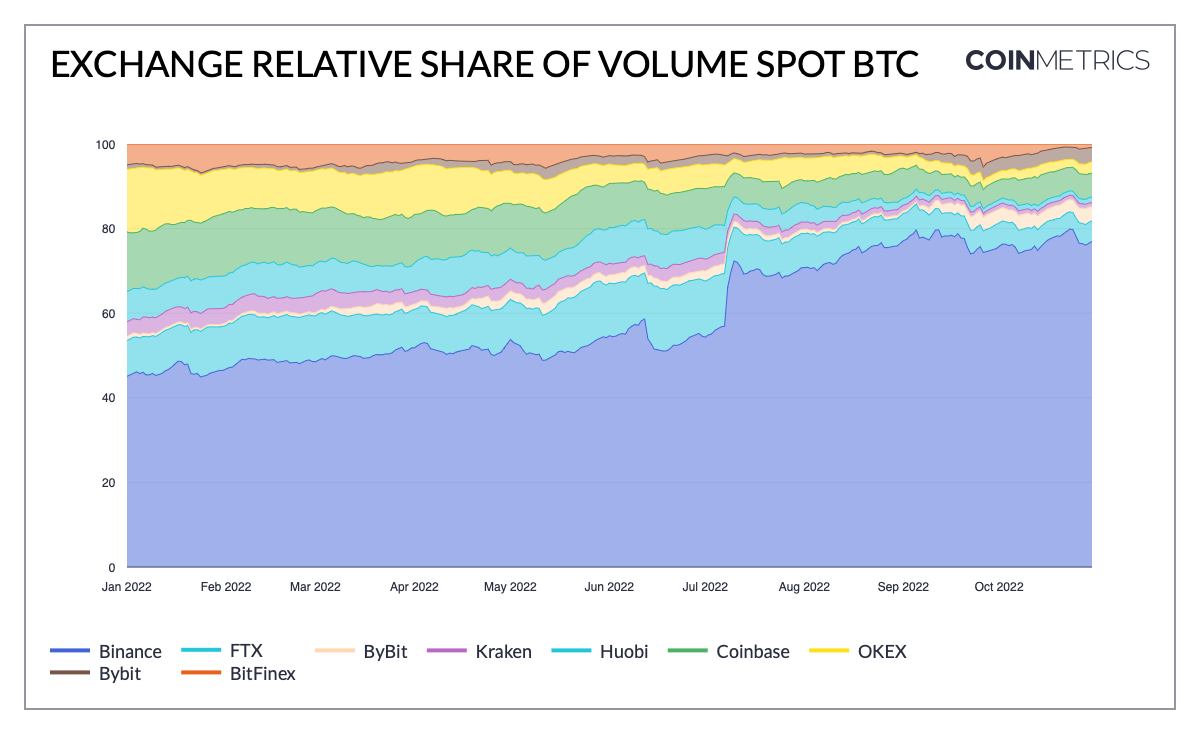

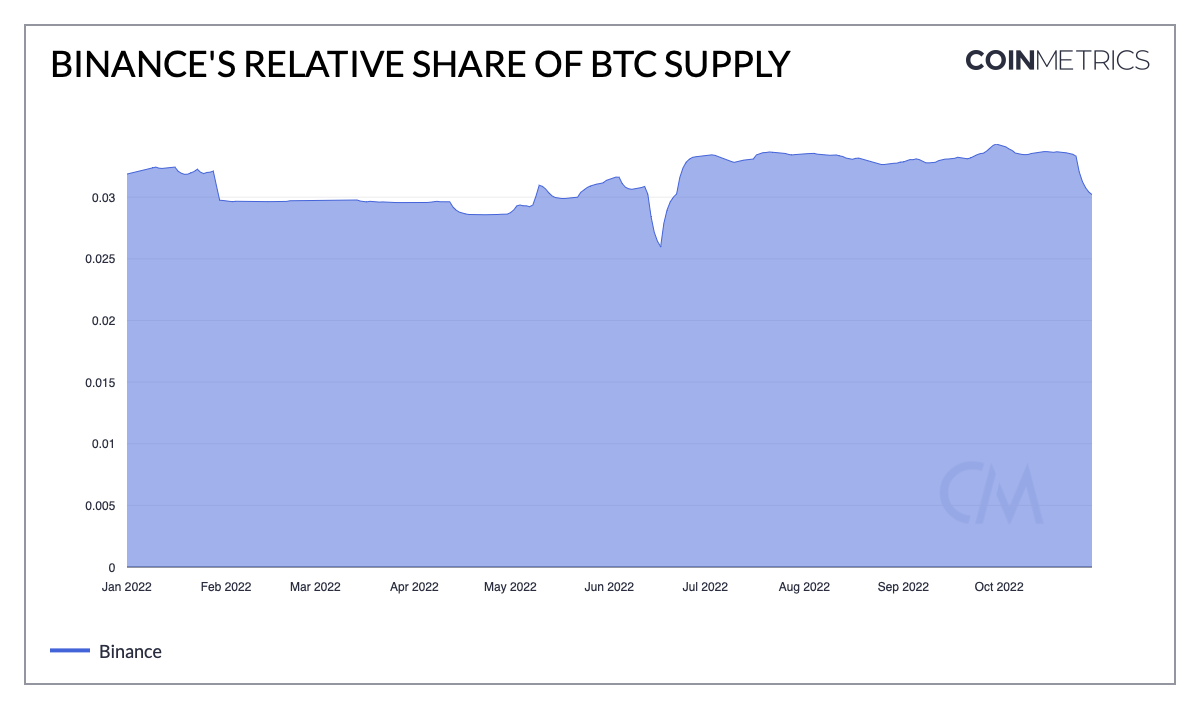

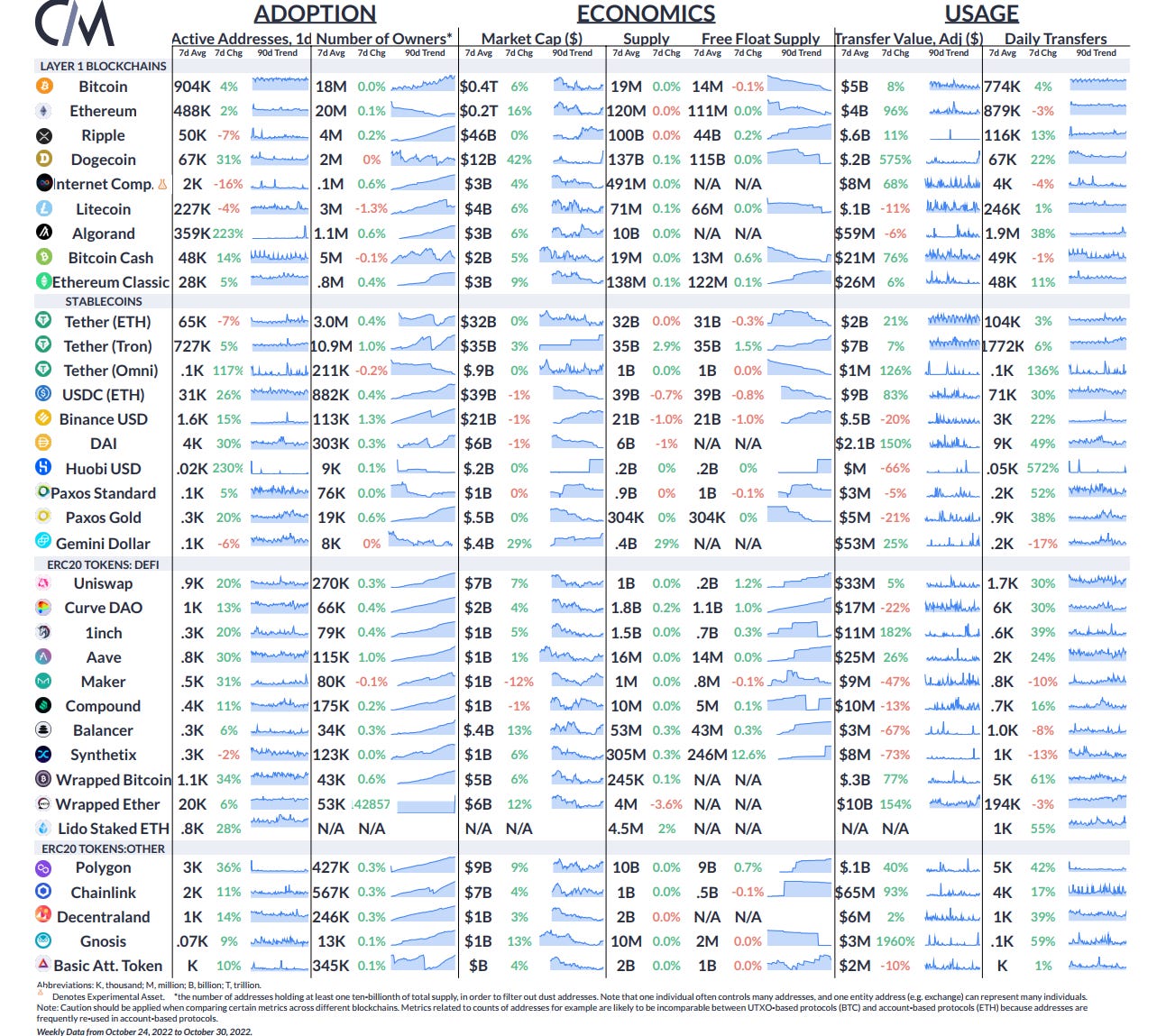

Get the best data-drive crypto insights and analysis every week: Through the Blockchain and Beyond: Combining On-Chain and Off-Chain Data with Coin Metrics Charting ToolsBy Kyle Waters, Matías Andrade and Nate Maddrey Coin Metrics has long been devoted to providing a holistic view of the crypto landscape through the lens of both network and crypto market data offerings. Understanding the distinction between these two crypto data types—on-chain and off-chain—is an essential first step in any crypto researcher’s journey. Simply put, “on-chain” data refers to data that is recorded on the blockchain. Examples of this type of data include blocks, transactions, transfers, and crypto addresses/wallet identifiers. At Coin Metrics, on-chain data is collected from the blockchain nodes that we run (a “node” is a computer running the blockchain’s open-source software allowing it to send and receive data from other nodes in the network). Check out our recent State of the Network on running an Ethereum node for a deeper look at the practical node. In contrast, “off-chain” is generally used as a catch-all describer for any data that is not directly written to the blockchain. The primary example is the trading of cryptocurrencies on exchanges where a central limit order book is maintained by a company to connect buyers and sellers and execute trades (in the crypto jargon, these are referred to as “centralized” exchanges because of the dependence on a central entity to maintain the order book). This data on trade prices and volume is collected from APIs that the exchanges offer. Working with this data allows us to create reference rates, indices, and other helpful market data offerings. Both data types are essential ingredients for crypto research and analysis. And combining both can lead to some interesting types of analyses. That’s why we’re excited to recently have augmented our charting tools with new market data capabilities, including exchange and exchange-asset pair metrics. In this SOTN, we walk through some examples where combining on-chain and off-chain data empowers users to make better insights. Exchange Holdings vs. Spot VolumeAs we have pointed out in the past, correlations between exchange holdings and spot volumes can yield insights about the health of exchange data and the legitimacy of exchange data. In this way, on-chain data can provide a verifiable record that we can use to learn more about our counterparties. As an example, we can test the idea that exchange volumes should follow supply flowing into exchanges by comparing the relative share of supply held in exchanges to spot volumes on the exchange. This can inform our process of due-diligence and help to trust our funds in an exchange. Soon after Ethereum was created and started trading, Kraken was a dominant venue for trading ETH, with over 10% of outstanding ETH supply held on exchange. Kraken’s share of all exchange-traded volume was also very high at this point, during some periods over 20% of total reported exchange volume. ETH supplies held on exchange has not recovered since 2017, and the relative share of ETH volume traded similarly has decreased as Kraken incorporated more assets and other competing exchanges drew away ETH supplies. Source: Coin Metrics Formula Builder A similar picture can be gleaned from BTC market data on Kraken too. BTC supply held on Kraken began rising in 2014, and by 2016 it held around 0.8% of total supply. The exchange’s share of BTC spot volume closely tracked these inflows, peaking around 2016 and then slowly decreasing, likely in proportion to interest in Ethereum and alt-coins as they rose to the spotlight in 2017 and thereafter. Source: Coin Metrics Formula Builder Address Balances vs. Spot VolumeWe can also witness an interesting dynamic between exchange traded volumes and on-chain balance data, and XRP offers a fascinating example. We can track the number of addresses with large balances (greater than 1M XPR) and their activities using our network data metrics and trading volumes in the US-based exchange Coinbase. Source: Coin Metrics Formula Builder Exchange Holdings vs. Spot VolumeWe can use exchange volumes over time and compare their relative shares across the most important exchanges to judge their relative market share distribution. This can reveal interesting dynamics in the fickle competitive environment of crypto exchanges. Binance has quickly grown to become a market leader between exchanges in terms of market volume traded. This dominance becomes visible when we plot the relative share of spot volume in USD terms taking place among the largest exchanges. Source: Coin Metrics Formula Builder On July 8, Binance decided to set trading fees on BTC-quoted pairs at zero in a demonstration of the liquidity of their markets. We can see that the share of BTC supply held on Binance (across the exchanges Coin Metrics tracks supply for) did not increase significantly after this decision, even though volume transacted measurably increased during the same period, indicative of an increase in the turnover of BTC held on exchange — a reasonable corollary resulting from reduced trading costs. Source: Coin Metrics Formula Builder ConclusionWith a coverage universe currently consisting of 3,117 assets, 38 exchanges, 17,250 spot markets, 9,139 futures markets, 45,309 options markets, and 3,573 pairs, there are many more potential avenues of inquiry. To follow the data used in this piece and explore our other network and market metrics check out our free charting tool, formula builder, correlation tool, and mobile apps. Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Pro On-chain activity picked up as crypto asset prices rose broadly over the week. Value transferred on Ethereum and Bitcoin rose sharply, while active addresses also increased. Active addresses on Algorand rose considerably to 359K per day, a 223% increase from the week prior. There were 1.05M active addresses on Algorand on October 24th, the highest since December 2021. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. Check out the Coin Metrics Blog for more in depth research and analysis. © 2022 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. If you liked this post from Coin Metrics' State of the Network, why not share it? |

Older messages

Coin Metrics’ State of the Network: Issue 178

Tuesday, October 25, 2022

Tuesday, October 25th, 2022

Coin Metrics' State of the Network: Issue 177

Tuesday, October 18, 2022

Tuesday, October 18th, 2022

Coin Metrics' State of the Network: Issue 176

Tuesday, October 11, 2022

Tuesday, October 10th, 2022

Coin Metrics' State of the Network: Issue 175

Tuesday, October 4, 2022

Tuesday, October 4th, 2022

Coin Metrics' State of the Network: Issue 174

Tuesday, September 27, 2022

Tuesday, September 27th, 2022

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏