Weekly project updates: NFT markets' competitive overview, Ethereum's new routes, Art Gobblers, etc

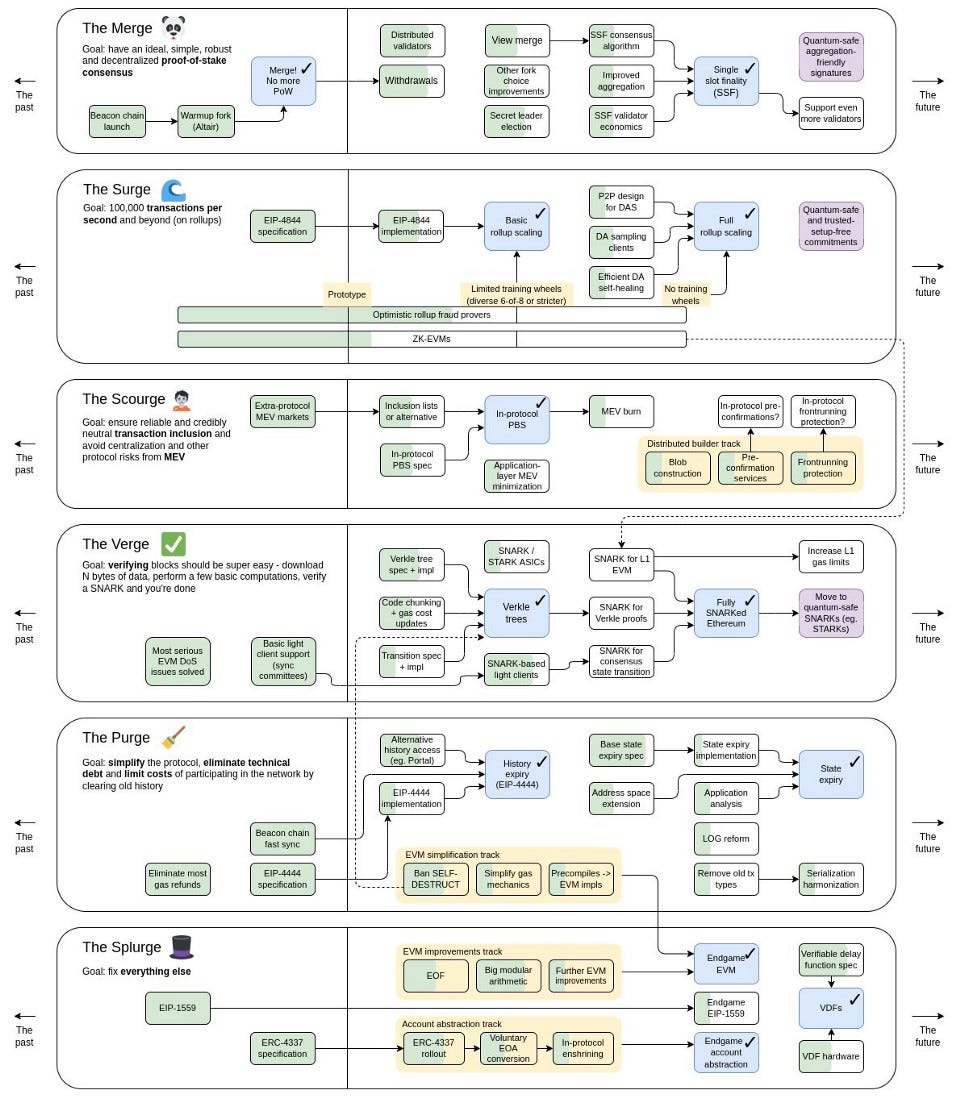

1. Arweave’s weekly summary a. Arweave works with Meta to give Instagram creators with storage. link Arweave, a blockchain storage platform, revealed on November 3 that it has been incorporated into Meta, which uses Arweave to store the digital collections of Instagram creators. b. RSS3 will assist Arweave in enabling cross-platform presentation. link RSS3 said on November 3 that it has began adaption work for the Arweave integration Meta, which will enable the display of NFT information across social platforms. c. Market’s response link After the announcement of the news on November 3, the price of Arweave’s original token, AR, skyrocketed from $9.99 on November 2 to $17.47 on November 3, a rise of 74.8%. 2. Opensea’s weekly summary a. With Twitter and OpenSea deal adrift, Magic Eden emerges as key NFT partnerlink On November 5, sources with knowledge of the situation said that OpenSea and Twitter had considered collaborating on Tweet Tiles but had not reached an agreement on terms. Magic Eden may become a Twitter partner. (The block) b. OpenSea introduces a new replica detection technique link OpenSea announced on November 2 the development of a new replica detection system that can identify replicas within seconds. c. Formula One manufacturer Haas F1 Team has partnershiped with Opensea Haas will release a variety of NFTs, and the Opensea logo will be used on its automobiles. 3. NFT marketplaces’ weekly summary a. GameStop has established the NFT market officially. link On October 31, GameStop announced the debut of their NFT store on Immutable X, which would showcase primarily assets from Immutable X games such Gods Unchained, Guild of Guardians, and Illuvium. b. STEPN NFT market MOOAR declared the launch. link The NFT Marketplace MOOAR started on November 1, offering the first “membership model” in which members pay an initial membership cost of $29.90 per month, are exempt from transaction fees, and can conduct an unlimited number of NFT transactions. Community members will be able to produce and publish their own series on the MOOAR launch board. According to reports, the platform would implement a required royalty structure where creators’ royalties will default to 2% or range from 0.5% to 10%, depending on the settings specified by the creators. c. The Fractal of the Web3 NFT market has launched on Ethereum. link Fractal, a Web3 gaming NFT marketplace created by Twitch co-founder Justin Kan in December 2021, launched on Ethereum on November 2, alongside the Fractal wallet, SDK, Launchpad, and trading marketplace, with other EVM-compatible chains to come. d. ImmutableX has released a mechanism for enforcing Ethereum NFT royalties. link Immutable will launch whitelisting and blacklisting tools on Ethereum on November 4 to enforce creator royalties. The item has been applied to ImmutableX. Creators must determine how tightly they wish to enforce royalties. e. X2Y2 aggregator will soon be available. link The NFT aggregator will allow users to acquire NFT from various markets on LooksRare, as was stated on November 5. No launch date has been set yet. 4. Vitalik provided an Ethereum roadmap. link Ethereum co-founder Vitalik Buterin posted a new roadmap on social media on November 5. Main changes: a. The Verge is about “verkle trees” and “verification”. b. Finale: SNARKed Ethereum. c. The Scourge: reliable and fair genuinely neutral transaction inclusion, address MEV problems. 5. Art Gobblers’ weekly summary Background: Justin Roiland and Paradigm, a venture capital firm, founded Art Gobblers. The Paradigm Goo model and VRGDA mechanism have garnered significant community interest. News: Achieve the highest 24-hour trade volume among OpenSea and Blur. On 1 November, NFT market Blur data revealed that Art Gobblers from NFT projects had the highest 24-hour transaction volume with 12,228.85 ETH. Art Gobblers had 1,046 subscribers, and the floor price increased to 13.9 ETH. With a 24-hour trading volume of 6,149 ETH and a floor price of 14,1 ETH, Art Gobblers topped the list on OpenSea. Related reading: link 6. Oracle’s weekly summary a. Chainlink offers a low-latency approach for predicting DeFi derivatives on the market. A tested version of Chainlink’s low-latency Oracle solution for the DeFi derivatives market is likely to be available before the end of the year, as revealed on 2 November. The solution, according to Chainlink, has a developing architecture built to perfectly fulfil the requirements of a derivative dApp, with benefits such as low latency, reduced front-runner risk, and decreased Gas costs. b. The oracle project Pyth Network onboard on Ethereum and Optimism. link Pyth Network, the old Solana Eco-Oracle project, announced on November 1 the online publication of its feed price data on the Ethereum and Optimism mainwebs through a collaboration with Wormhole, a cross-chain interoperability technology. Pyth has previously launched BNB Chain and Aptos. c. Version 1.0 of Empiric Network, an oracle based on StarkNet, has been released. On November 2, Empiric Network, a decentralised oracle built on StarkNet, published V1.0, which included interface changes, futures data, new endpoints, and other features. 7. MakerDao’s weekly summary a. MakerDAO has augmented its portfolio with traditional financial assets. link MakerDAO reported on November 4 that it has added traditional financial assets, including as short-term bond ETFs, to its portfolio and got a return on its GUSD holdings. According to official estimates, its yearly revenue will be $20.2 million. b. Sandwich attack suspected in DODO’s USDT/DAI liquidity pool link Mike B, the head of technology at Balancer DAO, tweeted on November 1 that major sandwiching is occurring at the Dodo USDT/DAI pool. Have you ever wondered why a stableswap pool with less than $10 million in liquidity and average depth generates $50-$100 million in daily volume? The response is MEV. 8. Public Chain Sui introduces Sui Capys. link On November 4, Gonglian Sui launched the Web3 game Preview Sui Capys on the beta Web, where players can buy, trade, breed and decorate Capys. Capys used Sui’s object-orientation to illustrate asset ownership, transferability, and dynamic fields. The developer used Sui Move to construct modules, types, and a registry for recording and validation to develop Sui Capys. 9. Compound Community will vote on a proposal to cut cSUSHI to 70%. link Compound Community Proposal 133, which proposes lowering the Compound V2 SUSHI mortgage factor cSUSHI from 73% to 70%, was placed on the vote on November 2. The vote concluded on November 4 with 90.7% in favour. 10. Yuga lab’s weekly summary a. The ApeCoin community has proposed a $1,000,000 bug bounty. link The ApeCoinDAO community released a draught AIP on October 30, while the ApeCoin community proposed a million-dollar bug bounty. The plan recommends using Treasury Assets to fund Immunefi’s $1 million APE to support bug bounty programmes and to collaborate with Llama in designing, implementing, and operating these programmes. AIP-134 was approved on November 3 with 57.92% of the vote. b. Yuga Labs’ NFT project Meebits has released a brand-new activation website. link The Meebits NFT project by Yuga Labs unveiled a new activation webpage and a free printing service for holders on November 4. Meebits are created as 3D characters, with MB1 serving as the initial chapter of the story. There will be nine versions, and the newly activated website will serve as the launching pad for every new experience, activation, or opportunity. Follow us If you liked this post from Wu Blockchain, why not share it? |

Older messages

PECland: Gamefi + NFT + social new ideas that trying to break the budget game market

Saturday, November 5, 2022

Author: Carol @CC99Carol Editor: Colin Wu Abstract: Since the crypto market entered a bear market for half a year, the investment scale of top investment banks have all contracted to varying degrees.

WuBlockchain Weekly:75bps、Deribit & Gala Hacked、Alameda's BS Concerns and Top10 News

Friday, November 4, 2022

Top10 News 1、Fed raises rates by 75bps, US unemployment and nonfarm payrolls were both higher than expected in October This week, fed as scheduled to raise interest rates 75bps, Powell three key

Alameda's Messy Balance Sheet Raises Concerns About FTX Does It Pose Systemic Risk?

Friday, November 4, 2022

Preface: CoinDesk's report on Alameda found that its largest single asset, a large amount of collateral are FTX's platform coin FTT (most likely borrowing from FTX), a large number of opaque

Why is Core Scientific, the largest bitcoin miner in North America, on the brink of bankruptcy?

Friday, November 4, 2022

Editor: Kate Li, TSE Core Scientific, one of the largest publicly traded crypto mining companies in the US with a purported 457 MW of operations, filed a statement with the US Securities and Exchange

The direction of Web3 reform after Elon Musk's acquisition of Twitter

Thursday, November 3, 2022

On Oct. 28, the world's richest man, Elon Musk, completed the acquisition of social media giant Twitter for $44 billion after several twists and turns. After the acquisition, Musk fired

You Might Also Like

What is DeFAI? The AI-enabled DeFi narrative looking to take 2025 by storm

Wednesday, January 15, 2025

AI-driven DeFi projects aim to simplify finance with real-time insights, trading, and personalized strategies, but face hurdles in transparency and security. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

OKX Founder's Full Speech: "Always Hold Bitcoin"

Wednesday, January 15, 2025

January 14, 2025, OKX CEO Star delivered a speech via video link. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

JPMorgan believes Solana, XRP ETPs could attract $15 billion in net inflows

Tuesday, January 14, 2025

Both assets register $2.5 billion in assets under management currently, with a little over $500 million in inflows registered last year. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Coin Metrics’ 2025 Crypto Outlook

Tuesday, January 14, 2025

Key Trends & Outlooks Shaping Digital Assets in the Year Ahead ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin’s sharp rise and fall starts week with $418 million in liquidations

Monday, January 13, 2025

Crypto positions unwind with $245M in longs liquidated across major exchanges. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading i…

Monday, January 13, 2025

US-based entities hold 65% more BTC than non-US entities; Crypto.com launched stocks and ETFs trading in the US; South Korea is reportedly planning to gradually allow institutional crypto trading ͏ ͏ ͏

Crypto Crash Imminent As US DOJ Sells Over 69K BTC

Monday, January 13, 2025

Monday Jan 13, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Crypto Crash Imminent As US DOJ Sells Over 69K BTC Senator Lummis To Head New Crypto Subcommittee Dogecoin Fails To Break

2024 Cex Annual Report: Binance's lead narrowed, while Bybit spot and Bitget contracts grew significantly

Monday, January 13, 2025

In December, major exchanges recorded a 14% increase in spot trading volume, with Bitget leading at 102% growth, and a 6% rise in derivatives trading volume, where Gate saw the largest increase at 111%