Follow-up: Does FTX keep user assets in cold wallets?

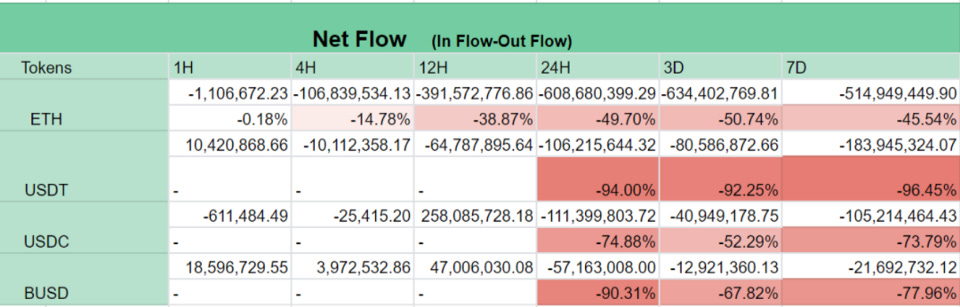

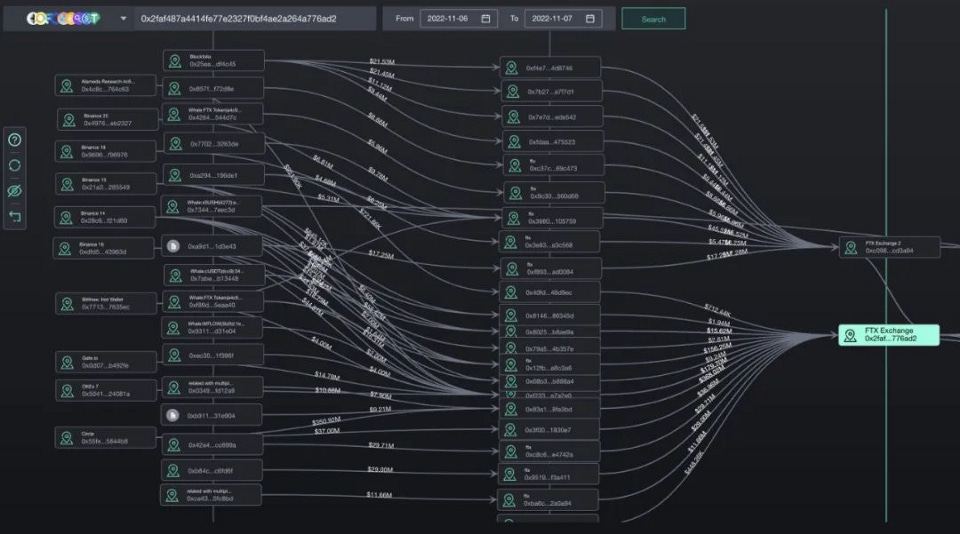

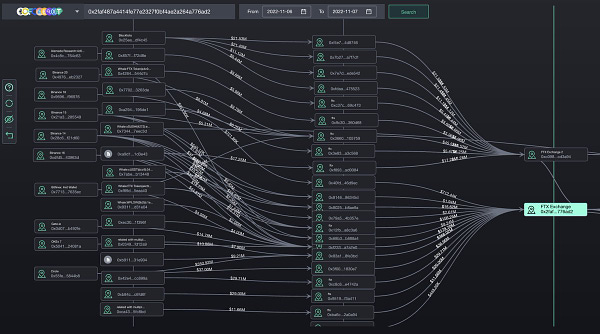

FTX has generally survived the withdrawal run on Nov. 7. Although many users took 2–3 hours to withdraw their assets, there were no significant withdrawals that took more than 12 to 24 hours. Today FTT had a flash crash, and FTX may face another test in the future. After surviving the withdrawal wave, SBF also issued a summary: competitors are trying to go after us with false rumors. We do not invest client assets (even in treasuries). It is heavily regulated, even if that slows us down. We have GAAP audits and over $1 billion in cash. FTX’s official explanation for the slow withdrawals is that chain conditions may occasionally be congested (as in the BTC network), mainly due to node throughput caps, which FTX is accelerating. Stablecoin withdrawals are being processed, because banks are closed on weekends, the redemption of U.S. dollars / stablecoins is a little slower, until weekdays when banks are open, wire transfers will resume smoothly. However, it is worth noting that FTX’s summary explanation does not include the previous explanation that withdrawals are slow because we are refilling hot wallets. The question is, where does FTX fill its hot wallet? Typically, exchanges keep most of their user assets in their own or custodian cold wallets. When there is an urgent need to withdraw, the exchange will quickly withdraw assets from the cold wallet to the hot wallet. There are two cases: When Huobi liquidated Chinese users, 22,000 BTC was transferred from the cold wallet to the hot wallet within 1 hour to cope with users’ panic demand for withdrawal. In addition, from November 2 to November 11 after the Shanxi incident, a total of 18,652 bitcoins flowed into Binance from Huobi. Huobi Cold Wallet dropped by nearly 60,000 bitcoins. Moving from a cold wallet to a hot wallet takes time and formality. Of course, FTX’s withdrawals were slow at one point, but there were no significant numbers of non-withdrawals over 12 hours. However, from the on-chain data, we have some doubts about whether FTX keeps most of its user assets in cold wallets: According to the statistics of 0xScope, the USDT/USDC balance of the three FTX addresses decreased by 95% and the ETH decreased by 50% within 7 days. Alameda, on the other hand, has been replenishing FTX. In addition, addresses from Binance and KuCoin have been filling FTX coffers. Learn more:  Also, here is an Overview chart of today's FTX capital inflow, @okx & @bitfinex & @gate_io are on the list too.

The form:

Source -> Deposit Address -> FTX In addition, PeckShield’s data shows that in the last 24 hours, large transfers to FTX include: $177 million in USD have been transferred from Circle to FTX ($122 million) and Alameda Research 1 ($55 million); approximately $66.8 million worth of cryptocurrencies have been transferred from address 0xb84c…. .d6f to FTX: 0x2fa and FTX: 0xC09, including approximately 4,900 ETH (approximately $7.7 million) and 59 million USDC; Alameda Research transferred $116.7 million USDT and USDC to FTX; $37 million USDC was transferred from Circle to FTX; and 68.3 million stable (BUSD, USDT, USDC) from Alameda Research to FTX; in addition, market makers like JUMP also transferred stablecoins to FTX, etc. It is very confusing to read this. If the user’s assets are 100% reserve, why are they not coming from cold wallets, or a single custodian, but from Alameda and other exchanges? Of course since all this data comes from on-chain, it is only a small part of the story and we have no way of knowing what is going on off-chain. What is the reason for this? Especially since SBF emphasizes that it does not use client assets for any investments (including treasuries), there is no reason not to keep them in cold wallets. I’m afraid the reasons behind this require more explanation and response from SBF and FTX. One possible explanation is that FTX stores users’ stablecoin assets in banks as fiat currency, but this does not explain why there are also many sources of assets from other exchanges and Alamdea. Binance founder CZ also “lost no time” in revealing that there is $8 billion of ETH in Binance’s cold wallets 1 and 2, “These are not our money. They are user assets. We are just the custodian”. This seems to imply that FTX does not keep all of its users’ assets in cold wallets. Gate, for its part, said it had completed a third 100% margin audit with U.S. auditing firm Armanino LLP. “Tokens held and effectively at the disposal of the exchange and stored on the blockchain in a total amount greater than or equal to the sum of the number of tokens held by all users of the platform represent a 100% margin provided by the platform for that token.” This move by Gate is certainly a very good example. As of press time, FTX has not responded to Wu’s comments on how FTX stores user assets. In addition, FTX has not responded to FTX’s financial dealings with Alameda. Follow us If you liked this post from Wu Blockchain, why not share it? |

Older messages

The battle between FTX and Binance: why, will FTX crash?

Monday, November 7, 2022

With CoinDesk's disclosure of Alameda's financial data, which had nothing to do with Binance, but Binance's attacks never stopped. Binance co-founder He Yi said to the event: “Binance does

Global Crypto Mining News (Oct 31 to Nov 6)

Monday, November 7, 2022

1. Bitcoin miner Argo Blockchain's previous $27 million funding plan has been announced as a failure. The Company sold 3843 new-in-box Bitmain S19J Pro machines for cash proceeds of $5.6 million.

Asia's weekly TOP 10 crypto news (Oct 31 to Nov 6)

Sunday, November 6, 2022

Author:Lily Editor:Colin Wu 1. HongKong's weekly summary 1.1 HK Government releases Policy Statement on the Development of Virtual Assets in Hong Kong Link The Hong Kong SAR Government issued a

Weekly project updates: NFT markets' competitive overview, Ethereum's new routes, Art Gobblers, etc

Saturday, November 5, 2022

1. Arweave's weekly summary a. Arweave works with Meta to give Instagram creators with storage. link Arweave, a blockchain storage platform, revealed on November 3 that it has been incorporated

PECland: Gamefi + NFT + social new ideas that trying to break the budget game market

Saturday, November 5, 2022

Author: Carol @CC99Carol Editor: Colin Wu Abstract: Since the crypto market entered a bear market for half a year, the investment scale of top investment banks have all contracted to varying degrees.

You Might Also Like

What is DeFAI? The AI-enabled DeFi narrative looking to take 2025 by storm

Wednesday, January 15, 2025

AI-driven DeFi projects aim to simplify finance with real-time insights, trading, and personalized strategies, but face hurdles in transparency and security. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

OKX Founder's Full Speech: "Always Hold Bitcoin"

Wednesday, January 15, 2025

January 14, 2025, OKX CEO Star delivered a speech via video link. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

JPMorgan believes Solana, XRP ETPs could attract $15 billion in net inflows

Tuesday, January 14, 2025

Both assets register $2.5 billion in assets under management currently, with a little over $500 million in inflows registered last year. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Coin Metrics’ 2025 Crypto Outlook

Tuesday, January 14, 2025

Key Trends & Outlooks Shaping Digital Assets in the Year Ahead ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin’s sharp rise and fall starts week with $418 million in liquidations

Monday, January 13, 2025

Crypto positions unwind with $245M in longs liquidated across major exchanges. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading i…

Monday, January 13, 2025

US-based entities hold 65% more BTC than non-US entities; Crypto.com launched stocks and ETFs trading in the US; South Korea is reportedly planning to gradually allow institutional crypto trading ͏ ͏ ͏

Crypto Crash Imminent As US DOJ Sells Over 69K BTC

Monday, January 13, 2025

Monday Jan 13, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Crypto Crash Imminent As US DOJ Sells Over 69K BTC Senator Lummis To Head New Crypto Subcommittee Dogecoin Fails To Break

2024 Cex Annual Report: Binance's lead narrowed, while Bybit spot and Bitget contracts grew significantly

Monday, January 13, 2025

In December, major exchanges recorded a 14% increase in spot trading volume, with Bitget leading at 102% growth, and a 6% rise in derivatives trading volume, where Gate saw the largest increase at 111%